Start Your eSignature Journey: Online Signature for Loans with Direct Lenders

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

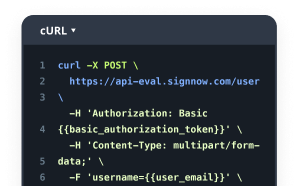

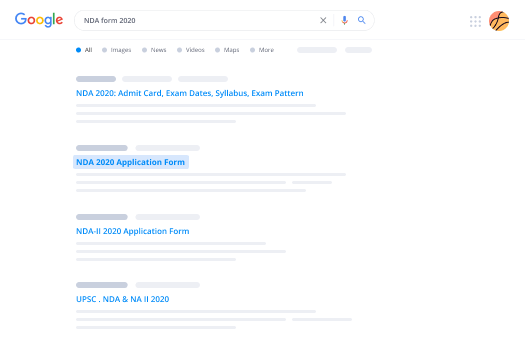

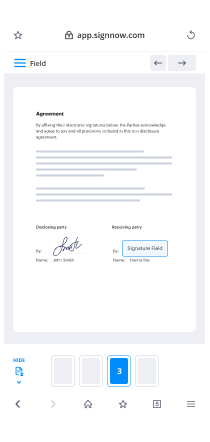

Quick-start guide on how to use online signature for loans with direct lenders feature

Is your business willing to eliminate inefficiencies by about three-quarters or more? With airSlate SignNow eSignature, weeks of contract approval turn into days, and hours of signature collection become minutes. You won't need to learn everything from scratch thanks to the intuitive interface and step-by-step instructions.

Take the following steps below to use the online signature for loans with direct lenders functionality in a matter of minutes:

- Open your web browser and visit signnow.com.

- Subscribe for a free trial or log in utilizing your email or Google/Facebook credentials.

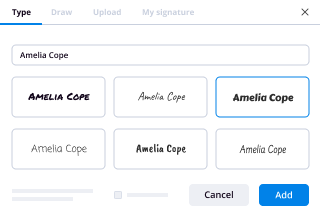

- Click on User Avatar -> My Account at the top-right corner of the webpage.

- Personalize your User Profile by adding personal data and adjusting settings.

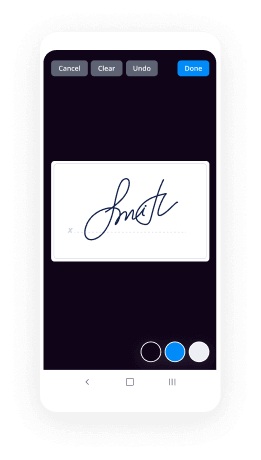

- Design and manage your Default Signature(s).

- Go back to the dashboard webpage.

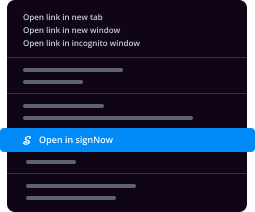

- Hover over the Upload and Create button and select the appropriate option.

- Click the Prepare and Send button next to the document's title.

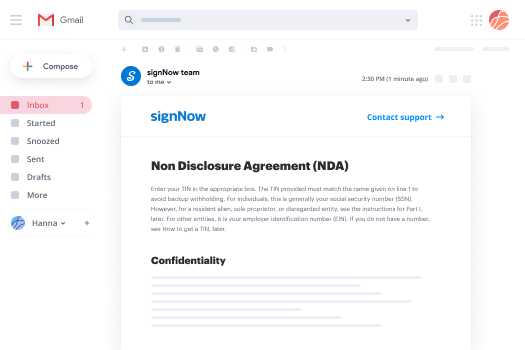

- Enter the name and email address of all signers in the pop-up window that opens.

- Make use of the Start adding fields option to begin to edit document and self sign them.

- Click on SAVE AND INVITE when you're done.

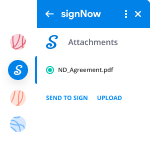

- Continue to customize your eSignature workflow employing advanced features.

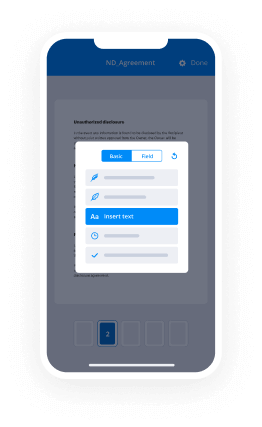

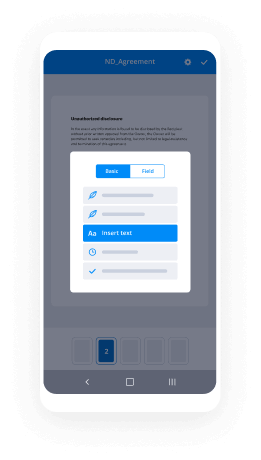

It can't be simpler to use the online signature for loans with direct lenders feature. It's available on your mobile phones as well. Install the airSlate SignNow app for iOS or Android and run your customized eSignature workflows even while on the move. Skip printing and scanning, time-consuming submitting, and expensive document delivery.

How it works

Rate your experience

What is the signature loans online

Signature loans online are unsecured personal loans that do not require collateral. They are based on the borrower's creditworthiness and are typically used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. The application process is streamlined, allowing users to apply, receive approval, and access funds quickly through online platforms.

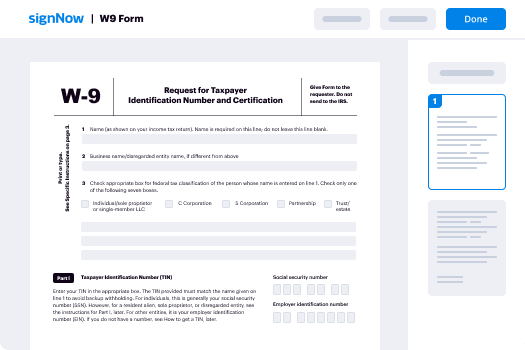

How to use the signature loans online

Using signature loans online involves several straightforward steps. First, borrowers can fill out an online application form, providing necessary personal and financial information. Once submitted, lenders review the application and perform a credit check. If approved, the borrower receives a loan offer, which they can accept electronically. Funds are then disbursed directly to the borrower's bank account, often within one to three business days.

Steps to complete the signature loans online

Completing a signature loan online typically involves the following steps:

- Visit the lender's website and locate the application form.

- Fill out the form with accurate personal and financial details.

- Submit the application for review.

- Receive a loan offer if approved, detailing the terms and conditions.

- Review and electronically sign the agreement using an eSignature tool.

- Receive the funds directly into your bank account.

Legal use of the signature loans online

Signature loans online are legally binding agreements. When borrowers electronically sign the loan documents, they are agreeing to the terms set forth by the lender. It is essential for users to understand their rights and obligations under the loan agreement, including repayment terms and interest rates. Electronic signatures are recognized under U.S. law, making them valid for loan agreements.

Security & Compliance Guidelines

Security is paramount when handling signature loans online. Lenders must comply with regulations such as the Gramm-Leach-Bliley Act, which protects consumers' personal information. Users should ensure that the platform they use employs encryption technology to safeguard their data. Additionally, verifying that the lender is licensed and regulated in their state can provide an extra layer of security.

Eligibility and Access to signature loans online

Eligibility for signature loans online typically depends on factors such as credit score, income, and employment status. Most lenders require a minimum credit score for approval, but options may exist for borrowers with bad credit through direct lenders specializing in these loans. It is advisable for potential borrowers to check their credit reports and ensure they meet the lender's criteria before applying.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are signature loans online?

Signature loans online are unsecured personal loans that require only your signature as collateral. They are typically used for various purposes, such as debt consolidation or unexpected expenses. With airSlate SignNow, you can easily manage your loan documents electronically.

-

How do I apply for signature loans online?

Applying for signature loans online is a straightforward process. You can fill out an application form on our website, providing necessary information about your financial situation. Once submitted, you can eSign your documents using airSlate SignNow for a quick and efficient approval process.

-

What are the benefits of using airSlate SignNow for signature loans online?

Using airSlate SignNow for signature loans online offers numerous benefits, including a user-friendly interface and secure document management. You can track your loan application status in real-time and receive notifications when documents are signed. This streamlines the entire process, making it hassle-free.

-

Are there any fees associated with signature loans online?

Yes, there may be fees associated with signature loans online, such as origination fees or late payment penalties. It's essential to review the terms and conditions before signing any documents. With airSlate SignNow, you can easily access and understand all associated costs before proceeding.

-

How quickly can I receive funds from signature loans online?

The speed at which you receive funds from signature loans online can vary based on the lender's processing times. Typically, once your application is approved and documents are signed via airSlate SignNow, you can expect to receive funds within a few business days. This quick turnaround is one of the advantages of online loans.

-

Can I manage my signature loans online through airSlate SignNow?

Absolutely! airSlate SignNow allows you to manage all your signature loans online efficiently. You can track your loan status, access documents, and eSign any necessary paperwork from anywhere, making it convenient and accessible.

-

What types of documents do I need for signature loans online?

To apply for signature loans online, you typically need to provide identification, proof of income, and possibly credit history. airSlate SignNow simplifies the document submission process, allowing you to upload and eSign required documents securely and quickly.

airSlate SignNow capabilities for online signature for loans with direct lenders

Join over 28 million airSlate SignNow users

Get more for online signature for loans with direct lenders

- Discover How to Change Your Name in Email Signature ...

- Unlock the Secret to Changing Your Signature in Outlook ...

- Discover How to Change the Signature on Outlook 365 ...

- Discover How to Change the Signature in PDF ...

- How to Change Your Digital Signature Password in Adobe ...

- Discover How to Change Your Email Signature in ...

- Unlock the Potential: Change Your Email Footer in ...

- How to Change Your Email Sign Off in Outlook Easily and ...