Signed Copy of Tax Return in India

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your complete how-to guide - signed copy of tax return in india

Boost your workflows: signed copy of tax return in India

Nowadays, printing hard copies of documents and manual signing is absolutely nothing but wasting time and effort. Millions of people around the globe are going paperless every day and replacing wet ink signatures with electronic ones.

airSlate SignNow makes using the signed copy of tax return in India simple and fast, all without you having to go somewhere from your office. Access a straightforward service with global compliance and industry-leading security standards.

Signed copy of tax return in India: how to implement

- Sign up for an account. Visit the airSlate SignNow website, click Free trial to start the registration procedure.

- Choose a document. Click the blue Upload Documents button to find a file from your internal memory or drag and drop one into the designated area.

- Change the document. Include new texts, checkmarks, dates etc., that you can find on the left toolbar.

- Make your PDF file interactive. Add smart fillable fields, dropdowns, radio button groups, and more.

- Add a payment request. Select Settings > Request Payment.

- Double-check the your document. Make sure all the details are updated and correct.

- Add signature fields. Add a Signature Field for each party you need.

- Self sign the document. Select the My Signature element and choose to draw, type, or upload a scanned picture of your signature.

- Send the document for signing. Click Invite to Sign and indicate recipient email(s) to send a signature request.

- Download your form. Select Save and Close > Download (on the right sidebar) to save the file on your device.

Get professional signed copy of tax return in India with airSlate SignNow.

Start your Free trial today and boost your document workflows!

How it works

Rate your experience

What is the signed copy of tax return in India

A signed copy of a tax return in India is an official document that confirms the submission of an individual's or entity's income tax return to the Income Tax Department. This document typically includes essential details such as the taxpayer's name, income, deductions, and tax liability. It serves as proof that the tax return has been filed and is crucial for various financial and legal purposes.

In the context of electronic filing, a signed copy can be generated digitally, ensuring that it meets the necessary compliance and verification standards. This digital version can be easily shared, stored, and retrieved when needed.

How to use the signed copy of tax return in India

The signed copy of a tax return in India is used for multiple purposes, including applying for loans, visas, and other financial transactions. It acts as a verification tool for income and tax compliance. When submitting this document, ensure that it is the most recent version and contains all relevant information.

For electronic use, the signed copy can be shared via email or uploaded to secure platforms, making it accessible for both personal and professional use. Utilizing a digital signature enhances its authenticity and ensures that it is legally recognized.

Steps to complete the signed copy of tax return in India

Completing a signed copy of a tax return electronically involves several steps:

- Gather all necessary financial documents, including income statements and deduction proofs.

- Access the tax filing platform and input the required information accurately.

- Review the completed tax return for any errors or omissions.

- Utilize the eSignature feature to sign the document electronically.

- Save or download the signed copy for your records.

- Submit the signed copy to the relevant authorities or share it as needed.

Security & Compliance Guidelines

When handling a signed copy of a tax return, it is essential to adhere to security and compliance guidelines to protect sensitive information. Ensure that the platform used for eSigning is secure and compliant with legal standards.

Utilizing encryption and secure access protocols can safeguard personal data. Regularly update passwords and limit access to authorized individuals only. Compliance with regulations such as the General Data Protection Regulation (GDPR) is also crucial when managing electronic documents.

Digital vs. Paper-Based Signing

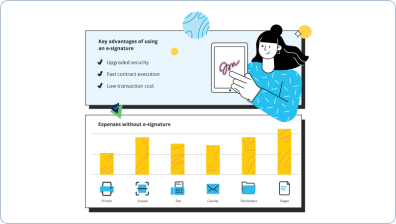

Digital signing of a tax return offers several advantages over traditional paper-based methods. Digital signatures are faster, allowing for immediate submission and processing. They also reduce the risk of loss or damage associated with physical documents.

Additionally, digital signing provides a clear audit trail, enhancing transparency and accountability. The ability to store and retrieve documents electronically simplifies record-keeping, making it easier to access the signed copy when needed.

Sending & Signing Methods (Web / Mobile / App)

There are various methods available for sending and signing a signed copy of a tax return electronically. Users can choose to complete the process via web browsers, mobile applications, or dedicated eSignature platforms.

Each method offers unique features, such as mobile notifications for signature requests or the ability to fill out forms directly on a smartphone. Users should select the method that best fits their workflow and preferences for ease of use and accessibility.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a signed copy of tax return in India?

A signed copy of tax return in India is a legally recognized document that confirms the submission of your tax return to the Income Tax Department. It includes your personal details, income, deductions, and tax calculations, along with your digital signature. This document is essential for tax compliance and can be requested by various financial institutions.

-

How can I obtain a signed copy of tax return in India using airSlate SignNow?

With airSlate SignNow, you can easily create and send your tax return documents for eSignature. Once your tax return is prepared, simply upload it to our platform, add the necessary signers, and send it out for signatures. After all parties have signed, you will receive a signed copy of tax return in India, ready for submission.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your tax returns streamlines the signing process, saving you time and reducing paperwork. You can track the status of your documents in real-time and ensure that you receive a signed copy of tax return in India quickly. Additionally, our platform is secure and compliant with legal standards, providing peace of mind.

-

Is there a cost associated with getting a signed copy of tax return in India through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost will depend on the features you choose and the volume of documents you need to process. However, our solution is designed to be cost-effective, ensuring you get a signed copy of tax return in India without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to streamline your workflow and ensure that you can easily obtain a signed copy of tax return in India directly from your preferred applications.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as document templates, automated reminders, and real-time tracking for your tax documents. These tools help ensure that you can efficiently manage your tax returns and obtain a signed copy of tax return in India without any hassle.

-

How secure is the signed copy of tax return in India when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your sensitive information. When you obtain a signed copy of tax return in India through our platform, you can trust that your data is safe and compliant with industry standards.

Signed copy of tax return in india

Trusted eSignature solution - signed copy of tax return in india

Related searches to signed copy of tax return in india

Join over 28 million airSlate SignNow users

Get more for signed copy of tax return in india

- Electronic Signature Legitimacy for Research and ...

- Unlock Electronic Signature Legitimacy for Research and ...

- Boost Research and Development in European Union with ...

- Electronic Signature Legitimacy for Research and ...

- Electronic signature legitimacy for Research and ...

- Unlock Electronic Signature Legitimacy for Research and ...

- Unlock Electronic Signature Legitimacy for Management ...

- Unlock Electronic Signature Legitimacy for Management ...

The ins and outs of eSignature