Fill and Sign the 2020 Pa Corporate Net Income Tax Declaration for a State E File Report Pa 8453 C Pa Department of Revenue Form

Valuable advice on getting your ‘2020 Pa Corporate Net Income Tax Declaration For A State E File Report Pa 8453 C Pa Department Of Revenue’ ready online

Are you fed up with the inconvenience of managing paperwork? Search no further than airSlate SignNow, the premier eSignature service for individuals and businesses. Bid farewell to the labor-intensive process of printing and scanning files. With airSlate SignNow, you can conveniently complete and sign documents online. Utilize the powerful features embedded in this user-friendly and cost-effective platform and transform your document management approach. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘2020 Pa Corporate Net Income Tax Declaration For A State E File Report Pa 8453 C Pa Department Of Revenue’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your part.

- Insert and allocate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t be concerned if you need to work with others on your 2020 Pa Corporate Net Income Tax Declaration For A State E File Report Pa 8453 C Pa Department Of Revenue or send it for notarization—our solution provides all the tools necessary to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

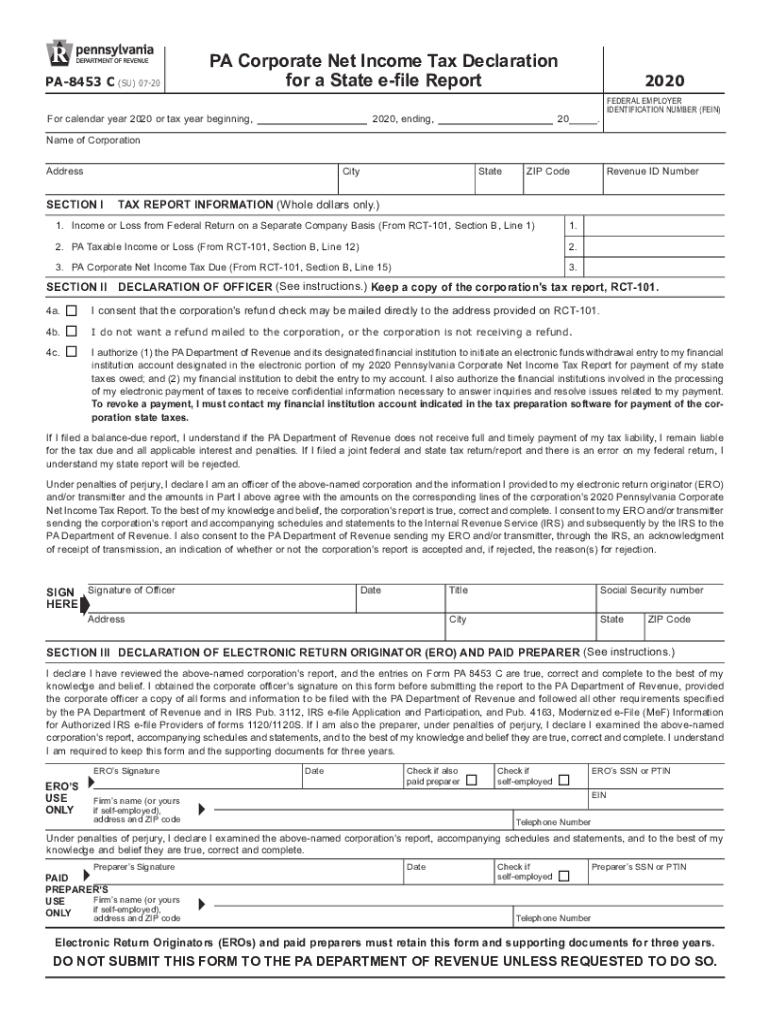

What is the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

The PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C is a form required by the Pennsylvania Department of Revenue for corporations to report their net income. This form serves as a declaration for e-filing state corporate taxes, ensuring compliance with state regulations. Using this form correctly is crucial for avoiding penalties and ensuring accurate tax reporting.

-

How can airSlate SignNow help with the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

airSlate SignNow offers an easy-to-use platform that streamlines the process of completing and eSigning the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. Our solution allows businesses to quickly fill out, send, and securely store these documents, ensuring that you meet all necessary compliance requirements. This can signNowly reduce the time and hassle associated with tax reporting.

-

What are the key features of airSlate SignNow for handling PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

Key features of airSlate SignNow include customizable templates, secure eSigning, and seamless document management. These features specifically cater to the needs of businesses preparing the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C, making it easier to manage deadlines and maintain compliance. Additionally, our platform integrates with various accounting software for enhanced efficiency.

-

Is there a cost associated with using airSlate SignNow for the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs, including options for those focusing on the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. Our plans are designed to be cost-effective while providing robust features to help businesses comply with state tax requirements. You can choose a plan that best fits your document signing needs.

-

Can I integrate airSlate SignNow with other software for filing the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software and other business applications, making it easier to manage the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. This integration allows for a more streamlined workflow, reducing the chance of errors and ensuring all documentation is in one place.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, such as the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C, offers numerous benefits including increased efficiency, enhanced security, and improved accuracy. Our platform simplifies document workflows, allowing you to focus on your core business activities while ensuring compliance with state tax regulations. Plus, our easy-to-use interface makes the process straightforward for all users.

-

How secure is airSlate SignNow when handling sensitive tax documents like the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

airSlate SignNow prioritizes the security of your documents, including the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. We implement advanced encryption and security protocols to protect sensitive information during transmission and storage. Our compliance with industry standards ensures that your data remains safe and secure.

Find out other 2020 pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles