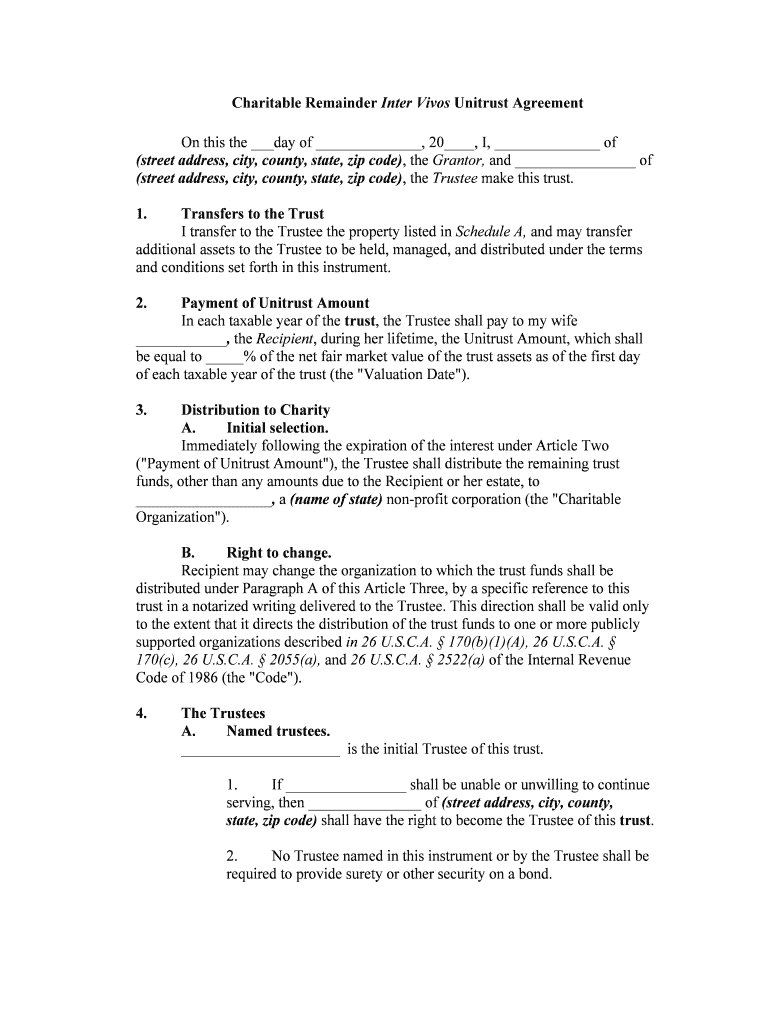

Charitable Remainder Inter Vivos Unitrust Agreement

On this the ___day of ______________, 20____, I, ______________ of

(street address, city, county, state, zip code) , the Grantor, and ________________ of

(street address, city, county, state, zip code) , the Trustee make this trust.

1. Transfers to the Trust I transfer to the Trustee the property listed in Schedule A, and may transfer

additional assets to the Trustee to be held, managed, and distributed under the terms

and conditions set forth in this instrument.

2. Payment of Unitrust Amount In each taxable year of the trust, the Trustee shall pay to my wife

____________ , the Recipient , during her lifetime, the Unitrust Amount, which shall

be equal to _____% of the net fair market value of the trust assets as of the first day

of each taxable year of the trust (the "Valuation Date").

3. Distribution to Charity A. Initial selection.

Immediately following the expiration of the interest under Article Two

("Payment of Unitrust Amount"), the Trustee shall distribute the remaining trust

funds, other than any amounts due to the Recipient or her estate, to __________________ , a (name of state) non-profit corporation (the "Charitable

Organization").

B. Right to change.

Recipient may change the organization to which the trust funds shall be

distributed under Paragraph A of this Article Three, by a specific reference to this

trust in a notarized writing delivered to the Trustee. This direction shall be valid only

to the extent that it directs the distribution of the trust funds to one or more publicly

supported organizations described in 26 U.S.C.A. § 170(b)(1)(A), 26 U.S.C.A. §

170(c), 26 U.S.C.A. § 2055(a), and 26 U.S.C.A. § 2522(a) of the Internal Revenue

Code of 1986 (the "Code").

4. The Trustees

A. Named trustees.

_____________________ is the initial Trustee of this trust.

1. If ________________ shall be unable or unwilling to continue

serving, then _______________ of (street address, city, county,

state, zip code) shall have the right to become the Trustee of this trust.

2. No Trustee named in this instrument or by the Trustee shall be

required to provide surety or other security on a bond.

3. No Trustee shall be responsible for or need inquire into any

acts or omissions of a prior Trustee.

B. Additional trustee.

The Trustee may appoint any person as Co-Trustee or additional Trustee to

serve at the pleasure of the appointing Trustee.

C. Delegation.

Any Trustee may delegate any powers and authorities to another Trustee for

any period that the delegating Trustee deems appropriate. A person dealing in good

faith with any Trustee may rely without inquiry upon that Trustee's representation

that a particular power or authority has been delegated and not rescinded.

D. Resignation.

Any Trustee may resign by giving written notice specifying the effective date

of the resignation to the designated successor Trustee.

1.If no successor Trustee is designated, a resigning Trustee shall

give this written notice to the Recipient, if then living, and to the

Charity. 2. A successor Trustee to fill any vacancy shall be named by the

Recipient, if then living, or otherwise by the Charity.

E. Compensation .

Each person who serves as a Trustee shall be entitled to receive reasonable

compensation for services rendered. In the case of a corporate Trustee, reasonable

compensation is based upon its published fee schedule in effect at the time its services

are rendered, or as otherwise agreed, and its compensation may vary from time to

time based on that schedule.

F. Management powers.

I grant the Trustee the powers described below, to be exercised in a fiduciary

capacity.

1. The Trustee may hold and retain as part of the trust any assets

received from any source, and invest and reinvest them (or leave them

temporarily uninvested) in any type of property and every kind of

investment in the same manner as a prudent investor would invest its

own assets. 2. The Trustee may sell or exchange any real or personal property

contained in the trust, for cash or credit, at public or private sale, and

with such warranties or indemnifications as the Trustee may deem

advisable.

3. The Trustee may borrow money (even from the Trustee and

from any beneficiary of the trust) for the benefit of the trust and may

secure these debts with assets of the trust. 4. The Trustee may grant security interests and execute all

instruments creating such interests on such terms as the Trustee may

deem advisable. 5. The Trustee may compromise and adjust claims against or on

behalf of the trust on such terms as the Trustee may deem advisable.6. The Trustee may take title to any securities in the name of any

custodian or nominee without disclosing this relationship.7. The Trustee may determine whether receipts are to be allocated

to income or principal and whether disbursements are to be charged

against income or principal to the extent not clearly established by

state law. All determinations made by the Trustee in good faith shall

not require equitable adjustments. 8. The Trustee may make all tax elections and allocations the

Trustee may consider appropriate; however, this authority is

exercisable only in a fiduciary capacity and may not be used to enlarge

or shift any beneficial interest except as an incidental consequence of

the discharge of fiduciary duties. All tax elections and allocations

made by the Trustee in good faith shall not require equitable

adjustments. 9. The Trustee may employ such lawyers, accountants, and other

advisers as the Trustee may deem useful and appropriate for the

administration of the trust. The Trustee may employ a professional

investment adviser and delegate to this adviser any discretionary

investment authorities to manage the investments of the trust

(including any investment in mutual funds, investment trusts, or

managed accounts), and may rely on the adviser's investment

recommendations without liability to any beneficiary. 10. The Trustee may divide and distribute the assets of the trust in

kind or in cash, or partly in each, without regard to the income tax

basis of any asset and without the consent of any beneficiary. The

decision of the Trustee in dividing any portion of the trust between or

among two or more beneficiaries shall be binding on all persons.

5. Mandatory Unitrust Provisions A. Overriding tax purpose.

This trust is established as and shall operate as a charitable remainder unitrust,

within the meaning of 26 U.S.C.A. § 664(d)(2) and Rev. Proc. 89-20, and all

provisions of this instrument shall be construed in a manner consistent with this

purpose. The Trustee shall not exercise any discretion under this instrument in a

manner inconsistent with this purpose.

B. Payment of the Unitrust Amount.

The Unitrust Amount shall be paid in quarterly installments on the last day of

each quarter. The Unitrust Amount shall be paid from trust income and, to the extent

income is insufficient, from principal. Any trust income for a taxable year in excess

of the Unitrust Amount shall be added to principal.

C. Misvaluation.

If for any year the net fair market value of the trust assets is incorrectly

determined, then within a reasonable period after the value is finally determined for

federal tax purposes, the Trustee shall pay to the Recipient (in the case of an

undervaluation) or receive from the Recipient (in the case of an overvaluation) an

amount equal to the difference between the Unitrust Amount properly payable and the

Unitrust Amount actually paid.

D. Short taxable years.

In determining the Unitrust Amount, the Trustee shall prorate the same on a

daily basis for a short taxable year and for the taxable year ending with the

Recipient's death.

E. Additional contributions.

If any additional contributions are made to the trust after the initial

contribution, the Unitrust Amount for the year in which the additional contribution is

made shall be equal to ________% of the sum of:

1. The net fair market value of the trust assets as of the Valuation

Date (excluding the assets so added and any income from, or

appreciation on, such assets); and 2. That proportion of the fair market value of the assets so added

that was excluded under item (1) that the number of days in the period

that begins with the date of contribution and ends with the earlier of

the last day of the taxable year or the date of the Recipient's death

bears to the number of days in the period that begins on the first day of

such taxable year and ends with the earlier of the last day in such

taxable year or the date of the Recipient's death. In the case where

there is no Valuation Date after the time of contribution, the assets so

added shall be valued as of the time of contribution.

F. Hard-to-value assets.

Any donor who is also a Trustee cannot participate in the determination of the

value of any hard-to-value assets, such as real estate or closely held stock. The value

of such assets shall be determined by any then-serving Trustee who is not a donor of

such assets, or if there are no such Trustees, by a non-donor appointed as Trustee by

the then serving Trustee.

G. Private foundation rules.

The trust income for each taxable year shall be distributed at such time and in

such manner as not to subject the trust to tax under 26 U.S.C.A. § 4942. Except for the

payment of the Unitrust Amount to the Recipient, the Trustee shall not engage in any

act of self-dealing, as defined in 26 U.S.C.A. § 4941(d), and shall not make any

taxable expenditures, as defined in 26 U.S.C.A. § 4945(d). The Trustee shall not make

any investments that jeopardize the charitable purpose of the trust, within the

meaning of 26 U.S.C.A. § 4944, or retain any excess business holdings, within the

meaning of 26 U.S.C.A. § 4943.

H. Investment of trust assets.

Nothing in this instrument shall restrict the Trustee from investing the trust

assets in a manner that could result in the annual realization of a reasonable amount

of income or gain from the sale or disposition of trust assets.

I. Taxable year.

The trust's taxable year shall be the calendar year.

J. Irrevocability.

This trust is irrevocable. However, the Trustee shall have the power, acting

alone, to amend the trust in any manner required for the sole purpose of ensuring that

the trust qualifies and continues to qualify as a charitable remainder unitrust within

the meaning of 26 U.S.C.A. § 664(d)(2) of the Code.

K. Qualification of charities.

If any Charity designated to receive any distribution from this trust is not a

publicly supported organization described in 26 U.S.C.A. § 170(b)(1)(A), 26 U.S.C.A.

§ 170(c), 26 U.S.C.A. § 2055(a), and 26 U.S.C.A. § 2522(a) of the Code, at the time

when any principal or income of the trust is to be distributed to it, then the Trustee

shall distribute such principal and income to one or more organizations, selected at

the Trustee's sole discretion, which are publicly supported organizations described in

Sections 170(b)(1)(A), 170(c), 2055(a), and 2522(a ) of the Code.

6. Trust Administration A. Disabled recipient.

The Trustee may distribute payments that would be made to the Recipient at a

time when the Recipient is a minor or disabled to the Recipient's parent, guardian, or

personal representative, or to the person with whom the Recipient resides, without

looking to the proper application of those payments.

B. Accountings.

The Trustee shall not be required to file annual accounts with any court or

court official in any jurisdiction.

C. Change of situs.

The Trustee may change the situs of this trust (and to the extent necessary or

appropriate, move the trust assets) to a state or country other than the one in which

the trust is then administered, if the Trustee believes it to be in the best interests of the

trust or the beneficiaries. The Trustee may elect that the law of such other jurisdiction

shall govern the trust to the extent necessary or appropriate under the circumstances.

D. Additional transfers.

Anyone may transfer property to the Trustee at any time. The Trustee may

refuse to accept a transfer if the Trustee deems acceptance is not in the trust's best

interests. The Trustee may accept a gift subject to one or more conditions imposed by

the donor or the Trustee if it is in the best interests of the trust and the beneficiaries

and if the condition does not change the rights of a beneficiary with respect to any

prior gift.

7. Definitions and miscellaneous A. Disabled.

An individual is "disabled" or "under a disability" if the Trustee (or, if the

person whose disability is in question is a Trustee, the next successor Trustee),

receives written certification from two physicians, both of whom have personally

examined the individual and at least one of whom is board-certified in the specialty

most closely associated with the alleged disability. The certification must state that

the individual is incapable of managing his or her own finances, regardless of cause

and regardless of whether there is an adjudication of incompetence, mental illness, or

need for a committee, conservator, guardian, or other personal representative. No

person is liable to anyone for actions taken in reliance on these certifications, or for

dealing with a Trustee other than the one removed for disability based on these

certifications.

B. Trustee.

The "Trustee" shall include each Trustee, Co-Trustee, and any successor

Trustee.

C. Tax-related terms.

All tax-related terms shall have the same meaning that they have in the

Internal Revenue Code of 1986, as amended.

D. Choice of law.

The operation of the trust shall be governed by the laws of the state of

_______________. However, the Trustee may not exercise any power or discretion

granted under the laws of said state that would be inconsistent with the qualification

of the trust under 26 U.S.C.A. § 664(d)(2) of the Code and the corresponding

regulations.

E. Copies.

Anyone may rely on a copy of this trust instrument certified by a notary public

or similar official to be a true copy of the signed original (and of any amendments), as

if that copy were the signed original. Anyone may rely upon any statement of fact

certified by the person who appears from the original document or a certified copy to

be a Trustee.

F. Number.

Whenever the context requires, the singular number includes the plural, and

the plural the singular.

WITNESS our signatures as of the day and date first above stated.

By:______________________________

______________________ (Name and Office in Bank)

JOHN DOE

Acknowledgments (form of acknowledgment may vary by state)

Attach Schedule A