I.D. Control # ________________

License # ________________

DEBENTURE

*****************

(the "Original Principal Amount")

$

(the "Maturity Date")

(the "Company")

(Street)

(City)

(State)

(Zip)

PART I -- PERIOD SPECIFIC TERMS

A.

Applicable for the Scheduled Interim Period (and New Interim

Periods, as applicable)

Interest rate per annum for the Scheduled Interim Period:

Annual Charge applicable to the Scheduled Interim Period:

%

% per annum

Date of Issuance:

Scheduled Pooling Date:

Scheduled Interim Period:

from and including the Date of Issuance

to but excluding the Scheduled Pooling Date

The following italicized terms will apply if the Interim Period is

extended by SBA:

New

New

New

New

interest rate(s) per annum

(a)_______%

Annual Charge per annum

(a)_______%

Pooling Date(s):

(a)

Interim Period(s): from and including:(a)

to but excluding: (a)

(b)

(b)

(b)

(b)

(b)

% (c)______%

% (c)______%

(c)______

(c)______

(c)______

The Company, for value received, promises to pay to JPMorgan Chase Bank

N.A., as Custodian (the "Custodian") for the U.S. Small Business

Administration ("SBA") and SBIC Funding Corporation (the "Funding

Corporation"), pursuant to the Custody and Administration Agreement (the

"Custody Agreement") dated as of April 27, 1998 among SBA, the Funding

Corporation, the Federal Home Loan Bank of Chicago, as Interim Funding

Provider (the "Interim Funding Provider"), and the Custodian, as

amended,: (i) interest on the Original Principal Amount listed above at

the applicable rate per annum listed above, and (ii) an Annual Charge on

the Original Principal Amount listed above at the applicable rate per

annum listed above, each at such location as SBA, as guarantor of this

Debenture, may direct and each at the related rate per annum identified

for the Scheduled Interim Period (and each New Interim Period, if any).

SBA FORM 444C (Revised 9/06)

1 of 4

�This Debenture will bear interest for, and the Annual Charge will apply

to, the Scheduled Interim Period (and each New Interim Period, if any)

at the rate(s) and for the applicable period(s) indicated above, to be

paid in arrears by 1:00 p.m. (New York City time) on the Business Day

prior to the Scheduled Pooling Date (and each New Pooling Date, if any)

listed above. As used throughout this Debenture, "Business Day" means

any day other than: (i) a Saturday or Sunday; (ii) a legal holiday in

Washington, D.C.; and (iii) a day on which banking institutions in New

York City are authorized or obligated by law or executive order to be

closed. Interest on this Debenture and the Annual Charge for the

Scheduled Interim Period (and each New Interim Period, if any) will each

be computed on the basis of the actual number of days in the applicable

Interest Period divided by 360. The Company may not prepay this

Debenture, in whole or in part, during the Scheduled Interim Period or

any New Interim Period.

B.

This Section B. is effective only after (i) the Scheduled

Interim Period and any New Interim Period(s) expire and (ii)

the Custodian receives this Debenture for pooling.

The Company, for value received, promises to pay to the order of

JPMorgan Chase Bank N.A., acting as Trustee (the "Trustee") under that

certain Amended and Restated Trust Agreement dated as of February 1,

1997, as the same may be amended from time to time, by and among the

Trustee, the SBA and SBIC Funding Corporation, and as the Holder hereof,

interest semiannually on March 1st and September 1st (the "Payment

Dates") of each year, at such location as SBA, as guarantor of this

Debenture, may direct at the rate of

% per annum (the

"Stated Interest Rate"), and to pay a ______% per annum fee (the “Annual

Charge”) to SBA on each Payment Date, each calculated on the basis of a

year of 365 days, for the actual number of days elapsed (including the

first day but excluding the last day), on the Original Principal Amount

from the last day of the Interim Period until payment of such Original

Principal Amount has been made or duly provided for. The Company shall

deposit all payments with respect to this Debenture not later than 12:00

noon (New York City time) on the applicable Payment Date or the next

Business Day if the Payment Date is not a Business Day, all as directed

by SBA.

The Company may elect to prepay this Debenture, in whole and not in

part, on any Payment Date, in the manner and at the price as next

described. The prepayment price (the "Prepayment Price") must be an

amount equal to the Original Principal Amount, plus interest accrued and

unpaid thereon to the Payment Date selected for prepayment together with

the accrued and unpaid Annual Charge thereon to the Payment Date

selected for prepayment.

The amount of the Prepayment Price must be sent to SBA or such agent as

SBA may direct, by wire payment in immediately available funds, not less

than three Business Days prior to the regular Payment Date. Until the

Company is notified otherwise in writing by SBA, any Prepayment Price

must be paid to the account maintained by the Trustee, entitled the SBA

Prepayment Subaccount and must include an identification of the Company

by name and SBA-assigned license number, the loan number appearing on

the face of this Debenture, and such other information as SBA or its

agent may specify.

SBA FORM 444C (Revised 9/06)

2 of 4

�II. -- GENERAL TERMS

For value received, the Company promises to pay to the order of the

Trustee the Original Principal Amount on the Maturity Date at such

location as SBA, as guarantor of this Debenture, may direct.

This Debenture is issued by the Company and guaranteed by SBA, pursuant

and subject to Section 303 of the Small Business Investment Act of 1958,

as amended (the "Act") (15 U.S.C. Section 683). This Debenture is

subject to all of the regulations promulgated under the Act, as amended

from time to time, provided, however, that 13 C.F.R. Sections 107.1810

and 107.1830 through 107.1850 as in effect on the date of this Debenture

are incorporated in this Debenture as if fully set forth. If this

Debenture is accelerated, then the Company promises to pay an amount

equal to the Original Principal Amount of this Debenture, plus interest

and Annual Charge accrued and unpaid thereon to but excluding the next

Payment Date following such acceleration.

This Debenture is deemed issued in the District of Columbia as of the

day, month, and year first stated above. The terms and conditions of

this Debenture must be construed in accordance with, and its validity

and enforcement governed by, federal law.

The warranties, representations, or certification made to SBA on any SBA

Form 1022 or any application letter of the Company for an SBA commitment

related to this Debenture, and any documents submitted in connection

with the issuance of this Debenture, are incorporated in this Debenture

as if fully set forth.

Should any provision of this Debenture or any of the documents

incorporated by reference in this Debenture be declared illegal or

unenforceable by a court of competent jurisdiction, the remaining

provisions will remain in full force and effect and this Debenture must

be construed as if such provisions were not contained in this Debenture.

All notices to the Company which are required or may be given under this

Debenture shall be sufficient in all respects if sent to the above-noted

address of the Company. For the purposes of this Debenture, the Company

may change this address only upon written approval of SBA.

SBA FORM 444C (Revised 9/06)

3 of 4

�Execution of this Debenture by the Company's general partner, in the

case that the Company is organized as a limited partnership, shall not

subject the Company's general partner to liability, as such, for the

payment of any part of the debt evidenced by this Debenture.

COMPANY ORGANIZED AS LIMITED PARTNERSHIP

(CORPORATE GENERAL PARTNER)

-----------------------------------------IN WITNESS WHEREOF, the Company's general partner has caused this

Debenture to be signed by its duly authorized officer and the corporate

seal of the general partner to be affixed and attested by its Secretary

or Assistant Secretary as of the date of issuance stated above.

CORPORATE SEAL

(Name of Licensee)

By:

(Corporate General Partner)

By:

(Typed Name and Title)

ATTEST:

Secretary or Assistant Secretary

(Strike One)

SBA FORM 444C (Revised 9/06)

4 of 4

�COMPANY ORGANIZED AS CORPORATION

IN WITNESS WHEREOF, the Company has caused this debenture to be signed

by its duly authorized officer and its corporate seal to be hereunto

affixed and attested by its Secretary or Assistant Secretary as of the

date of issuance stated above.

CORPORATE SEAL

(Name of Licensee)

By:

(Typed Name and Title)

ATTEST:

Secretary or Assistant

Secretary (Strike One)

SBA FORM 444C (Revised 9/06)

4 of 4

�Execution of this debenture by the Company's general partner, in the

case that the Company is organized as a limited partnership, shall not

subject the Company's general partner to liability, as such, for the

payment of any part of the debt evidenced by this debenture.

COMPANY ORGANIZED AS LIMITED PARTNERSHIP

(GENERAL PARTNERSHIP GENERAL PARTNER)

----------------------------------------IN WITNESS WHEREOF, this debenture has been signed by the general

partner of the Company's general partner as of the date of issuance

stated above.

(Name of Licensee)

By:

(Name of General Partnership General Partner)

By:

Typed Name)

GENERAL PARTNER

SBA FORM 444C (Revised 9/06)

4 of 4

�Execution of this debenture by the Company's general partner, in the

case that the Company is organized as a limited partnership, shall not

subject the Company's general partner to liability, as such, for the

payment of any part of the debt evidenced by this debenture.

COMPANY ORGANIZED AS LIMITED PARTNERSHIP

(INDIVIDUAL GENERAL PARTNER)

----------------------------------------IN WITNESS WHEREOF, this debenture has been signed by the Company's

general partner as of the date of issuance stated above.

(Name of Licensee)

By:

(Typed Name)

GENERAL PARTNER

SBA FORM 444C (Revised 9/06)

4 of 4

�Execution of this debenture by the Company's general partner, in the

case that the Company is organized as a limited partnership, shall not

subject the Company's general partner to liability, as such, for the

payment of any part of the debt evidenced by this debenture.

COMPANY ORGANIZED AS LIMITED PARTNERSHIP

(LIMITED PARTNERSHIP GENERAL PARTNER)

----------------------------------------IN WITNESS WHEREOF, this debenture has been signed by the general

partner of the Company's general partner as of the date of issuance

stated above.

(Name of Licensee)

By:

(Name of Limited Partnership General Partner)

By:

(Typed Name)

GENERAL PARTNER

SBA FORM 444C (Revised 9/06)

4 of 4

�Execution of this debenture by the Company's general partner, in

the case that the Company is organized as a limited partnership, shall

not subject the Company's general partner to liability, as such, for the

payment of any part of the debt evidenced by this debenture.

COMPANY ORGANIZED AS LIMITED PARTNERSHIP

(LIMITED LIABILITY COMPANY GENERAL PARTNER)

IN WITNESS WHEREOF, the Company’s general partner has caused this

debenture to be signed by its duly authorized representative as of the

date of issuance stated above.

(Name of Licensee)

By:

(Name of Limited Liability Company General Partner)

By:

(Typed Name)

GENERAL PARTNER

SBA FORM 444C (Revised 9/06)

4 of 4

�

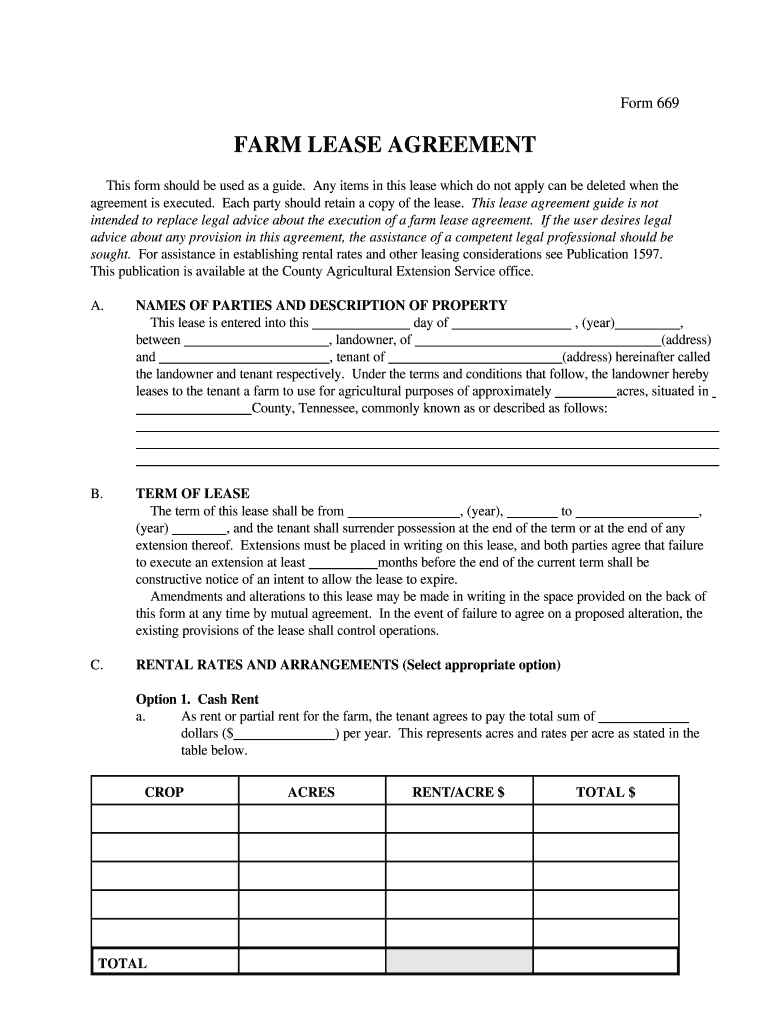

Useful suggestions for preparing your ‘Farm Lease Form’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Wave goodbye to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the comprehensive features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Access your ‘Farm Lease Form’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Farm Lease Form or send it for notarization—our platform offers everything you require to complete such endeavors. Register with airSlate SignNow today and elevate your document management to a new standard!