Fill and Sign the Form 990 Policy Series Public Counsel Publiccounsel

Valuable Suggestions for Preparing Your ‘Form 990 Policy Series Public Counsel Publiccounsel’ Online

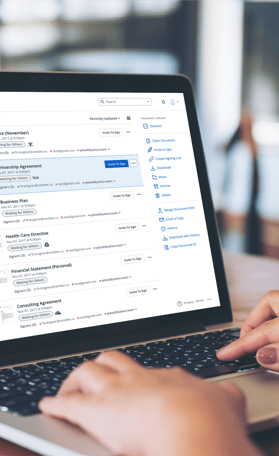

Are you fed up with the burden of handling documentation? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the cumbersome task of printing and scanning files. With airSlate SignNow, you can seamlessly finalize and sign documents online. Utilize the robust features packed into this intuitive and cost-effective platform to transform your methodology for document management. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all effortlessly, requiring only a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our template library.

- Access your ‘Form 990 Policy Series Public Counsel Publiccounsel’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

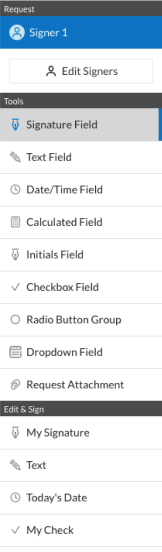

- Add and assign fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or transform it into a reusable template.

Don’t fret if you need to work together with your teammates on your Form 990 Policy Series Public Counsel Publiccounsel or send it for notarization—our platform is equipped with everything you require to complete such endeavors. Establish an account with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

What is the Form 990 Policy Series from Public Counsel?

The Form 990 Policy Series from Public Counsel provides essential guidance on how nonprofit organizations can effectively prepare and file their Form 990. This series addresses key issues and best practices to enhance transparency and compliance in the nonprofit sector. By utilizing the Form 990 Policy Series from Public Counsel, organizations can better navigate the complexities of IRS requirements.

-

How can airSlate SignNow help with Form 990 submissions?

airSlate SignNow offers a seamless eSigning solution that simplifies the process of signing Form 990 documents. With its user-friendly interface, organizations can quickly send, sign, and store Form 990 filings, ensuring that all necessary documents are signed and submitted on time. This efficiency is crucial for maintaining compliance with the Form 990 Policy Series from Public Counsel.

-

What are the pricing options for using airSlate SignNow with Form 990 documents?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes, ensuring that accessing tools for Form 990 submissions is cost-effective. Whether you are a small nonprofit or a large organization, there is a plan suited for your needs. Each plan offers features to enhance your experience with the Form 990 Policy Series from Public Counsel.

-

Are there any integrations available with airSlate SignNow for Form 990 management?

Yes, airSlate SignNow integrates with various platforms, allowing for easy management of Form 990 documents alongside your other business tools. This means you can connect your accounting software, CRMs, and other applications to streamline the preparation and filing of Form 990. Integration with airSlate SignNow enhances the efficiency of the Form 990 Policy Series from Public Counsel.

-

What are the benefits of using airSlate SignNow for nonprofit organizations?

Nonprofit organizations benefit greatly from using airSlate SignNow when dealing with Form 990 documents. Its easy-to-use platform not only speeds up the eSigning process but also ensures that documents are securely stored and easily accessible. By leveraging airSlate SignNow, organizations can focus more on their mission rather than administrative tasks related to the Form 990 Policy Series from Public Counsel.

-

Can airSlate SignNow assist in tracking Form 990 filing deadlines?

Absolutely, airSlate SignNow includes features that help organizations track important deadlines related to Form 990 filings. Users can set reminders and receive notifications to ensure that they never miss a filing date. This functionality is especially beneficial for compliance with the guidelines outlined in the Form 990 Policy Series from Public Counsel.

-

Is airSlate SignNow compliant with regulations related to Form 990?

Yes, airSlate SignNow is fully compliant with the necessary regulations for eSigning documents, including Form 990. The platform adheres to the legal standards set forth for electronic signatures, ensuring that your Form 990 submissions meet all regulatory requirements. This compliance is essential for maintaining the trust and integrity emphasized in the Form 990 Policy Series from Public Counsel.

Related searches to form 990 policy series public counsel publiccounsel

Find out other form 990 policy series public counsel publiccounsel

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles