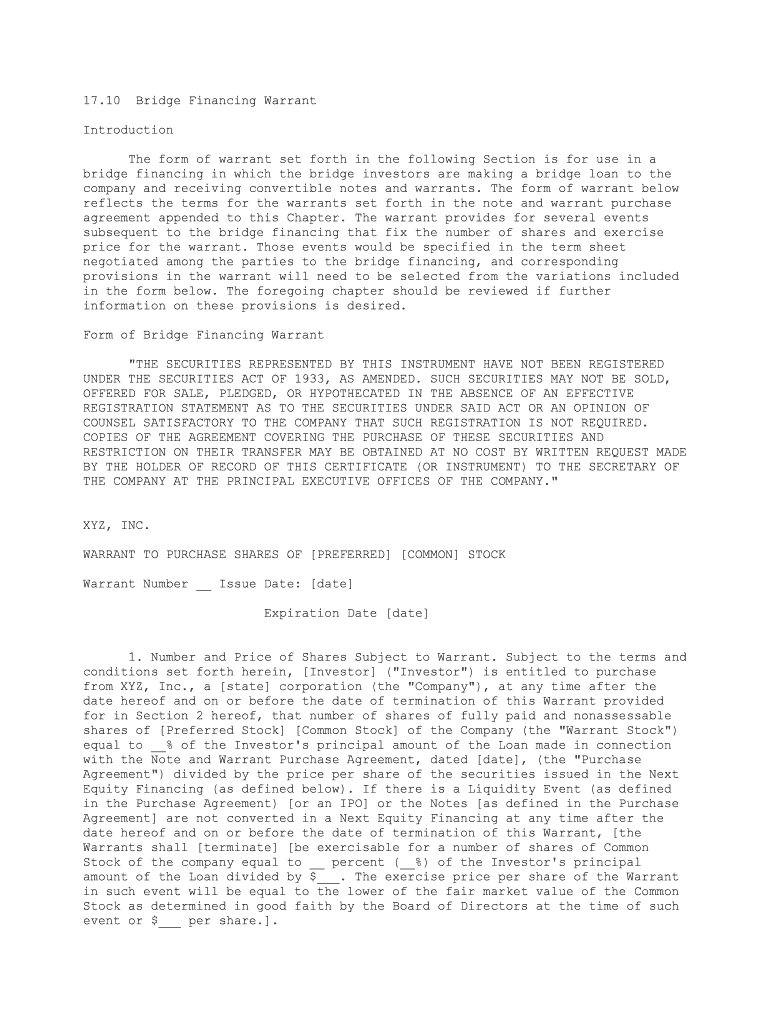

17.10 Bridge Financing Warrant

IntroductionThe form of warrant set forth in the following Section is for use in a

bridge financing in which the bridge investors are making a bridge loan to the

company and receiving convertible notes and warrants. The form of warrant below

reflects the terms for the warrants set forth in the note and warrant purchase

agreement appended to this Chapter. The warrant provides for several events

subsequent to the bridge financing that fix the number of shares and exercise

price for the warrant. Those events would be specified in the term sheet

negotiated among the parties to the bridge financing, and corresponding

provisions in the warrant will need to be selected from the variations included

in the form below. The foregoing chapter should be reviewed if further

information on these provisions is desired.

Form of Bridge Financing Warrant

"THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED. SUCH SECURITIES MAY NOT BE SOLD,

OFFERED FOR SALE, PLEDGED, OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE

REGISTRATION STATEMENT AS TO THE SECURITIES UNDER SAID ACT OR AN OPINION OF

COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

COPIES OF THE AGREEMENT COVERING THE PURCHASE OF THESE SECURITIES AND

RESTRICTION ON THEIR TRANSFER MAY BE OBTAINED AT NO COST BY WRITTEN REQUEST MADE

BY THE HOLDER OF RECORD OF THIS CERTIFICATE (OR INSTRUMENT) TO THE SECRETARY OF

THE COMPANY AT THE PRINCIPAL EXECUTIVE OFFICES OF THE COMPANY." XYZ, INC.

WARRANT TO PURCHASE SHARES OF [PREFERRED] [COMMON] STOCK

Warrant Number __ Issue Date: [date]

Expiration Date [date]

1. Number and Price of Shares Subject to Warrant. Subject to the terms and

conditions set forth herein, [Investor] ("Investor") is entitled to purchase

from XYZ, Inc., a [state] corporation (the "Company"), at any time after the

date hereof and on or before the date of termination of this Warrant provided

for in Section 2 hereof, that number of shares of fully paid and nonassessable

shares of [Preferred Stock] [Common Stock] of the Company (the "Warrant Stock")

equal to __% of the Investor's principal amount of the Loan made in connection

with the Note and Warrant Purchase Agreement, dated [date], (the "Purchase

Agreement") divided by the price per share of the securities issued in the Next

Equity Financing (as defined below). If there is a Liquidity Event (as defined

in the Purchase Agreement) [or an IPO] or the Notes [as defined in the Purchase

Agreement] are not converted in a Next Equity Financing at any time after the

date hereof and on or before the date of termination of this Warrant, [the

Warrants shall [terminate] [be exercisable for a number of shares of Common

Stock of the company equal to __ percent (__%) of the Investor's principal

amount of the Loan divided by $___. The exercise price per share of the Warrant

in such event will be equal to the lower of the fair market value of the Common

Stock as determined in good faith by the Board of Directors at the time of such

event or $___ per share.].

Upon a Next Equity Financing, the exercise price per share subject to this

Warrant is equal to the price of the series and class of Preferred Stock issued

in the Next Equity Financing. This Warrant is one of a series of warrants (collectively, the "Warrants")

having substantially similar terms and issued in connection with the issuance of

the Notes, which issuance and sale were made pursuant to Purchase Agreement.

2. Termination. This Warrant (and the right to purchase securities upon

exercise hereof) shall terminate upon the earliest of (i) ___ years after

issuance; or (ii) the closing of an acquisition of all or substantially all of

the assets or capital stock of the Company by another entity [for cash.]; [or

(iii) the initial public offering of the Company's securities; or (iv)

immediately prior to the closing of a merger or consolidation of the Company in

which the stockholders of the Company immediately before such transaction would

own less than 50% of the voting power of the surviving entity immediately after

such transaction.] The Company shall give the holder of this Warrant written

notice of such sale, merger, consolidation or public offering at least twenty

(20), but no more than sixty (60), days prior to the closing of any such

transaction.

3. No Fractional Shares. No fractional shares of Warrant Stock will be

issued in connection with any subscription hereunder. In lieu of any fractional

shares which would otherwise be issuable, the Company shall pay cash equal to

the product of such fraction multiplied by the fair market value of one share of

Warrant Stock on the date of exercise, as determined in good faith by the

Company's Board of Directors.

4. No Stockholder Rights. This Warrant shall not entitle its holder to any

of the rights of a stockholder of the Company.

5. Reservation of Stock. The Company covenants that during the period this

Warrant is exercisable, the Company will reserve from its authorized and

unissued Stock a sufficient number of shares to provide for the issuance of

Warrant Stock upon the exercise of this Warrant.

6. Exercise of Warrant.(a) Procedure for Exercise. This Warrant may be exercised by the

registered holder or its registered assigns, in whole or in part, by the

surrender of this Warrant at the principal office of the Company, accompanied by

payment in full of the Warrant Price in cash or by check or by the cancellation

of any present or future indebtedness from the Company to the holder hereof, and

delivery of an exercise notice in the form of Exhibit A hereto. Upon partial

exercise hereof, a new warrant or warrants containing the same date and

provisions as this Warrant shall be issued by the Company to the registered

holder for the number of shares of Warrant Stock with respect to which this

Warrant shall not have been exercised. A Warrant shall be deemed to have been

exercised on the close of business on the date of its receipt by the Company

upon surrender for exercise as provided above, and the person entitled to

receive the shares of Warrant Stock issuable upon such exercise shall be treated

for all purposes as the holder of such shares of record as of the close of

business on such date; provided that the transfer books of the Company shall not

have been closed. If the transfer books have been closed, the person shall be

deemed to be a holder of shares of record as of the close of business on the

first day that the transfer books reopen. As promptly as practicable on or after

such date, the Company shall issue and deliver to the person or persons entitled

to receive the same a certificate or certificates for the number of full shares

of Warrant Stock issuable upon such exercise, together with cash in lieu of any

fraction of a share as provided above.(b) Net Exercise Rights. Notwithstanding the payment provisions set

forth in this Section 6, the holder may elect to receive shares of Warrant Stock

equal to the value (as determined below) of this Warrant by surrender of this

Warrant at the principal office of the Company together with notice of such

election, in which event the Company shall issue to the holder the number of

shares of Common Stock determined by use of the following formula:

X = Y(A - B)_______ A

Where: X = the number of shares of Common Stock to be issued

to the holder.

Y = the number of shares of Warrant Stock subject to this

Warrant.

A = the Fair Market Value (as defined below) of one (1) share

of Warrant Stock.

B = Exercise price per share of Warrant Stock.

For purposes of this Section 6, fair market value of a share as of a

particular date shall mean:

(i) If the Company's Stock is registered under the

Securities and Exchange Act of 1933, as amended, and traded on a securities

exchange or electronic trading network, then the fair market value of a share

shall be the closing price (the last reported sales price, if not so reported,

the average of the last reported bid and asked prices) of the Company's stock as

of the last business day immediately prior to the exercise of this Warrant.

(ii) If the Company's Common Stock is not so registered, then

the fair market value of a share of Common Stock shall be determined in good

faith by the Company's Board of Directors upon a review of relevant factors.

7. Adjustment of Warrant Price and Number of Shares. The number and kind

of securities issuable upon the exercise of this Warrant shall be subject to

adjustment from time to time, and the Company agrees to provide notice upon the

happening of certain events as follows:

(a) Adjustment for Dividends in Stock. In case at any time or from

time to time during the term of this Warrant the holders of the Common Stock of

the Company (or any shares of stock or other securities at the time receivable

upon the exercise of this Warrant) shall have received, or, on or after the

record date fixed for the determination of eligible stockholders, shall have

become entitled to receive, without payment therefor, other or additional

securities or other property of the Company by way of dividend or distribution,

then and in each case, the holder of this Warrant shall, upon the exercise

hereof, be entitled to receive, in addition to the number of shares of Common

Stock receivable thereupon, and without payment of any additional consideration

therefor, the amount of such other or additional securities or other property of

the Company which such holder would hold on the date of such exercise had it

been the holder of record of such Common Stock on the date hereof and had

thereafter, during the period from the date hereof to and including the date of

such exercise, retained such shares and/or all other additional securities or

other property receivable by it as aforesaid during such period, giving effect

to all adjustments called for during such period by this Section 7.(b) Adjustment for Reclassification. In case of any reclassification

of the outstanding Common Stock of the Company during the term of this Warrant

(other than a transaction terminating this Warrant under Section 2), then the

holder of this Warrant, upon the exercise hereof at any time after the

consummation of such reclassification, change or reorganization, shall be

entitled to receive, in lieu of the stock or other securities and property

receivable upon the exercise hereof prior to such consummation, the stock or

other securities or property to which such holder would have been entitled upon

such consummation if such holder had exercised this Warrant immediately prior

thereto. The terms of this Section 7 shall similarly apply to successive

reclassifications.

(c) Stock Splits and Reverse Stock Splits. If at any time during the

term of this Warrant the Company shall subdivide its outstanding shares of

Common Stock into a greater number of shares, the Warrant Price in effect

immediately prior to such subdivision shall thereby be proportionately reduced

and the number of shares receivable upon exercise of the Warrant shall thereby

be proportionately increased. Conversely, if at any time on or after the date

hereof the outstanding number of shares of Common Stock shall be combined into a

smaller number of shares, the Warrant Price in effect immediately prior to such

combination shall thereby be proportionately increased and the number of shares

receivable upon exercise of this Warrant shall thereby be proportionately

decreased.

8. Transfer of Warrant. This Warrant or the Warrant Stock may not be

transferred or assigned, in whole or in part, by the holder hereof (except to

any affiliate hereof) without compliance with applicable federal and state

securities laws. The rights and obligations of the Company and the holders of

this Warrant shall be binding upon and benefit the successors, assignors, heirs,

administrators and transferees of the parties. Any transferee hereof agrees to

be bound by the restrictions set forth herein and in the Note and Warrant

Purchase Agreement. For any transfer, the holder hereof must deliver this

Warrant to the Company and a notice of transfer signed by the holder in the form

of Exhibit B below.

9. Governing Law. This Agreement shall be governed in all respects by the

internal laws of the State of ______________. [Any and all disputes arising out

of or related to this Agreement shall be adjudicated exclusively in the state or

federal courts located in [county] [state]].

10. Waiver and Amendment. Amendment or Waiver of any term of this Warrant

shall be conducted pursuant to the terms of the Purchase Agreement.

11. Successors and Assigns. Except as otherwise expressly provided

herein, the provisions hereof shall inure to the benefit of, and be binding

upon, the successors, assigns, heirs, executors and administrators of the

parties hereto.

12. Notices. All notices and other communications shall be made and

delivered as prescribed in the Purchase Agreement.

ISSUED this __th day of _________, 20__.

XYZ, INC.

By:_______________________

Title: ________________________

EXHIBIT A

NOTICE OF EXERCISE

TO: [COMPANY] _________________________

_________________________

Attention: President

1. The undersigned hereby elects to purchase __________ shares of _____________

pursuant to the terms of the attached Warrant.

2. Method of Exercise (Please initial the applicable Section): ___ The undersigned elects to exercise the attached Warrant by means of a

cash payment, and tenders herewith payment in full for the purchase price of the

shares being purchased, together with all applicable transfer taxes, if any.

___ The undersigned elects to exercise the attached Warrant by means of

the net exercise provisions of Section 6 of the Warrant.

3. Please issue a certificate or certificates representing said Shares in the

name of the undersigned or in such other name as is specified below:

_________________________________(Name)

_________________________________

_________________________________ (Address)

4. The undersigned hereby represents and warrants that the aforesaid Shares are

being acquired for the account of the undersigned for investment and not with a

view to, or for resale, in connection with, the distribution thereof, and that

the undersigned has no present intention of distributing or reselling such shares.

________________________(Signature)

________________________ (Name)

________________________ ___________________ (Date) (Title)

EXHIBIT B

FORM OF TRANSFER

(To be signed only upon transfer of Warrant)

FOR VALUE RECEIVED, the undersigned hereby sells, assigns and transfers

unto _______________________________________________ the right represented by

the attached Warrant to purchase ____________ shares of ________________________

of [COMPANY] to which the attached Warrant relates, and appoints ______________

attorney to transfer such right on the books of __________, with full power of

substitution in the premises.

Dated: ____________________

___________________________

(Signature must conform in all respects to name of Holder as specified on the

face of the Warrant.)

Address: _______________________

_______________________

_______________________

Signed in the presence of:

_______________________

Valuable advice on preparing your ‘Bridge Financing Warrant’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Utilize the robust tools included in this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘Bridge Financing Warrant’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Bridge Financing Warrant or send it for notarization—our platform provides you with everything required to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!