Sign Church Donation Giving Form Online

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Accelerate your document workflows with eSignature by airSlate SignNow

Make the most of legally-binding eSignatures

Set up signing orders

Use eSignatures outside airSlate SignNow

Enhance your teamwork

Sign church donation giving form online professionally

Save time with shareable links

Quick-start guide on how to sign church donation giving form online

Every organization needs signatures, and every organization wants to optimize the process of collecting them. Get professional document management with airSlate SignNow. You can sign church donation giving form online, create fillable templates, set up eSignature invites, send signing links, work together in teams, and much more. Learn how to improve the collection of signatures electronically.

Follow the steps listed below to sign church donation giving form online within a few minutes:

- Open your web browser and visit signnow.com.

- Sign up for a free trial or log in with your email or Google/Facebook credentials.

- Click User Avatar -> My Account at the top-right corner of the page.

- Personalize your User Profile by adding personal information and altering settings.

- Design and manage your Default Signature(s).

- Get back to the dashboard page.

- Hover over the Upload and Create button and select the needed option.

- Click the Prepare and Send key next to the document's name.

- Enter the email address and name of all signers in the pop-up box that opens.

- Use the Start adding fields option to begin to edit document and self sign them.

- Click SAVE AND INVITE when completed.

- Continue to customize your eSignature workflow employing more features.

It can't get any easier to sign church donation giving form online than that. Also, you can install the free airSlate SignNow app to your mobile device and access your account from any location you are without being tied to your desktop computer or office. Go digital and begin signing contracts online.

How it works

Rate your experience

What is the church donation form

The church donation form is a document used by congregations to facilitate contributions from members and supporters. This form typically includes fields for the donor's name, contact information, donation amount, and payment method. It serves as a record for both the church and the donor, ensuring transparency and accountability in financial contributions. By utilizing an electronic version of this form, churches can streamline the donation process, making it easier for donors to contribute online while maintaining accurate records for tax purposes.

How to use the church donation form

Using the church donation form is straightforward. Donors can access the form online, fill in the required information, and submit it electronically. With airSlate SignNow, users can easily fill and sign the form digitally. The process involves selecting the donation amount, entering personal details, and choosing a payment method. Once completed, the form can be sent for signature if necessary or saved securely for record-keeping. This electronic method enhances convenience and ensures that donations are processed efficiently.

Steps to complete the church donation form

Completing the church donation form involves several key steps:

- Access the form online through the church's website or a direct link.

- Fill out the required fields, including your name, email, and donation amount.

- Select a payment method, such as credit card or bank transfer.

- Review the information for accuracy before submitting.

- Sign the form electronically using airSlate SignNow's eSignature feature, if required.

- Submit the form and save a copy for your records.

These steps ensure that the donation process is seamless and secure for both the donor and the church.

Key elements of the church donation form

The church donation form typically includes several key elements to ensure clarity and effectiveness:

- Donor Information: Name, address, and contact details of the donor.

- Donation Amount: The specific amount the donor wishes to contribute.

- Payment Method: Options for payment, such as credit card or bank transfer.

- Purpose of Donation: A section where donors can specify if the contribution is for a particular cause or project.

- Signature Section: An area for the donor to provide an electronic signature, confirming their intent to donate.

These elements help ensure that the donation is processed correctly and that both parties have a clear understanding of the transaction.

Security & Compliance Guidelines

When using the church donation form electronically, it is crucial to adhere to security and compliance guidelines. airSlate SignNow ensures that all documents are encrypted and securely stored, protecting sensitive donor information. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is essential for safeguarding payment information. Additionally, churches should maintain transparency by providing donors with clear information about how their contributions will be used and ensuring that their data is handled responsibly.

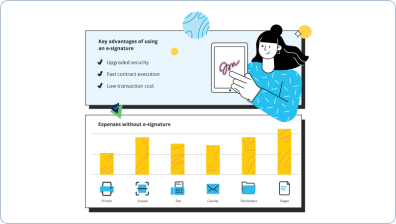

Digital vs. Paper-Based Signing

Choosing between digital and paper-based signing for the church donation form has significant implications. Digital signing offers numerous advantages, including increased efficiency, reduced paperwork, and enhanced security. With airSlate SignNow, users can complete and sign the form from any device, eliminating the need for physical storage and manual processing. In contrast, paper-based signing can lead to delays and potential errors in record-keeping. Embracing digital solutions streamlines the donation process and fosters a more environmentally friendly approach.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a church donation form?

A church donation form is a document that allows congregants to make financial contributions to their church easily. It can be customized to include various donation options, such as one-time gifts or recurring donations, making it a versatile tool for fundraising efforts.

-

How can airSlate SignNow help with church donation forms?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning church donation forms. With its user-friendly interface, churches can streamline the donation process, ensuring that members can contribute quickly and securely.

-

What features does airSlate SignNow offer for church donation forms?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure payment processing for church donation forms. These tools help churches manage donations effectively while providing a seamless experience for donors.

-

Is there a cost associated with using airSlate SignNow for church donation forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for churches. The cost is competitive and provides excellent value considering the features available for managing church donation forms.

-

Can I integrate airSlate SignNow with other tools for church donation forms?

Absolutely! airSlate SignNow integrates with various applications, allowing churches to connect their donation forms with CRM systems, payment processors, and more. This integration enhances the overall efficiency of managing church donations.

-

What are the benefits of using airSlate SignNow for church donation forms?

Using airSlate SignNow for church donation forms offers numerous benefits, including increased donation efficiency, improved donor experience, and enhanced security. These advantages help churches maximize their fundraising efforts while maintaining trust with their congregants.

-

How secure are church donation forms created with airSlate SignNow?

Security is a top priority for airSlate SignNow. Church donation forms created on the platform are protected with advanced encryption and compliance measures, ensuring that donor information remains confidential and secure throughout the donation process.

Sign church donation giving form online

Trusted eSignature solution - sign church donation giving form online

Join over 28 million airSlate SignNow users

Get more for sign church donation giving form online

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

The ins and outs of eSignature