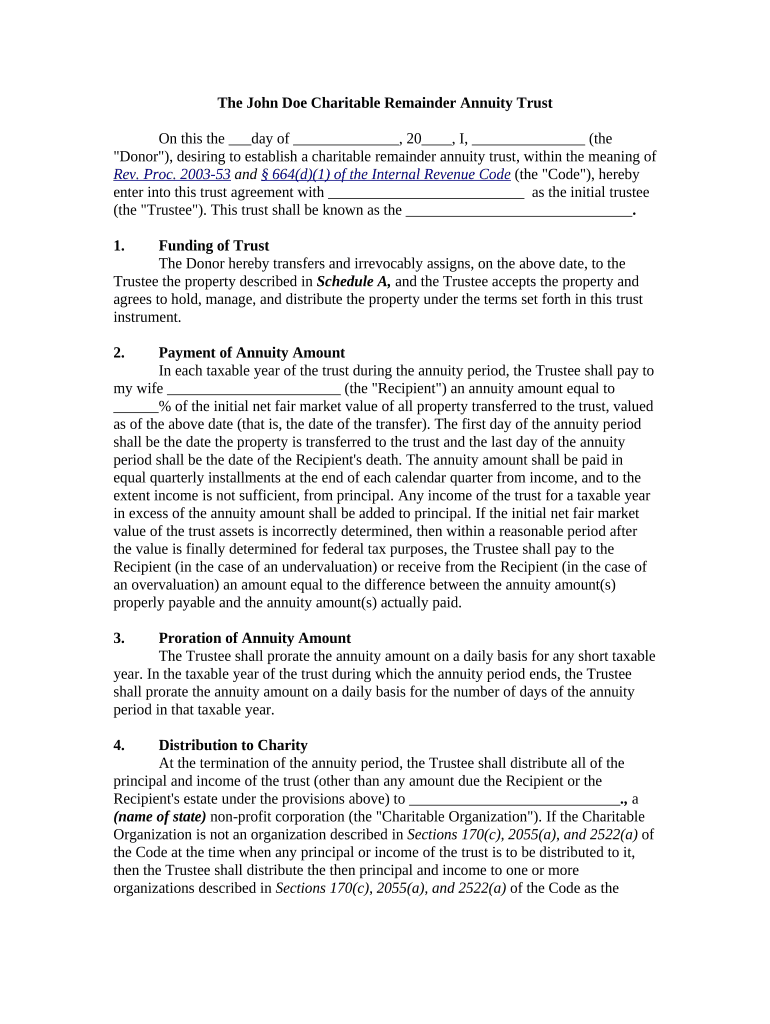

Fill and Sign the Charitable Remainder Trust Form

Useful suggestions for finalizing your ‘Charitable Remainder Trust’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and corporations. Wave goodbye to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and validate paperwork online. Utilize the powerful features integrated into this intuitive and cost-effective platform and transform your document management strategy. Whether you need to validate forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, in just a few clicks.

Follow this detailed guide:

- Access your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘Charitable Remainder Trust’ in the editor.

- Click Me (Fill Out Now) to fill out the document on your end.

- Include and assign fillable fields for other participants (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or turn it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Charitable Remainder Trust or send it for notarization—our platform equips you with everything necessary to achieve these tasks. Create an account with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

What is a Charitable Remainder Trust and how does it work?

A Charitable Remainder Trust (CRT) is an estate planning tool that allows individuals to donate assets to a charity while retaining an income stream from those assets for a specified period. When the trust term ends, the remaining assets go to the designated charity. This arrangement not only supports charitable causes but also provides potential tax benefits to the donor.

-

How can a Charitable Remainder Trust benefit me financially?

Utilizing a Charitable Remainder Trust can provide signNow financial advantages, including income tax deductions, the ability to avoid capital gains taxes on appreciated assets, and a steady income stream during your lifetime. These benefits make CRTs an appealing option for individuals looking to support their favorite charities while managing their financial portfolios effectively.

-

What are the costs associated with setting up a Charitable Remainder Trust?

The costs for establishing a Charitable Remainder Trust can vary based on the complexity of the trust and the fees charged by financial or legal advisors. Typically, there might be initial setup fees, ongoing management fees, and potential tax advisory costs. It's important to consider these factors to ensure the trust aligns with your financial goals.

-

Can I integrate airSlate SignNow with my Charitable Remainder Trust documents?

Absolutely! airSlate SignNow simplifies the process of managing Charitable Remainder Trust documents by providing an easy-to-use eSignature solution. You can seamlessly send, sign, and store your CRT documents electronically, ensuring a smooth workflow for all parties involved, including beneficiaries and charities.

-

What features does airSlate SignNow offer for managing Charitable Remainder Trusts?

airSlate SignNow offers robust features tailored for managing Charitable Remainder Trusts, including secure eSigning, customizable templates, and tracking capabilities. These features help streamline the documentation process, ensuring that all legal requirements are met while also maintaining a clear record of transactions and signatures.

-

How does a Charitable Remainder Trust affect my estate planning?

Incorporating a Charitable Remainder Trust into your estate planning can enhance your overall strategy by providing a charitable legacy while also allowing you to manage your income during retirement. This unique structure not only supports charitable organizations but can also help minimize estate taxes, making it a valuable component of a well-rounded estate plan.

-

Is a Charitable Remainder Trust suitable for everyone?

While a Charitable Remainder Trust can be beneficial for many individuals, it’s particularly suited for those with signNow assets who wish to leave a charitable legacy. However, it’s essential to assess your financial situation and goals, as well as consult with financial advisors to determine if a CRT aligns with your personal objectives.

The best way to complete and sign your charitable remainder trust form

Find out other charitable remainder trust form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles