Sign VAT Invoice

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch form management with airSlate SignNow

Get access to a robust form library

Create reusable templates

Collect signatures through links

Keep paperwork safe

Enhance collaboration

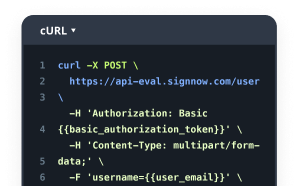

eSign by means of API integrations

Your complete how-to guide - vat invoice

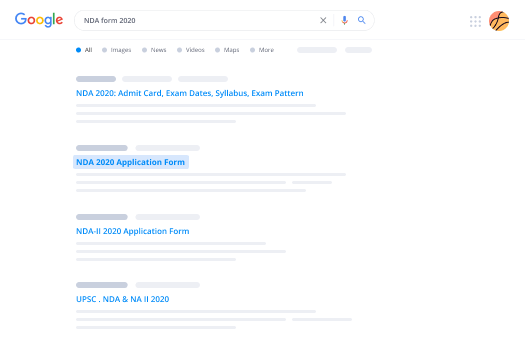

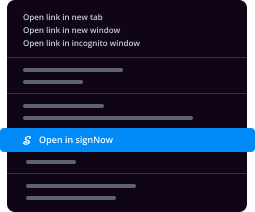

Nowadays, it is likely you won't find an organization that doesn't use contemporary technological innovation to atomize work-flow. An electronic signing is no longer the future, but the present. Contemporary businesses using their turnover simply cannot afford to give up web-based programs that provide advanced document management automation tools, such as Sign VAT Invoice option.

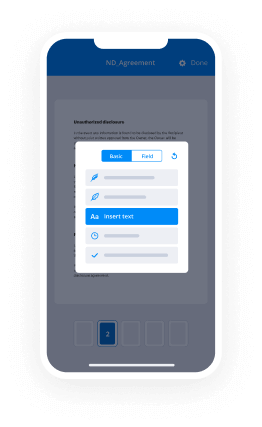

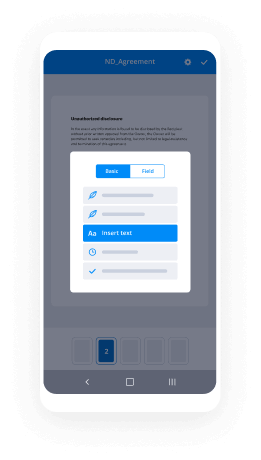

How to handle Sign VAT Invoice airSlate SignNow feature:

-

Once you get to our website, Login or make your account if you don't have one, it will take you a few seconds.

-

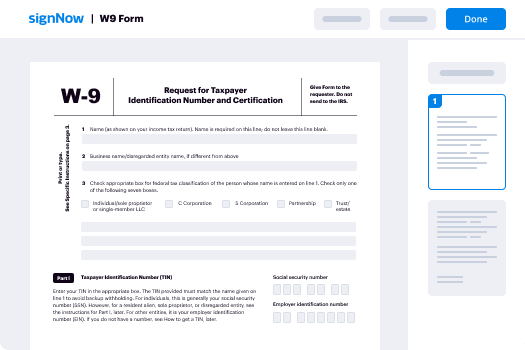

Upload the appropriate data file or choose one from your catalogue folders: Documents, Archive, Templates.

-

As a result of cloud-based storage compatibility, you may quickly load the appropriate doc from recommended clouds with practically any gadget.

-

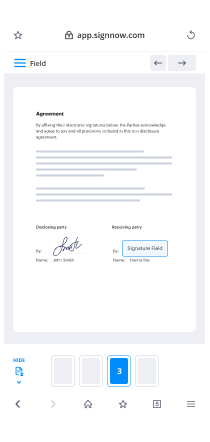

You'll get your data file opened in the up-to-date PDF Editor where you can add modifications before you carry on.

-

Type textual content, insert images, include annotations or fillable boxes to be completed further.

-

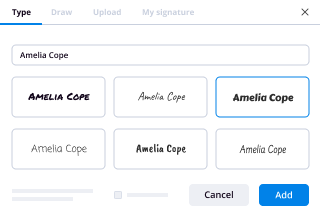

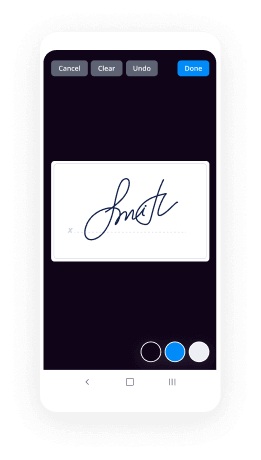

Use My Signature button for self-signing or include Signature Fields to send the sign request to a single or numerous individuals.

-

Tap the DONE button when completed to go on with Sign VAT Invoice function.

airSlate SignNow browser solution is necessary to boost the efficiency and productivity of all operational processes. Sign VAT Invoice is among the capabilities that can help. Using the internet-based software nowadays is actually a necessity, not much of a competitive edge. Test it now!

How it works

Rate your experience

What is the sale invoice would show supplier vat registration number

A sale invoice that shows the supplier's VAT registration number is a crucial document in business transactions involving VAT (Value Added Tax). This invoice serves as proof of the sale and includes essential details such as the supplier's VAT registration number, which is necessary for tax compliance. It verifies that the supplier is authorized to collect VAT on behalf of the government, ensuring that the buyer can reclaim VAT if applicable. This document is particularly important for businesses that are VAT registered, as it helps in maintaining accurate financial records and fulfilling tax obligations.

How to use the sale invoice would show supplier vat registration number

Using a sale invoice that displays the supplier's VAT registration number involves several steps. First, ensure that all relevant information is accurately filled out, including the supplier's details, the buyer's information, the description of goods or services provided, and the total amount charged, including VAT. Once the invoice is prepared, it can be sent electronically for approval or signature. Utilizing airSlate SignNow, you can easily fill out the invoice online, send it for signature, and securely store the completed document. This electronic process streamlines workflows and enhances efficiency.

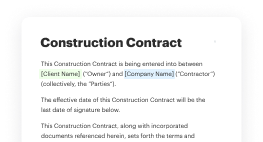

Steps to complete the sale invoice would show supplier vat registration number

Completing a sale invoice that shows the supplier's VAT registration number can be done in a few simple steps:

- Access the invoice template within airSlate SignNow.

- Fill in the supplier's name, address, and VAT registration number.

- Enter the buyer's details, including their name and address.

- List the goods or services provided, including quantities and unit prices.

- Calculate the total amount, ensuring to include the applicable VAT.

- Review all information for accuracy before sending.

- Send the invoice for electronic signature using airSlate SignNow.

Key elements of the sale invoice would show supplier vat registration number

Key elements of a sale invoice that includes the supplier's VAT registration number are essential for compliance and clarity. These elements typically include:

- Supplier Information: Name, address, and VAT registration number.

- Buyer Information: Name and address of the buyer.

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date the invoice is created.

- Description of Goods/Services: Detailed list of what was sold.

- Total Amount: The total cost, including VAT.

Security & Compliance Guidelines

When handling sale invoices that show supplier VAT registration numbers, it is important to adhere to security and compliance guidelines. Ensure that all sensitive information is protected during transmission and storage. Using airSlate SignNow provides a secure platform for electronic signatures, which complies with legal standards such as the ESIGN Act and UETA. Always verify the identity of signers and maintain a secure audit trail for all transactions to safeguard against fraud and ensure compliance with tax regulations.

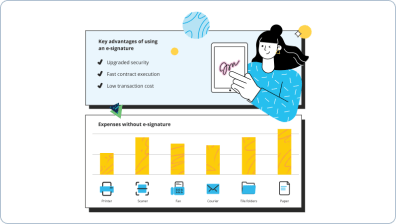

Digital vs. Paper-Based Signing

Choosing between digital and paper-based signing for sale invoices that show the supplier's VAT registration number can significantly impact efficiency. Digital signing, facilitated by platforms like airSlate SignNow, allows for quicker processing times, reduced paper usage, and easier storage. It eliminates the need for physical delivery and manual handling, which can lead to delays. Additionally, digital signatures provide enhanced security features, such as encryption and authentication, ensuring the integrity of the document while maintaining compliance with legal standards.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What information does a sale invoice include?

A sale invoice would show supplier VAT registration number along with other essential details such as the invoice date, itemized list of products or services, total amount due, and payment terms. This information is crucial for both the supplier and the buyer for accounting and tax purposes.

-

How does airSlate SignNow help with invoicing?

With airSlate SignNow, you can easily create and send invoices that include all necessary details, ensuring that a sale invoice would show supplier VAT registration number. Our platform streamlines the invoicing process, making it efficient and user-friendly.

-

Is there a cost associated with using airSlate SignNow for invoicing?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides features that ensure a sale invoice would show supplier VAT registration number, along with other functionalities to enhance your document management.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to automate your invoicing process. This ensures that every sale invoice would show supplier VAT registration number accurately, reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for invoicing?

Using airSlate SignNow for invoicing offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. A sale invoice would show supplier VAT registration number, ensuring that your business meets tax regulations effortlessly.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow. All documents, including those where a sale invoice would show supplier VAT registration number, are encrypted and stored securely, ensuring that your sensitive information remains protected.

-

Can I customize my invoices with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your invoices to reflect your brand. You can ensure that a sale invoice would show supplier VAT registration number along with your logo and other branding elements, making your invoices professional and recognizable.

Vat invoice

Trusted eSignature solution - vat invoice

Join over 28 million airSlate SignNow users

Get more for vat invoice

- Start Your eSignature Journey: create signature online

- Enjoy Flexible eSignature Workflows: create signature ...

- Try Seamless eSignatures: create signature online for ...

- Start Your eSignature Journey: create signature style ...

- Start Your eSignature Journey: create signature with ...

- Start Your eSignature Journey: create transparent ...

- Start Your eSignature Journey: create your own ...

- Start Your eSignature Journey: create your signature ...

The ins and outs of eSignature