UWS

EMPLOYEE

STARTER PACK

UWS and sgfleet strongly advise anyone who is considering entering into salary packaging arrangements to seek

independent financial advice prior to entering into any such arrangement. All documentation should be read

carefully. This document contains information that is confidential and which may be legally privileged. If you are not

the intended recipient, you must not read, use, distribute or copy this document.

sgfleet - employee starter pack

Page 1 of 14

November 2008

�TABLE OF CONTENTS

Welcome to sgfleet Salary Packaging

3

Important Information for UWS Employees

3

What is a Novated Lease?

3

Suitability

4

Getting Started

5

Dedicated UWS Web Site

Contact Numbers

5

5

UWS Dedicated Account Managers

5

Procedures for a Novated Lease Facility

6

How the sgfleet System Can Benefit You

7

Flexibility

7

Tax Advantages

7

GST

7

Choice of Vehicle

7

Supplier Choice

7

Pricing Advantage

7

Sale and Leaseback

8

Additional Vehicles

8

Discounts on Running Costs

8

Lease Options

8

Lease Terms

8

Lease Guard – Protection against Involuntary Retrenchment

8

Employee Reimbursements

8

Actual Cost Accounting

9

Lease End Benefits for Novated Finance Lease

9

Portable

9

Monthly Reporting

9

Frequently Asked Questions

sgfleet - employee starter pack

10

Page 2 of 14

November 2008

�WELCOME TO SGFLEET SALARY PACKAGING

IMPORTANT INFORMATION FOR UWS EMPLOYEES – PLEASE READ

UWS’s Salary Packaging Policy allows Employees to take advantage of the potential benefits of Flexible Salary

Packaging, which means you are in a position to structure your gross salary to best suit your personal requirements

and legitimately maximise the tax effectiveness of your salary package.

UWS has retained the services of SGFLEET Salary Packaging (sgfleet) exclusively to manage the Salary

Packaging program.

sgfleet provide a one stop shop for your total Salary Packaging and Novated Leasing needs and have dedicated

Account Managers to assist you throughout the entire process. This brochure has been developed to outline

information of a general nature to assist you get started. In order to obtain detailed salary packaging information or

pricing schedules on vehicles, you should refer to the attached sgfleet Telephone Directory for website and

Account Manager details.

Under the UWS Salary Packaging Policy you are able to salary package the following items through sgfleet.

Salary Packaging Item

Motor Vehicles – Novated Lease

Applicable FBT

Concessional

WHAT IS A NOVATED LEASE?

The sgfleet Novated Lease incorporates a standard Finance Lease Agreement held in the Employee’s name. The

monthly payment obligation of this Lease is then transferred to the Employer/Agency via a Novation Agreement.

The Employer/Agency then proceed to make the monthly lease payments on the Employee’s behalf.

Under the sgfleet Novated Lease arrangement the entire annual vehicle costing are incorporated into the

Employee’s salary package. The system provides a tax efficient and flexible car benefit system.

Note: Should the Employee leave their employer for any reason, the Novation Agreement is severed and

the finance obligation reverts to the Employee. The Employee retains possession of the vehicle, and has

the choice to re-novate the vehicle to their next Employer, sell the vehicle to pay out the lease, or simply

continue to pay the finance company directly. The Employers obligation to make the lease payment

ceases upon termination of employment.

The sgfleet Novated Lease has a fixed term which expires on the final lease installment, the Employee is then

responsible for the payment or refinancing of the residual value. This allows the Employee to take advantage of

any lease end benefits that may have accrued.

The sgfleet Novated Lease System allows Employees flexibility in their choice of vehicle without additional cost to

the Employer/Agency. With this arrangement Employees have the satisfaction of choosing a vehicle that best suits

their requirements. Refer to ‘Employee Benefits’ section three of this brochure.

The terms and conditions of the Lease contracts and ancillary documents will dictate your exact obligation and

should be referred to carefully.

sgfleet - employee starter pack

Page 3 of 14

November 2008

�SUITABILITY

The level of benefit that any Salary Packaged item can provide will vary greatly depending on the Employee’s

personal circumstances and the level of Fringe Benefits Tax applicable to each Salary Packaged item.

The Calculator and Package BuilderTm located on the website are designed to allow you to assess your best

options 24 hours a day 7 days a week.

The benefits of an sgfleet Novated Lease are a lot easier to quantify and have been detailed in the back of this

handout.

sgfleet - employee starter pack

Page 4 of 14

November 2008

�GETTING STARTED

1. Visit the web site at www.sgfleet.com and log in to your dedicated area

using the code

UWS

2. View Salary Packaging Information

•

•

•

Information on Allowable Benefit Items

An Interactive Package BuilderTM

Relevant Forms & Processes for Non-Vehicle Related Salary Packaging

3. For all Novated Lease enquiries please contact a member of your dedicated

team of Account Managers to assist you through the entire process.

Your dedicated service team is the Green Team.

Green Team Account Managers

PH: 1800 818 487

Fax (02) 9391 5602

Account Manager

Colin Markley

Dirk Lievert

Rodney Walsh

Email Address

cmarkley@sgfleet.com

dlievert@sgfleet.com

rwalsh@sgfleet.com

One of the Green Team Account Managers will assist you from your initial enquiry and

right throughout the entire process, along with a Settlements Co-ordinator to ensure

your vehicle is delivered as required in good time with all paperwork in place.

SGFLEET ALONG WITH UWS RECOMMEND EMPLOYEES SEEK INDEPENDENT FINANCIAL ADVICE

BEFORE ENTERING INTO ANY NOVATED LEASE ARRANGEMENTS.

sgfleet - employee starter pack

Page 5 of 14

November 2008

�PROCEDURE TO APPLY FOR A NOVATED LEASE FACILITY

Prior to phoning sgfleet, we recommend Employees visit our informative website,

www.sgfleet.com & login ID UWS

to obtain preliminary Novated Leasing information

The Employee phones their sgfleet Account Manager to discuss vehicle and leasing options

and resolve any related queries. The Employee must also provide an estimate of their annual

Kilometres to assist with the preparation of a Vehicle Salary Sacrifice Schedule (VSSS).

The Account Manager will organise vehicle pricing tenders, then fax a VSSS

to the Employee outlining the annual budgeted cost to package (usually within 24hrs),

accompanied by a Novated Lease application form.

The Employee completes the

Application form and faxes it to

their sgfleet Account Manager

The Employee and ‘authorised’ company

representative sign the VSSS then fax it to

the Account Manager at sgfleet

Within 24hrs of receiving the signed Novated Lease Application and signed VSSS, the lease

documents are prepared and emailed or posted to the Employee's work or home address. The

vehicle is ordered as soon as the leasing finance has been approved.

Employee signs lease documentation then returns all documents to their sgfleet Settlement Co-ordinator.

Yes

Did we use an sgfleet Panel

Motor Vehicle Dealer?

The vehicle will be delivered within 1-2

days as sgfleet have credit

arrangements with our dealer network

No

The vehicle will not be delivered until

the lease settles and funds are

deposited into their account usually

within 7-14 days.

The authorised deductions are subsequently matched to the payment advice form

sgfleet - employee starter pack

Page 6 of 14

November 2008

�HOW AN SGFLEET NOVATED LEASE CAN BENEFIT YOU

You have choice, flexibility and satisfaction in ownership!

sgfleet gives you freedom of vehicle choice and the opportunity to be the registered owner,

providing you with total satisfaction.

Achieve real Tax $avings!

With an sgfleet novated lease you are able to “Salary Sacrifice” a portion of your pre-tax

income to accommodate a vehicle in your salary package providing you with potential tax

savings.

Pay no G$T!

Acquiring a vehicle through an sgfleet Novated Lease means that you will pay no GST on the

purchase price of the vehicle if purchased from a GST registered dealer. The Novation

Agreement allows the financier to claim a 100% Input Tax credit on the GST payable. This

represents a significant saving for you.

Running costs associated with your sgfleet Novated Lease are also GST free.

This

represents a 10% saving on all motor vehicle expenditure deducted pre-tax via payroll. Your

Employer will receive an Input Tax Credit for any GST that is applied to your vehicle running

expenses.

Compare running your vehicle without using the Salary Packaging mechanism to saving an

ongoing 10% on most components of motor vehicle expenditure (i.e. leasing costs, fuel,

maintenance, insurance etc) – the savings are very real.

Choose a Vehicle to suit your lifestyle!

You have a wide choice of vehicle make or model, including new and used vehicles up to 6

years old.

Choose a supplier that suits your needs!

sgfleet does not place any restrictions on where you buy your vehicle. Vehicles may be

purchased from licensed motor vehicle traders, private sales (e.g. purchase from

newspaper), sale and leaseback or any other legitimate means.

Access superior discounts!

As a private purchaser of a new vehicle you would receive only minimal discount. Acquiring

a vehicle through an sgfleet Novated Lease allows you to take advantage of sgfleet’s volume

purchasing power – this means greatly reduced prices for you!

sgfleet - employee starter pack

Page 7 of 14

November 2008

�Instant Cash Injection – Sale & Leaseback!

You can also choose to package the vehicle you currently own or have under finance.

sgfleet assists in determining the market value of your vehicle, then the Finance Company

pays the market value for the vehicle directly to you. You can then use these funds for any

purpose (e.g. investment, lump sum payment on your mortgage, debt consolidation etc).

The vehicle is then leased back to you under a Novated Lease arrangement allowing you to

pay for the vehicle using pre-tax salary for all or most of your vehicle expenses.

One Vehicle Policy!

You are only able to Salary Package one vehicle at a time as per your employer’s packaging

guidelines. Refer to your intranet website or Human Resources dept for further details.

Access discounts on all running costs!

Through sgfleet’s Australia wide Dealer Service Network (comprising of around 6,000 service

outlets), you receive up to 30% on all service, parts and labour costs. This is over and above

the existing pre-tax savings.

sgfleet’s Pre- Authorisation program delivers;

9 Significant discounts on labour rates.

9 Trade price on parts

9 An expert opinion on the value of the work to be performed prior to the work being

commenced.

9 A correct Tax Invoice to enable any GST credit claims.

On your terms!

The sgfleet Novated Lease is based on lease terms from 1 year to 5 years, depending on

your individual circumstances.

Protection against involuntary termination with – Lease Guard!

Lease Guard has been designed specifically for needs of Employees with Novated Leases.

In the event of involuntary termination or retrenchment, Lease Guard will cover your lease

payments for a period of unemployment. Following termination, the first lease payment is

paid by the policy holder, followed by up to 11 consecutive monthly lease payments then

covered by your policy. Leaseguard is another value added benefit designed to give you

peace of mind, and is recommended for all employees entering into a Novated Lease facility.

No out of pocket expenses!

You will never be left out of pocket for any vehicle related expenditure. Should you wish or

need to pay for a vehicle cost personally (such as fuel or maintenance), sgfleet will reimburse

you directly for any out of pocket expenses which you have incurred.

sgfleet - employee starter pack

Page 8 of 14

November 2008

�Only pay for what you use!

sgfleet uses an “Actual Cost Accounting” system which means that you only pay for what you

use. A fixed monthly amount is allocated from your pre-tax salary to accommodate your total

running expenses. This value is credited to your vehicle fund with sgfleet. All vehicle

related expenditure is then deducted from this fund. In the event that you do not spend your

entire allocation, the funds are passed back to you on an after tax basis through payroll at

lease end. sgfleet provide you with a monthly driver’s report advising whether you are on

target for both running costs and FBT. In the event you spent more than your budget, any

shortfall is also adjusted after tax via payroll. If you are not on track at any point throughout

your lease period, sgfleet can simply arrange to revise your annual budget accordingly.

Access to lease end benefits!

At the end of an sgfleet Novated Lease you will be in a position to offer to purchase the

vehicle at the predetermined residual value (plus GST) and sell or trade their vehicle at

market value. Under a Finance Lease you will directly benefit from any profit made on

disposal.

It’s portable!

In the event that you leave your Employer, you can retain the vehicle and may re-novate to

your new Employer.

Easy to stay informed!

sgfleet offer full online reporting and in addition will provide monthly reporting which will be

emailed directly to you, providing a fully itemised reconciliation of your total vehicle

expenditure, recording all debits/credits. This report also annualises kilometres so you can

easily track your kilometres for FBT purposes.

sgfleet - employee starter pack

Page 9 of 14

November 2008

�FREQUENTLY ASKED QUESTIONS

When should I start the process?

Depending on the make and model of the new vehicle, delivery times can be up to 3–4 mths.

We recommend that you contact sgfleet as soon as possible to discuss your requirements

with your dedicated Account Manager.

What lease term & residual value can I choose?

You can select lease terms of between 12 to 60 months. If you select a used vehicle the

lease term will be determined by the age and kilometres travelled by the vehicle.

Finance Lease Term

12 months

24 months

36 months

48 months

60 months

Residual Value

-

65%

55%

45%

35%

25%

These are the minimum residual values allowable by the Australian Taxation Office. Higher

residual values may be selected on consultation with your Account Manager.

How do I request a VSSS (quote)?

Quotes can be requested either directly by telephoning or emailing your dedicated Account

Manager or on–line through the sgfleet web site www.sgfleet.com

What information will my VSSS (quote) contain?

Your VSSS will contain the following information:

Section 1 – Employee details

Section 2 – Vehicle details

Section 3 – Finance details & FBT Method

Section 4 – Salary Sacrifice Estimate - All running costs based on estimated Kilometres

including, Statutory Fraction for FBT, Maintenance Budget, Tyres, Roadside Assistance

(optional), Registration, Insurance, Leaseguard, FBT (if applicable), Fuel Budget and sgfleet

management fee. These figures calculate the Total Estimated Pre-tax & Post-tax (if

applicable) annual cost which is the amount that will be deducted from your annual salary.

An estimated cost on your take-home pay in line with your pay cycle is also provided as a

guide.

Summary of Savings - Savings that can be achieved from GST on purchase price & GST on

pre-tax running costs, volume savings on running costs & income tax savings

Last Sections – Employee & Employer Authorisation

sgfleet - employee starter pack

Page 10 of 14

November 2008

�How is FBT calculated?

This method of calculating FBT is based only on the total number of kilometres travelled

each FBT year, regardless as to the level of business use involved in this travel.

Kilometre Band

FBT Bracket

Less than 15 000

15 000 to 24 999

25 000 to 40 000

Over 40 000

26%

20%

11%

7%

The annual FBT payable on a vehicle under the Statutory Fraction Method is calculated by

means of the following formula:

FBT payable =

(A x B x C) - E

--------------D

Where;

A = the capital cost of the car

B = the statutory fraction

C = the number of days in the FBT year when the car was used or available for private use of

Employee

D = the number of days in the FBT year

E = the Employee contribution (where applicable)

There no requirement to identify business use therefore there is no need to run a log book.

Remember that Employees are responsible for the actual FBT liability based on the

annualised kilometers traveled – during the FBT year (1st April – 31st March).

Employees not sacrificing at the highest Marginal Tax Rate are often best to package a

vehicle via the Employee Contribution Method (ECM). This method allows you to pay for

some of your vehicle costs from after-tax (nett) income via payroll. Every dollar you

contribute after-tax towards running your vehicle offsets the same amount in FBT, eliminating

FBT! (provided you meet your annual km bracket). Your sgfleet Account Manager will work

out the best FBT method for you based on the gross income figure you have provided.

Will sgfleet source my vehicle for me?

For new vehicles, sgfleet utilise a nationwide panel of approved new motor vehicle dealers to

service our national client base. The network covers remote locations as we have many

drivers spread across all corners of the country.

sgfleet’s panel of motor vehicle dealers delivers vehicles to the Employee. They also provide

sgfleet with credit facilities of 7 days which has proven invaluable in speeding up the vehicle

delivery process i.e. when using an sgfleet panel dealer the vehicle can be released once all

paperwork is signed. Non-panel dealers usually will not release the vehicle until settlement is

complete and the money is in their bank account.

sgfleet - employee starter pack

Page 11 of 14

November 2008

�For used vehicles, you have the option of sourcing a used vehicle personally by the usual

methods, or by utilising the many links available to various dealer portals via the The Red

Book Guide on the sgfleet website. This can be found at the Vehicle Package Calculator on

the fast find index on the sgfleet website - www.sgfleet.com sgfleet’s Used Vehicle Service

can also assist you to source a quality used car and also help you at time of disposal. Refer

to our website for further details on contact sgfleet on our toll-free number.

Can I source my own vehicle?

sgfleet offer the flexibility of allowing you to source and nominate your own dealer for new

and used vehicles. You are not “locked in” to buying the vehicle through sgfleet panel

dealers. You are also welcome to source your vehicle from a private sale or even leasing

back your own vehicle. The process for applying for a Novated Lease is the same for new

and used vehicles, except that dealers can occasionally request a deposit to hold a particular

used vehicle, which is generally refunded upon delivery. Please note that a private sale used

vehicle delivery can take a little longer to settle due to vehicle inspection requirements.

Please contact your sgfleet Account Manager for further details.

What do sgfleet do with my personal details for the Credit Application?

Details provided to sgfleet on your credit application are used only for the purpose of

obtaining credit approval. The Privacy Act ensures that this information is used only for the

purpose for which it was intended & cannot be shared with any other party (including your

employer).

Can I claim car wash and running expenses?

Car Washing, detailing and even minor paint repairs can be claimed against your sgfleet

Fund as these are considered “maintenance and upkeep of your vehicle”

Can I package Tolls and Infringement Notices?

Tolls and road traffic infringements do not form part of your vehicles operating expenses and

therefore cannot be salary packaged. You must pay for tolls and road traffic infringements

out of your own pocket.

Can I claim my motoring association membership?

Auto Club membership expenses are associated with running your vehicle and therefore can

be claimed against your sgfleet Fund.

Can I have accessories/extra’s fitted to my car?

Prior to ordering your vehicle you are free to add any option you choose. If during the term

of your lease you wish to fit extra’s to your car you must pay for this out to your own pocket.

You can not seek reimbursement for sgfleet for this type of expense. In order to gain the

maximum tax benefit & avoid additional paperwork, it is best to opt for all required

accessories at the time of enquiry with your sgfleet account manager. You must also

immediately notify your insurer if your have any extra’s fitted.

You must also immediately notify your insurer if your have any extra’s fitted.

sgfleet - employee starter pack

Page 12 of 14

November 2008

�If my repairer/dealer isn’t in the Drivers Guide, how do I request that they join the Gold

Club program?

If the repairer you use is not part of the sgfleet preferred repairers listing, please provide the

name of the repairer and their contact details to our Maintenance Department. They will

contact the repairer and seek to arrange their addition to the sgfleet preferred listing.

I’ve heard that Cash receipts must include the vehicle registration number and if not I

have to pay GST. Is this correct?

Receipts should have registration numbers on them to confirm the invoice relates to the

vehicle novated. The only exception to this is fuel, as it is too difficult to expect the fuel

attendant to write a receipt with the registration number etc on it.

How often are odometer readings required?

Odometer readings are updated on your vehicle report after the end of each month based on

the odometer readings provided via fuel purchases and vehicle servicing carried out in the

previous month. Once received, this information is then updated to your records and included

in your next monthly Driver’s Report. An odometer declaration is required by you per vehicle

for each year ending 31 March to reconcile your actual kms travelled to that budgeted for

payment of your FBT liability.

How do I know if my vehicle running fund expenses are running to budget?

sgfleet will email you a monthly Cost Allocation report which provides you with actual

expenditure vs. budgeted expenditure. sgfleet combine your entire vehicle running costs into

one fund enabling costs to be distributed evenly e.g. your fuel budget won’t be in deficit while

you have extra funds sitting in your maintenance account.

sgfleet Revised Package Dept receive an exception report every month highlighting any

driver who has a Fund balance of greater than $1,500 in debit. The Revision Officer reviews

that Employee’s transaction history to determine whether they are really “off track”, or,

whether it is a timing difference only.

Where there is a genuine deviation from the budget, the dedicated Revision Officer will

contact the Employee to discuss the situation. If necessary a new VSSS will be prepared

with the required (increased) salary allocation to rectify the position and ensure adequate

funds are being provided.

How do I know if I am going to meet my FBT bracket?

Your Monthly Cost Allocation report annualises the last provided odometer readings and

compares the actual FBT liability (FBT Year to Date) to the FBT provision that has been

deducted from your salary to date. It is therefore extremely important to provide an

odometer reading at every fuel fill!

Every month you can see how you are tracking with your kilometres for FBT purposes and

whether you are on track with budgeted running costs. You may request a revised VSSS at

any time, even if you are within the negative balance tolerable limit.

sgfleet - employee starter pack

Page 13 of 14

November 2008

�What if I leave the company?

If you leave the company the vehicle goes with you, and the novation agreement ceases.

You can choose to either pay out the lease or continue making lease payments personally

via a direct debit. You will have a direct relationship with the financier, just as if you had

finance on a personal motor vehicle now. Your sgfleet maintenance fund (where all

your deductions go) is reconciled and the funds returned to you via payroll. You may also

have the opportunity to re-novate the lease to a new employer if they are happy to be the

new novator, so you can once again enjoy the many benefits on the sgfleet Novated Lease

Program. Continued management of your vehicle is dependant upon whether sgfleet has an

arrangement with the new employer in managing their novated lease program.

sgfleet - employee starter pack

Page 14 of 14

November 2008

�

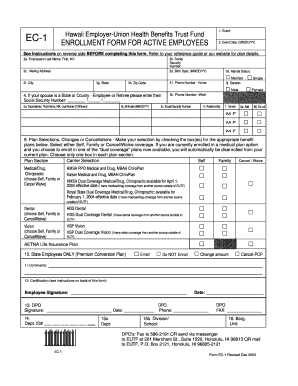

Valuable advice on preparing your ‘Enrollment Form For Active Employees Hawaii’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features offered by this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Follow this step-by-step guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Enrollment Form For Active Employees Hawaii’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with your colleagues on your Enrollment Form For Active Employees Hawaii or send it for notarization — our service provides all you need to accomplish these tasks. Register for an account with airSlate SignNow today and elevate your document management to new levels!