Fill and Sign the Estate After Death Form

Valuable suggestions for preparing your ‘Estate After Death’ online

Are you fed up with the inconvenience of handling paperwork? Search no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the powerful features included in this user-friendly and economical platform to transform your document management approach. Whether you need to approve forms or collect eSignatures, airSlate SignNow simplifies the process with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a free trial with our service.

- Hit +Create to upload a document from your device, cloud storage, or our form collection.

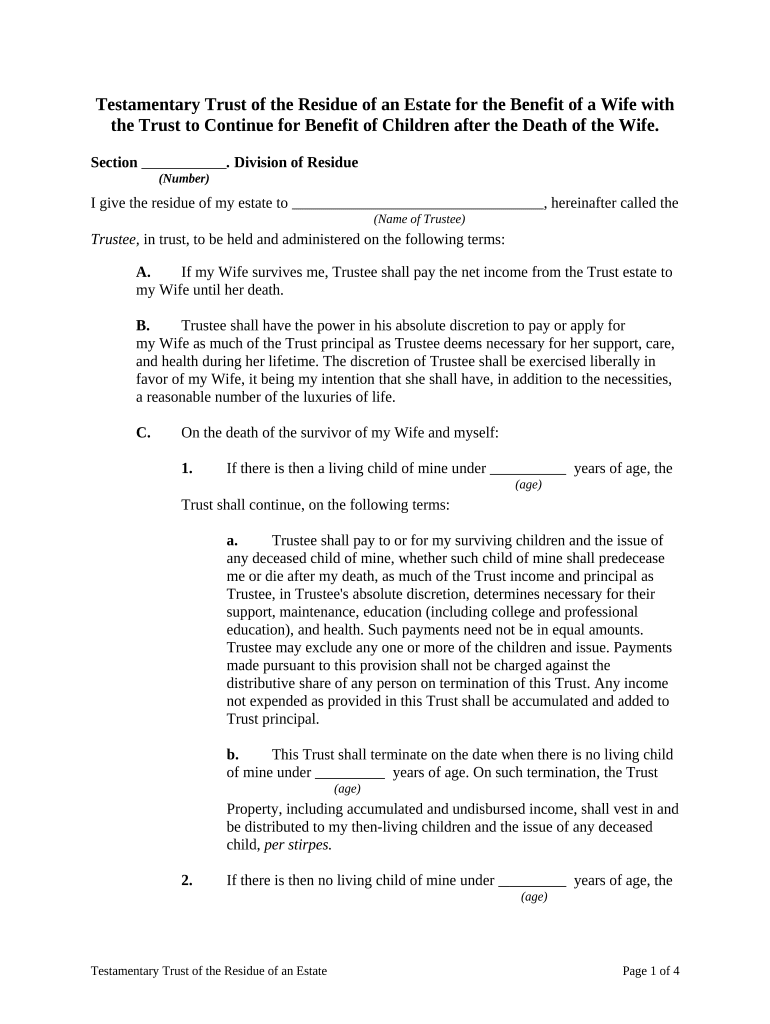

- Open your ‘Estate After Death’ in the editor.

- Select Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite options to seek eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you have to work with your teammates on your Estate After Death or send it for notarization—our platform provides everything you need to accomplish these tasks. Set up an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the process for managing an estate after death with airSlate SignNow?

Managing an estate after death involves several steps that can be streamlined using airSlate SignNow. Our platform allows you to easily create, sign, and store essential documents like wills and estate plans securely. With our intuitive interface, you can ensure that all necessary paperwork is completed quickly and accurately, facilitating a smoother estate settlement process.

-

How can airSlate SignNow help with eSigning estate documents after death?

airSlate SignNow simplifies the eSigning of estate documents after death by providing a user-friendly platform for all parties involved. Whether it's for wills, trusts, or powers of attorney, our solution allows you to send documents for signature and track their progress in real-time. This efficiency helps expedite the management of an estate after death, ensuring timely execution of the deceased’s wishes.

-

Are there any costs associated with using airSlate SignNow for estate management after death?

Yes, airSlate SignNow offers various pricing plans that cater to individual needs, including features specifically beneficial for managing an estate after death. Our plans are competitively priced to provide cost-effective solutions for document management and eSigning. You can choose a plan that best fits your requirements while ensuring all necessary estate documents are handled efficiently.

-

What features does airSlate SignNow offer for handling estate documents after death?

airSlate SignNow provides a range of features ideal for managing estate documents after death, including customizable templates, secure cloud storage, and multi-party signing capabilities. Our platform ensures that all documents are legally binding and securely stored, making it easier for executors to handle estates efficiently. Additionally, you can access audit trails to track document status and compliance.

-

Can airSlate SignNow integrate with other tools when managing an estate after death?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms that are essential for managing an estate after death. Whether it's accounting software, document management systems, or CRM tools, our integrations enhance your workflow and ensure that all necessary information is centralized, making estate management more efficient.

-

What are the benefits of using airSlate SignNow for estate after death documentation?

Using airSlate SignNow for estate after death documentation offers numerous benefits, including enhanced security, ease of use, and reduced turnaround time for document signing. Our platform ensures that all estate documents are handled with the utmost confidentiality and legality. Plus, the ability to manage everything online means less hassle and more focus on fulfilling the deceased's wishes.

-

Is airSlate SignNow legally compliant for estate after death documents?

Yes, airSlate SignNow is fully compliant with legal standards for eSigning, ensuring that all documents related to an estate after death are valid and enforceable. Our platform adheres to the ESIGN Act and UETA, providing you with peace of mind that your estate documents are executed in compliance with applicable laws. This legal assurance is crucial for the proper handling of any estate matters.

The best way to complete and sign your estate after death form

Find out other estate after death form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles