- 1 -

PROPOSALS 4 AND 5

New Investment Management Agreement Between the Fund and Asia Management and New Advisory Agreement between

Asia Management and NICAM

The Board of Directors of the Fund has approved and recommended for the approval of

stockholders at the 1991 Special Meeting a new Investment Management Agreement with Asia

Management (the "proposed Management Agreement") and a new Advisory Agreement between

Asia Management and NICAM (the "proposed NICAM Agreement"). The proposed Manage-

ment Agreement is a new form of agreement that would replace the existing Investme nt

Advisory and Management Agreement with Asia Management dated as of June 5, 1989 (the

"present Management Agreement") and increase the rates of the fees payable to Asia

Management in the manner described below. The proposed NICAM Agreement would amend

the existing Advisory Agreement between Asia Management and NICAM dated as of June 5,

1989 (the "present NICAM Agreement") by increasing the rates of the fees payable to NICAM

by Asia Management in the manner described below. The proposed Management Agreement and

the proposed NICAM Agreement are attached hereto as Exhibits C and D, respectively.

Rate of Compensation Under the New Agreements

The principal difference between the present Management Agreement and the proposed

Management Agreement is that the annual fee payable to Asia Management would be increased

from (a) 0.75 of I % on the first S 150 million of average daily net assets, 0.60 of I % on assets in

excess of $150 million up to and including $200 million and 0.55 on 1% on assets excess of

$200 million, payable monthly to (b) 0.85 of 1% on the first $200 million of average daily ne t

assets, 0.80 of 1% on assets in excess of $200 million up to and including $300 million, 0.75 of

1% on assets in excess of $300 million up to and including $700 million and 0.70 of assets in

excess of $700 million, payable monthly. The fee structure under the present Management

Agreement has been in effect since July 1, 1986.

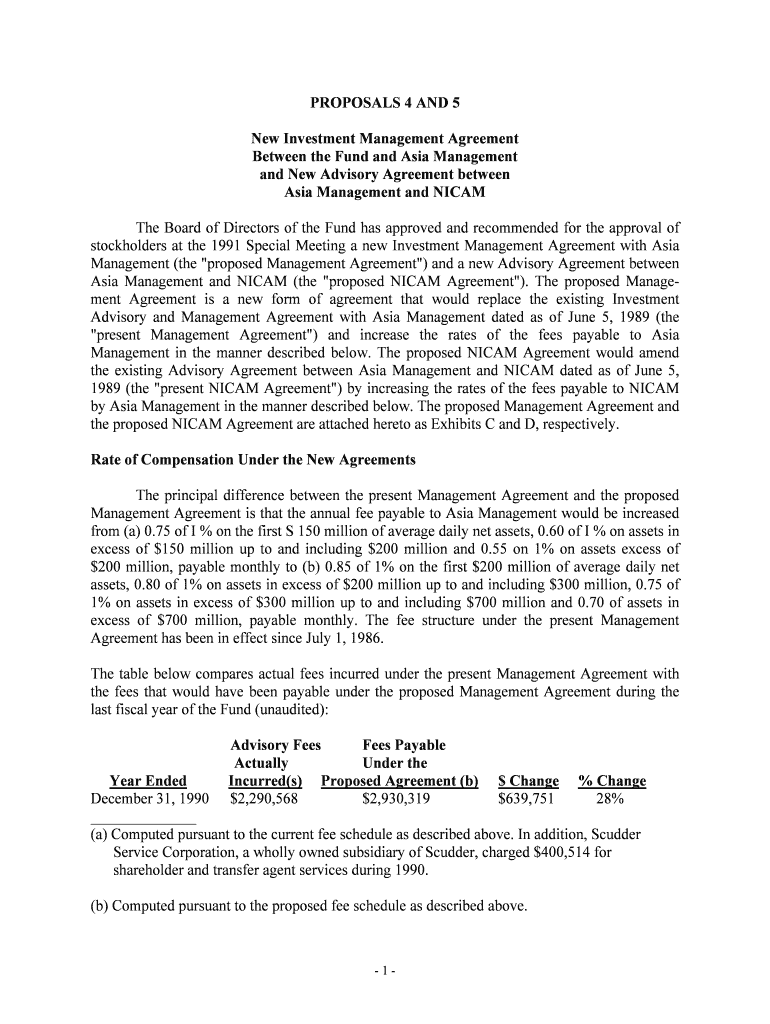

The table below compares actual fees incurred under the present Management Agreement with

the fees that would have been payable under the proposed Management Agreement during the

last fiscal year of the Fund (unaudited):

Advisory Fees Fees Payable

Actually Under the

Year Ended Incurred(s) Proposed Agreement (b) $ Change % Change

December 31, 1990 $2,290,568 $2,930,319 $639,751 28% ______________

(a) Computed pursuant to the current fee schedule as described above. In addition, Scudder

Service Corporation, a wholly owned subsidiary of Scudder, charged $400,514 for

shareholder and transfer agent services during 1990.

(b) Computed pursuant to the proposed fee schedule as described above.

- 2 -

The ratio of operating expenses to average net assets for the fiscal year ended December

31, 1990 was 1.05%. If the proposed Management Agreement had been in effect the ratio would

have been 1.23%. At February 28, 1991, the net assets of the Fund were approximately

$371,831,624. There can be no assurance as to the future size of the Fund.

The proposed NICAM Agreement would increase the annual fee payable to NICAM by

Asia Management from (a) 0.1875 of 1 % on the first $150 million of average daily net asset s,

0.15 of 1 % on assets in excess of $150 million up to and including $200 million and 0.1375 of

1% on assets in excess of $200 million, payable monthly, to (b) 0.23 of 1% on the first $200

million of average daily net assets, 0.21 of 1% on assets in excess of $200 million up to a nd

including $300 million, 0.19 of 1% on assets in excess of $300 million up to and including $700

million and 0.17 of 1% on assets in excess of $700 million, payable monthly. The fee structure

under the present NICAM Agreement has been in effect since July 1, 1986.

In 1990, the advisory fee incurred by Asia Management to NICAM was $572,642. Had

the rates provided under the proposed NICAM Agreement been in effect, the advisory fee

incurred to NICAM would have been $779,014.

Board of Directors' Approval and Recommendation

The Board of Directors at a meeting on January 25, 1991 approved the proposed Manage-

ment Agreement and the proposed NICAM Agreement and recommended the agreements for

approval by stockholders. At the same meeting these agreements were approved by a majori ty of

the directors who are not "interested persons" of the Fund or of any party to the respective

agreements as that term is defined under the 1940 Act (the "Non-Interested Directors"). In

approving the agreements and the fee increases provided thereunder, the directors of the Fund,

including the Non-Interested Directors, took into account all factors they deemed rel evant. These

factors included the nature, quality and extent of services furnished by Asia Management and

NICAM, including the intensive and complex research, tailored to the Fund's objectives, e ntailed

in the active management of the Fund's portfolio; the investment record of Asia Managem ent and

NICAM in managing the Fund; the personnel of Asia Management, Scudder and NICAM

supporting the Fund; the desirability of providing in one contract for investment advisory and

administrative services necessary or appropriate for managing the Fund; the services rendered by

NICAM to Asia Management, including the quality and quantity of research materials a nd the

frequency of communication about market and investment conditions in Japan; the profitabi lity

and costs of Asia Management and NICAM with respect to the Fund; possible economies of

scale to Asia Management and NICAM if the Fund's assets increase; the risks assumed by Asia

Management, Scudder and NICAM; data as to the investment performance, advisory fees and

expense ratios of funds deemed comparable to the Fund; possible corollary benefits to Asia

Management, Scudder and NICAM resulting from the advisory relationships; possible benefits to

Asia Management and Scudder from affiliates of Asia Management and Scudder serving as

principal underwriter and transfer agent of the Fund; financial and other benefits of Scudder

Trust Company receiving payments from the Fund's shareholders for providing retirement plan

services; financial and other benefits to Scudder Service Corporation of receiving payment s from

- 3 -

the Fund for acting as transfer, dividend-paying and shareholder service agent for the Fund;

Scudder's expenditures in developing worthwhile and innovative shareholder services for the

Fund; improvements in the quality and scope of the shareholder services provided to the Fund's

shareholders; the financial resources of Asia Management and NICAM and the continuance of

appropriate incentives to assure the continued furnishing of high quality services to the Fund;

and various other factors.

Description of the Proposed Management Agreement

The following summary of certain provisions of the proposed Management Agreement is

qualified in its entirety by reference to the proposed Management Agreement, which is at tached

hereto as Exhibit C.

Under the proposed Management Agreement, Asia Management will agree to provide

continuing investment management of the Fund's assets, as well as to use reasonable effort s to

manage the Fund so that it will qualify as a regulated investment company under the Internal

Revenue Code of 1986, as amended, to make available investment records and ledgers as

necessary to assist the Fund to comply with the 1940 Act and other applicable laws, to determine

what portion of the Fund's portfolio shall be invested in securities and other assets and wha t

portion, if any, should be held uninvested, and to furnish periodic reports on the investment

performance of the Fund and on the performance of Asia Management's obligations under the

proposed Management Agreement to the Fund's Board of Directors.

In addition to the provision of portfolio management services and furnishing at its

expense office space and facilities for the Fund, under the proposed Management Agreement

Asia Management will render significant administrative services (not otherwise provided by

third parties) necessary for the Fund's operations as an open-end investment company, including,

but not limited to, preparing reports and notices to the directors and shareholders; supervisi ng,

negotiating contractual arrangements with, and monitoring various third-party service providers

to the Fund (such as the Fund's transfer agent, pricing agents, custodian, accountants and others);

preparing and making filings with the Securities and Exchange Commission and other regulat ory

agencies; assisting in the preparation and filing of the Fund's federal, state and loc al tax returns;

preparing and filing the Fund's federal excise tax returns; assisting with investor and public

relations matters; monitoring the valuation of securities and the calculation of net asset value;

monitoring the registration of shares of the Fund under applicable federal and state sec urities

laws; maintaining the Fund's books and records to the extent not otherwise maintained by a third

party-, assisting in establishing accounting policies of the Fund; assisting in the resolution of

accounting and legal issues; establishing and monitoring the Fund's operating budget; processi ng

the payment of the Fund's bills; assisting the Fund in, and otherwise arranging for, the payment

of distributions and dividends and otherwise assisting the Fund in the conduct of its business,

subject to the direction and control of the directors. The directors believe it is desirable to include

the responsibility for providing these services in the proposed Management Agreement.

Under the proposed Management Agreement, Asia Management will provide the Fund

with portfolio management services and administrative services (which include provision of

office facilities). Under both the present and proposed Agreements, the Fund is responsible for

- 4 -

all expenses not entailed in Asia Management's provision of those services. The proposed

Management Agreement enumerates certain expenses for which the Fund and not Asia

Management would be responsible, including fees and expenses incurred in connection with

membership in investment company organizations; brokers' commissions; legal, auditing and

accounting expenses; portfolio pricing services; taxes and governmental fees; the fees and

expenses of the transfer agent; expenses of preparing share certificates and any other expense s,

of issue, redemption or repurchase of shares; the expenses of and fees for registering or

qualifying securities for sale; the fees and expenses of directors who are not affiliated with Asia

Management; the cost of printing and distributing reports and notices to stockholders; and t he

fees and disbursements of custodians. The custodian agreement provides that the custodian shall

compute the net asset value. The Fund is also responsible for expenses of stockholders' meetings

and indemnification of officers and directors of the Fund.

Under the proposed Management Agreement, Asia Management pays the compensation

of all officers and employees of the Fund who are affiliated persons of Asia Management a nd

makes available, without expense to the Fund, the services of such directors, officers and

employees of Asia Management or of Scudder as may be duly elected officers of the Fund,

subject to their individual consent to serve and to any limitations imposed by law. Sim ilarly,

Asia Management is also responsible for the salaries of such persons under the present

Management Agreement. Under both Agreements, the Fund is responsible for the fees and

expenses of directors not affiliated with Asia Management. The proposed Management

Agreement also specifically provides that the Fund will pay the expenses, such as trave l

expenses, of directors and officers of the Fund who are directors, officers or employees of Asia

Management, to the extent that such expenses relate to attendance at me etings of the Board of

Directors or any committees thereof held outside Boston, Massachusetts or New York, New York.

The proposed Management Agreement provides that Asia Management shall not be liable

for any error of judgment or mistake of law or for any loss suffered by the Fund in connection

with matters to which the Agreement relates, except a loss resulting from will ful misfeasance,

bad faith or gross negligence on the part of Asia Management in the performance of its dut ies or

from reckless disregard by Asia Management of its obligations and duties under the Agreement.

If approved by the stockholders, the present Management Agreement will terminate and

the proposed Management Agreement will become effective on the day following approval and

will remain in force until February 28, 1993. The proposed Management Agreement would

continue in effect thereafter by its terms from year to year only so long as it s continuance is

specifically approved at least annually by the vote of a majority of those directors who are not

"interested persons" of the Fund or Asia Management cast in person at a meeting call ed for that

purpose, and either by vote of the directors, or a majority of the Fund's outstanding voting

securities, as defined below. The proposed Management Agreement may be terminated on 60

days' written notice, without penalty, by the directors, by the vote of the holders of a ma jority of

the Fund's outstanding voting securities, or by Asia Management, and automatically termi nates

in the event of its assignment. The present Management Agreement requires annual approval of

its continuance and contains the same termination provisions as the proposed Management

Agreement.

- 5 -

Description of the Proposed NICAM AgreementPursuant to the present NICAM Agreement, NICAM provides, and under the proposed

NICAM Agreement NICAM will provide, Asia Management with information, investment

recommendations, advice and assistance for use by Asia Management in advising the Fund.

NICAM is free, under the terms of both NICAM Agreements, to render similar services to

others, including other investment companies.

If approved by the stockholders, the present NICAM Agreement will terminate, and the

proposed NICAM Agreement will become effective on the day following approval and will

remain in force until February 28, 1993. The proposed NICAM Agreement would continue in

effect thereafter by its terms from year to year only so long as its continua nce is specifically

approved at least annually by vote of a majority of those directors who are not "interest ed

persons" of the Fund, Asia Management or NICAM cast in person at a meeting called for that

purpose, and either by vote of the directors, or a majority of the Fund's outstanding voting

securities, as defined below. Pursuant to its terms the proposed NICAM Agreement may be

terminated by the directors, by vote of the holders of a majority of the Fund's outstanding vot ing

securities or by Asia Management on 60 days’ written notice to NICAM or by NICAM on six

months' written notice to the Fund and Asia Management and terminates automatical ly if it or the

Agreement between the Fund and Asia Management is assigned.

Voting Requirement for Proposals 4 and 5

A favorable vote by the holders of a majority of the outstanding voting securities of the

Fund will be necessary for adoption of Proposals 4 and 5, which under the 1940 Act means the

vote of the lesser of (a) 67% or more of the shares present at a meeting, if the holders of more

than 50% of the outstanding shares are present or represented by proxy or (b) more than 50% of

the outstanding shares of the Fund.

If Proposal 4 or 5 is not approved by stockholders, the present Management Agreement

or the present NICAM Agreement, as the case may be, will continue in full force and effect.

The Board of Directors recommends that you vote FOR approval of Proposals 4 and

5.

INFORMATION CONCERNING ASIA MANAGEMENT

Asia Management, a Delaware corporation, was created to provide management services

and investment advice to the Fund as well as to others, including, but not limited t o, other

investment companies investing in- Japan. Asia Management presently has no understanding or

arrangement with respect to providing services to any company or person other than the Fund,

although it may provide advisory services to Scudder. The capitalization of Asia Manageme nt at

December 31, 1990 is set forth in the balance sheet attached as Exhibit A. All of the stock of

Asia Management is owned by Scudder.

- 6 -

The directors of Asia Management include Mr. 0. Robert Theurkauf, Ms. Gina

Provenzano, Mr. Douglas M. Loudon, Mr. Nicholas Bratt and Ms. Kathryn L. Quirk. Mr.

Theurkauf is President of Asia Management and of the Fund, Ms. Quirk is Vice President and

Secretary of Asia Management and Secretary of the Fund and Mr. William E. Holzer is a Vice

President of Asia Management and of the Fund. Ms. Elizabeth J. Allan is a Vice President of

Asia Management, the Fund and Scudder. Mr. Seung K. Kwak is a Vice President of Asia

Management and Scudder. Ms. Gina Provenzano serves as Vice President and Treasurer of both

the Fund and Asia Management and is also a Vice President of Scudder. Ms. Carol Berg serves

as Assistant Secretary of both the Fund and Asia Management. Messrs. Bratt, Holzer, Loudon

and Theurkauf and Ms. Quirk are Managing Directors of Scudder.

The address of Asia Management and its officers and directors is 345 Park Avenue, New

York, New York 10154.

INFORMATION CONCERNING SCUDDER

Scudder, a Delaware corporation, is one of the most experienced investment management

firms in the United States. Since 1919 it has pioneered the practice of providing inve stment

counsel to clients on a fee basis rather than receiving compensation based on portfolio

transactions for clients. The principal source of Scudder's income is professional fees receive d

from providing continuing investment advice and management. The firm derives no income from

banking, brokerage or underwriting of securities.

Today Scudder provides investment management services for individuals and institutions,

including employee benefit funds, insurance companies, colleges, industrial corporations,

financial and banking organizations and investment companies. In some instances, investme nts

appropriate for the Fund may also be appropriate for clients, including investment companies,

advised by Scudder. Scudder maintains a large research department, which conducts continuous

studies of the factors that affect various industries, companies and individual securities both in

the United States and abroad. In this work, Scudder utilizes certain reports and statist ics from a

wide variety of sources, including brokers and dealers who may execute portfolio transactions

for investment companies and other clients of Scudder.

Scudder has been active in international investment for over 35 years and its investme nt

company clients include Scudder International Fund, Inc., an investment company specializ ing in

foreign investments, initially incorporated in Canada as the first foreign investment company

registered with the United States Securities and Exchange Commission, The Korea Fund, Inc., a

closed-end investment company organized in 1984 to invest in Korean securities, Scudder New

Asia Fund, Inc., a closed-end investment company organized in 1987 to invest in Asian

companies, including smaller Japanese companies, The Brazil Fund, Inc., a closed-end

investment company organized in 1988 to invest in Brazilian securities and Scudder Ne w Europe

Fund, Inc., a closed-end investment company organized in 1990 to invest in smaller or emerging

European securities markets and companies. Several members of Scudder's research staff have

extensive experience in portfolio investment in Japanese securities, and Scudder has dea lt with

Nikko Securities for many years.

- 7 -

Scudder has managed investment companies since 1928 and is today the adviser of

registered investment companies with combined assets of over $14 billion. Total assets under

Scudder's supervision exceed $45 billion.

Daniel Pierce, 175 Federal Street, Boston, Massachusetts, is the Chairman of the Board

of Scudder, Edmond D. Villani, 345 Park Avenue, New York, New York, is the President and a

director of Scudder and Stephen R. Beckwith, 345 Park Avenue, New York, New York, Lynn S.

Birdsong, 345 Park Avenue, New York, New York, Nicholas Bratt, 345 Park Avenue, New

York, New York, Cuyler W. Findlay, 345 Park Avenue, New York, New York, Jerard K.

Hartman, 345 Park Avenue, New York, New York, Douglas M. Loudon, 345 Park Avenue, New

York, New York, John T. Packard, 101 California Street, San Francisco, California, Juris

Padegs, 345 Park Avenue, New York, New York, Cornelia M. Small, 345 Park Avenue, New

York, New York, 0. Robert Theurkauf, 345 Park Avenue, New York, New York, and David B.

Watts, 175 Federal Street, Boston, Massachusetts are the other members of the Board of

Directors of Scudder. The principal occupation of each of the above-named individuals is serving

as a Managing Director of Scudder.

INFORMATION CONCERNING NICAM AND NIKKO SECURITIES

NICAM, a Japanese corporation which is an indirectly controlled affiliate of Nikko

Securities, is engaged in an investment counseling and management business providing

economic research, business information and security analysis to a variety of Japanese and

international clients, including investors interested in Japanese and other Far East ern securities

and companies interested in international direct investments and joint ventures or in raising funds

in international capital markets. NICAM has agreed that its separate staff which prepares and

makes specific investment recommendations to Asia Management and the Fund will not make

specific investment recommendations to any other person or entity.

Nikko Securities, a Japanese corporation which is one of the largest securities houses of

Japan, conducts a general investment banking business and acts as broker, dealer and underwrite r

with respect to all types of corporate and government securities. In the course of its cust omary

activities, Nikko Securities purchases and sells Japanese securities as a dealer for its own account

and it may have long or short positions in securities of companies which are represented in t he

Fund's portfolio.

Mr. Shoji Umemura, a member of the Fund's Board of Directors, is Chairman of the

Board of Nikko Securities. As of January 31, 1991, Mr. Umemura owned 416,000 shares of the

1,466,162,197 shares of common stock of Nikko Securities outstanding as of that date. All

outstanding shares of Nikko Securities common stock have voting power.

Officers and Directors of NICAM

The names and titles of the principal executive officers and directors of NICAM are set

forth below. The principal occupation of all such persons is that of fund manager or investment

advisor for both international and domestic clients. A separate staff within the NICAM

- 8 -

organization prepares and makes specific investment recommendations to Asia Management and

is supervised by a director whose principal occupation is investment research.

Todao Kobayashi, President and Director Satoru Takahashi, Director

Tsuneo Izawa, Senior Managing Director Kazuhiro Higashino, Director

Toshiyuki Kiyohara, Managing Director Takashi Murakami, Director

Takashi Murakami, Managing Director Kazuyuki Utsunomiya, Auditor

Yoshihiko Kubota, Managing Director Kohei Ohiwa, Auditor*

Yukihiro Noguchi, Director____________________

*Part-time.

The principal office of NICAM in Japan, 7-3, Marunouchi 2-chome, Chiyoda-Ku, Tokyo

100, Japan, is the address of each of the officers and directors of NICAM.

SECURITIES TRANSACTIONS FOR AND WITH THE FUND

Total brokerage commissions paid by the Fund amounted to $908,407 for 1990,

$1,177,634 for 1989 and $788,279 for 1988. Of these amounts, commissions were paid by the

Fund- for brokerage services rendered by Nikko Securities in respect of portfolio transactions by

the Fund in the amounts of $51,688 for 1990, $63,049 for 1989 and $49,831 for 1988. Such

amounts represented 5.7%, 5.4% and 6.3% of the total brokerage commissions paid by the Fund

in these years, respectively. The advisory fee paid to NICAM was not reduced because of the se

brokerage commissions and it is not expected that the advisory fees paid in the fut ure to NICAM

will be so reduced. The rate of total portfolio turnover of the Fund for the years 1990, 1989 and

1988 was 52.7%, 60.4% and 38.8%, respectively.

One of the Fund's directors is affiliated with J.P. Morgan Securities Asia, Ltd. In 1990

there were $2,659 in commissions paid or accrued by the Fund to J.P. Morgan Securities Asia,

Ltd.

The Fund always seeks to place portfolio transactions with those brokers which, in the

opinion of the Management of the Fund, provide the best execution of Fund orders. The Fund

considers the obtaining of the most favorable price for Fund orders a major factor in best

execution. Subject to this practice of seeking the best execution, the Fund in alloc ating brokerage

may consider research information provided by brokers to the Fund or to Asia Management for

use in advising the Fund. Orders for portfolio transactions of the Fund may be placed through

Scudder Fund Distributors, Inc., a wholly owned subsidiary of Scudder, which in turn places

orders on behalf of the Fund with other brokers and dealers. Scudder Fund Distributors, Inc.

receives no commissions, fees or other remuneration from the Fund for this service.

The 1940 Act prohibits Asia Management, NICAM or Nikko Securities as principal from

knowingly selling any security to the Fund or knowingly purchasing any security from the Fund,

subject to certain limited exceptions including the purchase of securities issued by t he Fund. It is

the policy of the Fund not to deal with Asia Management, NICAM and Nikko Securities a s

principal in the purchase or sale of securities.

- 9 -

EXHIBIT C

Proposed Investment Management Agreement between the Fund and Asia Management _______________________

THE JAPAN FUND, INC. 345 Park Avenue

New York, New York 10154

May 24, 1991

Asia Management Corporation

345 Park Avenue

New York, NY 10154

INVESTMENT MANAGEMENT AGREEMENT

Dear Sirs: The Japan Fund, Inc. (the "Fund") has been established as a Maryland Corporation to

engage in the business of an investment company.

The Fund has selected you (the "Advisor") to act as investment manager of the Fund and

to provide certain other services, as more fully set forth below, and you have indicated tha t you

are willing to act as such investment manager and to perform such services under t he terms and

conditions hereinafter set forth. Accordingly, the Fund agrees with you as follows:

1. Delivery of Document. The fund engages in the business of investing and reinvesting

the assets of the Fund in the manner and in accordance with the investment object ives, policies

and restrictions specified in the currently effective Prospectus (the "Prospectus") and State ment

of Additional Information (the "SAI") included in the Fund's Registration Statement on Form N-

IA, as amended from time to time, (the "Registration Statement") filed by the Fund under the

Investment Company Act of 1940, as amended, (the "1940 Act") and the Securities Act of 1933,

as amended. Copies of the documents referred to in the preceding sentence have been furni shed

to you by the Fund. The Fund has also furnished you with copies properly certified or

authenticated of each of the following additional documents related to the Fund:

(a) Articles of Incorporation of the Fund dated June 8, 1989, as amended to date

(the "Articles").

(b) By-laws of the Fund as in effect on the date hereof (the "By-Laws").

(c) Resolutions of the Directors of the Fund and the shareholders of the Fund

selecting you as investment manager and approving the form of this Agreement.

- 10 -

The Fund will furnish you from time to time with copies, properly certified or

authenticated, of all amendments of or supplements, if any, to the foregoing, including the

Prospectus, the SAI and the Registration Statement.

2. Portfolio Management Services. As manager of the assets of the Fund, you shall

provide continuing investment management of the assets of the Fund in accordance with the

investment objectives, policies and restrictions set forth in the Prospectus and SAI; the applicable

provisions of the 1940 Act and the Internal Revenue Code of 1986, as amended, (the "Code")

relating to regulated investment companies and all rules and regulations thereunde r; and all other

applicable federal and state laws and regulations of which you have knowledge; subjec t always

to policies and instructions adopted by the Fund's Board of Directors. In connection therewith,

you shall use reasonable efforts to manage the Fund so that it will qualify as a regul ated

investment company under Subchapter M of the Code and regulations issued thereunder. In

managing the Fund in accordance with the requirements set forth in this section 2, you sha ll be

entitled to receive and act upon advice of counsel to the Fund or counsel to you. You shall also

make available to the Fund promptly upon request all of the Fund's investment records and

ledgers as are necessary to assist the Fund to comply with the requirements of the 1940 Ac t and

other applicable laws. To the extent required by law, you shall furnish to regulatory a uthorities

having the requisite authority any information or reports in connection with the service s provided

pursuant to this Agreement which may be requested in order to ascertain whether the ope rations

of the Fund are being conducted in a manner consistent with applicable laws and regulations.

You shall determine the securities, instruments, investments, currencies, repurchase

agreements, futures, options and other contracts relating to investments to be purchased, sol d or

entered into by the Fund and place orders with broker-dealers, foreign currency dealers, futures

commission merchants or others pursuant to your determinations and all in accordance with

Fund policies as expressed in the Registration Statement and with guidelines and dire ctions from

the Board of Directors. Subject to such policies and guidelines, you shall determine wha t portion

of the Fund's portfolio shall be invested in securities and other assets and what portion, if any,

should be held uninvested.

You shall furnish to the Fund's Board of Directors periodic reports on the investment

performance of the Fund and on the performance of your obligations pursuant to this Agreement,

and you shall supply such additional reports and information as the Fund's officers or Board of

Directors shall reasonably request.

In rendering the services required under this section you may receive the assistance of

The Nikko International Capital Management Co., Ltd. ("NICAM"), which is to furnish regular

investment research and advisory services with respect to the Fund pursuant to an agreement

with the Advisor dated as of the date hereof (as the same may be amended from tim e to time),

and may contract with or consult with such banks, other securities firms or other parties in Japan

or elsewhere, including Scudder, Stevens & Clark, Inc. (an Affiliated company of the Advisor, as

defined in the Investment Company Act of 1940, as amended) as it may deem appropriate to

obtain information and advice, including investment recommendations, advice regarding

economic factors and trends, advice as to currency exchange matters, and clerical and accounting

services and other assistance, but any fees, compensation or expenses to be paid to any such

- 11 -

parties shall be paid by you, and no obligation shall be incurred on the Fund's behalf in any such

respect.3. Administrative Services. In addition to the portfolio management services specified

above in section 2, you shall furnish at your expense for the use of the Fund such office space

and facilities as the Fund may require for its reasonable needs, and you (or one or more of your

affiliates designated by you) shall render to the Fund administrative services necessary for

operating as an investment company and not provided by persons not parties to this Agreem ent

including, but not limited to, preparing reports to and meeting materials for the Fund's B oard of

Directors and reports and notices to Fund shareholders; supervising, negotiating contractual

arrangements with, to the extent appropriate, and monitoring the performance of, custodians,

depositories, transfer and pricing agents, accountants, attorneys, printers, underwriters, brokers

and dealers, insurers and other persons in any capacity deemed to be necessary or desirable t o

Fund operations; preparing and making filings with the Securities and Exchange Commission

(the "SEC") and other regulatory and self-regulatory organizations, including, but not limited to,

preliminary and definitive proxy materials, post-effective amendments to the Regist ration State-

ment, semi-annual reports on Form N-SAR and notices pursuant to Rule 24f-2 under the 1940

Act; overseeing the tabulation of proxies by the Fund's transfer agent; assisting in the pre paration

and filing of the Fund's federal, state and local tax returns; preparing and filing the Fund's federal

excise tax return pursuant to Section 4982 of the Code; providing assistance with investor and

public relations matters; monitoring the valuation of portfolio securities, the calc ulation of net

asset value and the calculation and payment of distributions to Fund shareholders; moni toring the

registration of the Fund's shares of capital stock, S.331/3 par value per share (the "Shares") under

applicable federal and state securities laws; maintaining or causing to be m aintained for the Fund

all books, records and reports and any other information required under the 1940 Act, to the

extent that such books, records and reports and other information are not maintained by the

Fund's custodian or other agents of the Fund; assisting in establishing the accounting policies of

the Fund; assisting in the resolution of accounting issues that may arise with respect to the Fund's

operations and consulting with the Fund's independent accountants, legal counsel and the Fund's

other agents as necessary in connection therewith; establishing and monitoring the Fund's

operating expense budgets; reviewing the Fund's bills; processing the payment of bills that have

been approved by a person authorized by the Fund; assisting the Fund in determining the amount

of dividends and distributions available to be paid by the Fund to its shareholders, preparing a nd

arranging for the printing of dividend notices to shareholders, and providing the transfer and

dividend paying agent and the custodian with such information as is required for such parties to

effect the payment of dividends and distributions; and otherwise assisting the Fund as it may

reasonably request in the conduct of its business, subject to the direction and control of the

Fund's Board of Directors. Nothing in this Agreement shall be deemed to shift to you or to

diminish the obligations of any agent of the Fund or any other person not a party to this

Agreement which is obligated to provide services to the Fund.

4. Allocation of Charges and Expenses. Except as otherwise specifically provided in this

section 4, you shall pay the compensation and expenses of all Directors, officers and employees

of the Fund (including the Fund's share of payroll taxes) who are affiliated persons of you, or are

affiliated persons of 'Scudder, Stevens & Clark, Inc., and you shall make available, without

expense to the Fund, the services of such of your, or Scudder, Stevens & Clark, Inc.'s, directors,

- 12 -

officers and employees as may duly be elected officers of the Fund, subject to their individual

consent to serve and to any limitations imposed by law. You shall provide at your expense the

portfolio management services described in section 2 hereof and the administrative servi ces

described in section 3 hereof.

You shall not be required to pay any expenses of the Fund other than those specifically

allocated to you in this section 4. In particular, but without limiting the generality of the

foregoing, you shall not be responsible, except to the extent of the reasonable compensation of

such of the Fund's Directors and officers as are directors, officers or employees of you whose

services may be involved, for the following expenses of the Fund, to the extent they are not

entailed in your provision of the services described in section 2 and section 3 hereof:

organization expenses of the Fund (including out-of-pocket expenses, but not including your

overhead or employee costs); fees payable to you and to any other Fund advisors or consultants

expenses; auditing and accounting expenses; maintenance of books and records which are

required to be maintained by the Fund's custodian or other agents of the Fund; telephone, tel ex,

facsimile, postage and other communications expenses; taxes and governmental fees; fe es, dues

and expenses incurred by the Fund in connection with membership in investment company tra de

organizations; fees and expenses of the Fund's custodians, sub-custodians, transfer agents,

dividend disbursing agents and registrars payment for portfolio pricing or valuation services to

pricing agents, accountants, bankers an d other specialists, if any; expenses of preparing share

certificates and, except as provided below in this section 4, other expenses in connection with the

issuance, offering, distribution, sale, redemption or repurchase of securities issued by the Fund;

expenses relating to investor and public relations; expenses and fees of registering or qualifying

Shares of the Fund for sale; interest charges, bond premiums and other insurance expense;

freight, insurance and other charges in connection with the shipment of the Fund's portfolio

securities; the compensation and all expenses (specifically including travel expenses relating to

Fund business) of Directors, officers and employees of the Fund who are not affiliated persons of

you; brokerage commissions or other costs of acquiring or disposing of any portfolio securities

of the Fund; expenses of printing and distributing reports, notices and dividends to shareholders;

expenses of printing and mailing Prospectuses and SAIs of the Fund and supplements thereto;

costs of stationery; any litigation expenses, indemnification of Directors and officers of the Fund;

costs of shareholders' and other meetings; and travel expenses (or an appropriate portion thereof)

of Directors and officers of the Fund who are directors, officers or employees of you to the

extent that such expenses relate to attendance at meetings of the Board of Direc tors of the Fund

or any committees thereof or advisors thereto hold outside of Boston, Massachusetts or New

York, New York.

You shall not be required to pay expenses of any activity which is primarily intended to

result in sales of Shares of the Fund if and to the extent that (i) such expenses are re quired to be

borne by a principal underwriter which acts as the distributor of the Fund's Shares pursuant to a n

underwriting agreement which provides that the underwriter shall assume some or all of such

expenses, or (ii) the Fund shall have adopted a plan in conformity with the 1940 Act providing

that the Fund (or some other party) shall assumed some or all of such expenses. You shall be

required to pay such of the foregoing sales expenses as are not required to be paid by the

principal underwriter pursuant to the underwriting agreement or are not permitted to be pai d by

the Fund (or some other party) pursuant to such a plan.

- 13 -

5. Management Fee. For all services to be rendered, payments to be made and costs to be

assumed by you as provided in sections 2, 3 and 4 hereof, the Fund shall pay you a monthly fee,

payable in dollars, equal on an annual basis to .85 of I% of the value of the average dail y net

assets of the Fund up to and including $200 million; plus .80 of I% of the value of the average

daily net assets of the Fund over $200 million and up to and including $300 million; plus .75 of

1% of the value of the average daily net assets of the Fund over $300 million and up to a nd

including $700 million; plus .70 of 1% of the average daily net assets over $700 million.

The "average daily net assets" of the Fund shall mean the average of the values pl aced on

the Fund's net assets as of 4:00 p.m. (New York time) on each day on which the net asset value

of the Fund is determined consistent with the provisions of Rule 22c-1 under the 1940 Act or, if

the Fund lawfully determines the value of its net assets as of some other time on e ach business

day, as of such time. The value of the net assets of the Fund shall always be determine d pursuant

to the applicable provisions of the Articles and the Registration Statement. If the determination

of net asset value does not take place for any particular day, then for the purposes of thi s section

5, the value of the net assets of the Fund as last determined shall be deemed to be the value of its

net assets as of 4:00 p.m. (New York time), or as of such other time as the value of the ne t assets

of the Fund's portfolio may be lawfully determined on that day. If the Fund determines the value

of the net assets of its portfolio more than once on any day, then the last such det ermination

thereof on that day shall be deemed to be the sole determination thereof on that day for the

purposes of this section 5.

You agree that your gross compensation for any fiscal year shall not be greater than an

amount which, when added to the other expenses of the Fund, shall cause the aggregate expenses

of the Fund to equal the maximum expenses under the lowest applicable expense limita tion

established pursuant to the statutes or regulations of any jurisdiction in which the Shares of the

Fund may be qualified for offer and sale. Except to the extent that such amount has be en

reflected in reduced payments to you, you shall refund to the Fund the amount of any payment

received in excess of the limitation pursuant to this section 5 as promptly as prac ticable after the

end of such fiscal year, provided that you shall not be required to pay the Fund an amount gre ater

than the fee paid to you in respect of such year pursuant to this Agreement. As used in this

section 5, “expenses" shall mean those expenses included in the applicable expense li mitation

having the broadest specifications thereof, and "expense limitation" means a lim it on the

maximum annual expenses which may be incurred by an investment company determined (i) by

multiplying a fixed percentage by the average, or by multiplying more than one such pe rcentage

by different specified amounts of the average, of the values of an investment company's net

assets for a fiscal year or (ii) by multiplying a fixed percentage by an investment company's net

investment income for a fiscal year. The words "lowest applicable expense limitat ion" shall be

construed to result in the largest reduction of your compensation for any fiscal year of the Fund;

provided, however, that

6. Avoidance of Inconsistent Position; Services Not Exclusive. In connection with

purchases or sales of portfolio securities and other investments for the account of the Fund,

neither you nor any of your directors, officers or employees shall act as a principal or agent or

receive any commission. You or your agent shall arrange for the placing of all orders for the

- 14 -

purchase and sale of portfolio securities and other investments for the Fund's account with

brokers or dealers selected by you in accordance with Fund policies as expressed in the

Registration Statement. If any occasion should arise in which you give any advice to clients of

yours concerning the Shares of the Fund, you shall act solely as investment counsel for such

clients and not in any way on behalf of the Fund.

Your services to the Fund pursuant to this Agreement are not to be deemed to be

exclusive and it is understood that you may render investment advice, management and se rvices

to others. In acting under this Agreement, you shall be an independent contractor and not an

agent of the Fund.

7. Limitation of Liability of Manager. As an inducement to your undertaking to render

services pursuant to this Agreement, the Fund agrees that you shall not be liable under t his

Agreement for any error of judgment or mistake of law or for any loss suffered by the Fund in

connection with the matters to which this Agreement relates, provided that nothing in this

Agreement shall be deemed to protect or purport to protect you against any liability t o the Fund

or its shareholders to which you would otherwise be subject by reason of willful misfeasance,

bad faith or gross negligence in the performance of your duties, or by reason of your reckless

disregard of your obligations and duties hereunder. Any person, even though also employed by

you, who may be or become an employee of and paid by the Fund shall be deemed, when acting

within the scope of his or her employment by the Fund, to be acting in such employment solely

for the Fund and not as your employee or agent.

8. Duration and Termination of This Agreement . This Agreement shall remain in force

until February 28, 1993, and continue in force from year to year thereafter, but only so long as

such continuance is specifically approved at least annually (a) by the vote of a ma jority of the

Directors who are not parties to this Agreement or interested persons of any party to thi s

Agreement, cast in person at a meeting called for the purpose of voting on such approval and (b)

by the Directors of the Fund, or by the vote of a majority of the outstanding voting securities of

the Fund. The aforesaid requirement that continuance of this Agreement be "specificall y

approved at least annually" shall be construed in a manner consistent with the 1940 Act a nd the

rules and regulations thereunder.

This Agreement may be terminated with respect to the Fund at any time, without the

payment of any penalty, by the vote of a majority of the outstanding voting securities of t he Fund

or by the Fund's Board of Directors on 60 days' written notice to you, or by you on 60 days'

written notice to the Fund. This Agreement shall terminate automatically in the event of its

assignment.

9. Amendment of this Agreement. No provision of this Agreement may be changed,

waived, discharged or terminated orally, but only by an instrument in writing signed by the pa rty

against whom enforcement of the change, waiver, discharge or termination is sought.

10. Miscellaneous. The captions in this Agreement are included for convenience of refer-

ence only and in no way define or limit any of the provisions hereof or otherwise affect the ir

construction or effect. This Agreement may be executed simultaneously in two or more counte r-

- 15 -

parts, each of which shall be deemed an original, but all of which together shall constitute one

and the same instrument.

This Agreement shall not apply to the management of assets allocated to any seri es of the

Fund's Shares hereafter established by the Fund's Board of Directors.

In interpreting the provisions of this Agreement, the definitions contained in Section 2(a)

of the 1940 Act (particularly the definitions of "affiliated person," "assignment" and "majorit y of

the outstanding voting securities"), as from time to time amended, shall be applied, subject,

however, to such exemptions as may be granted by the SEC by any rule, regulation or order.

This Agreement shall be construed in accordance with the laws of the State of Maryla nd,

provided that nothing herein shall be construed in a manner inconsistent with the 1940 Act, or in

a manner which would cause the Fund to fail to comply with the requirements of Subchapt er M

of the Code.

This Agreement shall supersede all prior investment advisory or management agreements

entered into between you and the Fund.

If you are in agreement with the foregoing, please execute the form of acceptance on t he

accompanying counterpart of this letter and return such counterpart to the Fund, whereupon this

letter shall become a binding contract effective as of the date of this Agreement.

Yours very truly,

THE JAPAN FUND, INC.

By ______________________________ Chairman

The foregoing Agreement is hereby accepted as of the date hereof.

ASIA MANAGEMENT

CORPORATION

By ______________________________President

- 16 -

EXHIBIT D

Proposed Advisory Agreement

between Asia Management and NICAM ________________________

ASIA MANAGEMENT CORPORATION 345 Park Avenue

New York, NY 10154-0004 May 24, 1991

THE NIKKO INTERNATIONAL CAPITAL

MANAGEMENT CO., LTD.

7-3, 2-chome, Marunouchi,

Chiyoda-ku

Tokyo, Japan

Dear Sirs:

We have entered into an Investment Management Agreement (the "Management Agree-

ment") dated as of May 24, 1991 with The Japan Fund, Inc., a Maryland corporation (the

"Fund"), pursuant to which we act as investment advisor to and manager of the Fund. A copy of

the Management Agreement has been previously furnished to you. In furtherance of such duties

to the Fund, and with the approval of the Fund, we wish to avail ourselves of your investment

advisory services. Accordingly, with the acceptance of the Fund, we hereby agree with you as

follows for the duration of this Agreement:

1. You agree to furnish to us such information, investment recommendations, advice and

assistance, as we shall from time to time reasonably request. In that connection, you a gree to

continue to maintain a separate staff within your organization to furnish such servic es

exclusively to us. In addition for the benefit of the Fund, you agree to pay the fees and expenses

of any directors of the Fund who are directors, officers or employees of you or of the Nikko

Securities Co., Ltd.

2. We agree to pay in United States dollars to you, as compensation for the services t o be

rendered by you hereunder, a monthly fee, payable in dollars, equal on an annual basis to .23 of

1% of the value of the average daily net assets of the Fund up to and including $200 mil lion; plus

.21 of 1% of the value of the average daily net assets over $200 million and up to and including

$300 million; plus .19 of I% of the value of the average daily net assets over $300 million and up

to and including $700 million; plus .17 of 1% of the value of the average daily net asset s over

$700 million. For purposes of computing the monthly fee, the "average daily net assets" of the

Fund for any calendar month means the average of the daily net asset values of the Fund's

portfolio for such calendar month determined by the Fund's custodian pursuant to the procedures

established by the Board of Directors of the Fund and in accordance with the requirements of the

Investment Company Act of 1940, as amended, and the applicable rules and regulations of the

Securities and Exchange Commission. Each payment of a monthly fee shall be made by us to

you no later than the fifteenth day of the following calendar month.

- 17 -

3. You agree that there will be full compliance with any and all provisions of the

Investment Company Act of 1940, as amended, applicable to you and your directors, officers or

employees, or to interested persons with respect to you.

4. You agree that you will not make a short sale of any capital stock of the Fund, or

purchase any share of the capital stock of the Fund otherwise than for investment.

5. Your services to us are not to be deemed exclusive and you are free to render simila r

services to others, except as otherwise provided in section I hereof.

6. Nothing herein shall be construed as constituting you as agent of us or of the Fund.

7. We and the Fund agree that you may rely on information reasonably believed by you

to be accurate and reliable. We and the Fund further agree that, except as may otherwise be

provided by the Investment Company Act of 1940, as amended, neither you nor your officers,

directors, employees or agents shall be subject to any liability for any act or omissi on in the

course of, connected with or arising out of any services to be rendered hereunder except by

reason of willful misfeasance, bad faith or gross negligence in the performance of your duties or

by reason of reckless disregard of your obligations and duties under this Agreement.

8. This Agreement shall remain in effect until February 28, 1993, and shall continue in

effect thereafter, but only so long as such continuance is specifically approved at l east annually

by the affirmative vote of (i) a majority of the members of the Fund's Board of Directors who are

not interested persons of the Fund, you or us, cast in person at a meeting called for the purpose of

voting on such approval, and (ii) a majority of the Fund's Board of Directors or the holders of a

majority of the outstanding voting securities of the Fund. This Agreement may nevertheless be

terminated at any time, without penalty, by us or by the Fund's Board of Directors or by vote of

holders of a majority of the outstanding voting securities of the Fund, upon sixty (60) days

written notice delivered or sent by registered mail, postage prepaid, to you, at your addre ss given

above or at any other address of which you shall have notified us in writing, or by you upon six

(6) months such written notice to us and to the Fund, and shall automatically be termi nated in the

event of its assignment or of the assignment of the Management Agreement. Any such notice

shall be deemed given when received by the addressee.

9. This Agreement may not be transferred, assigned, sold or in any manner hypothecated

or pledged by either party hereto. It may be amended by mutual agreement, but only aft er

authorization of such amendment by the affirmative vote of (i) the holders of a majority of the

outstanding voting securities of the Fund, and (ii) a majority of the members of the Fund's Boa rd

of Directors who are not interested persons of the Fund, you or us, cast in person at a meeting

called for the purpose of voting on such approval.

10. This Agreement shall be construed in accordance with the laws of the State of New

York, provided, however, that nothing herein shall be construed as being inconsistent with the

Investment Company Act of 1940, as amended. As used herein the terms "interested person",

"assignment", and "vote of a majority of the outstanding voting securities" shall have the

meanings set forth in the Investment Company Act of 1940, as amended.

- 18 -

If you are in agreement with the foregoing, please sign the form of acceptance on the

enclosed counterpart hereof and return the same to us.

Very truly yours,

THE JAPAN FUND, INC.

By _______________________________Chairman

The foregoing agreement is hereby accepted as of the date first above written.

ASIA MANAGEMENT CORPORATION

By ________________________________President