Fill and Sign the 50 244 Dealeramp39s Motor Vehicle Inventory Declaration Window State Tx Form

Useful advice on preparing your ‘50 244 Dealeramp39s Motor Vehicle Inventory Declaration Window State Tx’ online

Are you weary of the complications associated with paperwork? Look no further than airSlate SignNow, the top eSignature platform for individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can conveniently fill out and sign documents online. Utilize the comprehensive tools available in this intuitive and economical platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Adhere to this thorough guide:

- Sign in to your account or commence a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘50 244 Dealeramp39s Motor Vehicle Inventory Declaration Window State Tx’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Include and assign fillable fields for others (if needed).

- Proceed with the Send Invite options to seek eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work together with your colleagues on your 50 244 Dealeramp39s Motor Vehicle Inventory Declaration Window State Tx or send it for notarization—our platform has everything you require to manage such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

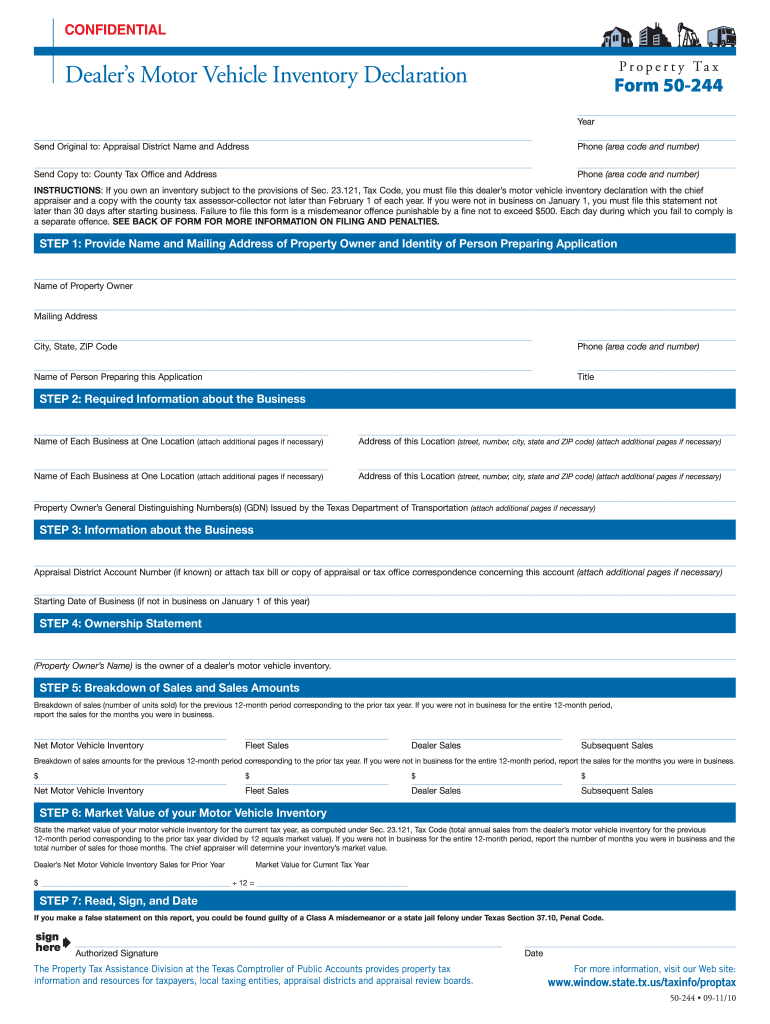

What is the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

The 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx is a document required for vehicle dealers in Texas to report their inventory to the state. This declaration helps ensure compliance with state regulations and provides an accurate inventory count for taxation purposes.

-

How can airSlate SignNow help with the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

airSlate SignNow simplifies the process of completing and signing the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx. With our easy-to-use platform, you can quickly fill out the form, obtain eSignatures, and securely send it to the necessary authorities, streamlining your workflow.

-

Is there a cost associated with using airSlate SignNow for the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose a plan that suits your volume of document management, including the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking for the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx. These features enhance efficiency, allowing you to manage your inventory declarations seamlessly.

-

Can I integrate airSlate SignNow with other software for the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to connect your existing systems for managing the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx. This integration helps create a streamlined workflow tailored to your business needs.

-

How secure is airSlate SignNow for submitting the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your data, including the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx. You can trust that your sensitive information is safe and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx?

Using airSlate SignNow for the 50 244 Dealer's Motor Vehicle Inventory Declaration Window State Tx improves efficiency, reduces paperwork, and accelerates the signing process. This user-friendly platform not only saves time but also enhances accuracy, helping you maintain compliance with state regulations.

Find out other 50 244 dealeramp39s motor vehicle inventory declaration window state tx form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles