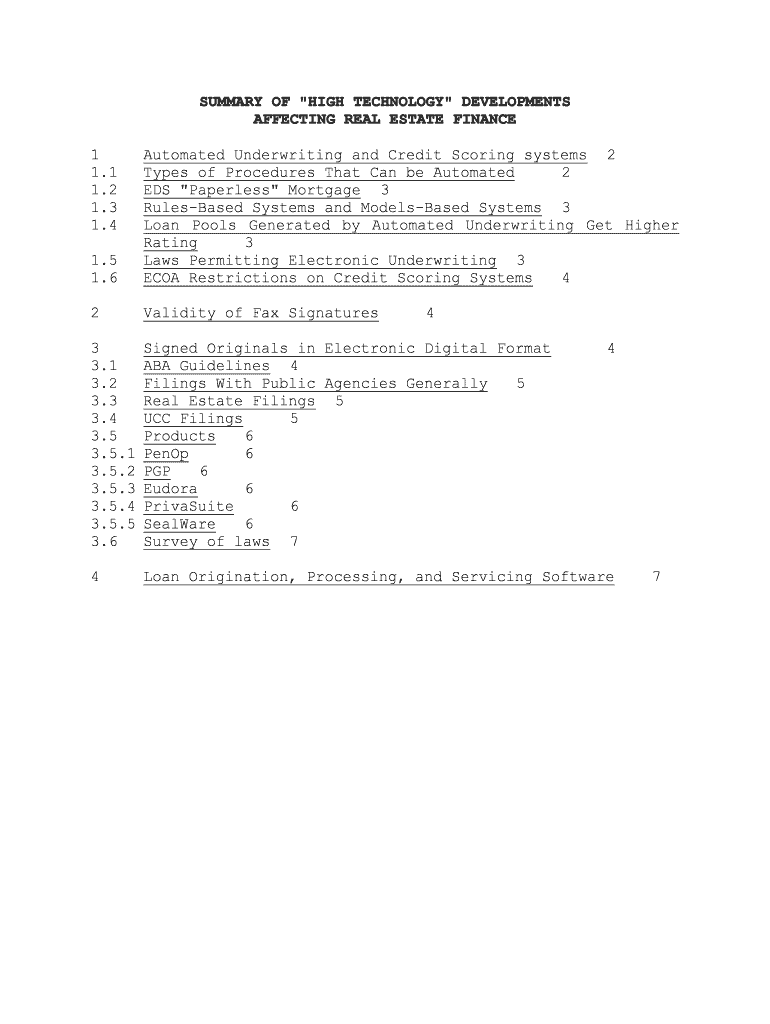

SUMMARY OF "HIGH TECHNOLOGY" DEVELOPMENTS

AFFECTING REAL ESTATE FINANCE

1 Automated Underwriting and Credit Scoring systems

2

1.1 Types of Procedures That Can be Automated

2

1.2 EDS "Paperless" Mortgage

3

1.3 Rules-Based Systems and Models-Based Systems

3

1.4 Loan Pools Generated by Automated Underwriting Get Higher

Rating 3

1.5 Laws Permitting Electronic Underwriting

3

1.6 ECOA Restrictions on Credit Scoring Systems

4

2 Validity of Fax Signatures

4

3 Signed Originals in Electronic Digital Format

4

3.1 ABA Guidelines

4

3.2 Filings With Public Agencies Generally

5

3.3 Real Estate Filings

5

3.4 UCC Filings

5

3.5 Products

6

3.5.1 PenOp

6

3.5.2 PGP

6

3.5.3 Eudora

6

3.5.4 PrivaSuite

6

3.5.5 SealWare

6

3.6 Survey of laws

7

4 Loan Origination, Processing, and Servicing Software

7

1. Automated Underwriting and Credit Scoring systems

1.1. Types of Procedures That Can be Automated

"First, loan applications can actually be taken over the

web using on-line preformatted forms. . . . Secure on-line

connections can also automatically process a credit card fee

using a system such as IC Verify, or using digital cash to pay

for an application fee from one of the many automated banking

systems such as Security First Network Bank at the web address http://www.sfnb.com.

"Second, credit checks can be ordered on-line, employment

can be verified, or financial reports can be accessed from services such as Dun & Bradstreet.

"Third, . . . an appraisal can be ordered on-line and in

some cases performed without the need for physical inspections,

using fully computerized data bases, geographic information

systems, or GIS, 1

and property address electronic photo banks.

GIS is the mapping of data onto geographic space, allowing the user to visualize or analyze the data . . . .

"In the case of residential property, Freddie Mac has

started to implement an automated collateral assessment program

in its on-line Loan Prospector program, which uses a nationwide

network of real estate agents who verify the existence of the collateral property."

Miller, "Web Implications and Resources for Real Estate Finance," Real Est. Fin., Fall 1996, at 74, 76.

"[T]he time required to receive an `accept' decision from

Freddie Mac for mortgage applications originated through the

Loan Prospector system has been reduced to three or four minutes from the current 15-20 days under manual systems." 2

Fannie Mae states: We are not mandating the use of [automated

underwriting or credit scoring systems]; however, we expect

that, as other lenders become better acquainted with the

1 MapInfo (800-327-8627) is an example of a GIS software package used for

market research purposes.

2 Standard & Poor's Structured Finance, Apr. 1996, at 5.

concept of credit scoring and the benefits of Desktop

Underwriter [which is Fannie Mae's automated underwriting

system], they will decide on their own that the use of these tools can offer them many benefits.

Fed. Nat'l Mge. Ass'n, "Mortgage Underwriting Tools -- Automated Underwriting and Credit Scores" (LL01-97, Feb. 21, 1997).

1.2. EDS "Paperless" Mortgage

"EDS . . . has announced that 22 firms plan to participate

in the `Accelerated Closing and Delivery' system, designed to

squeeze paperwork out of the mortgage lending process. . . .

The goal of the program . . . is to pave the way for the

paperless mortgage. `Virtual' documents and electronic signatures will be used to satisfy regulatory requirements that

mandate much of the paperwork used to close loans today. Larry

Walker, head of EDS's mortgage and real estate division, said .

. . `Our vision is that you could actually obtain a mortgage

without a single sheet of paper.'" Cornwell, "EDS Advances the Paperless Mortgage," Nat. Mge. News, Mar. 31, 1997, at 17.

Rules-Based Systems and Models-Based Systems

Automated underwriting systems can be "rules-based,"

"models-based," or a combination of both. In a "rules-based"

system, a single negative factor which does not meet the

underwriting rules may result in the rejection of a loan

application. In a "models-based" system, a loan application is

scored on a continuum, and each factor is given a certain weight, with no single factor disqualifying a loan application. 3

Loan Pools Generated by Automated Underwriting Get

Higher Rating

Pools of loans originated with automated underwriting

systems "that evidence a high degree of predictability coupled

with consistency of scoring" will get a higher credit rating. 4

This means that lenders using such systems will be able to sell their loans for a premium in the secondary market.

1.3. Laws Permitting Electronic Underwriting

Official Staff Interpretations issued by the Division of

Consumer and Community Affairs of the Federal Reserve Board

3 Standard & Poor's Structured Finance, Nov. 1995, at 18.

4 Standard & Poor's Structured Finance, Nov. 1995, at 17-18.

confirm that data entries into a computerized system qualify as

a written application. 12 C.F.R. Pt. 202, App. D, §§ 202.5(e), 202.13(b), reprinted in Fed. Banking L. Rep. (CCH) ¶ 27-295 at

28,276, 28,287. Similarly, written records need not be retained

if such records are preserved in computerized form. Id. § 202.12(b).

1.4. ECOA Restrictions on Credit Scoring Systems

If the lender uses an automated credit scoring system as

part of the loan underwriting process, the system must

ultimately be validated by the lender's own

credit experience in

accordance with the regulations under the Equal Credit

Opportunity Act ("ECOA"). If the lender obtains a credit

scoring system from another party, but is "unable during the

development process to validate the system based on its own

credit experience . . ., the system must be validated when

sufficient credit experience becomes available. A system that

fails this validity test is no longer an empirically derived,

demonstrably and statistically sound, credit scoring system for"

that lender. 12 C.F.R. § 202.2(p). See also "Credit Scoring

Models," OCC 97-24 (May 20, 1997), reprinted in Fed. Banking

L.Rep. (CCH) ¶ 64-557.

2. Validity of Fax Signatures

Signatures transmitted by fax machines are enforceable in

many states pursuant to statute. For example, in the case of a

"qualified financial contract," pursuant to Section 5-701(b)(4) of the New York General Obligations Law,

the tangible written text produced by telex, telefacsimile,

computer retrieval or other process by which electronic

signals are transmitted by telephone or otherwise shall

constitute a writing and any symbol executed or adopted by

a party with the present intention to authenticate a writing shall constitute a signing.

However, in Parma Tile Mosaic & Marble Co. v. Estate of

Short , 87 N.Y.2d 524, 640 N.Y.S.2d 477 (1996), New York's

highest court held that the line identifying the sender at the

top of each fax page does not constitute a "signing." The court

stated, "The act of identifying and sending a document to a

particular destination does not, by itself, constitute a signing

authenticating the contents of the document for Statute of

Frauds purposes." See generally International Products &

Technologies, Inc. v. Iomega Corp., 10 UCC Rep. Serv. 2d

(Callaghan) 694 (E.D. Pa. 1989), aff'd mem. 908 F.2d 962 (3d

Cir. 1990); Bazak Int'l Corp. v. Mast Industries, Inc., 73 N.Y.2d 113, 538 N.Y.S.2d 503, 535 N.E.2d 633 (1989).

3. Signed Originals in Electronic Digital Format

ABA Guidelines

The ABA's Information Security Committee has issued

guidelines for the creation and verification of digital

signatures. These guidelines contemplate that three different

parties will be involved: the subscriber, the recipient, and the

certification authority. The subscriber is a person who adds a

digital signature to a document by means of a private key that

corresponds to a public key identified in a certificate. The

recipient is a party who receives a digital signature and who

can rely on it. A certification authority issues a computer-

based record which identifies such certification authority and the subscriber and contains the public key of the subscriber. 5

3.1. Filings With Public Agencies Generally

The Florida Secretary of State's Advisory Committee on

Digital Signatures is considering expanding the use of

electronic digital signatures. According to Aaron Bowden of the

Florida Bar's Law Office Management Assistance Service, "`The

possibility of fraud must be minimized. Specifically, when a

document is sent to you over the Internet, you want to verify

the sender's identity and that the document hasn't been altered after it was sent." Fla. Bar News, Dec. 1, 1996 at 12.

3.2. Real Estate Filings

California and Utah are among several states which have

enacted legislation permitting electronic filing (from off-site

locations) of real estate documents in local recording offices.

Cal. Gov't Code § 165; Utah Code § 46-3-101. See generally

Colavito, "Vision 2000: A Status Report," New York Law Journal, Aug. 18, 1997, at S16.

UCC Filings

"Texas now permits electronic filing, but so far has had

little use.

5 Kennedy & Davids, "Bartleby the Cryptographer," New York Law Journal,

Jan. 22, 1996, at S4.

. . . .

"The Drafting Committee considered whether to impose

requirements for authenticating filings, such as termination

statements. Some filing offices are considering the use of

World Wide Web filing systems. The Drafting Committee decided

not to mandate any specific security systems." Article 9

Drafting Committee Report (March 7-9, 1997 meeting) reprinted in

Secured Transactions Guide (CCH) ¶ 55,607.

"[D]ata transmitted electronically to the filing office and

reduced to tangible form constitute a financing statement or

other filing under Article 9 if they provide all the information

required under the applicable provision of Article 9." PEB

Commentary No. 15 - Electronic Filing Under Article 9 (July 16, 1996), reprinted in Secured Transactions Guide (CCH) ¶ 55,552.

Products

3.2.1. PenOp

PenOp (its website is www.penop.com) produces a device for

secure electronic signatures, not by public key encryption, but

by a holographic signature made on a pressure sensitive tablet.

ApproveIT Toolkit by Silanis Technology, Inc., Dorval, Quebec,

is a new digital signature application that allows documents to

be hand-signed electronically using encryption technology which

then protects the signature (and the document containing it) from manipulation and copying.

PGP

One form of encryption software, called "PGP" (for "Pretty

Good Privacy"), is available for free at:

http://web.mit.edu/network/pgp.html

PGP uses a 2048-bit key, which provides an extraordinary

level of protection that "probably is unbreakable even by the

National Security Agency, clearly a level well beyond ordinary office needs. But PGP suffers from use difficulty." 6

More information on PGP is available at:

6 Beckman & Hirsch, "Making Encryption the Norm," 83 ABA J., Sept. 1997

at 82.

http://www.abanet.org/lpm/catdiv/home.html http://www.pgp.com3.2.2. Eudora

A well-known e-mail software program called Eudora plans to

incorporate PGP. 7

More information is available at:

http://www.eudora.com

PrivaSuite

PrivaSuite (made by Aliroo) uses 40-bit encryption. It

encrypts any document in a Windows application. 8

3.2.3. SealWare

SealWare (also made by Aliroo) "`echoes' the printed

portion of the page in the white space [that appears on the same

page] (printing a microscopic map of the document), which is

either invisible to the eye or appears as slightly gray shading.

One can then scan the document and decode it to make sure the

visible text corresponds to the map, meaning it has not been altered." 9

This application could be very useful for reproducing

signed loan documents and any other documents that need to be authenticated.

3.2.4. WitnesSoft

Aliroo is also planning to market a software program called

WitnesSoft, which "will put an invisible 100-bit label randomly

on 50 different locations on a page. The label includes an

authenticating signature that traces time, place of creation,

and software and hardware used (down to the serial number of each)." 10

Survey of laws

For a compilation of the status of digital signature laws

in the U.S. see:

7 Id.

8 Id.

9 Id. at 83.

10 Id.

www.magnet.state.ma.us/itd/legal/sigleg7.htm

See generally Oxton, "Digital Signatures: Potential and

Pitfalls," New York Law Journal, July 21, 1997; Science and

Technology Section, Information Security committee of the

American Bar Association, Digital Signature Guidelines (August

1996); "The Risks of Key Recovery, Key Escrow, and Trusted

Third-Party Encryption" (available at http://www.crypto.com/key__study/report.shtml); "Cryptography's

role in Securing the Information Society" Nat. Research Council: http://www.nap.edu/bookstore

4. Loan Origination, Processing, and Servicing Software

- ALLTEL InterChange is available from Alltel

Information Services, 601 Riverside Avenue, Jacksonville,

Florida 32204-2987 (1-800-991-1274; 904-354-4650 (fax);

www.alltelmd.com) (ALLTEL offers software systems ranging

from mortgage origination, to secondary marketing, to servicing and industry-wide EDI connectivity).

- Bankruptcy Navigator, available from Equifax.

See Pettit, "System Aims at Predicting Defaults," Nat. Mge.

News, Mar. 31, 1997. "Equifax has developed the Bankruptcy

Navigator, a package of automated tools designed to improve

the ability of lenders to monitor and forecast payment

problems with existing customers as well as to predict patterns of payment and default."

- CheckFree Software Solutions, Inc, 5655 Spalding

Drive, Norcross, Georgia 30092 (770-734-3845) (offers loan origination and servicing software).

- DOCX is available from DOCX National Sales

Office, P.O. Box 889251, Atlanta, Georgia 30356 (creates

mortgage assignments, satisfactions, sales of servicing agreements, loan sale agreements, etc.).

- EDS (see the discussion of the EDS "paperless

mortgage" above).

- Excelis is a servicing system available from

First American Real Estate Information Services, Inc. (800-717-5554).

- Fair Isaac & Co., Inc. (mortgage servicing

technology) "designs the credit bureau risk scoring systems

that are most widely used in consumer and mortgage lending."11

- Fast Doc Plus software is available from Entyre

Doc Prep, Inc. (800-292-8669)

- Federal National Mortgage Association ("FNMA" or

"Fannie Mae") has its own proprietary software for mortgage

loan underwriting (Fannie Mae's automated underwriting

system is called Desktop Underwriter), originations, and

servicing. For more information, see its website (listed

on the document entitled "Real Estate and Finance Internet Sites" with the filename "WEBSITES.897").

- Federal Home Loan Mortgage Corporation ("FHLMC"

or "Freddie Mac") has its own proprietary software for

mortgage loan underwriting, originations, and servicing.

For more information, see its website (listed on the

document entitled "Real Estate and Finance Internet Sites" with the filename "WEBSITES.897").

- Genesis 2000 for Windows (automated mortgage loan

origination package, which, inter alia, allows loans to be

submitted electronically to Fannie Mae MORNETPlus Network,

and contains a pricing and rate locking system) - available

from Genesis 2000, Inc., 5000 North Parkway Calabasas,

Suite 200, Calabasas, California 91302 (800-882-0504; www.genesis2000.com).

- Greatland (800-530-9393) offers MDM Mortgage

Software (TIL Disclosure, Processing, Closing and Tracking

Modules are available) and ARM Adjustment Auditor (intended to help justify ARM servicing practices).

- Interlinq. See Kersnar, "INTERLINQ Software Gets

Warm Reception," Mtge. Servicing News, Feb. 1997 at 16

"Interlinq Software Corp.'s MortgageWare Servicing software

. . . provides all of the capabilities necessary to do loan

servicing, such as collections, automatic payment processing, escrow tracking and analysis, and investor reporting."

- Origination and servicing software is available

from Financial Industry Computer Systems, Inc. (972-458-8583).

11 Standard & Poor's Structured Finance, Apr. 1996, at 7.

- POINT mortgage origination software is available

from Calyx Software (800-362-2599).

- Standard & Poor's LEVELS model replaces the

customary A-D scale used to rank residential mortgage

loans, according to the probability of foreclosure, with a

system of risk grades RG1 to RG7, with RG1 being the highest credit quality. 12

- The TRAKKER Loan Servicing Program is available

from Multi-Financial Services Co., Inc., Tallahassee, Florida (800-326-4112).

Books and articles

:

Real Estate Solutions, Inc., Guide to Real Estate & Mortgage Banking Software

12 Standard & Poor's Structured Finance, Sept. 1996, at 6.