GSA SmartPay Conference

Disputes:

Resolution without Delay

Civilian

Heelay Yaftali

Vice President, Citi

®

�11th Annual GSA SmartPay Conference

Phoenix, Arizona

July 28th - July 30th, 2009

®

�Disputes: Resolution without Delay

House Rules

To ensure the best possible learning

experience for participants, please adhere to

the following house rules:

•

•

•

Turn cell phones and pagers to vibrate

Hold questions to end of session

Must be scanned to receive CLP credits

•

Unanswered Questions

− For each course

− Q-Cards & Ballot Boxes

− Answer to be emailed after the

conference - within 45 days

®

�Disputes: Resolutions without Delay

Goals & Objectives

This session is designed to assist you in

achieving the following goals:

•

Provide an overview and outline of the

dispute process

•

Provide tools and information to educate

your cardholders

•

Facilitate more timely and effective dispute

resolutions

®

�Agenda

1. Defining a Dispute

2. Dispute Process

3. CitiDirect® Card

Management System

Benefits

4. Ensuring a Successful

Dispute Process

5. Dispute Resolution

6. Cardholder Tips

®

�1. Defining a Dispute

®

�Defining Disputes

What is a Dispute?

Association Definition: A transaction amount that

the cardholder believes should be returned in full

or in part to the merchant.

– A dispute is the first step in the process to return a

charge to the merchant’s bank

– It may be determined for a given reason that all or

part of the charge amount could be charged back to

the merchant bank

Common Reasons for a Dispute:

– A charge on statement that cardholder does not

remember making

– Difference in amount

– Duplicate charges

– Canceled or returned merchandise

®

�2. Dispute Process

®

�Dispute Process

Understanding the Basics

Who are the players?

– Visa & MasterCard –

the card associations

– Card Issuers

– Merchants

– Card Acquirers

– Cardholders

Who sets the guidelines?

®

�Dispute Process

Quick Facts & Tips for Cardholders

Cardholder MUST notify the issuer

of dispute within 60 days from

statement date on which transaction

appears

Cardholders should carefully review

their statements every month

Cardholders should retain all

receipts and other transaction

documentation

®

�Dispute Process

Steps to Initiating a Dispute Claim

Step 1: Contact the merchant directly

– Disputes are often resolved by contacting the merchant directly

Step 2: If the merchant is unable to help, contact the issuing bank

– The issuing bank will research the transaction with the merchant and their acquirer on

the cardholder’s behalf

– Citi: 800-790-7206

– Complete and submit dispute form – including additional required documentation

Remember the 60 Day Rule!

– Rights to dispute charges after the 60-day rule may be relinquished

®

�Dispute Process

Steps to Initiating a Dispute Claim – Obtaining the Dispute Form

CitiDirect® Card Management

System

CitiManager® Web Site

Customer Service

Fax completed dispute

forms to (605) 357-2019

®

�Dispute Process

Obtaining the Dispute Form

®

�Dispute Process

Obtaining the Dispute Form

®

�Dispute Process

Obtaining the Dispute Form

®

�Dispute Process

Obtaining the Dispute Form

®

�Dispute Process

Obtaining the Dispute Form

®

Required Fields:

1. Inquirer’s Name

2. Date

3. Cardholder’s Name

4. Account Number

5. Transaction Date

6. Dollar Amount of Charge

7. Merchant

8. Cardholder Signature

9. Error Description

®

�Dispute Process

Obtaining the Dispute Form

®

1. Unauthorized Transaction

2. Multiple Processing

3. Merchandise Not Received in the Amount of $

4. Cancelled Transaction

5. Merchandise Returned in the Amount of $

6. Credit not Received

7. Difference in Amount

8. Copy Request

9. Services Not Received

10. Paid for by Another Means

11. Not as Described

12. None of the Above…

®

�Dispute Process

Obtaining the Dispute Form

Remember – the cardholder MUST sign the form

®

®

�Dispute Process

Pop Quiz

1. What is the first step a cardholder

should take in the dispute process?

A. Contact the Merchant

2. If the merchant is unable to assist, what

is the next step the cardholder should

take?

A. Contact Citi or Submit a Dispute

Form

3. Name the website where the dispute

form can be found.

A. www.citimanager.com

®

�3. CitiDirect® Card Management System Benefits

®

�CitiDirect® Card Management System Benefits

Submitting the Dispute Form – Using the CitiDirect® Card

Management System

Preferred method for many

agencies

®

Ensure all required fields are

complete (including dispute reason

and transaction amount) prior to

clicking “submit” button

Attend CitiDirect® Card

Management System hands-on

session to learn more

®

�CitiDirect® Card Management System Benefits

Submitting the Dispute Form – Using the CitiDirect® Card

Management System

®

�4. Ensuring a Successful Dispute Process

®

�Ensuring a Successful Dispute Process

Cardholder Tips

Submitting a dispute on line will initiate the

dispute process

May not dispute if previously disputed

May not dispute if older than 60 days

Cannot dispute fees

A signed dispute form may be required

®

�Ensuring a Successful Dispute Process

The Dispute Process

®

�5. Dispute Resolution

®

�Dispute Resolution

Chargeback Process at Citi

1. Citi requests charge amount via the

merchant’s bank

a. Visa requires merchant response within

45 days of notification of dispute

b. If response is not received within 45 days,

disputes are automatically resolved in

favor of the cardholder

2. Documentation is sent to the Bankcard

Associations

®

�Dispute Resolution

Chargeback Process: Representment

Representment: The disputed charge is rejected by the merchant and sent back to

the issuer.

1. Merchant disputes charge. Reasons may include:

a. Invalid reason

b. Reason criteria not met

c. Missing documentation or paperwork

2. Merchant provides supporting documentation of charge

3. Cardholder has opportunity to dispute

4. Account may be re-billed and resolved

®

�Dispute Resolution

Chargeback Process: About Provisional Credits

A provisional (temporary) credit may be

applied when dispute is initiated

The provisional credit may be re-billed

to the cardholder’s account, depending

upon

– Merchant response / documentation

– Cardholder’s failure to respond to

correspondence from Citi requesting

additional documentation

®

�Dispute Resolution

Dispute Process: Chargeback Flow

®

1

Presentment

2

Chargeback

Second Presentment

4

Arbitration Chargeback

Arbitration Case

Issuing Bank

3

5

Acquiring Bank

®

�Dispute Resolution

Dispute Process: Confirmation

1. Cardholder completes dispute form

a. Must complete within 21 days of verbal submission

b. Include all documentation with dispute form

c. Sign form

d. Include any documented (verbal or written)

correspondence with merchant

e. Keep copies of everything

2. Citi sends letter to cardholder acknowledging dispute:

a. Letter sent to address on file

b. Allow 45 days for investigation

3. Investigation begins (allow 45 days)

4. Cardholder may be contacted to provide additional information

a. Timely customer follow up is critical (even while traveling) or dispute may be closed

b. Any Citi-issued credit could be re-billed

c. Contact Customer Service to ensure receipt of documentation

®

�Dispute Process

Pop Quiz

1. What is the timeframe your cardholders

should allow for a dispute investigation?

A. 45 business days

2. How long after the verbal submission

does the cardholder have to submit the

dispute form?

A. 21 days

3. Cardholders must notify Citi of a dispute

within ____ calendar days of receipt of

their statement.

A. 60 calendar days

®

�4. Cardholder Tips

®

�Cardholder Tips

Avoiding Unnecessary Delays – What is Within Your Control

1. Include ANY & ALL documentation with dispute form, including:

a) such as receipts

b) verbal / written correspondence with merchant

2. Always sign the form

3. Maintain copies of everything

4. If returned merchandise, show receipt or tracking information from shipper

5. Cardholder must have his/her receipt if questioning the amount billed

6. The currency amount in the total box is the amount that will be processed

®

�Cardholder Tips

CitiDirect® Card Management System

Dispute form must be received within 21 days of

verbal submission

May not dispute if previously disputed

May not dispute if older than 60 days

Cannot dispute fees

®

�Cardholder Tips

Fraud

Unrecognized Charges:

– A single unauthorized charge may be merchant error

Unrecognized Merchant:

– Merchants may bill under a name other than their operating name or bill from a different

state from where the purchase was made

Unauthorized mail or telephone orders

Charges appearing to be fraudulent will have a block placed on the account and

a new account will be opened in its place

Contact Customer Service to close account:

– Complete affidavit

– Fax to Security Operations at (605) 330-6801

Cardholders should contact Customer Service as soon as they believe the card

is being used fraudulently

®

�Cardholder Tips

Misuse

Transactions due to misuse are not eligible for

dispute or chargeback

A/OPC manages to policy

Proper use of tools

– Use MCC restrictions

– Manage credit limits

– Close inactive accounts

– Close terminated employee account immediately

– Manage delinquency

®

�Dispute Process

Pop Quiz

1. What must the cardholder do on all forms

BEFORE sending them to the

Disputes Department ?

A. Sign their name

2. What should the cardholder

maintain copies of?

A. Everything related to the dispute

3. True or False: A cardholder should

wait to verify that a charge is fraudulent

before contacting Customer Service.

A. False. If the customer believes a charge to be fraudulent, they

should contact Customer Service immediately.

®

�5. Tracking Disputes

®

�Tracking Disputes

Keeping Track of Disputes

A/OPCs: Use CitiDirect® Card

Management System to view cardholder

statements

Cardholders: View statement

Transaction Dispute Report

®

�Tracking Disputes

Keeping Track of Disputes

Settled in cardholder favor

Dispute Date

(2/9/09)

Dispute Settled

Date (3/11/09)

®

�Tracking Disputes

Top 5 Ways to Ensure Success!

1) Fill out dispute form completely

2) Sign dispute form

3) Submit dispute form within timeframe

4) Provide all supporting documentation

5) Follow up for additional

correspondence requests in a timely

manner

®

�Disputes: Resolutions without Delay

Summary

This session was designed to assist you in

achieving the following goals:

•

Provide an overview and outline of the

dispute process

•

Provide tools and information to educate

your cardholders

•

Facilitate more timely and effective dispute

resolutions

®

�Terms & Disclosures

IRS Circular 230 Disclosure: Citigroup Inc. and its affiliates do not provide tax or legal advice. Any discussion of tax matters in these materials (i) is not intended or written to be used, and cannot be

used or relied upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the "promotion or marketing" of any transaction contemplated hereby

("Transaction"). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor.

Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment to lend, syndicate a

financing, underwrite or purchase securities, or commit capital nor does it obligate us to enter into such a commitment. Nor are we acting in any other capacity as a fiduciary to you. By accepting this presentation,

subject to applicable law or regulation, you agree to keep confidential the existence of and proposed terms for any Transaction.

Tuesday, July 28, 2009

Prior to entering into any Transaction, you should determine, without reliance upon us or our affiliates, the economic risks and merits (and independently determine that you are able to assume these risks) as well as

the legal, tax and accounting characterizations and consequences of any such Transaction. In this regard, by accepting this presentation, you acknowledge that (a) we are not in the business of providing (and you

are not relying on us for) legal, tax or accounting advice, (b) there may be legal, tax or accounting risks associated with any Transaction, (c) you should receive (and rely on) separate and qualified legal, tax and

accounting advice and (d) you should apprise senior management in your organization as to such legal, tax and accounting advice (and any risks associated with any Transaction) and our disclaimer as to these

matters. By acceptance of these materials, you and we hereby agree that from the commencement of discussions with respect to any Transaction, and notwithstanding any other provision in this presentation, we

hereby confirm that no participant in any Transaction shall be limited from disclosing the U.S. tax treatment or U.S. tax structure of such Transaction.

We are required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with us. We will ask for your complete name, street address, and taxpayer ID

number. We may also request corporate formation documents, or other forms of identification, to verify information provided.

Any prices or levels contained herein are preliminary and indicative only and do not represent bids or offers. These indications are provided solely for your information and consideration, are subject to change at any

time without notice and are not intended as a solicitation with respect to the purchase or sale of any instrument. The information contained in this presentation may include results of analyses from a quantitative

model which represent potential future events that may or may not be realized, and is not a complete analysis of every material fact representing any product. Any estimates included herein constitute our judgment

as of the date hereof represent potential future events that may or may not be realized, and is not a complete analysis of every material fact representing any product. Any estimates included herein constitute our

judgment as of the date hereof and are subject to change without any notice. We and/or our affiliates may make a market in these instruments for our customers and for our own account. Accordingly, we may have

a position in any such instrument at any time.

Although this material may contain publicly available information about Citi corporate bond research, fixed income strategy or economic and market analysis, Citi policy (i) prohibits employees from offering, directly or

indirectly, a favorable or negative research opinion or offering to change an opinion as consideration or inducement for the receipt of business or for compensation and (ii) prohibits analysts from being compensated

for specific recommendations or views contained in research reports. So as to reduce the potential for conflicts of interest, as well as to reduce any appearance of conflicts of interest, Citi has enacted policies and

procedures designed to limit communications between its investment banking and research personnel to specifically prescribed circumstances.

© 2009 Citibank, N.A. All rights reserved. Citi, Citi Arc Design, CitiDirect, Citimanager, Citibank Custom Reporting System, Citibank Electronic Reporting System, are trademarks and service marks of Citigroup Inc.

or its affiliates and are used and registered throughout the world.

In January 2007, Citi released a Climate Change Position Statement, the first US financial institution to do so. As a sustainability leader in the financial sector, Citi has taken concrete steps to address this important

issue of climate change by: (a) targeting $50 billion over 10 years to address global climate change: includes significant increases in investment and financing of alternative energy, clean technology, and other

carbon-emission reduction activities; (b) committing to reduce GHG emissions of all Citi owned and leased properties around the world by 10% by 2011; (c) purchasing more than 52,000 MWh of green (carbon

neutral) power for our operations in 2006; (d) creating Sustainable Development Investments (SDI) that makes private equity investments in renewable energy and clean technologies; (e) providing lending and

investing services to clients for renewable energy development and projects; (f) producing equity research related to climate issues that helps to inform investors on risks and opportunities associated with the issue;

and (g) engaging with a broad range of stakeholders on the issue of climate change to help advance understanding and solutions.

Citi works with its clients in greenhouse gas intensive industries to evaluate emerging risks from climate change and, where appropriate, to mitigate those risks.

®

�®

©2009 Citibank, N.A. All rights reserved. Citi, Citi and Arc Design and CitiDirect are trademarks and service marks of Citigroup Inc., used and registered

throughout the world.

�

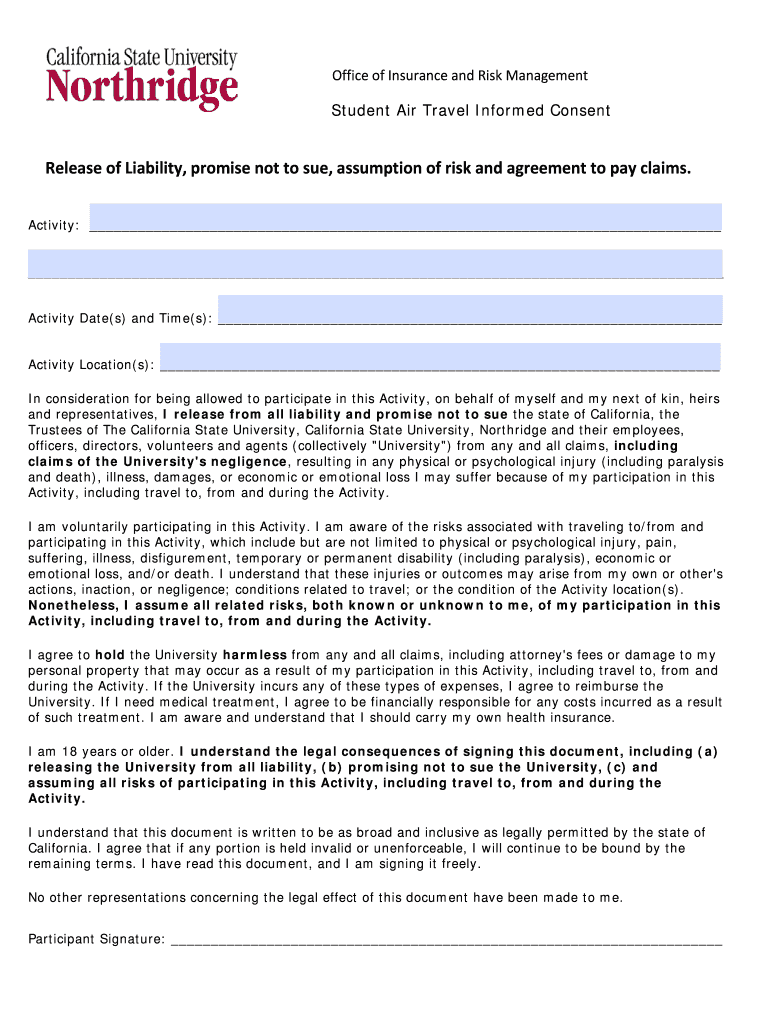

Useful suggestions for preparing your ‘Air Informed Consent’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the top electronic signature platform for both individuals and businesses. Bid farewell to the tedious tasks of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features contained within this user-friendly and cost-effective platform to transform your document management practices. Whether you need to approve forms or collect eSignatures, airSlate SignNow simplifies everything with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Open your ‘Air Informed Consent’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Include and assign fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to work with others on your Air Informed Consent or send it for notarization—our platform provides you with all the resources necessary to accomplish these tasks. Establish an account with airSlate SignNow today and elevate your document management to a new standard!