// // // //// // ////

Under penalties of perjury, I declare that I have examined this election, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

____________________________________________________________________________________________________________________________ Signature of authorized officer TitleDate

Social Security Number

or

Employer Identification Number for an estate or qualified trust * Share-

holder’sstate of

residency

State of New Jersey

Division of Taxation

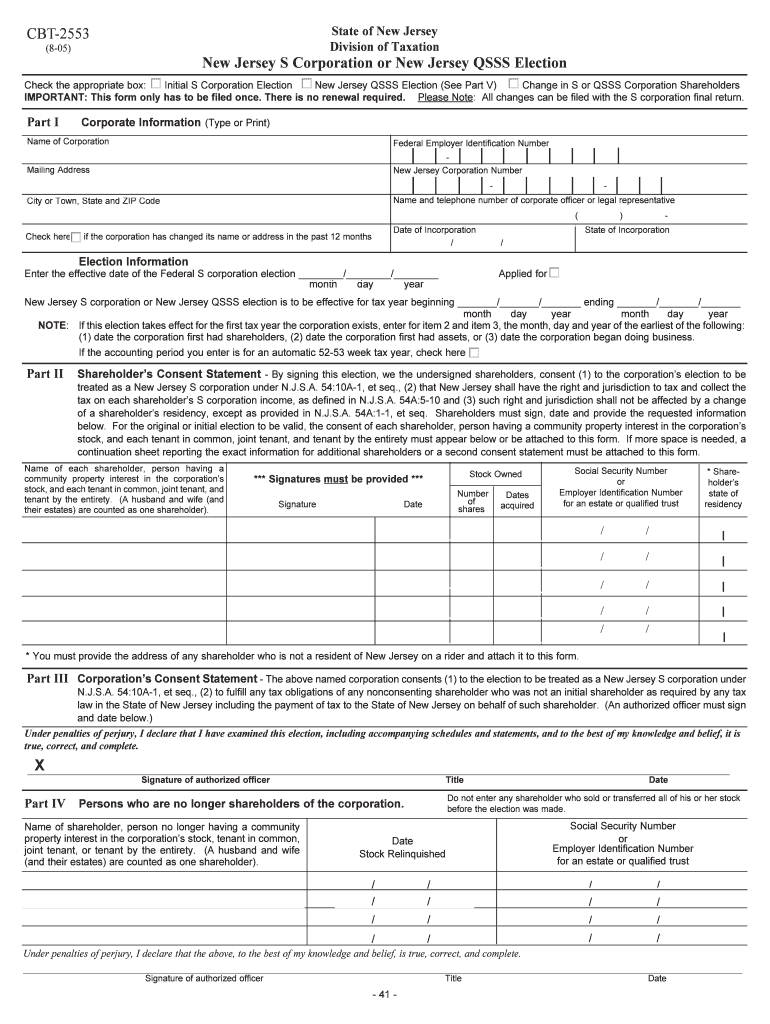

New Jersey S Corporation or New Jersey QSSS Election

Check the appropriate box: …Initial S Corporation Election …New Jersey QSSS Election (See Part V) …Change in S or QSSS Corporation Shareholders

IMPORTANT: This form only has to be filed once. There is no renewal required. Please Note

: All changes can be filed with the S corporation final return.

// // // // //

Check here

…if the corporation has changed its name or address in the past 12 months Federal Employer Identification Number

-

New Jersey Corporation Number

--

Name and telephone number of corporate officer or legal representative

() -

Date of Incorporation State of Incorporation //

Part I

Corporate Information (Type or Print)

Name of Corporation Mailing Address City or Town, State and ZIP Code

CBT-2553 (8-05)

Election Information

Enter the effective date of the Federal S corporation election ________/________/________ Applied for …

month day year

New Jersey S corporation or New Jersey QSSS election is to be effective for tax year beginning _______/_______/_______ ending _ ______/_______/_______

month day year month day year

NOTE : If this election takes effect for the first tax year the corporation exists, enter for item 2 and item 3, the month, day and year of the earliest of the following:

(1) date the corporation first had shareholders, (2) date the corporation first had assets, or (3) date the corporation began doing business.

If the accounting period you enter is for an automatic 52-53 week tax year, check here …

Part IIShareholder’s Consent Statement - By signing this election, we the undersigned shareholders, consent (1) to the corporation’s election to be

treated as a New Jersey S corporation under N.J.S.A. 54:10A-1, et seq., (2) that New Jersey shall have the right and jurisdiction to tax and collect the

tax on each shareholder’s S corporation income, as defined in N.J.S.A. 54A:5-10 and (3) such right and jurisdiction shall not be affected by a change

of a shareholder’s residency, except as provided in N.J.S.A. 54A:1-1, et seq. Shareholders must sign, date and provide the requested information

below. For the original or initial election to be valid, the consent of each shareholder, person having a community property interest in the corporation’s

stock, and each tenant in common, joint tenant, and tenant by the entirety must appear below or be attached to this form. If more space is needed, a

continuation sheet reporting the exact information for additional shareholders or a second consent statement must be attached to this form.

Name of each shareholder, person having a community property interest in the corporation’sstock, and each tenant in common, joint tenant, andtenant by the entirety. (A husband and wife (andtheir estates) are counted as one shareholder). Signature DateStock Owned

Number

of

shares Dates

acquired

Part III Corporation’s Consent Statement - The above named corporation consents (1) to the election to be treated as a New Jersey S corporation under

N.J.S.A. 54:10A-1, et seq., (2) to fulfill any tax obligations of any nonconsenting shareholder who was not an initial shareholder as required by any tax

law in the State of New Jersey including the payment of tax to the State of New Jersey on behalf of such shareholder. (An authorized officer must signand date below.)

Part IV Persons who are no longer shareholders of the corporation.

Name of shareholder, person no longer having a community property interest in the corporation’s stock, tenant in common,joint tenant, or tenant by the entirety. (A husband and wife(and their estates) are counted as one shareholder).

Date

Stock Relinquished Social Security Number

or

Employer Identification Number

for an estate or qualified trust

Do not enter any shareholder who sold or transferred all of his or her stock before the election was made.

Under penalties of perjury, I declare that the above, to the best of my knowledge and belief, is true, correct, and complete. _______________________________________________________________________________________________________________________________ Signature of authorized officer TitleDate

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

- 41 -

*** Signatures must

be provided ***

X

Under penalties of perjury, I declare that I have examined this election, and to the best of my knowledge and belief, it is true, correct, and complete.

_______________________________________________________________________________________________________________________________________________ Signature of authorized officer TitleDate

- 42 -

INSTRUCTIONS for Form CBT-2553

Part V

Qualified Subchapter S Subsidiary Election

Corporation’s Consent Statement - The above named corporation consents (1) to the election to be treated as a “New Jersey Qualified

Subchapter S Subsidiary”, and (2) to file a CBT-100S reflecting the $500 minimum tax liability or the $2,000 minimum tax liability if the taxpayer is a

member of an affiliated group or a controlled group whose group has a total payroll of $5,000,000 or more for the privilege per iod. (An authorized offi-

cer must sign and date below.)

Under penalties of perjury, I declare that I have examined this election, and to the best of my knowledge and belief, it is true, correct, and complete. __________________________________________________________________________________________________________________ Signature of authorized officer TitleDate

1. Purpose- A corporation must file form CBT-2553 to elect to be

treated as a New Jersey S corporation or a New Jersey QSSS or to report a change in shareholders. Check the appropriate box toindicate if this is an initial S corporation election or a change in Sor QSSS corporation shareholders or a New Jersey QSSS elec-tion.

2. Who may elect - A corporation may make the election to be treat-

ed as a New Jersey S corporation only if it meets all of the follow-ing criteria:

a) The corporation is or will be an S corporation pursuant tosection 1361 of the Federal Internal Revenue Code;

b) Each shareholder of the corporation consents to the election and the jurisdictional requirements as detailed in Part II ofthis form;

c) The corporation consents to the election and the assumption of any tax liabilities of any nonconsenting shareholder whowas not an initial shareholder as indicated in Part III of thisform.

3. Where to file - Mail form CBT-2553 to: New Jersey Division of

Revenue, PO Box 252, Trenton, NJ 08646-0252 (Registered MailReceipt is suggested)

4. When to make the election - The completed form CBT-2553 shall

be filed within one calendar month of the time at which a FederalS corporation election would be required. Specifically, it must befiled at any time before the 16th day of the fourth month of the firsttax year the election is to take effect (if the tax year has 3-1/2months or less, and the election is made not later than 3 monthsand 15 days after the first day of the tax year, it shall be treated astimely made during such year). An election made by a small busi-ness corporation after the fifteenth day of the fourth month butbefore the end of the tax year is treated as made for the next year.

5. Acceptance or non-acceptance of election - The Division of

Revenue will notify you if your election is accepted or not accept -

ed within 30 days after the filing of the CBT-2553 form . If you are

not notified within 30 days, call (609) 292- 9292.

6. End of election - Generally, once an election is made, a corpora-

tion remains a New Jersey S corporation as long as it is a Federal S corporation. There is a limited opportunity to revoke an electiononly during the first tax year to which an election would otherwiseapply. To revoke an election, a letter of revocation signed by shareholders holding more than 50% of the outstanding shares ofstock on the day of revocation should be mailed to the address ininstruction 3 on or before the last day of the first tax year to whichthe election would otherwise apply. A copy of the original electionshould accompany the letter of revocation. Such a revocation willrender the original election null and void from inception.

7. Initial election - Complete Parts I, II and III in their entirety for an

initial New Jersey S Corporation election. Each shareholder whoowns (or is deemed to own) stock at the time the election is made,must consent to the election. A list providing the social securitynumber and the address of any shareholder who is not a NewJersey resident must be attached when filing this form.

8. Reporting shareholders who were not initial shareholders - Complete Parts I, II and III when filing this form to report any newshareholder. A new shareholder is a shareholder who, prior to theacquisition of stock, did not own any shares of stock in the S cor-poration, but who acquired stock (either existing shares or sharesissued at a later date) subsequent to the initial New Jersey S cor-poration election. If a new shareholder fails to sign a consentstatement, the corporation is obligated to fulfill the tax require-ments as stated in Part III on behalf of the nonconsenting share-holder. An existing shareholder whose percentage of stock own-ership changes is not considered a new shareholder. If the tax-payer previously had elected to be treated as a New Jersey QSSS,the new shareholder must also complete Part V.

9. Part IV should only be completed for any person who is no longer

a shareholder of the corporation. You do not have to enter anyshareholder who sold or transferred all of his or her stock beforethe election was made. All changes can be filed with the S corpo-ration final return.

10. Part V must be completed in order to permit a New Jersey S

Corporation to be treated as a New Jersey Qualified Subchapter SSubsidiary and remit only a minimum tax. In addition, the parentcompany also must consent to filing and remitting New JerseyCorporation Business Tax which would include the assets, liabili-ties, income and expenses of its QSSS along with its own. Failureof the parent either to consent or file a CBT-100 or CBT-100S fora period will result in the disallowance of the New Jersey QSSSelection and require the subsidiary to file and remit a CBT-100Sdetermining its own liability.

Corporate Parent Company’s Consent Statement

- By signing this election, the undersigned corporation consents (1) to the subsidiary’s elec-

tion to be treated as a “New Jersey Qualified Subchapter S Subsidiary” and (2) to taxation by New Jersey by filing a CBT-100S or a CBT-100 and

remitting the appropriate tax liability including the assets, liabilities, income, and expenses of its QSSS.

Corporate Parent Name AddressFID Number

CBT-2553 - Cert Mail to:

(8-05) PO Box 252

Trenton, NJ 08646-0252(609) 292-9292

State of New Jersey Division of Taxation

New Jersey S Corporation Certification

This certification is for use by unauthorized foreign (non-NJ) entities that want New Jersey S

Corporation Status. This form MUSTbe attached to form CBT-2553.

Part I. Corporate Information (Type or Print)

Name of Corporation: ____________________________________________________ Federal Employer Identification Number: ______ - _____________________________

Part II. Corporate Attestation

By signing this statement, the corporation affirms that the corporation has not conducted any activi-

ties within this state that would require the Corporation to file a Certificate of Authority in accordance

with N.J.S.A. 14A :13-3. Specifically, the corporation attests that it is not transacting business in

accordance with the definitions provided in statute.

Print the name and title of the person executing this document on behalf of the Corporation. This person must

be a corporate officer.

Name: ________________________________ Title: ___________________________ Signature: _____________________________ Date: ___________________________

- 43 -

Instructions for Form CBT-2553 - Cert

1. This form is to be used by non-New Jersey business entities wishing to apply for New Jersey "S" Corporation status which are not required to be authorized to transact business in accor- dance with N.J.S.A. 14A :13-3 , given below. This form is in addition to

and must accompany

form CBT-2553.

2. Name of Corporation: Type or print name exactly as it appears on form NJ-REG and the CBT-2553.

3. Federal Employer Identification Number (FEIN): Please enter the Federal Identification Number assigned by the Internal Revenue Service.

4. Please read the Corporate Attestation and the cited statutes for compliance.

5. Print the name and title of the corporate officer signing this document and the CBT-2553. Both documents must be signed by the same corporate officer.

6. Mail the completed forms to: New Jersey Division of Revenue, PO Box 252 Trenton, NJ 08646-0252

14A:13-3. Admission of foreign corporation (1) No foreign corporation shall have the right to transact business in this State until it shall have

procured a certificate of authority so to do from the Secretary of State. A foreign corporation

may be authorized to do in this State any business which may be done lawfully in this State by a domestic corporation, to the extent that it is authorized to do such business in the jurisdiction

of its incorporation, but no other business.

(2) Without excluding other activities which may not constitute transacting business in this State, a

foreign corporation shall not be considered to be transacting business in this State, for the

purposes of this act, by reason of carrying on in this State any one or more of the following activities

(a) maintaining, defending or otherwise participating in any action or proceeding, whether judicial,

administrative, arbitrative or otherwise, or effecting the settlement thereof or the settlement of claims or disputes; (b) holding meetings of its directors or shareholders;

(c) maintaining bank accounts or borrowing money, with or without security, even if such borrow-

ings are repeated and continuous transactions and even if such security has a situs in this State; (d) maintaining offices or agencies for the transfer, exchange and registration of its securities, or

appointing and maintaining trustees or depositaries with relation to its securities.

(3) The specification in subsection 14A:13-3(2) does not establish a standard for activities which

may subject a foreign corporation to service of process or taxation in this State.

- 44 -

Divisio n Use O nly — DLN Sta m p Divisio n Use O nly — Da te Sta m p

Se nd to :

Divisio n o f Re ve nue

PO Bo x 252

Tre nto n, NJ 08646-0252

1-2011

ENC LO SE FEE W ITH A PPLIC A TIO N

Fo rm C M - 1 0 0 C o m b ine d C ig a re tte

Lic e nse A p p lic a tio n

Re ta il O ve r-the -C o unte r

Ve nd ing Ma c hine

Ma nufa c ture r Re p re se nta tive

C he c k O ne Bo x fo r the Lic e nse De sire d Enc lo se Fe e

C ig a re tte Re ta il De a le r’ s O ve r-the -C o unte r Lic e nse

— 1 ye a r lic e nse

C o m p le te Se c tio ns A & B b e lo w $ 50

00

C ig a re tte Ve nd ing Ma c hine Lic e nse —

1 ye a r lic e nse e a c h m a c hine

C o m p le te Se c tio ns A & C b e lo w $ 50

00 e a c h

C ig a re tte Ma nufa c ture r Re p re se nta tive Lic e nse —

1 ye a r lic e nse

C o m p le te Se c tio ns A & D b e lo w $ 5

00

Ta xp a ye r Na m e

Sta rt Da te fo r Busine ss in Ne w Je rse y

Tra d e Na m e FEIN (fo r b usine sse s) So c ia l Se c urity No (fo r ind iv id ua ls)

Busine ss A d d re ss Ma iling A d d re ss

C he c k Typ e o f O w ne rship Fo r a ll c o rp o ra tio ns, g iv e Sta te o f Inc o rp o ra tio n: C o rp o ra tio n LLC Pa rtne rship LLP Pro p rie to rship Re p re se nta tive O the r (sp e c ify) Po int o f C o nta c t: Pho ne N o

Email

O W NERS’ INFO RM A TIO N ( a tta c h list if ne e d e d )

Na m e Title So c ia l Se c urity N o

Ho m e A d d re ss

Se c tio n B — Re ta il O ve r- the - C o unte r Lic e nse Pro v id e info rm a tio n a b o ut tho se fro m w ho m yo u

p urc ha se c ig a re tte s – a tta c h list if ne e d e d

$ 5000 Sup p lie r Sup p lie r’ s FEIN Sup p lie r’ s A d d re ss

C ity Sta te Pho ne No

Se c tio n C — Ve nd ing M a c hine Lic e nse Pro v id e info rm a tio n a b o ut the m a c hine s yo u w ill

o p e ra te — a tta c h list if ne e d e d

$ 5000

e a c h Sup p lie r Sup p lie r

FEIN Pho ne No

A d d re ss w he re m a c hine is lo c a te d C ity Sta te

Se c tio n D — M a nufa c ture r Re p re se nta tive Lic e nse Pro v id e info rm a tio n o n the c o m p a ny yo u re p re se nt

$ 500 C o m p a ny FEIN A d d re ss

C ity Sta te Pho ne No

By sig ning , sig na to ry a ffirm s tha t a ll info rm a tio n is c o m p le te a nd

a c c ura te . Sho uld a ny info rm a tio n b e inc o m p le te o r

ina c c ura te , the a p p lic a tio n w ill no t b e p ro c e sse d .

The A p p lic a tio n Fe e m ust b e e nc lo se d to p ro c e ss the

a p p lic a tio n

A utho rize d Sig na ture

To ta l Fe e Enc lo se d :

$

Printe d Na m e Title Da te

Se c tio n A — Lic e nse e Info rm a tio n C he c k o ne : Initia l A p p lic a tio n

Re ne wa l A p p lic a tio n

Divisio n use o nly – DLN Sta m p Divisio n use o nly – Da te Sta m p

Se nd to :

Ne w Je rse y Divisio n o f Ta xa tio n

PO Bo x 189

Tre nto n, NJ 08695-0189 Re v 12-2013

Fo rm MFA - 1 C o m b ine d Mo to r Fue ls

Lic e nse A p p lic a tio n

Initial Application Change Application Renewal Application

Section 1 – Business Information

Federal ID Number IRS 637 Number New Jersey Tax ID Number Does your company have

internet access? Yes No

Business Name

Webpage Address

Trade Name

Phone Number

Fax Number

Physical Address

Mailing Address

Books and Records Address

Hours of Operation

Mon. -- Tues. -- Wed. -- Thur. -- Fri. -- Sat. -- Sun. --

Section 2 – Contact Information

If you wish to give an attorney, or accountant access to your tax information, you must supply us with an Appointment of Taxpayer

Representative Form (Form M-5008-R) giving us the authority to release confidential information to them.

Contact for Registration Title

Telephone No

Email Address

Contact for Reporting

Title

Telephone No

Email Address

Site Manager Title

Telephone No

Email Address

Individual Completing this Form Title

Telephone No

Email Address

Section 3 – Prior Owner Information

Complete if you are purchas

ing an existing business.

Former Business Name Former License Number Former Phone Number

Former Business Address

City, State, Zip Date Ownership Transferred

Former Business Mailing Address

City, State, Zip

Date Former Business Ended

Section 4 – Type of Ownership

Sole Proprietorship (may include spouse)

Limited Liability Partnership

New Jersey Corporation

Date of Incorporation : __________

Partnership

Government Entity

Out-of-State Corporation – State: _______

Date Registered in New Jersey: _______

Limited Partnership

Trust

Other (specify)

___________________________

Section 5 – Owner Information

Provide information for sole proprietor, a ll partners, or principal officers of corporations or limited liability corporations

( attach rider if necessary ).

Name (Last, First, M) Title Social Security Number

Home Address

Home Phone Number Cell Phone Number

Name (Last, First, M) Title Social Security Number

Home Address Home Phone Number Cell Phone Number

Name (Last, First, M)

Title Social Security Number

Home Address Home Phone Number Cell Phone Number

Name (Last, First, M)

Title Social Security Number

Home Address Home Phone Number Cell Phone Number

Section 6 – Relationships with Other Organizations

Information regarding persons aff

iliated with this business who either are also af filiated or have been affiliated with another

business that requires licensing u nder NJSA §54:39-101 et. seq. (attach rider if necessary).

Individual’s Name Title with Applicant Date Joining Applicant Social Security Number

Individual’s Home Address City, State, Zip

Name of Business with which Affiliation Exists

Affiliated Business FID Title Effective Date of Title

Address of Business with which Affiliation Exists City, State, Zip

Individual’s Name

Title with Applicant Date Joining Applicant Social Security Number

Individual’s Home Address City, State Zip

Name of Business with which Affiliation Exists Affiliated Business FID Title Effective Date of Title

Address of Business with which Affiliation Exists City, State Zip

Section 7 – Types of

Products Handled

Check each type of product with which you will be dealing in New Jersey.

Gasoline

Gasohol

Fuel Grade Alcohol

LPG

Undyed Diesel

Dyed Diesel

Dyed Kerosene

Undyed Biodiesel

Dyed Biodiesel

Undyed Kerosene

Aviation Fuel

Other – List each other

product:

Section 8 – Business Activity; License Requested

Check all that apply.

Supplier of Motor Fuels An Application Fee of $450 is due for a 3-year license.

1. You are registered or required to be registered pursuant to Section 4101 of the Federal Internal Revenue Code of 1986 and one or more of A through E.

A. You are a Position Holder in a terminal in New Jersey ( List each Terminal and its location).

B You export fuel from this State ( List the states to which you export and your License N o

in each state ).

C. You Import as a Position Holder in another state ( List the states from which you import and your License N o

in each state ).

D. You Import from another Position Holder ( List the Position Holders, the Position Holder’s License N o

, and the state ).

E. You acquire Motor Fuel in this State by two-party exchanges (List exchange partners and their License N o

).

2. You produce Fuel Grade Alcohols in New Jersey or for import into New Jersey.

Permissive Supplier of Motor Fuels An Application Fee of $450 is due for a 3-year license.

You are an out-of -State Supplier who is not required to be licen sed as a Supplier in this State, but you elect to be licensed anyway.

Terminal Operator An Application Fee of $450 is due for a 3-year license for each

Terminal Operated.

1. You own one or more Terminals in New Jersey ( List each Terminal, state whether it is a barge, pipeline, or fixed location, and its location).

2. You control one or more Terminals in New Jersey ( List each Terminal, state whether it is a barge, pipeline, or fixed location, and its location).

3. You commingle products with those of another company ( List each company and the products commingled).

Distributor of Motor Fuels An Application Fee of $450 is due for a 3-year license.

1.

You acquire Fuel from a Supplier, Permissive Supplier, or another Distributor for subsequent resale.

2. You import Fuel from another state ( List the states, Suppliers, each Supplier’s License N o

and the products imported ).

3. You export Fuel to another state ( List the states, customers, each customer’s License N o

, and the products exported ).

4. You blend Fuels ( List the types of fuels you blend and the blendstocks used ).

5. You sell Aviation Fuel.

Retailer of Motor Fuels An Application Fee of $150 is due for a 3-year license.

You must file a separate MFA-1 for each retail establishment.

1.

You engage in the business of selling or dispensi ng motor fuel to the consumers in this state.

2. You operate a blocked pu mp for clear kerosene.

3. You sell Aviation Fuels to the consumers.

4. You dispense LPG into on-road vehicles.

Please provide the follo wing regarding your retail location.

1. What is the baseload minimum power requi rement for your station? (ensuring back up power to pumps, P.O.S system, lighting, a nd requisite safety equipment)

2. Do you have a backup generator on site? Yes No

3. If yes, please submit a description.

4. If no, is your station pre-wired for a generator?

5. Number of gasoline pumps. _______________ Average gall ons of gasoline sold during the last 12 months. ________________

6. Number of diesel pumps. _______________ Average gallons of diesel fuel sold during the last 12 months. _____________ __

7. Number of kerosene pumps_______________ Average gall ons of kerosene sold during the last 12 months. ________________

8. Do you lease your retail location (if yes, please provide a copy of the lease agreement)? Yes No

Transporter An Application Fee of $50 is due for a 1-year license for each

conveyance licensed.

1. You transport your own fuels.

2. You transport fuels under contract as a common carrier. ( List your customers, each customer’s License No

, and the fuels transported ).

For each Fuel Transportation Vehicle or Ve ssel, give the following information. (Attach rider if you are licensing more than 14 vehicles or vessels ).

Conveyance Type

VIN or Vessel Name

Conveyance Type

VIN or Vessel Name

Total Application Fee due fo r this application: $________

Section 9 – Consumer Registration

Only consumers may complete this section. If you sell fuel, then you are not a consumer and you must apply for one of the

licenses in Section 8.

Check all that apply. You purchase dyed fuel for use in on-road vehicles. You blend your own fuel.

You pick up taxable, on-road fuel from a terminal. You recycle fuel for use on-road.

You make your own fuel. You acquire taxable fuel that has not been taxed.

Check each type of fuel you will consume. Gasoline or Ethanol Diesel, Biodiesel or Kerosene Dyed Diesel, Biodiesel or Kerosene Aviation Fuel

Section 10 – Fuel Customers / Suppliers / Position Holders

Supplier of Motor Fuels applicants list customers. Distributor of Motor Fuels applicants list suppliers. Terminal Operator

applicants list position holders in your terminal(s). Retailers of Motor Fuels applicants list suppliers.

Customer / Supplier / Position Holder

Name Federal ID N

o

License N o

Products Terminal No

How product is

received

Section 11 – Transporters Hired

List common carriers you will use to transport fuel. Transporter Name Point of Contact Phone Number Federal ID Number Mode

Section 12 – Terminals

Refer to instructions to determine which terminals must be listed ( attach rider if necessary). Terminal Code Street Address City, State, Zip

Section 13 – New Jersey Storage Tank Information

List storage tank information by product type ( attach rider if necessary). Product Type Address City, State Zip Total Tank Capacity

Section 14 – Bond Information

Complete the parts applicable to the license you are requesting.

Supplier or Permissive Supplier Applicants Bond or Security must be 3 times the liability

for the estimated gallons handled per month.

( minimum $25,000; maximum $2,000,000 )

List estimated gallons to be handled pe

r month by product types as grouped below

Gasoline

Diesel & Kerosene (dyed & undyed) Aviation Gasoline Jet Fuel

Check type of Security to be used Surety Bond Certificate of Deposit Letter of Credit Cash Deposit

Issue of Security Instrument

Number Issue Date

Amount

Address of Issuer

City, State Zip

Terminal Operator Applicants

Bond or Security must be 3 times the liability

for the estimated gallons handled per month.

List estimated gallons to be handled pe

r month by product types as grouped below

Gasoline

Diesel & Kerosene (dyed & undyed) Aviation Gasoline Jet Fuel

Check type of Security to be used Surety Bond Certificate of Deposit Letter of Credit Cash Deposit

Issue of Security Instrument

Number Issue Date

Amount

Address of Issuer

City, State Zip

Distributor of Motor Fuels Applicants

Bond or Security must be 3 times the liability

for the estimated gallons handled per month.

List estimated gallons to be handled pe

r month by product types as grouped below

Gasoline

Diesel & Kerosene (dyed & undyed) Aviation Gasoline Jet Fuel

Check type of Security to be used Surety Bond Certificate of Deposit Letter of Credit Cash Deposit

Issue of Security Instrument

Number Issue Date

Amount

Address of Issuer

City, State Zip

Section 15 – Notice of Election for Suppliers and Permissive Suppliers

THIS NOTICE OF ELECTION PROVIDES FOR THE PRECOLLECTION OF THE NEW JERSEY MOTOR FUEL TAX ON ALL REMOVALS FROM ALL OUT-OF-STATE TERMINALS LISTED IN SECTION 12 WHERE SUPPLIERS OR PERMISSIVE SUPPLIERS ARE POSITION HOLDERS.

We elect to treat all removals from all out-of-state terminals with a destination into New Jersey as shown on the terminal-issu ed shipping

papers as if the removals were removed across the rack by the supplier from a terminal in New Jersey as provided in Section 54: 39-118.

We agree to precollect the New Jersey motor fuel tax in acco rdance with Chapter P.L 2010. C22 on all removals from a qualified terminal

where we are a position holder without regard to the license stat us of the person acquiring the fuel, the point of terms of the sale or the character of

delivery.

We further agree to waive any defense that the State of New Jersey lacks jurisdiction to require collection on all out-of-state sales by such

person as to which the person had knowledge th at the shipments were destined for New Jersey and that New Jersey imposes the requirements under

its general police powers to regula te the movement of motor fuels.

NOTICE OF ELECTION must be signed by an authorized representative of the company as listed in Section 5 of this

application. Signature Title Printed

Name

Date Signed

Section 16 – Application to

be a Qualified Distributor

Pursuant to Section 54:39-121, Qualified Distributors may delay remittance of the tax precollected by their Suppliers and Permi ssive Suppliers until up to the 20th

day of the month following the removal of taxable products from a terminal by a fuel transportation vehicle. Payments made to Suppliers and Permissive Suppliers MUST be made by EFT.

We acknowledge our Suppliers’ obligations to precollect tax due on Motor Fuels from us, hold it in trust for New Jersey, and re mit the

precollected tax no later than the 22 nd

of the month following the taxable event.

We affirm that:

1. Our company was a licensee in good standing with the State of New Je rsey under R. S. 54:39-1 et seq. Our filings and payments

were made accurately and timely.

— OR —

2. Our company meets the financial responsibility or bonding require ments set forth by the Motor Fuels Tax Act of 2010.

We agree that in order to enable our Suppliers to m eet their obligations to the State of New Jersey, we MUST remit the amount of tax due

to our Suppliers by EFT no later than the 20 th

day of the month following the taxable event.

Based on the above acknowledgment, affirmation, and agreement, we request that the State of New Jersey recognize us as a Qualif ied

Distributor pursuant to R. S. 54:39-101 et seq. We are qualified to delay remittance to our Suppliers of tax due until the 20 th

day of the month

following the taxable event. We recognize that our company, an d not our Suppliers, will be liable for penalties and interest in the event that we make

remittance to our Suppliers late. We further recognize that a la te remittance to our Suppliers will revoke our status as a Qualified Distributor.

QUALIFIED DISTRIBUTOR APPLICATION must be signed by an authorized representative of the company as listed in

Section 5 of this application. Signature Title Printed Name Date Signed

Section 17 – Authorizing Signature

Under penalty of perjury, my signature affirms all of the following:

The information provided in this applicatio n, to include all attachments, is accurate and complete to the best of my knowledge.

The applicant agrees to provide accurate and timely reports and to make timely payments.

Inaccurate or incomplete informat ion in any section is cause for denial of the requests made in Section 15 or 16, and/or the de nial of

the entire application.

Signature Title Printed Name Date Signed

New Jersey Form MFA-1 Instructions

Complete all appropriate sections and remit this

application with a check for the total application fee payable

to “State of New Jersey – LMF” to: New Jersey Division of Taxation

P. O. Box 189

Trenton, NJ 08695-0189

Be sure to check whether this is an Initial, Change, or

Renewal Application. If you ar e a licensee and wish to note

changes of Address, Activ ity, etc, check Change.

Failure to provide all required data will result in

automatic denial of this application.

Section 1

If you already have a NJ Tax Identification Number, enter it, otherwise leave th at space blank.

If you already have an IRS 637 Number, enter it; otherwise

leave that space blank .

The Business Name is your co mpany’s name as it appears on

the Business Registration.

The Trade Name is the name by which you company does business and is known in the industry.

The Physical Address is your company’s location for operations in New Jersey. If there are no New Jersey

locations, enter your company’s primary business location.

The Mailing Address is the address the Division of Taxation can use to contact your comp any for general inquiries or

notices.

The Books and Records Address is the address the Division of

Taxation can use to contact your company regarding

reporting and payments. It is the address where tax

specific inquiries will be sent.

Section 2

The Contact for Registration is the individual who can answer questions regarding this application. If this individual is

not an employee or owner of the company, a completed

Form M-5008-R must accompany this application.

The Contact for Reporting is the individual who can answer questions regarding filing of reports and issuance of

payments. If this individual is not an employee or owner

of the company, a comple ted Form M-5008-R must

accompany this application.

The Individual Completing this form is the individual who actually provides the information on the application. If this individual is not an employee or owner of the

company, a completed Form

M-5008-R must accompany

this application.

Section 3

This section is for individuals or companies who purchase an existing business. All others should enter “N/A” under

Former Business Name and leave all other spaces in

Section 3 blank.

Section 4

Check the box that applies and leave all others blank. If you check New Jersey Corporation, you must give the Date of

Incorporation. If you check Out of State Corporation, you

must give the state of in corporation and the Date

Registered in New Jersey. If you check Other, you must

give the type of ownership.

Section 5

You must provide all requested information for the owner, owner and spouse, all partners, or all principal officers. If

there are more than four partne rs or principal officers, you

must write “See Rider Attached” in the first space and

provide the information on a separate sheet.

Section 6

Provide this information for an y owner, officer, or employee

who operated, managed, or reported for another company

that required a Motor Fuels license of any type.

Section 7

Check each type of product you will possibly handle in New Jersey. If you check “Other”, you must give each other

product.

Section 8

Check one or more of the licen se types highlighted. For each

license you request, you must be able to check one or more

of the numbered boxes below that license type. You must

pay the application fee for each license requested. Enter

the total amount due for all licenses requested at the end of

this section. You may write one check for the total due for

all licenses requested. Make the check payable to State of

New Jersey – LMF .

Section 9

Complete this section if you are an end user who picks up fuel

in a terminal or if you receive , produce, or blend fuel that

has not been taxed.

Section 10

Provide the information requested for the companies with

whom you do business. If you deal in more than one

product with a particular co mpany, list it once for each

type of product. Under “How product is received”, state

how your company receives control or possession of the

products listed. For instance, pipeline, rack, rail, barge,

etc.

Section 11

Provide the information request ed for each transporter hired

by your company. If you use your own modes of

transport, write “Own means of transport” in the first

space, and apply for a Transporters License. If you neither

provide modes of transport no r hire transporters, write

“N/A” in the first space.

Section 12 Suppliers – Provide the requested information for New Jersey

terminals in which you are a position holder and any out-

of-state terminals in which you are a position holder and

will collect the New Jersey tax on all removals destined to

New Jersey.

Permissive Suppliers – Provide the requested information for

any out-of-state terminal in which you are a position

holder and agree to precollect the New Jersey tax on all

removals destined for New Jersey.

Terminal Operators – Provide the requested information for

the New Jersey terminal(s) you operate.

Section 13

Please furnish the requested info rmation for all storage tanks

you have in New Jersey. It is not necessary to list

individual tanks. Show the total storage capacity for each

product type for each location. If you have no storage in

New Jersey, write “N/A” in the first space.

Section 14

Complete the sections appropriate for the type of license you are requesting. If you are requesting more than one

license, you will need a separate bond for each license.

Section 15

This section is for Suppliers an d Permissive Suppliers only.

Suppliers may complete this section if they choose. Their

choice will not affect the rest of the application.

Permissive Suppliers must complete this section, or the

application will be denied. Other applicants should write,

“N/A” in the signature space.

Section 16

This section is to be completed by Distributor applicants who desire recognition as a Qualified Distributor. All others

should write, “N/A” in the signature space. A Distributor

applicant’s choice not to apply for recognition as a

Qualified Distributor will not affect the rest of this

application.

Section 17

Only an individual listed in Section 5 of this application may sign this application. Without an appropriate signature,

this application cannot be processed.