Sign Promissory Note Template Online

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Speed up your document workflows with eSignature by airSlate SignNow

Take full advantage of legally-binding eSignatures

Create signing orders

Use eSignatures outside airSlate SignNow

Boost your teamwork

Sign promissory note template online professionally

Save your time with shareable links

Quick guide on how to sign promissory note template online

Every organization needs signatures, and every organization wants to optimize the process of collecting them. Get professional document management with airSlate SignNow. You can sign promissory note template online, create fillable templates, set up eSignature invites, send signing hyperlinks, collaborate in teams, and more. Figure out how to streamline the collection of signatures digitally.

Complete the following steps below to sign promissory note template online within a few minutes:

- Open your browser and visit signnow.com.

- Join for a free trial or log in using your electronic mail or Google/Facebook credentials.

- Click User Avatar -> My Account at the top-right corner of the webpage.

- Personalize your User Profile by adding personal information and adjusting configurations.

- Design and manage your Default Signature(s).

- Go back to the dashboard webpage.

- Hover over the Upload and Create button and select the appropriate option.

- Click on the Prepare and Send button next to the document's title.

- Type the name and email address of all signers in the pop-up box that opens.

- Make use of the Start adding fields option to proceed to edit file and self sign them.

- Click on SAVE AND INVITE when completed.

- Continue to fine-tune your eSignature workflow using more features.

It can't get any easier to sign promissory note template online than that. Also, you can install the free airSlate SignNow app to your mobile device and access your account from any location you happen to be without being tied to your desktop computer or office. Go digital and start signing contracts online.

How it works

Rate your experience

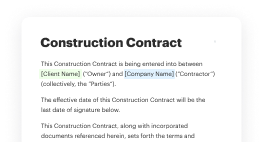

What is the online promissory note

An online promissory note is a digital document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This type of note is legally binding and can be created, signed, and managed electronically, making it a convenient option for individuals and businesses. By utilizing an electronic format, users can easily access, fill out, and store their promissory notes securely, ensuring that all parties have a clear understanding of the repayment obligations.

How to use the online promissory note

Using an online promissory note involves several straightforward steps. First, users can select a legally binding promissory note template that suits their needs. Once the template is chosen, it can be filled out with the necessary details, including the loan amount, interest rate, repayment schedule, and any other relevant terms. After completing the document, users can send it for signature to the involved parties. airSlate SignNow facilitates this process by allowing users to eSign the document electronically, ensuring a quick and efficient workflow.

Steps to complete the online promissory note

Completing an online promissory note is a simple process that can be done in a few steps:

- Select a fillable promissory note template from airSlate SignNow.

- Fill in the required fields, including borrower and lender information, loan amount, interest rate, and repayment terms.

- Review the document for accuracy to ensure all details are correct.

- Use the eSignature feature to sign the document electronically.

- Send the completed note to the other party for their signature.

- Once all signatures are obtained, securely store the document for future reference.

Key elements of the online promissory note

When creating an online promissory note, it is important to include several key elements to ensure its legality and clarity:

- Borrower and lender information: Full names and contact details of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The agreed-upon interest rate, if applicable.

- Repayment terms: Clear details on how and when the borrower will repay the loan.

- Signatures: Electronic signatures from both parties to validate the agreement.

Legal use of the online promissory note

Online promissory notes are legally binding in the United States, provided they meet certain criteria. To ensure enforceability, the note must include all essential elements, be signed by both parties, and comply with state laws regarding promissory notes. Utilizing airSlate SignNow's electronic signature capabilities helps to streamline the process while maintaining legal validity. It is advisable for users to consult legal counsel to ensure their specific note complies with applicable regulations.

Security & Compliance Guidelines

When handling online promissory notes, security and compliance are paramount. airSlate SignNow employs robust security measures, including encryption and secure storage, to protect sensitive information. Users should ensure that their electronic signatures are compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By following these guidelines, users can confidently manage their promissory notes while safeguarding their data.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

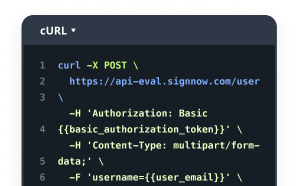

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an esignature sign promissory note template online?

An esignature sign promissory note template online is a digital document that allows users to create, sign, and manage promissory notes electronically. This template simplifies the process of securing loans or agreements by providing a legally binding format that can be easily customized and shared.

-

How does airSlate SignNow ensure the security of my esignature sign promissory note template online?

airSlate SignNow employs advanced encryption and security protocols to protect your esignature sign promissory note template online. All documents are stored securely, and access is controlled to ensure that only authorized users can view or edit the documents.

-

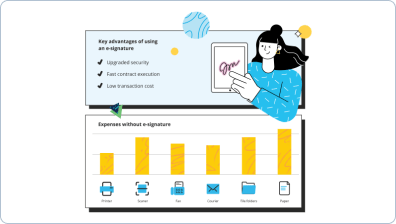

What are the benefits of using an esignature sign promissory note template online?

Using an esignature sign promissory note template online streamlines the signing process, saves time, and reduces paperwork. It also enhances the convenience of signing from anywhere, while ensuring compliance with legal standards for electronic signatures.

-

Is there a cost associated with using the esignature sign promissory note template online?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that includes access to the esignature sign promissory note template online, along with other features that enhance document management and signing.

-

Can I customize the esignature sign promissory note template online?

Absolutely! The esignature sign promissory note template online can be easily customized to fit your specific requirements. You can modify text, add fields for signatures, and include any additional information necessary for your agreement.

-

What integrations does airSlate SignNow offer for the esignature sign promissory note template online?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your esignature sign promissory note template online alongside your other business tools for enhanced efficiency.

-

How quickly can I get started with the esignature sign promissory note template online?

Getting started with the esignature sign promissory note template online is quick and easy. Simply sign up for an account, choose the template, and you can begin customizing and sending documents for signatures within minutes.

Sign promissory note template online

Trusted eSignature solution - sign promissory note template online

Join over 28 million airSlate SignNow users

Get more for sign promissory note template online

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

- Start Your eSignature Journey: how to make online ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore Your Digital Signature – Questions Answered: ...

The ins and outs of eSignature