Fill and Sign the Form 1041 N Rev January 2005 Fill in Capable Us Income Tax Return for Electing Alaska Native Settlement Trusts

Practical tips for setting up your ‘Form 1041 N Rev January 2005 Fill In Capable Us Income Tax Return For Electing Alaska Native Settlement Trusts’ online

Are you fed up with the inconvenience of handling documentation? Look no further than airSlate SignNow, the premier digital signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features contained in this intuitive and cost-effective platform and transform your method of document management. Whether you need to sign documents or gather signatures, airSlate SignNow makes the process simple, requiring just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Form 1041 N Rev January 2005 Fill In Capable Us Income Tax Return For Electing Alaska Native Settlement Trusts’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or transform it into a multi-use template.

Don’t be concerned if you need to collaborate with your colleagues on your Form 1041 N Rev January 2005 Fill In Capable Us Income Tax Return For Electing Alaska Native Settlement Trusts or send it for notarization—our platform equips you with all the tools necessary to achieve such tasks. Register with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

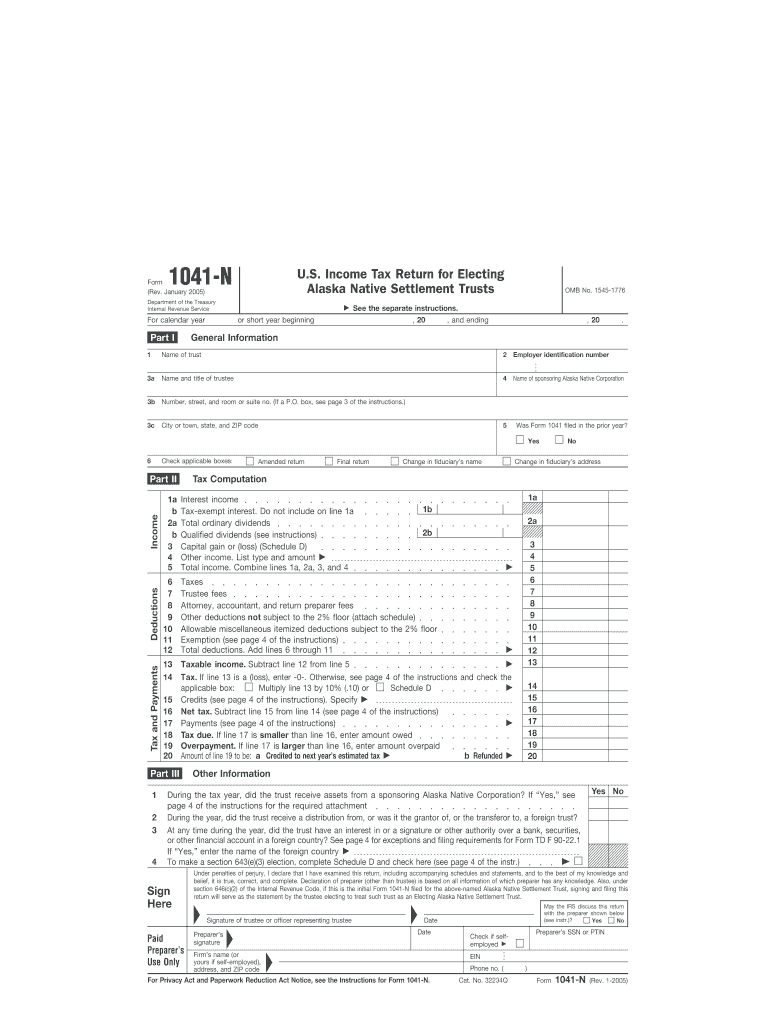

What is Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts is a tax form specifically designed for Alaska Native Settlement Trusts to report income, deductions, and credits. This form ensures compliance with U.S. tax regulations while providing a straightforward method for trustees to file their returns.

-

How can airSlate SignNow help with Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow streamlines the process of preparing and submitting the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our platform allows users to fill in, sign, and send the form electronically, making tax season less stressful and more efficient.

-

Is there a cost associated with using airSlate SignNow for filing Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, airSlate SignNow offers various subscription plans tailored to different needs, including options for individuals and businesses. While specific pricing may vary, we ensure our services remain cost-effective for users needing to file the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts.

-

What features does airSlate SignNow offer for managing Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow includes features like document templates, customizable workflows, and secure eSignatures, all designed to simplify the management of Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. Users can easily track their document status and ensure timely submissions.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Absolutely! airSlate SignNow supports integrations with popular accounting software that can enhance your workflow for filing the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. This allows for seamless data transfer and improved efficiency.

-

Is airSlate SignNow secure for filing Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your personal and financial information while you prepare and submit the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts.

-

What kind of support does airSlate SignNow provide for users of Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Our dedicated customer support team is available to assist users with any questions or issues related to Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. We offer resources such as tutorials, FAQs, and live chat support to ensure a smooth experience.

Find out other form 1041 n rev january 2005 fill in capable us income tax return for electing alaska native settlement trusts

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles