Tax Return Signature in India

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your complete how-to guide - tax return signature in india

Boost your workflows: tax return signature in India

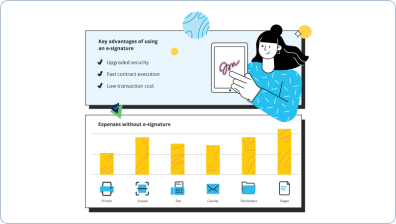

Nowadays, printing hard copies of docs and manual signing is nothing but losing time and paper. People around the globe are going digital every single day and replacing wet ink signatures with electronic ones.

airSlate SignNow makes using the tax return signature in India easy and fast, all without you having to go somewhere from your home or office. Get access to an easy-to-use eSignature service with global compliance and industry-leading security standards.

Tax return signature in India: how to implement

- Sign up for an account. Visit the airSlate SignNow website, click Free trial to start the registration procedure.

- Choose a document. Click the blue Upload Documents button to find a PDF from the internal memory or drag and drop one into the designated area.

- Edit the document. Insert new text, checkmarks, dates and so on, that you can find on the left toolbar.

- Make your PDF file interactive. Add smart fillable fields, dropdowns, radio button groups, and more.

- Add a payment request. Select Settings > Request Payment.

- Recheck your document. Make sure all the details are updated and correct.

- Add signature fields. Add a Signature Field for each party you need.

- Self sign the document. Select the My Signature tool and choose to draw, type, or capture picture of your signature.

- Send the document for signing. Click Invite to Sign and specify recipient email(s) to send a signature request.

- Download your form. Select Save and Close > Download (on the right sidebar) to save the file on your device.

Get professional tax return signature in India with airSlate SignNow.

Start your Free trial today and boost your document workflows!

How it works

Rate your experience

What is the tax return signature in india

The tax return signature in India is a crucial component of the tax filing process. It serves as a formal declaration by the taxpayer that the information provided in the tax return is accurate and complete. This signature can be affixed electronically, which streamlines the submission process and enhances efficiency. With the rise of digital solutions, taxpayers can now use electronic signatures to validate their tax returns, ensuring compliance with regulatory requirements while simplifying their workflow.

How to use the tax return signature in india

To use the tax return signature in India, taxpayers can complete their tax return forms electronically through a secure platform. After filling out the necessary information, they can apply their electronic signature, which acts as a legally binding confirmation of the document's authenticity. This process typically involves selecting a signature option within the tax software, verifying identity, and securely submitting the signed document to the relevant tax authority.

Steps to complete the tax return signature in india

Completing the tax return signature electronically involves several straightforward steps:

- Access the tax return form through a trusted digital platform.

- Fill in all required fields with accurate information.

- Review the completed form for any errors or omissions.

- Select the option to eSign the document.

- Authenticate your identity as required, which may include entering a password or using a verification code.

- Submit the signed tax return electronically to the tax authority.

Key elements of the tax return signature in india

The key elements of the tax return signature in India include the taxpayer's name, the date of signing, and the electronic signature itself. These components ensure that the document is legally valid and can be traced back to the individual who submitted it. Additionally, the electronic signature must comply with the Electronic Signature Act, which outlines the necessary legal framework for digital signatures in India.

Security & Compliance Guidelines

When using electronic signatures for tax returns, it is essential to adhere to security and compliance guidelines. This includes using a secure platform that encrypts data during transmission and storage. Taxpayers should ensure that their electronic signature is generated through a certified service provider, which guarantees the authenticity and integrity of the signed document. Regular audits and compliance checks can further enhance security and trust in the electronic signature process.

Digital vs. Paper-Based Signing

The choice between digital and paper-based signing for tax returns presents distinct advantages. Digital signing offers enhanced convenience, allowing taxpayers to complete and submit their forms from anywhere at any time. It reduces the need for physical paperwork, which can be cumbersome and prone to loss. Conversely, paper-based signing may be preferred by those who are less familiar with technology or who require physical copies for their records. Ultimately, the decision hinges on individual preferences and comfort with digital tools.

Eligibility and Access to tax return signature in india

Eligibility for using the tax return signature in India generally includes individuals and entities who are required to file tax returns. This encompasses salaried individuals, self-employed professionals, and businesses. Access to electronic signing tools is typically available through various tax filing software, which often includes user-friendly interfaces to facilitate the signing process. Taxpayers should ensure they meet any specific requirements set forth by the tax authority to utilize electronic signatures effectively.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is the process for obtaining a tax return signature in India using airSlate SignNow?

To obtain a tax return signature in India with airSlate SignNow, simply upload your tax return document, add the necessary signers, and send it for eSignature. The signers will receive an email notification to review and sign the document electronically. This streamlined process ensures that your tax return is signed quickly and securely.

-

Is airSlate SignNow compliant with Indian regulations for tax return signatures?

Yes, airSlate SignNow is fully compliant with Indian regulations regarding electronic signatures. Our platform adheres to the Information Technology Act, 2000, ensuring that your tax return signature in India is legally valid and recognized by authorities. You can confidently use our service for your tax documentation needs.

-

What are the pricing options for using airSlate SignNow for tax return signatures in India?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. You can choose from monthly or annual subscriptions, with options that provide unlimited eSignatures and document storage. This cost-effective solution makes it easy to manage your tax return signature in India without breaking the bank.

-

What features does airSlate SignNow offer for managing tax return signatures in India?

airSlate SignNow provides a range of features designed to simplify the eSigning process for tax returns in India. Key features include customizable templates, real-time tracking of document status, and secure cloud storage. These tools help ensure that your tax return signature process is efficient and organized.

-

Can I integrate airSlate SignNow with other software for tax return management?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including accounting and tax preparation tools. This allows you to streamline your workflow and manage your tax return signatures in India more effectively, enhancing productivity and reducing manual errors.

-

What are the benefits of using airSlate SignNow for tax return signatures in India?

Using airSlate SignNow for tax return signatures in India offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The electronic signature process eliminates the need for physical paperwork, making it easier to manage your tax documents. Additionally, our platform ensures that all signatures are legally binding and secure.

-

How secure is the tax return signature process with airSlate SignNow in India?

The security of your tax return signature in India is our top priority at airSlate SignNow. We utilize advanced encryption protocols and secure data storage to protect your documents and personal information. Our platform also includes authentication features to ensure that only authorized individuals can sign your tax returns.

Tax return signature in india

Trusted eSignature solution - tax return signature in india

Related searches to tax return signature in india

Join over 28 million airSlate SignNow users

Get more for tax return signature in india

- Ensuring Digital Signature Lawfulness for Employee ...

- Ensuring Digital Signature Lawfulness for Employee ...

- Digital Signature Lawfulness for Business Ethics and ...

- Ensure compliance with digital signature lawfulness for ...

- Ensuring Compliance with Digital Signature Lawfulness ...

- Ensuring Digital Signature Lawfulness for Disclosure ...

- Ensuring the Lawful Use of Digital Signatures for ...

- Digital Signature Legitimacy for Applications: Simplify ...

The ins and outs of eSignature