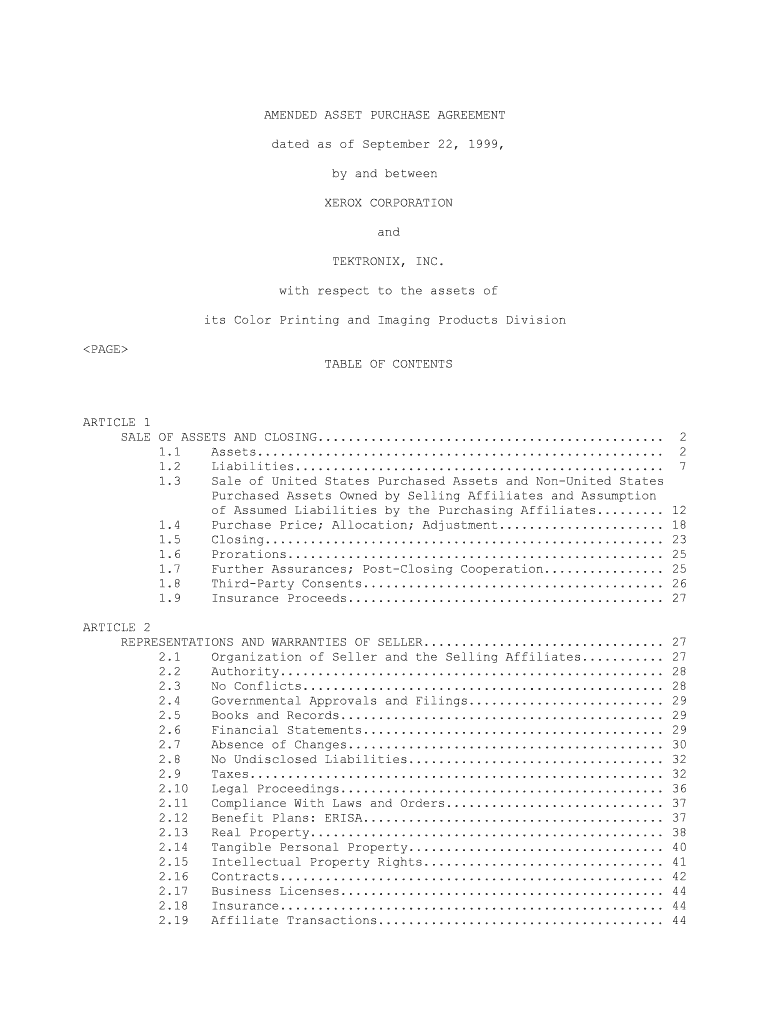

AMENDED ASSET PURCHASE AGREEMENT

dated as of September 22, 1999,

by and between

XEROX CORPORATION and

TEKTRONIX, INC.

with respect to the assets of

its Color Printing and Imaging Products Division

TABLE OF CONTENTS

ARTICLE 1

SALE OF ASSETS AND CLOSING.............................................. 2 1.1 Assets...................................................... 2 1.2 Liabilities................................................. 7

1.3 Sale of United States Purchased Assets and Non-United States

Purchased Assets Owned by Selling Affiliates and Assumption

of Assumed Liabilities by the Purchasing Affiliates......... 12

1.4 Purchase Price; Allocation; Adjustment...................... 18

1.5 Closing..................................................... 23

1.6 Prorations.................................................. 25

1.7 Further Assurances; Post-Closing Cooperation................ 25

1.8 Third-Party Consents........................................ 26

1.9 Insurance Proceeds.......................................... 27

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF SELLER................................ 27

2.1 Organization of Seller and the Selling Affiliates........... 27

2.2 Authority................................................... 28

2.3 No Conflicts................................................ 28

2.4 Governmental Approvals and Filings.......................... 29

2.5 Books and Records........................................... 29

2.6 Financial Statements........................................ 29

2.7 Absence of Changes.......................................... 30

2.8 No Undisclosed Liabilities.................................. 32

2.9 Taxes....................................................... 32

2.10 Legal Proceedings........................................... 36

2.11 Compliance With Laws and Orders............................. 37

2.12 Benefit Plans: ERISA........................................ 37

2.13 Real Property............................................... 38

2.14 Tangible Personal Property.................................. 40

2.15 Intellectual Property Rights................................ 41

2.16 Contracts................................................... 42

2.17 Business Licenses........................................... 44

2.18 Insurance................................................... 44

2.19 Affiliate Transactions...................................... 44

2.20 Employees; Labor Relations.................................. 45

2.21 Environmental Matters, etc.................................. 45

2.22 Substantial Customers and Suppliers......................... 48

2.23 Accounts Receivable......................................... 48

AMENDED ASSET PURCHASE AGREEMENT i Page

2.24 Inventory................................................... 48

2.25 Vehicles.................................................... 48

2.26 No Guarantees............................................... 49

2.27 Entire Business............................................. 49

2.28 Brokers..................................................... 49

2.29 Year 2000................................................... 49

2.30 Disclosure.................................................. 50

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF PURCHASER............................. 51

3.1 Organization of Purchaser and the Purchasing Affiliates..... 51

3.2 Authority................................................... 51

3.3 No Conflicts................................................ 51

3.4 Governmental Approvals and Filings.......................... 52

3.5 Legal Proceedings........................................... 52

3.6 Brokers..................................................... 52

ARTICLE 4

COVENANTS OF SELLER..................................................... 53

4.1 Regulatory and Other Approvals.............................. 53

4.2 HSR Filings, etc............................................ 53

4.3 Investigation by Purchaser.................................. 54

4.4 No Solicitations............................................ 54

4.5 Conduct of Business......................................... 55

4.6 Financial Statements and Reports; Filings................... 55

4.7 Employee Matters............................................ 56

4.8 Certain Restrictions........................................ 57

4.9 Security Deposits........................................... 58

4.10 Delivery of Books and Records, etc.; Removal of Property.... 58

4.11 Noncompetition.............................................. 58

4.12 Notice and Cure............................................. 60

4.13 Fulfillment of Conditions................................... 60

4.14 Environmental Matters. .................................... 61

ARTICLE 5

COVENANTS OF PURCHASER.................................................. 61

5.1 Regulatory and Other Approvals.............................. 61

5.2 HSR Filings, etc............................................ 62

5.3 Notice and Cure............................................. 62

5.4 Fulfillment of Conditions................................... 63

AMENDED ASSET PURCHASE AGREEMENT ii Page

ARTICLE 6

CONDITIONS TO OBLIGATIONS OF PURCHASER.................................. 63

6.1 Representations and Warranties.............................. 63

6.2 Performance................................................. 64

6.3 Officers' Certificates...................................... 64

6.4 No Material Adverse Change.................................. 64

6.5 Orders and Laws............................................. 64

6.6 Regulatory Consents and Approvals........................... 65

6.7 Third Party Consents........................................ 65

6.8 Title Insurance............................................. 65

6.9 General Assignment, Assignment Instruments.................. 66

6.10 Transition Agreement........................................ 66

6.11 Trademark License Agreement................................. 66

6.12 Technology Transfer Agreement............................... 66

6.13 Ancillary Agreements........................................ 66

6.14 Malaysian Stock Purchase Agreement.......................... 66

6.15 Proceedings................................................. 66

6.16 Accounting Policies......................................... 66

ARTICLE 7

CONDITIONS TO OBLIGATIONS OF SELLER..................................... 67

7.1 Representations and Warranties.............................. 67

7.2 Performance................................................. 67

7.3 Officers' Certificates...................................... 67

7.4 Orders and Laws............................................. 68

7.5 Regulatory Consents and Approvals........................... 68

7.6 Third Party Consents........................................ 68

7.7 Assumption Agreement; Assumption Instruments................ 68

7.8 Transition Agreement........................................ 69

7.9 Trademark License Agreement................................. 69

7.10 Technology Transfer Agreement............................... 69

7.11 Ancillary Agreements........................................ 69

7.12 Malaysian Stock Purchase Agreement.......................... 69

7.13 Proceedings................................................. 69

ARTICLE 8

TAX MATTERS; CLOSING AND POST-CLOSING TAXES; VAT........................ 70

8.1 General..................................................... 70

8.2 Return Preparation.......................................... 70

8.3 Tax Refunds................................................. 71

8.4 Cooperation with Respect to Tax Matters..................... 72

AMENDED ASSET PURCHASE AGREEMENT iii Page

8.5 Transfer Taxes.............................................. 73

8.6 Real Property Taxes......................................... 74

8.7 VAT......................................................... 74

ARTICLE 9

EMPLOYEE MATTERS........................................................ 77

9.1 Offer of Employment......................................... 77

9.2 Purchaser's Plan Service Credits............................ 77

9.3 Employee Benefit Programs Service Credits................... 78

9.4 WARN Act.................................................... 78

9.5 Foreign Nationals........................................... 78

9.6 Seller COBRA Compliance..................................... 78

9.7 Evidence of Insurability.................................... 79

9.8 HMO Coverage................................................ 79

9.9 Direct Transfer of 401(k) Balances.......................... 79

ARTICLE 10

SURVIVAL OF REPRESENTATIONS, WARRANTIES,COVENANTS AND AGREEMENTS.............................................................. 79

ARTICLE 11 INDEMNIFICATION......................................................... 80

11.1 Tax Indemnification......................................... 80

11.2 Other Indemnification....................................... 82

11.3 Method of Asserting Claims.................................. 85

ARTICLE 12 TERMINATION............................................................. 88

12.1 Termination................................................. 88

12.2 Effect of Termination....................................... 91

ARTICLE 13 DEFINITIONS............................................................. 92

13.1 Definitions................................................. 92

ARTICLE 14 MISCELLANEOUS...........................................................104 14.1 Notices.....................................................104

14.2 Bulk Sales Act..............................................106

14.3 Entire Agreement............................................106 14.4 Expenses....................................................106

AMENDED ASSET PURCHASE AGREEMENT iv

14.5 Public Announcements........................................106

14.6 Sony-Tektronix Corporation..................................106 14.7 Waiver......................................................107 14.8 Amendment...................................................107

14.9 No Third Party Beneficiary..................................107

14.10 No Assignment: Binding Effect...............................107 14.11 Headings....................................................107

14.12 Invalid Provisions..........................................107

14.13 Governing Law...............................................108

14.14 Accounting Policies.........................................108 14.15 Counterparts................................................108

AMENDED ASSET PURCHASE AGREEMENT v EXHIBITS

Exhibit A Technology Transfer Agreement

AMENDED ASSET PURCHASE AGREEMENT vi

This AMENDED ASSET PURCHASE AGREEMENT dated as of September 22, 1999, is

made and entered into by and between XEROX CORPORATION, a New York corporation,

("Purchaser"), and TEKTRONIX, INC., an Oregon corporation, ("Seller").

Capitalized terms not otherwise defined herein have the meanings set forth in

Section 13.1.

WHEREAS, Seller, through its Color Printing and Imaging Products Division

(the "Division"), and the wholly owned subsidiaries and Affiliates of Seller

identified in Section 2.1 of the Disclosure Schedules hereto (each such

subsidiary or Affiliate, a "Selling Affiliate"; all such subsidiaries and

Affiliates, collectively, the "Selling Affiliates") are engaged in the business

of developing, manufacturing, distributing and servicing printers and related

products, accessories and supplies throughout the world (such business as

conducted by the Division and the Selling Affiliates is hereinafter referred to

as the "Business");

WHEREAS, Seller desires to sell, transfer and assign to Purchaser, and

desires to cause the Selling Affiliates to sell, transfer and assign to

Purchaser, substantially all of the assets relating to the Business, all in

accordance with the terms and conditions set forth in this Agreement; and

WHEREAS, Purchaser desires to purchase and acquire from Seller or the

Selling Affiliates, or to cause certain subsidiaries or Affiliates of Purchaser

(each such subsidiary or Affiliate, a "Purchasing Affiliate"; all such

subsidiaries and Affiliates, collectively, the "Purchasing Affiliates") to

purchase and acquire from Seller or the Selling Affiliates, said assets relating

to the Business and, in connection therewith, Purchaser has agreed to assume, or

to cause one or more Purchasing Affiliates to assume, certain Liabilities

relating to the Business, all in accordance with the terms and conditions set

forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements set

forth in this Agreement, and for other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, the parties hereto

agree as follows:

ARTICLE 1

SALE OF ASSETS AND CLOSING

1.1 Assets.

(a) Assets Purchased. On the terms and subject to the conditions set forth

in this Agreement, at the Closing or the applicable Foreign Closing, as the case

may be, Seller will sell, transfer, convey, assign and deliver to Purchaser or

to a Purchasing Affiliate or Purchasing Affiliates designated by Purchaser, and

will cause each of the Selling Affiliates to sell, transfer, convey, assign and

deliver to Purchaser or to the designated Purchasing Affiliate, free and clear

of all Liens other than Permitted Liens,

AMENDED ASSET PURCHASE AGREEMENT 2

all of Seller's or the Selling Affiliates' right, title and interest in, to and

under the Assets and Properties used or held for use primarily in connection

with the Business, including but not limited to those Assets and Properties

described in this Section 1.1(a), and Purchaser or the designated Purchasing

Affiliate will purchase and pay for such Assets and Properties, as the same

shall exist on the Closing Date or the applicable Foreign Closing Date, as the

case may be (collectively, the "Purchased Assets"). Without limiting the

generality of the foregoing, the Purchased Assets shall not include any of the

Excluded Assets described in Section 1.1(b), but shall include the following:

(i) Real Property. The real property described in Section 1.1(a)(i) of

the Disclosure Schedule, and all of the rights arising out of the ownership

thereof or appurtenant thereto (the "Real Property"), together with all

buildings, structures, facilities, fixtures and other improvements thereto

(the "Improvements");

(ii) Real Property Leases. The leases and subleases of real property

described in Section 1.1(a)(ii) of the Disclosure Schedule as to which

Seller or a Selling Affiliate is the lessee or sublessee, together with any

options to purchase the underlying property and leasehold improvements

thereon, and in each case all other rights, subleases, licenses, permits,

deposits and profits appurtenant to or related to such leases and subleases

(the "Real Property Leases");

(iii) Inventory. All inventories of raw materials, work-in-process,

finished goods, demonstration equipment, office and other supplies, parts,

packaging materials and other accessories related thereto which are used or

held for use primarily in the conduct of the Business, including any of the

foregoing purchased subject to any conditional sales or title retention

agreement in favor of any other Person, but excluding any inventory

disposed of in the ordinary course of business before the Closing Date in

accordance with Section 4.8(a), together with all rights against suppliers

of such inventories (the "Inventory");

(iv) Accounts Receivable. All trade accounts receivable and all notes,

bonds and other evidences of Indebtedness of and rights to receive payments

arising out of sales occurring in the conduct of the Business and all

Security Agreements related thereto, including any rights with respect to

any third party collection procedures or any other Actions or Proceedings

which have been commenced in connection therewith, excluding any accounts

receivables included in Intercompany Accounts and any Sales Taxes included

in accounts receivable that are not invoiced as of the Closing Date or the

applicable Foreign Closing Date (the "Accounts Receivable");

(v) Tangible Personal Property. All furniture, computer hardware and

software, fixtures, equipment, machinery, tools, dies, jigs, patterns,

molds, breadboards, prototypes, engineering and pre-engineering models and

AMENDED ASSET PURCHASE AGREEMENT 3

components and other tangible personal property (other than Inventory and

Vehicles) used or held for use primarily in the conduct of the Business

(including but not limited to the items listed in Section 1.1(a)(v) of the

Disclosure Schedule), including any of the foregoing purchased subject to

any conditional sales or title retention agreement in favor of any other

Person, but excluding any such items disposed of in the ordinary course of

business before the Closing Date in accordance with Section 4.8(a) (the

"Tangible Personal Property");

(vi) Personal Property Leases. (A) The leases or subleases of Tangible

Personal Property used or held for use primarily in the conduct of the

Business, including those described in Section 1.1(a)(vi)(A) of the

Disclosure Schedule as to which Seller or a Selling Affiliate is the lessor

or sublessor, and (B) the leases of Tangible Personal Property used or held

for use primarily in the conduct of the Business, including those described

in Section 1.1(a) (vi) (B) of the Disclosure Schedule as to which Seller or

a Selling Affiliate is the lessee or sublessee, together with any options

to purchase the underlying property (the leases and subleases described in

subclauses (A) and (B) hereof, the "Personal Property Leases");

(vii) Business Contracts. All Contracts (other than the Real Property

Leases, the Personal Property Leases and the Accounts Receivable) which are

utilized in the conduct of the Business, including without limitation those

Contracts relating to suppliers, sales representatives, sales agents,

distributors, dealers, value-added resellers, purchase orders, service

arrangements, marketing arrangements, manufacturing arrangements, research

and development arrangements, product development arrangements and

licensing arrangements, including those listed in Section 2.16(a) of the

Disclosure Schedule (the "Business Contracts");

(viii) Prepaid Expenses. All prepaid items related primarily to the

Business and reflected in the Statement of Closing Net Assets as "prepaid

expenses" (the "Prepaid Expenses ");

(ix) Intangible Personal Property. All customer lists, intangibles for

marketing and other intangibles used or held for use in the conduct and/or

development of the Business (including any goodwill therein) and all

rights, privileges, claims, causes of action and options relating or

pertaining to the Business or the Purchased Assets, including but not

limited to the rights arising out of the covenant of non-competition in

Section 4.11 and the items listed in Section 1.1(a) (ix) of the Disclosure

Schedule, provided, however, that all Intellectual Property, including any

Intellectual Property transferred under the Technology Transfer Agreement,

shall be excluded (the "Intangible Personal Property");

AMENDED ASSET PURCHASE AGREEMENT 4

(x) Business Licenses. All Licenses (including applications therefor)

utilized in the conduct of the Business (the "Business Licenses");

(xi) Vehicles. All motor vehicles owned or leased by Seller or a

Selling Affiliate and used or held for use primarily in the conduct of the

Business, including but not limited to the vehicles listed in Section

1.1(a) (xi) of the Disclosure Schedule (the "Vehicles");

(xii) Security Deposits. All security deposits deposited by or on

behalf of Seller or a Selling Affiliate as lessee or sublessee under the

Real Property Leases or the Personal Property Leases (the "Tenant Security Deposits");

(xiii) Books and Records. All Books and Records used or held for use

in the conduct of the Business or otherwise relating to the Total Acquired

Assets, other than the minute books, stock transfer books, Tax Returns and

corporate seal of Seller or a Selling Affiliate (the "Business Books and Records");

(xiv) Stock in Tektronix Malaysia Sdn. Bhd. All of the capital stock

and other equity or ownership interests owned by Seller or a Selling

Affiliate in Tektronix Malaysia Sdn. Bhd. to be acquired by Purchaser or a

Purchasing Affiliate in accordance with the terms and conditions of a Stock

Purchase Agreement, in form and substance reasonably acceptable to Seller

and Purchaser, that is usual and customary for transactions of such type in

Malaysia so as to effect the sale and transfer of all of the capital stock

of Tektronix Malaysia Sdn. Bhd. to the Purchaser or the designated

Purchasing Affiliate in order to give the parties the benefit of this

Agreement and to conform to the Laws, customs and practices of Malaysia;

(xv) Selling Affiliate Cash. All cash on hand and in banks with

respect to any Selling Affiliate, the Non-United States Purchased Assets of

which are not sold on the Closing Date and which arise in the operation of

the Business between the Closing Date and the applicable Foreign Closing

Date with respect to such Selling Affiliate (so long as such Foreign

Closing Date actually occurs); and

(xvi) Other Assets and Properties. All other Assets and Properties

used or held for use primarily in connection with the Business and not

excluded pursuant to Section 1.1(b) (the "Other Purchased Assets").

To the extent any of the Business Books and Records are items susceptible

to duplication and are either (AA) used in connection with any of Seller's or

the Selling Affiliates' businesses other than the Business or (BB) are required

by Law to be retained by Seller or a Selling Affiliate or are necessary to

assist Seller in the preparation of its financial statements, Seller or the

Selling Affiliate may deliver photocopies, other reproductions or electronic

media from which, in the case of Business Books and Records referred to in the

foregoing clause (AA), information solely concerning Seller's

AMENDED ASSET PURCHASE AGREEMENT 5

or the Selling Affiliates' businesses other than the Business has been deleted.

(b) Excluded Assets. Notwithstanding anything in this Agreement to the

contrary, the following Assets and Properties (the "Excluded Assets") shall be

excluded from and shall not constitute Purchased Assets:

(i) Cash. Cash, commercial paper, certificates of deposit and other

bank deposits, treasury bills, other cash equivalents and rebates received

prior to Closing to the extent not reflected in the Statement of Closing

Net Assets (whether in respect of suppliers, insurers or otherwise other

than warranty rights);

(ii) Insurance. Life insurance policies on officers and other

employees of Seller and all other insurance policies relating to the

operation of the Business and rights arising from any refunds due

(including, but not limited to, retrospective premium adjustment) with

respect to insurance premium payments;

(iii) Employee Benefit Plans. All assets owned or held by any Benefit

Plans unless such assets relate to a foreign benefit obligation which

Purchaser is required to assume under applicable Laws;

(iv) Tax Refunds. All refunds or credits, if any, of Taxes due to or

from Seller or any of its Affiliates unless such refunds or credits are

included in the Statement of Closing Net Assets;

(v) Tax Deposits. Deposits of Seller or any Selling Affiliate with any

Taxing Authority, including without limitation, tax deposits, prepayment

and estimated payments unless included in the Statement of Closing Net Assets;

(vi) Deferred Tax Assets. Any Deferred Tax Assets of Seller or any

Selling Affiliate related to the Business;

(vii) Tax and Financial Records. Seller's and Selling Affiliates' Tax

Returns, tax and financial records and reports and other documents and

records pertaining to Seller's and Selling Affiliates' operation of the

Business that Seller or Selling Affiliates are required by Laws to retain

or that will be necessary or advisable for Seller or Selling Affiliates to

retain, in their reasonable discretion, for tax or related purposes;

(viii) Real and Personal Property and Real Property Leases. The real

and personal property and real property leases described in Section

1.1(b)(viii) of the Disclosure Schedule;

(ix) Litigation Claims. Any rights (including indemnification) and

claims and recoveries under litigation of Seller or a Selling Affiliate (A)

AMENDED ASSET PURCHASE AGREEMENT 6

commenced against third parties prior to the Closing Date or the applicable

Foreign Closing Date if and to the extent related to any of the Excluded

Assets or Retained Liabilities, whether arising by way of counterclaim or

otherwise or (B) arising out of or relating to events that occur following

the Closing;

(x) Shared Assets. The Shared Assets as defined in Section 2.27;

(xi) Intellectual Property. The Intellectual Property to be

transferred or licensed to Purchaser pursuant to the Technology Transfer Agreement;

(xii) Excluded Obligations. The rights and obligations of Seller or a

Selling Affiliate in, to and under (A) all Contracts listed in Section

1.1(b)(xii) of the Disclosure Schedule or (B) any other Contracts, unless

the obligations of Seller or a Selling Affiliate in, to and under such

other Contracts are expressly assumed by Purchaser pursuant to Section 1.2(a);

(xiii) Tradename and Logo. All right, title and interest in, to and

under the "Tektronix" name, trademark, service mark and the Tektronix logo;

(xiv) Prepaid Expenses. Rights arising from prepaid expenses, if any,

with respect to Excluded Assets;

(xv) Other Excluded Assets and Properties. The Assets and Properties

described on Schedule 1.1(b)(xv) of the Disclosure Schedule;

(xvi) Certain Rights of Seller. Seller's rights under this Agreement,

the Ancillary Agreements and the Operative Agreements;

(xvii) Assets Disposed of in the Ordinary Course of Business. Any

assets described in the Disclosure Schedules to Section 1.1 that are

transferred or otherwise disposed of by Seller or a Selling Affiliate prior

to the Closing in the ordinary course of business without violation of this

Agreement; and

(xviii) Non-Business Assets and Properties. Any of the Assets and

Properties of Seller or a Selling Affiliate that are not primarily related

to or used primarily in connection with the Business, including but not

limited to, Assets and Properties used in Seller's measurement business or

video business.

1.2 Liabilities.

(a) Assumed Liabilities. In connection with the sale, transfer, conveyance,

assignment and delivery of the Purchased Assets pursuant to this Agreement, on

the terms and subject to the conditions set forth in this Agreement, at the

Closing or the applicable Foreign Closing, as the case may be, subject to

Section 11.2(a)(iii), Purchaser will assume and agree to pay, perform and

discharge when due, or will cause a

AMENDED ASSET PURCHASE AGREEMENT 7

designated Purchasing Affiliate to assume and agree to pay, perform and

discharge when due, the following obligations of Seller or a Selling Affiliate,

as the case may be, arising primarily in connection with the operation of the

Business, as the same shall exist on the Closing Date or the applicable Foreign

Closing Date, as the case may be (the "AssumedLiabilities"), and no others:

(i) Real Property Lease Obligations. All obligations of Seller or a

Selling Affiliate under the Real Property Leases;

(ii) Accounts Payable. All obligations of Seller or a Selling

Affiliate with respect to accounts payable reflected or reserved against in

the Statement of Closing Net Assets and those arising in the ordinary

course of business since the date of the Statement of Closing Net Assets,

excluding (X) accounts payable included in Intercompany Accounts and (Y)

any amounts attributable to VAT which have been invoiced as of the Closing

Date or the applicable Foreign Closing Date (the "Accounts Payable");

(iii) Personal Property Lease Obligations. All obligations of Seller

or a Selling Affiliate under the Personal Property Leases;

(iv) Obligations under Business Contracts and Business Licenses. All

obligations of Seller or a Selling Affiliate under the Business Contracts

and Business Licenses;

(v) Accrued Expenses. All obligations of Seller or a Selling Affiliate

with respect to accrued expenses reflected or reserved against in the

Statement of Closing Net Assets or those incurred in the ordinary course of

business since the date of the Statement of Closing Net Assets, excluding

all accrued and unpaid expenses payable under Intercompany Accounts and all

Taxes (except to the extent they are Assumed Real Property Taxes) (the

"Accrued Expenses");

(vi) Assumed Real Property Taxes. The Prorated Real Property Taxes

arising out of the Business for the tax period during which the Closing

Date or the applicable Foreign Closing Date occurs (excluding any Liability

for Taxes arising out of the sale or transfer of the Real Property) (the

"Assumed Real Property Taxes"). The Assumed Real Property Taxes shall be

treated as an Assumed Liability irrespective of whether, at the time of

Closing or the applicable Foreign Closing, liability for the Real Property

Taxes attached or whether such Real Property Taxes have become payable or

have been paid by Seller or any Selling Affiliate;

(vii) Security Deposits. All obligations of Seller or a Selling

Affiliate with respect to any security deposit held by Seller or a Selling

Affiliate as lessor or sublessor under the Real Property Leases and the

Personal Property Leases (the "Landlord Security Deposits");

AMENDED ASSET PURCHASE AGREEMENT 8

(viii) Severance and Other Employee-Related Liabilities. All

Liabilities and obligations expressly assumed by Purchaser in accordance

with Article 9;

(ix) Balance Sheet Liabilities. All Liabilities and obligations

reflected in the Statement of Closing Net Assets;

(x) Liabilities of Selling Affiliates. All Liabilities of Selling

Affiliates, the Non-United States Purchased Assets of which are not sold on

the Closing Date, which arise in the operation of the Business between the

Closing Date and the Foreign Closing Date with respect to such Selling

Affiliate (so long as such Foreign Closing Date actually occurs);

(xi) Warranty Obligations. All Liabilities and obligations under all

of Seller's or a Selling Affiliate's warranty arrangements for Business

products sold before or after the Closing, which arrangements were made in

the ordinary course of business consistent with past practices;

(xii) Customer Support and Service. All Liabilities and obligations

for customer support and services under Seller's policies and practices for

the Business, whether arising before or after the Closing, which policies

and practices were made in the ordinary course of business consistent with

past practices;

(xiii) Customer Policies. All Liabilities and obligations of the

Business to customers whose purchased products are no longer covered by

warranty consistent with Seller's long-term support policies, whether

arising before or after the Closing, which policies were made in the

ordinary course of business consistent with past practices; provided, that

such obligations and Liabilities shall be discharged in a manner and with a

level of professionalism customary in the industry and consistent with

Purchaser's practices;

(xiv) Wilsonville, Oregon. All Liabilities or obligations of Seller or

any Selling Affiliate, whether known or unknown, fixed or contingent, with

respect to or relating to any Environmental Laws or any Environmental Claim

arising out of any acts, omissions, or conditions relating to the

operations associated with the Real Property located at Wilsonville,

Oregon, but specifically excluding any Environmental Claim related to the

real property (located adjacent to Seller's Wilsonville, Oregon, property)

that was sold by Seller to Venture Properties, Inc. in 1998;

(xv) Intellectual Property Infringement. All claims against or

Liabilities of Seller or any Selling Affiliates arising out of or in any

way connected with infringement of any Intellectual Property arising out of

the conduct of the Business, whether before or after the Closing Date,

regardless of whether said claim or Liability is asserted, including but

not limited to any claim

AMENDED ASSET PURCHASE AGREEMENT 9

or Liability for consequential or punitive damages in connection with the foregoing;

(xvi) Litigation. All Liabilities and obligations related to pending

litigation listed in Section 2.10 of the Disclosure Schedule;

(xvii) Other Taxes. All Taxes expressly assumed by Purchaser or

Purchasing Affiliates in accordance with Article 8;

(xviii) Hazardous Products, etc. Any claims against or Liabilities

arising out of or in any way connected with (A) Products that contain a

hazard or are found by any Governmental or Regulatory Authority to contain

a hazard as that term is used in the United States Consumer Product Safety

Commission Act or any similar Laws (including, but not limited to, any

voluntary or required recalls of such Products), or (B) Epidemic Failures

of Products (including but not limited to any costs or expenses incurred in

connection with refunds, returns, replacements or repairs of same), in

either case arising out of the sale of Products or the conduct of the

Business by Seller or any Selling Affiliate prior to the Closing Date or

the applicable Foreign Closing Date, regardless of when or against whom

said claim or Liability is asserted, including, but not limited to, any

claim or Liability for consequential or punitive damages in connection with

the foregoing and, in either case, excluding Retained Liabilities described

in Section 1.2(b)(vii); and

(xix) Print Head Drift. All Liabilities and obligations related to

print head drift associated with Seller's Phaser 340/350/360 Products

("Print Head Drift").

Subject to Section 11.2(a)(iii), Purchaser shall remain solely responsible

for satisfying, discharging or performing all such Assumed Liabilities on a

timely basis in accordance with their terms, provided Purchaser or a Purchasing

Affiliate shall have the ability to contest, in good faith, any such claim of

Liability asserted in respect thereof by any Person.

(b) Retained Liabilities. Except for the Assumed Liabilities, and without

any implication that Purchaser or a Purchasing Affiliate is assuming any

Liability not expressly excluded by this Section 1.2(b) and, where applicable,

without any implication that any of the following would constitute Assumed

Liabilities but for this Section 1.2(b), neither Purchaser nor any Purchasing

Affiliate shall assume by virtue of this Agreement or the transactions

contemplated hereby, and shall have no liability for, any Liabilities of Seller

or a Selling Affiliate (including, without limitation, those related to the

Business) of any kind, character or description whatsoever, whether known or

unknown, contingent or otherwise, including but not limited to those Liabilities

described in this Section 1.2(b) (the "Retained Liabilities").

AMENDED ASSET PURCHASE AGREEMENT 10

(i) Intercompany Accounts. Any Liabilities reflected in Intercompany Accounts;

(ii) Fees. Any Liabilities for legal, accounting, audit and investment

banking fees, brokerage commissions, and any other expenses incurred by

Seller or the Selling Affiliates in connection with the negotiation and

preparation of this Agreement and the sale of the Assets and Properties;

(iii) Taxes. Any Liabilities of Seller or any of its Affiliates for

Taxes, irrespective of the manner in which such Taxes are reflected on the

financial statements of Seller or any Affiliate, including any Deferred Tax

Liability, except to the extent they are Assumed Real Property Taxes or are

expressly assumed by Purchaser or any Purchasing Affiliate in accordance

with Article 8;

(iv) Debt. Any Liability for or related to Indebtedness of Seller or

any of the Selling Affiliates, on its own behalf or on behalf of other

Persons, to banks, financial institutions or other Persons with respect to

borrowed money and including any interest payable in respect thereof;

(v) Severance Payments. Any Liabilities of Seller or any of the

Selling Affiliates to pay severance benefits or similar obligations which

arise either from any action by Seller or a Selling Affiliate prior to the

Closing Date or the applicable Foreign Closing Date or by virtue of the

sale of the Purchased Assets pursuant to the provisions hereof (other than

(A) any such Liabilities which arise out of any action by Purchaser or a

Purchasing Affiliate on or following the Closing Date or the applicable

Foreign Closing Date with respect to a Transferred Employee, it being

understood and agreed that any such Liabilities constitute Assumed

Liabilities hereunder or (B) obligations of Purchaser under Article 9);

(vi) Worker Claims. Any Liability in respect of any wrongful discharge

claim or claims by any Employees of Seller or any Selling Affiliate under

any Laws arising out of the conduct of the Business by Seller or by any

Selling Affiliate on or before the Closing Date or the applicable Foreign

Closing Date;

(vii) Tort and Product Claims. Any claims against or Liabilities of

Seller or any Selling Affiliates for injury to or death of persons

(including, without limitation, any worker's compensation claims) or

damages to or destruction of property, arising from the sale or

distribution of Products distributed, and/or business services provided, by

Seller or any Selling Affiliate prior to the Closing Date or the applicable

Foreign Closing Date, regardless of when said claim or Liability is

asserted, including but not limited to, any claim or Liability for

consequential or punitive damages in connection with the foregoing;

AMENDED ASSET PURCHASE AGREEMENT 11

(viii) Benefit Plans. Except as specifically provided in Article 9,

any Liabilities arising out of or in connection with any of the Benefit Plans;

(ix) Employee Payments. Any so-called "sale bonuses" or similar

payments payable to any Employees of Seller or any Selling Affiliate by

reason of the sale of the Purchased Assets;

(x) Environmental Claims. Any Liabilities or obligations of Seller or

any Selling Affiliate, whether known or unknown, fixed or contingent, with

respect to, or relating to, any Environmental Laws or any Environmental

Claim, arising out of any acts, omissions, or conditions relating to the

operations of the Business at locations other than Wilsonville, Oregon,

including but not limited to the disposal of, transportation to, and

arrangements for disposal of Hazardous Materials at Seller's Beaverton,

Oregon, Treatment, Storage and Disposal Facility, the Western Processing

Superfund Site located in Kent, Washington, and/or any other location and

Hazardous Materials Contamination on the real property (located adjacent to

Seller's Wilsonville, Oregon property) that was sold by Seller to Venture

Properties, Inc. in 1998, Seller's former manufacturing facility in

Heerenveen, The Netherlands, that was sold in 1996 and the Nanticoke

Microtechnologies facility in Nanticoke, Pennsylvania;

(xi) Non-Purchased Assets. Except as otherwise expressly provided in

this Agreement, any Liability or obligation, whether presently in existence

or hereafter arising, which is attributable to Assets and Properties that

are not Purchased Assets;

(xii) Litigation. Any Liability of Seller or any Selling Affiliates

for any claim, complaint, action, suit, proceeding, arbitration or

litigation (pending, threatened, contingent or otherwise) arising out of

any acts, omissions or conditions that occurred prior to the Closing Date

or the applicable Foreign Closing Date, except to the extent assumed by

Purchaser or a Purchasing Affiliate pursuant to Section 1.2(a); and

(xiii) Other. Without limitation by the specific enumeration of the

foregoing, any Liabilities not expressly assumed by Purchaser or a

Purchasing Affiliate pursuant to Section 1.2(a).

Seller shall remain solely responsible for satisfying, discharging or performing

all such Retained Liabilities on a timely basis in accordance with their terms,

provided that Seller or a Selling Affiliate shall have the ability to contest,

in good faith, any such claim of Liability asserted in respect thereof by anyPerson.

1.3 Sale of United States Purchased Assets and Non-United States Purchased

Assets Owned by Selling Affiliates and Assumption of Assumed Liabilities by the

Purchasing Affiliates. Tektronix Export, Inc. ("TEI") and Tektronix Asia, Ltd.("Tek

AMENDED ASSET PURCHASE AGREEMENT 12

Asia") shall sell their United States Purchased Assets to Purchaser under terms

and conditions identical to the terms and conditions contained in this Agreement

governing the sale by Seller of its United States Purchased Assets. Seller shall

provide Purchaser with a separate bill of sale and any other commercially

reasonable documentation requested by Purchaser to evidence the sale of TEI and

Tek Asia's United States Purchased Assets to Purchaser. Certain of the

Non-United States Purchased Assets shall be sold to the Purchasing Affiliates

designated by Purchaser and certain of the Assumed Liabilities shall be assumed

by such Purchasing Affiliates pursuant to the terms and conditions of separate

Asset Purchase Agreements, in form and substance reasonably acceptable to Seller

and Purchaser, so as to effect the sale, transfer and assignment of the Assets

and Properties of the Selling Affiliates to the Purchasing Affiliates and the

assumption of the associated Assumed Liabilities by the Purchasing Affiliates in

order to give the parties the benefit of this Agreement and to conform to the

Laws, customs and practices of the relevant jurisdiction, as follows:

(a) Seller shall cause its Selling Affiliate, Tektronix Gesellschaft m.b.H.

("Austria Tek") to sell, transfer and assign the Assets and Properties of

Austria Tek that constitute Non-United States Purchased Assets to Purchasing

Affiliates, Xerox Austria G.m.b.H. ("Xerox Austria"), which shall purchase all

of Austria Tek's Assets and Properties except for the Intangible Personal

Property and Accounts Receivable which shall be purchased by Xerox Channels

Limited ("Xerox Channels") and Purchaser shall cause Xerox Austria and Xerox

Channels to purchase such Assets and Properties and to assume certain Assumed

Liabilities from Austria Tek (the "Austria Acquisition");

(b) Seller shall cause its Selling Affiliate, Tektronix Australia Pty. Ltd.

("Australia Tek"), to sell, transfer and assign the Assets and Properties of

Australia Tek that constitute Non-United States Purchased Assets to Purchaser or

a designated Australian Purchasing Affiliate and Purchaser shall, or shall cause

such designated Purchasing Affiliate to purchase such Assets and Properties and

to assume certain Assumed Liabilities from Australia Tek (the "AustraliaAcquisition");

(c) Seller shall cause its Selling Affiliate, Tektronix N.V. ("Belgium

Tek"), to sell, transfer and assign the Assets and Properties of Belgium Tek

that constitute NonUnited States Purchased Assets to Purchasing Affiliates, N.V.

Xerox S.A. ("Xerox Belgium"), which shall purchase all of Belgium Tek's Assets

and Properties except for the Intangible Personal Property and Accounts

Receivable which shall be purchased by Xerox Channels and Purchaser shall cause

Xerox Belgium and Xerox Channels to purchase such Assets and Properties and to

assume certain Assumed Liabilities from Belgium Tek (the "Belgium Acquisition");

(d) Seller shall cause its Selling Affiliate, Tektronix Industria e

Comercio Ltda. ("Brazil Tek"), to sell, transfer and assign the Assets and

Properties of Brazil Tek that constitute Non-United States Purchased Assets to

Purchasing Affiliate, Xerox Commercio E. Industria Ltda. ("Xerox Brazil"), and

Purchaser shall cause Xerox Brazil

AMENDED ASSET PURCHASE AGREEMENT 13

to purchase such Assets and Properties and to assume certain Assumed Liabilities

from Brazil Tek (the "Brazil Acquisition");

(e) Seller shall cause its Selling Affiliate, Tektronix Canada, Inc.

("Canada Tek"), to sell, transfer and assign the Assets and Properties of Canada

Tek that constitute Non-United States Purchased Assets to Purchasing Affiliate,

Xerox Canada Ltd. ("Xerox Canada"), and Purchaser shall cause Xerox Canada to

purchase such Assets and Properties and to assume certain Assumed Liabilities

from Canada Tek (the "Canada Acquisition");

(f) Seller shall cause its Selling Affiliate, Tektronix Electronics (China)

Co., Ltd. ("China Tek"), to sell, transfer and assign the Assets and Properties

of China Tek that constitute Non-United States Purchased Assets to Purchaser or

to its designated Chinese Purchasing Affiliate and Purchaser shall, or shall

cause its designated Chinese Purchasing Affiliate to, purchase such Assets and

Properties and to assume certain Assumed Liabilities from China Tek (the "ChinaAcquisition");

(g) Seller shall cause its Selling Affiliate, Tektronix A/S ("Denmark

Tek"), to sell, transfer and assign the Assets and Properties of Denmark Tek

that constitute NonUnited States Purchased Assets to Purchasing Affiliates,

Xerox A/S ("Xerox Denmark"), which shall purchase all of Denmark Tek's Assets

and Properties except for the Intangible Personal Property and Accounts

Receivable which shall be purchased by Xerox Channels and Purchaser shall cause

Xerox Denmark and Xerox Channels to purchase such Assets and Properties and to

assume certain Assumed Liabilities from Denmark Tek (the "Denmark Acquisition");

(h) Seller shall cause its Selling Affiliate, Tektronix Oy ("Finland Tek"),

to sell, transfer and assign the Assets and Properties of Finland Tek that

constitute NonUnited States Purchased Assets to Purchasing Affiliates, Xerox Oy

("Xerox Finland"), which shall purchase all of Finland Tek's Assets and

Properties except for the Intangible Personal Property and Accounts Receivable

which shall be purchased by Xerox Channels, and Purchaser shall cause Xerox

Finland and Xerox Channels to purchase such Assets and Properties and to assume

certain Assumed Liabilities from Finland Tek (the "Finland Acquisition");

(i) Seller shall cause its Selling Affiliate, Tektronix S.A. ("France

Tek"), to sell, transfer and assign the Assets and Properties of France Tek that

constitute NonUnited States Purchased Assets to Purchasing Affiliates, Xerox -

THE DOCUMENT COMPANY SAS ("Xerox France"), which shall purchase all of France

Tek's Assets and Properties except for the Intangible Personal Property and

Accounts Receivable which shall be purchased by Xerox Channels, and Purchaser

shall cause Xerox France and Xerox Channels to purchase such Assets and

Properties and to assume certain Assumed Liabilities from France Tek (the

"France Acquisition");

AMENDED ASSET PURCHASE AGREEMENT 14

(j) Seller shall cause its Selling Affiliate, Tektronix GmbH ("Germany

Tek"), to sell, transfer and assign the Assets and Properties of Germany Tek

that constitute NonUnited States Purchased Assets to Purchasing Affiliates,

Xerox GmBh ("Xerox Germany"), which shall purchase all of Germany Tek's Assets

and Properties except for the Intangible Personal Property and Accounts

Receivable which shall be purchased by Xerox Channels, and Purchaser shall cause

Xerox Germany and Xerox Channels to purchase such Assets and Properties and to

assume certain Assumed Liabilities from Germany Tek (the "Germany Acquisition");

(k) Seller shall cause its Selling Affiliate, Tektronix Hong Kong Limited

("Hong Kong Tek"), to sell, transfer and assign the Assets and Properties of

Hong Kong Tek that constitute Non-United States Purchased Assets to Purchaser or

its designated Hong Kong Purchasing Affiliate and Purchaser shall, or shall

cause such designated Hong Kong Purchasing Affiliate to, purchase such Assets

and Properties and to assume certain Assumed Liabilities from Hong Kong Tek (the

"Hong Kong Acquisition");

(l) Seller shall cause its Selling Affiliate, Tektronix (India) Limited

("India Tek"), to sell, transfer and assign the Assets and Properties of India

Tek that constitute Non-United States Purchased Assets to Purchaser or its

designated Indian Purchasing Affiliate and Purchaser shall, or shall cause such

designated Indian Purchasing Affiliate to, purchase such Assets and Properties

and to assume certain Assumed Liabilities from India Tek (the "IndiaAcquisition");

(m) Seller shall cause its Selling Affiliate, Tektronix S.p.A. ("Italy

Tek"), to sell, transfer and assign the Assets and Properties of Italy Tek that

constitute Non-United States Purchased Assets to Purchasing Affiliates, Xerox

S.p.A. ("Xerox Italy") which shall purchase all of Italy Tek's Assets and

Properties except for the Intangible Personal Property and Accounts Receivable

which shall be purchased by Xerox Channels, and Purchaser shall cause Xerox

Italy and Xerox Channels to purchase such Assets and Properties and to assume

certain Assumed Liabilities from Italy Tek (the "Italy Acquisition");

(n) Seller shall cause its Selling Affiliate, Tektronix Korea, Ltd. ("Korea

Tek"), to sell, transfer and assign the Assets and Properties of Korea Tek that

constitute NonUnited States Purchased Assets to Purchaser or its designated

Korean Purchasing Affiliate, and Purchaser shall, or shall cause such designated

Korean Purchasing Affiliate to, purchase such Assets and Properties and to

assume certain Assumed Liabilities from Korea Tek (the "Korea Acquisition");

(o) Seller shall cause its Selling Affiliate, Tektronix, S.A. de C.V.

("Mexico Tek"), to sell, transfer and assign the Assets and Properties of Mexico

Tek that constitute Non-United States Purchased Assets to Purchasing Affiliate,

Xerox Mexicana, S.A. de C.V. ("Xerox Mexico"), and Purchaser shall cause Xerox

Mexico to purchase such Assets and Properties and to assume certain Assumed

Liabilities from Mexico Tek (the "Mexico Acquisition");

AMENDED ASSET PURCHASE AGREEMENT 15

(p) Seller shall cause its Selling Affiliate, Tektronix Holland N.V.

("Holland Tek"), to sell, transfer and assign the Assets and Properties of

Holland Tek that constitute Non-United States Purchased Assets to Purchasing

Affiliates, Xerox (Nederland) BV ("Xerox Netherland"), which shall purchase all

of Holland Tek's Assets and Properties except for the Intangible Personal

Property and Accounts Receivable which shall be purchased by Xerox Channels, and

Purchaser shall cause Xerox Netherland and Xerox Channels to, purchase such

Assets and Properties and to assume certain Assumed Liabilities from Holland Tek

(the "Holland Acquisition");

(q) Seller shall cause its Selling Affiliate, Tektronix Distribution Europe

B.V. ("Europe Tek"), to sell, transfer and assign the Assets and Properties of

Europe Tek that constitute Non-United States Purchased Assets to Xerox Holding

(Nederland) BV ("Xerox Holding Holland") and/or its designated Dutch Purchasing

Affiliate which shall purchase all of Europe Tek's Assets and Properties and

Purchaser shall cause Xerox Holding Holland and/or its designated Dutch

Purchasing Affiliate to assume certain Assumed Liabilities from Europe Tek (the

"Dutch Acquisition").

(r) Seller shall cause its Selling Affiliate, Tektronix Norge A/S ("Norway

Tek"), to sell, transfer and assign the Assets and Properties of Norway Tek that

constitute NonUnited States Purchased Assets to Purchasing Affiliates, Xerox AS

("Xerox Norway") which shall purchase all of Norway Tek's Assets and Properties

except for the Intangible Personal Property and Accounts Receivable which shall

be purchased by Xerox Channels, and Purchaser shall cause Xerox Norway and Xerox

Channels to purchase such Assets and Properties and to assume certain Assumed

Liabilities from Norway Tek (the "Norway Acquisition");

(s) Seller shall cause its Selling Affiliate, Tektronix Southeast Asia Pte

Ltd ("Singapore Tek"), to sell, transfer and assign the Assets and Properties of

Singapore Tek that constitute Non-United States Purchased Assets to Purchaser or

its designated Singapore Purchasing Affiliate and Purchaser shall, or cause such

designated Singapore Purchasing Affiliate to, purchase such Assets and

Properties and to assume certain Assumed Liabilities from Singapore Tek (the

"Singapore Acquisition");

(t) Seller shall cause its Selling Affiliate, Tektronix Espanola, S.A.

("Spain Tek"), to sell, transfer and assign the Assets and Properties of Spain

Tek that constitute Non-United States Purchased Assets to Purchasing Affiliates,

Xerox Espana, The Document Company, S.A.U. ("Xerox Spain") which shall purchase

all of Spain Tek's Assets and Properties except for the Intangible Personal

Property and Accounts Receivable which shall be purchased by Xerox Channels, and

Purchaser shall cause Xerox Espana and Xerox Channels to purchase such Assets

and Properties and to assume certain Assumed Liabilities from Spain Tek (the

"Spain Acquisition");

(u) Seller shall cause its Selling Affiliate, Tektronix AB ("Sweden Tek"),

to sell, transfer and assign the Assets and Properties of Sweden Tek that

constitute Non-United States Purchased Assets to Purchasing Affiliates, Xerox AB

("Xerox Sweden"), which shall

AMENDED ASSET PURCHASE AGREEMENT 16

purchase all of Sweden Tek's Assets and Properties except for the Intangible

Personal Property and Accounts Receivable which shall be purchased by Xerox

Channels, and Purchaser shall cause Xerox Sweden and Xerox Channels to purchase

such Assets and Properties and to assume certain Assumed Liabilities from Sweden

Tek (the "Sweden Acquisition");

(v) Seller shall cause its Selling Affiliate, Tektronix International AG

("Switzerland Tek"), to sell, transfer and assign the Assets and Properties of

Switzerland Tek that constitute Non-United States Purchased Assets to Purchasing

Affiliate, Xerox AG ("Xerox Switzerland") which shall purchase all of

Switzerland Tek's Assets and Properties except for the Intangible Personal

Property and Accounts Receivable which shall be purchased by Xerox Channels, and

Purchaser shall cause Xerox Switzerland and Xerox Channels to purchase such

Assets and Properties and to assume certain Assumed Liabilities from Switzerland

Tek (the "Switzerland Acquisition");

(w) Seller shall cause its Selling Affiliate, Tektronix Taiwan, Ltd.

("Taiwan Tek"), to sell, transfer and assign the Assets and Properties of Taiwan

Tek that constitute Non-United States Purchased Assets to Purchaser or its

designated Taiwanese Purchasing Affiliate and Purchaser shall, or shall cause

such designated Taiwanese Purchasing Affiliate to, purchase such Assets and

Properties and to assume certain Assumed Liabilities from Taiwan Tek (the

"Taiwan Acquisition");

(x) Seller shall cause its Selling Affiliate, Tektronix U.K. Limited

("United Kingdom Tek"), to sell, transfer and assign the Assets and Properties

of United Kingdom Tek that constitute Non-United States Purchased Assets to

Purchasing Affiliates, Xerox (UK) Limited ("Xerox UK"), which shall purchase all

of United Kingdom Tek's Assets and Properties except for the Intangible Personal

Property and Accounts Receivable which shall be purchased by Xerox Channels, and

the lease on the Lithuanian property, which shall be purchased by a Purchasing

Affiliate designated by Purchaser, and Purchaser shall cause Xerox UK, Xerox

Channels and the designated Purchasing Affiliate to purchase such Assets and

Properties and to assume certain Assumed Liabilities from United Kingdom Tek

(the "United Kingdom Acquisition");

(y) Seller shall cause its Selling Affiliate, Tektronix Export Inc.

("TEI"), to sell, transfer and assign the Assets and Properties of TEI that

constitute Non-United States Purchased Assets in the Netherlands to Xerox

(Europe) Limited; and in Brazil, Australia, Canada and Hong Kong to Purchaser or

its designated Brazilian, Australian, Canadian and Hong Kong Purchasing

Affiliates respectively, and Purchaser shall or shall cause the aforementioned

designated Purchasing Affiliates to, purchase such Assets and Properties and to

assume certain Assumed Liabilities from TEI (the "TEI Acquisition").

(z) Seller shall cause either its Selling Affiliate, GVG Japan, Ltd. ("GVG

Japan Tek"), or Seller's designated Japanese Selling Affiliate, to sell,

transfer and assign the Assets and Properties presently owned by GVG Japan Tek,

or subsequently owned by Seller or Seller's designated Japanese Selling

Affiliate (the former being referred to as "Japan's

AMENDED ASSET PURCHASE AGREEMENT 17

Successor") that constitute Non-United States Purchased Assets to Purchaser or

its designated Japanese Purchasing Affiliate, and Purchaser shall, or cause such

designated Japanese Purchasing Affiliate to, purchase such Assets and Properties

and to assume certain Assumed Liabilities from Japan Tek or Japan's Successor

(the "Japan Acquisition");

(aa) Seller shall cause its Selling Affiliate, Tektronix Europe Ltd. ("Ltd.

Tek"), to sell, transfer and assign the Assets and Properties of Ltd. Tek that

constitute Non-United States Purchased Assets to Purchasing Affiliate, Xerox

(Europe) Limited ("Xerox Europe"), and Purchaser shall cause Xerox Europe to

purchase such Assets and Properties and to assume certain Assumed Liabilities

from Ltd. Tek (the "Europe Acquisition").

The portion of the Purchase Price Consideration and Cash Purchase Price in

respect of each of the Asset Purchase Agreements referred to in this Section 1.3

shall be as determined in Section 1.4. The Asset Purchase Agreements referred to

in this Section 1.3, together with any other agreements, documents or

instruments executed in connection therewith, are referred to, collectively, in

this Agreement as the "Ancillary Agreements". Seller unconditionally guarantees

any and all Liabilities and obligations of each Selling Affiliate in accordance

with the terms of this Agreement and the Ancillary Agreements to which it is a

party. In the event any Foreign Closing does not occur on the Closing Date,

Seller shall cause its Selling Affiliate to enter into arrangements reasonably

acceptable to the parties hereto with respect to the operation of that portion

of the Business until the consummation of the Foreign Closing or the termination

of this Agreement in respect thereof in accordance with Section 1.5.

Notwithstanding the foregoing, Purchaser shall have the right to designate any

other Purchasing Affiliate or Purchasing Affiliates to take the place of and be

substituted for another Purchasing Affiliate or Purchasing Affiliates at any

time at least ten (10) Business Days prior to the Closing Date or the applicable

Foreign Closing Date and Seller agrees that neither Seller nor any Selling

Affiliate shall refuse to amend the relevant Ancillary Agreements so as to

effect such designation. Further, in the event that a Selling Affiliate owns or

uses Assets and Properties that constitute Purchased Assets in any geographic

territory or jurisdiction other than the one set forth above in connection with

such Selling Affiliate, Purchaser may designate a Purchasing Affiliate in such

other geographic territory or jurisdiction to purchase such Assets and

Properties pursuant to the terms of an Asset Purchase Agreement to be executed

in respect thereof.

1.4 Purchase Price; Allocation; Adjustment.

(a) Purchase Price. The aggregate purchase price (the "Purchase Price

Consideration") for the Purchased Assets, the Purchased Intellectual Property

and for the covenants of Seller contained in Section 4.11 (collectively, the

"Total Acquired Assets") is the sum of (i) Nine Hundred Fifty Million Dollars

($950,000,000.00) (the "Cash Purchase Price"), subject to adjustment as provided

in Section 1.4(c), and (ii) Purchaser's and the Purchasing A