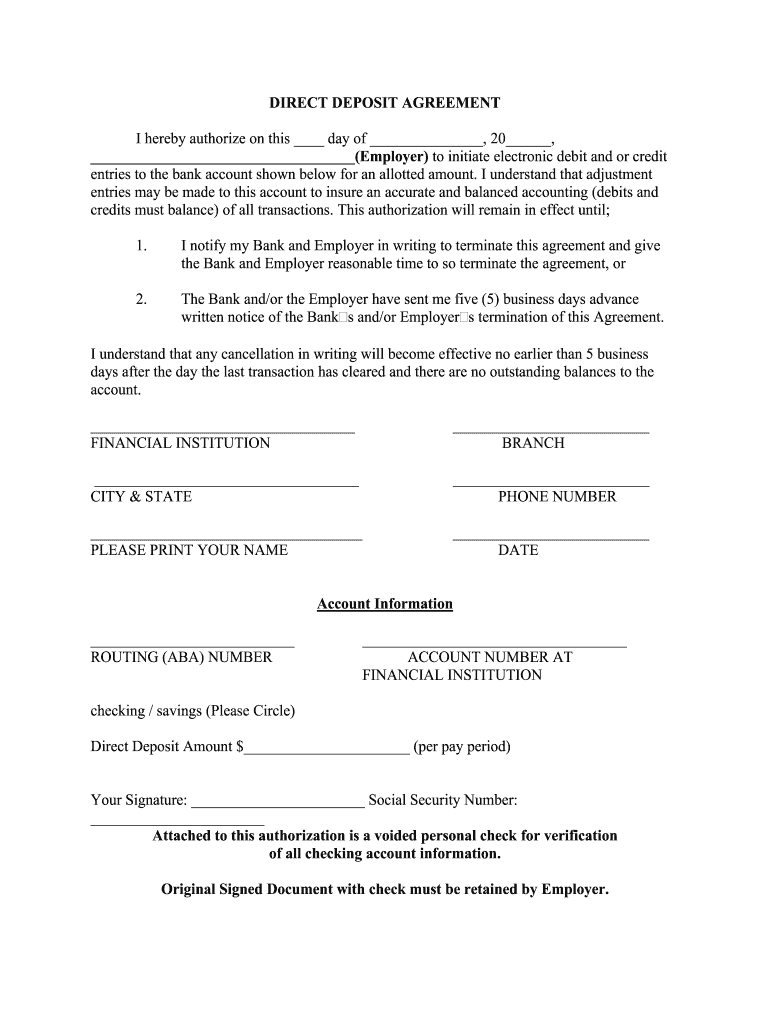

Fill and Sign the Direct Deposit Form Automatic Debit and Credit Agreement

Useful tips for preparing your ‘Direct Deposit Form Automatic Debit And Credit Agreement ’ online

Are you fed up with the trouble of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning files. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive tools incorporated into this easy-to-use and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect eSignatures, airSlate SignNow takes care of it all with just a few clicks.

Follow these comprehensive instructions:

- Log into your account or sign up for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud, or our template repository.

- Open your ‘Direct Deposit Form Automatic Debit And Credit Agreement ’ in the editor.

- Click Me (Fill Out Now) to get the document ready on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don't be concerned if you need to collaborate with your colleagues on your Direct Deposit Form Automatic Debit And Credit Agreement or send it for notarization—our platform provides everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is an ACH deposit form template?

An ACH deposit form template is a standardized document that allows businesses to collect bank account information from customers for electronic funds transfers. This template simplifies the process of setting up direct deposits and ensures compliance with banking regulations.

-

How can I create an ACH deposit form template using airSlate SignNow?

Creating an ACH deposit form template with airSlate SignNow is straightforward. You can start by selecting a pre-designed template or create your own from scratch, adding fields for necessary information such as account numbers and signatures, ensuring a seamless experience for your users.

-

What are the benefits of using an ACH deposit form template?

Using an ACH deposit form template streamlines the process of collecting payment information, reduces errors, and enhances security. It also saves time for both businesses and customers, making transactions more efficient and reliable.

-

Is there a cost associated with using the ACH deposit form template on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the ACH deposit form template. Depending on your business needs, you can choose a plan that fits your budget while enjoying the benefits of eSigning and document management.

-

Can I customize the ACH deposit form template?

Yes, airSlate SignNow allows you to fully customize the ACH deposit form template to meet your specific requirements. You can add your branding, modify fields, and adjust the layout to ensure it aligns with your business's needs.

-

What integrations are available with the ACH deposit form template?

airSlate SignNow integrates seamlessly with various applications, including CRM systems and payment processors. This allows you to automate workflows and enhance the functionality of your ACH deposit form template, making it easier to manage transactions.

-

How secure is the ACH deposit form template on airSlate SignNow?

Security is a top priority at airSlate SignNow. The ACH deposit form template is protected with advanced encryption and complies with industry standards, ensuring that sensitive banking information is kept safe during transmission and storage.

The best way to complete and sign your direct deposit form automatic debit and credit agreement

Get more for direct deposit form automatic debit and credit agreement

Find out other direct deposit form automatic debit and credit agreement

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles