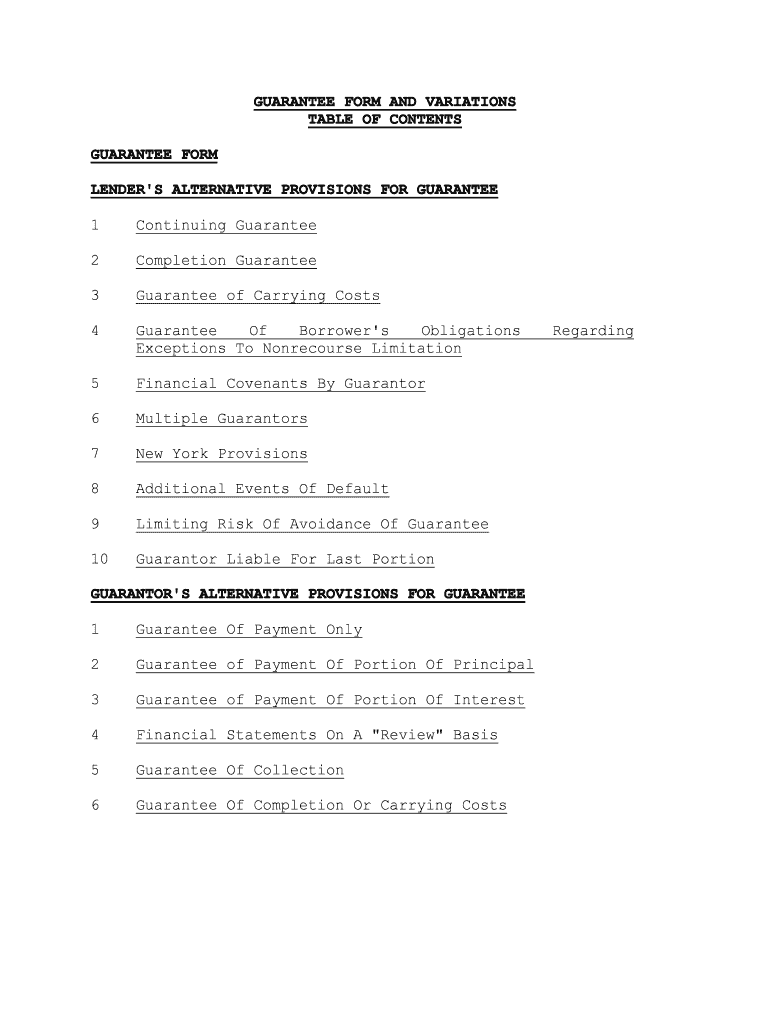

GUARANTEE FORM AND VARIATIONS

TABLE OF CONTENTS

GUARANTEE FORM

LENDER'S ALTERNATIVE PROVISIONS FOR GUARANTEE

1 Continuing Guarantee

2 Completion Guarantee

3 Guarantee of Carrying Costs

4 Guarantee Of Borrower's Obligations Regarding

Exceptions To Nonrecourse Limitation

5 Financial Covenants By Guarantor

6 Multiple Guarantors

7 New York Provisions

8 Additional Events Of Default

9 Limiting Risk Of Avoidance Of Guarantee

10 Guarantor Liable For Last Portion

GUARANTOR'S ALTERNATIVE PROVISIONS FOR GUARANTEE

1 Guarantee Of Payment Only

2 Guarantee of Payment Of Portion Of Principal

3 Guarantee of Payment Of Portion Of Interest

4 Financial Statements On A "Review" Basis

5 Guarantee Of Collection

6 Guarantee Of Completion Or Carrying Costs

GUARANTEE FORM

GUARANTEE1

{{{29/COUNTY OF ORIGINAL LOAN CLOSING}}},

{{{30/STATE OF ORIGINAL LOAN

CLOSING}}} {{{28/DATE OF ORIGINAL LOAN CLOSING}}}

WHEREAS, {{{31/BORROWER}}}, {{{40/TYPE OF BORROWER}}},

having an office at {{{32/ADDRESS OF BORROWER}}} (the

"Borrower

"), has applied to {{{1/LENDER}}}, {{{9/TYPE OF

LENDER}}}, having an office at {{{2/ADDRESS OF LENDER (FOR

NOTICES)}}} (the "Lender

"), for a loan, line of credit, or other

financing or financial accommodation in the maximum aggregate

principal sum of ${{{19/AMOUNT OF LOAN}}} (such loan, line of

credit, financing and other financial accommodation being

collectively called the "Loan

"), which Loan will be evidenced by

the note dated {{{28/DATE OF ORIGINAL LOAN CLOSING}}} in the

original principal sum of ${{{19/AMOUNT OF LOAN}}} made by the Borrower to the Lender (the "Note

");

WHEREAS the Lender is willing to make the Loan to the

Borrower only if {{{61/GUARANTOR}}} (the "Guarantor

") executes

and delivers this Guarantee and guarantees payment to the Lender

of the Indebtedness (defined below), and the performance of the Borrower's obligations, as provided in this Guarantee;

NOW, THEREFORE, in consideration of the premises and other

good and valuable consideration, the receipt and legal

sufficiency of which are hereby acknowledged, and in order to

induce the Lender to make the Loan to the Borrower, the

Guarantor hereby acknowledges, agrees and confirms that all of

the above recitals are true, correct and complete and hereby covenants and agrees with the Lender as follows:

Guarantee of Indebtedness; Definition of

"Indebtedness" and "Loan Documents" . The Guarantor

1 See Chapter 8 of the main text of this book for more details

regarding guarantees and other credit enhancements. This Chapter may discuss variations of the following form which are not included in such form and which are applicable to your particular transaction.

Suggested language for guarantees in mortgage securitizations has

been incorporated in the following form of guarantee. See Standard & Poor's, Legal and Structured Finance Issues in Commercial Mortgage

Securities at 92-94 (September 1995).

guarantees, absolutely, irrevocably and unconditionally, to the

Lender the payment of the Indebtedness, and the performance of

all obligations of the Borrower under the Loan Documents. "Indebtedness

," as used in this Guarantee, means all principal,

interest, additional interest (including, without limitation,

all interest accruing from and after the commencement of any

case, proceeding or action under any existing or future laws

relating to bankruptcy, insolvency or similar matters with

respect to the Borrower, all interest described in this

parenthetical being called the "Post-Bankruptcy Interest

"), and

all other sums of any nature whatsoever, which may or shall

become due and payable pursuant to the provisions of either the

Note, this Guarantee, or any other document or instrument

evidencing, securing, or guaranteeing payment of the indebtedness evidenced by the Note (in whole or in part) or any

other amount payable under any other document now or hereafter

executed and delivered in connection with such indebtedness or

the Note (the Note, and each such other document and instrument,

being collectively called the "Loan Documents

"). The

Guarantor's obligations under this Guarantee shall not be

affected by: 1) modification of the Indebtedness or any Loan

Document in any bankruptcy or insolvency proceeding, or 2) the

fact that the Lender may not have an allowed claim for the

Indebtedness or the other obligations under the Loan Documents,

against the Borrower, as a result of any bankruptcy or insolvency proceeding or otherwise.

Guarantee of Payment And Performance

. This Guarantee

is a guaranty of payment and performance, and not merely of

collection. The Guarantor further waives any right to require

that any action be brought against the Borrower or any other

person or party or to require that resort be had to any security

or to any balance of any deposit account or credit on the books

of the Lender in favor of the Borrower or any other person or

party. Any payment on account of or reacknowledgment of the

Indebtedness by the Borrower, or any other party liable for the

Indebtedness shall be deemed to be made on behalf of the

Guarantor and shall serve to start anew the statutory period of limitations applicable to the Indebtedness. 2

Guarantor's Obligations Absolute, Unconditional And

Irrevocable . The Guarantor acknowledges that this Guarantee,

and the Guarantor's obligations under this Guarantee, are and

shall at all times continue to be absolute, irrevocable and

unconditional in all respects, irrespective of the value,

2 Note that if the Guarantee is only a partial guarantee, the Lender may wish to

modify this language. For example, the modified language could provide that the statute

of limitations is deemed extended by the Borrower's payment, but the Guarantor does not

receive credit against its Share of the Indebtedness.

genuineness, validity, regularity, or enforceability of the

Obligations or the Loan Documents, and irrespective of any law,

regulation or order now or hereafter in effect in any

jurisdiction affecting the Obligations or the Loan Documents.

The liability of the Guarantor under this Guarantee is not, and

will not be, subject to any reduction, limitation, impairment,

termination, defense, offset, counterclaim or recoupment

whatsoever, whether: 1) by reason of any claim of any character

whatsoever (including, without limitation, any claim of waiver,

release, surrender, alteration, or compromise), or 2) by reason

of any liability at any time to the Guarantor or otherwise, or

3) based upon any obligations or any other agreement or

otherwise, and however arising, or 4) out of action or inaction

or otherwise or 5) arising from default, willful misconduct,

negligence or otherwise. This Guarantee (and the Guarantor's

obligations under this Guarantee) shall at all times be valid

and enforceable, irrespective of any other agreement or

circumstance of any nature whatsoever which might otherwise constitute a defense to:1) this Guarantee, or

2) the obligations of the Guarantor under this

Guarantee, or

3) the obligations of any other person or party

(including, without limitation, the Borrower) relating to this Guarantee, or

4) the obligations of the Guarantor under this

Guarantee or otherwise with respect to the Loan or the Indebtedness,

including, without limitation, each of the following:

A) the filing of a petition under Title 11 (or any

successor or replacement provision) of the United States Code with regard to the Borrower or the Guarantor, or

B) the commencement of an action or proceeding for the

benefit of the creditors of the Borrower or the Guarantor, or

C) the realization upon any collateral given, pledged

or assigned as security for all or any portion of the Indebtedness, or

D) the obtaining by the Lender of title to any

collateral given, pledged or assigned as security for the

Indebtedness by reason of foreclosure or enforcement of the

Lender's lien on such collateral, the acceptance of an

assignment or deed in lieu of foreclosure or sale, or otherwise, orE) any lack of validity or enforceability of the

Indebtedness or the Loan Documents or any agreement or

instrument relating to the Indebtedness or any of the Loan Documents.

This Guarantee sets forth the entire agreement and understanding, between both the Lender and the Guarantor, with

respect to the matters covered by this Guarantee. The Guarantor

acknowledges that no oral or other agreements, understandings,

representations or warranties exist with respect to this

Guarantee or with respect to the obligations of the Guarantor

under this Guarantee, except those specifically set forth in this Guarantee.

Waiver by Guarantor Of Notices, Protest, Demand, Etc.

The Guarantor hereby waives (unless and to the extent such

waiver is prohibited by applicable law):

4.1 notice of acceptance of this Guarantee, and

notice of the making of the Loan (and the making of any advance of proceeds of the Loan) by the Lender to the Borrower;

4.2 presentment and demand for payment of the

Indebtedness or any portion thereof;

4.3 protest and notice of dishonor or default to the

Guarantor or to any other person or party with respect to the Indebtedness or any portion thereof;

4.4 all other notices to which the Guarantor might

otherwise be entitled; and

4.5 any demand under this Guarantee.

Waiver by Guarantor of Defenses, Setoffs, Etc.

The

Guarantor absolutely, unconditionally and irrevocably waives any

and all right to assert or interpose any defense (other than the

final and indefeasible payment in full of the Indebtedness, if

and to the extent such payment has actually been made and has

not been disgorged by the Lender), setoff, counterclaim,

reduction, limitation, impairment, termination, recoupment or

crossclaim of any nature whatsoever with respect to this

Guarantee or the obligations of the Guarantor under this

Guarantee or the obligations of any other person or party

(including without limitation, the Borrower) relating to this

Guarantee or the obligations of the Guarantor under this

Guarantee or otherwise with respect to the Loan in any action or

proceeding brought by the Lender to collect the Indebtedness, or

any portion thereof, or to enforce the obligations of the

Guarantor under this Guarantee (provided, however, that the

foregoing shall not be deemed a waiver of the right of the

Guarantor to assert any compulsory counterclaim maintained in a

court of the United States, or of the State of {{{87/STATE WHOSE

LAW GOVERNS}}} if such counterclaim is compelled under local law

or rule of procedure, nor shall the foregoing be deemed a waiver

of the right of the Guarantor to assert any claim which would

constitute a defense, setoff, counterclaim or crossclaim of any

nature whatsoever against the Lender in any separate action or proceeding). Waiver by Guarantor of Rights of Subrogation,

Indemnity, Etc. Notwithstanding any payment made by the

Guarantor pursuant to the provisions of this Guarantee, the

Guarantor shall not seek to enforce or collect upon (and the

Guarantor hereby waives) any right (either direct or indirect)

which the Guarantor now has or may acquire (against the Borrower

or any other person or entity) either by way of subrogation,

indemnity, reimbursement, contribution, or other right of

payment or recovery, for any amount paid under this Guarantee or

by way of any other obligation whatsoever of the Borrower to the

Guarantor, nor shall the Guarantor file, assert or receive

payment on any claim, whether now existing or hereafter arising,

against the Borrower in the event of the commencement of a case

by or against the Borrower under Title 11 (or any successor or

replacement provision) of the United States Code. In the event

either a petition is filed under said Title 11 (or any successor

or replacement provision) of the United States Code with regard

to the Borrower, or an action or proceeding is commenced for the

benefit of the creditors of the Borrower, this Guarantee shall

at all times thereafter remain effective in regard to each

payment or other transfer of assets to the Lender received from

or on behalf of the Borrower which is or may be held voidable on

the ground of preference, fraud, fraudulent transfer, or other

ground, whether or not the Indebtedness has been paid in full.

To the extent the Borrower or the Guarantor makes a payment or

payments to the Lender, which payment or payments (or any part

thereof) are later invalidated, deemed to be fraudulent or

preferential, avoided, or required to be repaid to the Borrower

or the Guarantor or any of their respective estate, trustee,

receiver, or any other party, pursuant to any bankruptcy law, or

other federal or state law, common law, or equitable basis (all

such payments specified in this sentence being called the

"Avoided Payments

"), then, to the extent of such Avoided

Payments, this Guarantee and the Obligations which have been

paid, reduced or satisfied by the Avoided Payments shall be

reinstated and continued in full force and effect as of the date the Avoided Payments were first made to the Lender.Indemnity by Guarantor

. The Guarantor shall indemnify

and hold the Lender harmless, and defend the Lender, at the

Guarantor's sole cost and expense, against each loss, liability,

cost and expense (including, but not limited to, reasonable

attorneys' fees and disbursements of the Lender's counsel,

whether in-house staff, retained firms or otherwise), and each

claim, action, procedure and suit, to the extent any such loss,

liability, cost, expense, claim, action, procedure and suit arises out of or in connection with:

7.1 1) this Guarantee, 2) any transaction

contemplated by this Guarantee, 3) the Indebtedness (or any part

thereof), or 4) any Loan Document, including, but not limited

to, all costs of appraisals and reappraisals of any collateral for the Indebtedness;

7.2 any amendment to, or restructuring of, this

Guarantee, the Indebtedness, or any Loan Document;

7.3 any action that may be taken by the Lender: 1) in

connection with the enforcement of any Loan Document (including,

without limitation, any action or proceeding to enforce this

Guarantee), whether or not suit is filed in connection with such

Loan Document, or 2) in connection with either the Guarantor or

the Borrower (or any member, partner, joint venturer or

shareholder of any such person or entity) becoming a party to a

voluntary or involuntary federal or state bankruptcy, insolvency or similar proceeding; or

7.4 the past, present or future sale, or offering for

sale, of any stock, partnership or other equity interest in the

Guarantor or the Borrower, including, without limitation, any liability under any applicable securities or blue sky law.

All sums expended by the Lender shall be payable on demand by

the Lender, and, until reimbursed by the Borrower or by the

Guarantor pursuant to this Guarantee, shall bear interest at the Default Rate (as defined in the Note). 3

Financial Statements

. The Guarantor hereby

represents and warrants that all financial statements of the

Guarantor heretofore delivered to the Lender by or on behalf of

the Guarantor are true and correct in all material respects and

fairly present the financial condition of the Guarantor as of

3 If the "Default Rate" is not defined in the Note, then this term will have to be

defined in the Guarantee.

the respective dates of such financial statements. No material

adverse change has occurred in any financial condition reflected

in any such financial statement since the date of such financial

statement. In addition, the Guarantor covenants that so long

as: 1) any portion of the Indebtedness remains outstanding and

unpaid, or 2) the Lender has any obligation under any Loan

Document, then the Guarantor will furnish to the Lender, unless otherwise consented to in writing by the Lender: 8.1 as soon as available, but in any event within one

hundred twenty (120) days next following the end of each fiscal

year of the Guarantor, annual financial statements for the

Guarantor, on the Lender's standard form of such statement, for

such fiscal year, prepared and audited by (and certified as

being in accordance with generally accepted accounting

principles by) an independent certified public accountant of

recognized standing selected by the Guarantor and acceptable to

the Lender, and containing a fully itemized statement of profit

and loss and of surplus and a balance sheet, and otherwise in form and substance satisfactory to the Lender;

8.2 a certificate signed by the Guarantor (or if the

Guarantor is not an individual, by a duly authorized

representative of the Guarantor) certifying on the date of such

certificate that: (i) such financial statement is true, correct

and complete and (ii) no default, and no event which upon notice

or lapse of time or both would constitute a default, has

occurred under this Guarantee or, if such default exists, the

nature thereof and the period of time it has existed (such certificate being called a "Certification

"); and

8.3 within ten (10) days after request by the Lender,

such further detailed financial and other information (including, but not limited to, financial statements) as may be

requested by the Lender with respect to either the Guarantor, or

any affiliate of, or entity controlled by the Guarantor, as of a

date not earlier than that specified by the Lender in such

request, together with a Certification with respect to such financial and other information.

Lien, Security Interest And Setoff; Collateral

Security . In addition to any right available to the Lender

under applicable law or any other agreement, the Guarantor

hereby gives to the Lender a continuing lien on, security interest in, and right of setoff against:

1) all moneys, securities and other property of the

Guarantor and the proceeds thereof, now on deposit or now

or hereafter delivered, remaining with or in transit in any

manner to the Lender, its correspondents, participants or

its agents from or for the Guarantor, whether for

safekeeping, custody, pledge, transmission, collection or

otherwise or coming into possession of the Lender in any way,2) each balance of any deposit account or credit of

the Guarantor with, and each claim of the Guarantor against, the Lender at any time existing,

in each such case as collateral security for the payment of the

Indebtedness and each other obligation of the Guarantor under

this Guarantee, including, without limitation, fees, contracted

with or acquired by the Lender, whether joint, several,

absolute, contingent, secured, matured or unmatured (the

Indebtedness and all other obligations of the Guarantor under

this Guarantee being collectively called the "Obligations

").

The Guarantor hereby authorizes the Lender at any time or times,

without prior Notice (defined below), to apply such balances,

credits or claims, or any part thereof, to such Obligations in

such amounts as the Lender may select, whether contingent,

unmatured or otherwise and whether any collateral security

therefor is deemed adequate or not. The collateral security

described in this Guarantee shall be in addition to any

collateral security described in any separate agreement executed

by the Guarantor. The Lender, in addition to any right

available to the Lender under applicable law or any other

agreement, shall have the right, at the Lender's option, to set

off immediately the amount of any Obligations (or such portion

as may be designated by the Lender) against all monies owed by

the Lender in any capacity to the Guarantor, whether or not due,

and the Lender shall, at its option, be deemed to have exercised

such right to set off and to have made a charge against any such

money immediately upon the occurrence of any event of default

set forth below, even though such charge is made or entered on the books of the Lender subsequent to those events.

Event of Default

. If any of the following events

should occur (each such event being called an "Event of

Default "):

10.1 any default under any of the Loan Documents and

the continuance of such default beyond any applicable notice or grace period for such default contained in the Loan Documents;

10.2 the Guarantor violates any provision of this

Guarantee; or

10.3 the Guarantor terminates or dissolves or suspends

its usual business activities or conveys, sells, leases,

transfers, or otherwise disposes of all or a substantial part of

its property, business or assets, other than in the ordinary course of business;

then, and in any such event, the Lender may declare the

Obligations to be, and the Obligations shall become, immediately due and payable.Application by Lender of Moneys to Indebtedness

.

All moneys available to the Lender for application in

payment or reduction of the Indebtedness may be applied by the

Lender in such manner and in such amounts and at such time or

times and in such order, priority and proportions as the Lender

may see fit to the payment or reduction of such portion of the Indebtedness as the Lender may elect.

Guarantee Independent of Collateral; Rights of Lender;

Modification And Waiver; Additional Credit . The Guarantor

hereby expressly agrees that this Guarantee is independent of,

and in addition to, all collateral, if any, granted, pledged or

assigned under the Loan Documents. The Guarantor hereby

consents that from time to time, before or after any default by

the Borrower, with or without further Notice to or assent from the Guarantor:

12.1 any security at any time held by or available to

the Lender for any obligation of the Borrower, or any security

at any time held by or available to the Lender for any

obligation of any other person or party primarily, secondarily

or otherwise liable for all or any portion of the Indebtedness

or any other obligation of the Borrower or any other person or

party, other than the Lender, under any of the Loan Documents

(all such obligations specified above in this paragraph of

either the Borrower, or any other such person or entity, being

collectively called the "Aggregate Obligations

"), including any

guarantor of the Indebtedness or of any of such Aggregate

Obligations, may be accelerated, settled, exchanged, surrendered

or released and the Lender may fail to set off and may release,

in whole or in part, any balance of any deposit account or

credit on its books in favor of the Borrower, or of any such

other person or party, and the Lender may fail to perfect its

interest in any security for the Aggregate Obligations (or any part thereof);

12.2 any obligation of the Borrower, or of any such

other person or party, may be changed, altered, renewed,

extended, continued, accelerated, surrendered, compromised,

settled, waived or released in whole or in part, or any default with respect thereto waived;

12.3 the Lender may extend further credit in any

manner whatsoever to the Borrower, and generally deal with the

Borrower or any security, deposit account, credit on the

Lender's books or in Lender's possession or control (to the

extent such security, deposit account, or credit is described

above in this Section 12

), or any other person or party, as the

Lender may see fit;

12.4 the Lender may delay or fail to take any action

to obtain payment of the Obligations from any party other than the Guarantor; and

12.5 the Lender may delay or fail to take any action

either to enforce the Obligations or to exercise any right or

remedy against the Guarantor or any other party, whether under

this Guarantee, under the Loan Documents, or any other agreement or indulgence or compromise;

and the Guarantor shall remain bound in all respects under this

Guarantee, without any loss of any rights by the Lender and

without affecting the liability of the Guarantor,

notwithstanding any such exchange, surrender, release, change,

alteration, renewal, extension, continuance, compromise, waiver,

inaction, extension of further credit or other dealing. In

addition, all moneys available to the Lender for application in

payment or reduction of the Indebtedness or any Aggregate

Obligations may be applied by the Lender in such manner and in

such amounts and at such time or times and in such order, priority and proportions as the Lender may see fit.

Additional Undertakings

. The obligations and

liabilities of the Guarantor under this Guarantee are in

addition to the obligations and liabilities of the Guarantor

under the Additional Undertakings (as hereinafter defined). The

discharge of any or all of the Guarantor's obligations and

liabilities under any one or more of the Additional Undertakings

by the Guarantor or by reason of operation of law or otherwise

shall in no event or under any circumstance constitute or be

deemed to constitute a discharge, in whole or in part, of the

Guarantor's obligations and liabilities under this Guarantee.

Conversely, the discharge of any or all of the Guarantor's

obligations and liabilities under this Guarantee by the

Guarantor or by reason of operation of law or otherwise shall in

no event or under any circumstance constitute or be deemed to

constitute a discharge, in whole or in part, of the Guarantor's

obligations and liabilities under any of the Additional

Undertakings. The term "Additional Undertakings

" as used in

this Guarantee shall mean any other guaranty of payment,

guaranty of performance, completion guaranty, indemnification

agreement or other guaranty or instrument creating any

obligation or undertaking of any nature whatsoever (other than

this Guarantee) now or hereafter executed and delivered by the Guarantor to the Lender in connection with the Loan.Successors And Assigns; No Assignment By Guarantor

.

Each reference in this Guarantee to the Lender shall be

deemed to include its successors and assigns, in whose favor the

provisions of this Guarantee shall also inure. Each reference

in this Guarantee to the Guarantor shall be deemed to include

all heirs, executors, administrators, legal representatives,

successors and assigns, if any, of the Guarantor, all of whom

shall be bound by the provisions of this Guarantee, provided,

however, that the Guarantor shall in no event nor under any

circumstance have the right, without obtaining the prior written

consent of the Lender, to assign or transfer the Guarantor's

obligations and liabilities under this Guarantee, in whole or in part, to any other person, party or entity.

Definition of "Guarantor"

. If any Guarantor shall

be a partnership, the agreements and obligations on the part of

the Guarantor contained in this Guarantee shall remain in force

and application, notwithstanding any changes in the individuals

composing the partnership, and the term "Guarantor" shall

include each altered or successive partnership, but the

predecessor partnerships and their partners shall not thereby be

released from any obligations or liability under this Guarantee.

If any Guarantor shall be a corporation, limited liability

company, or other entity, then the agreements and obligations on

the part of the Guarantor contained in this Guarantee shall

remain in force and application notwithstanding the merger,

consolidation, reorganization or absorption of such entity, and

the term "Guarantor" shall include such new entity, but the old

entity shall not thereby be released from any obligations or liabilities under this Guarantee.

No Waiver By Lender

. No delay on the part of the

Lender in exercising any right or remedy under this Guarantee or

failure to exercise any such right or remedy shall operate as a

waiver in whole or in part of any such right or remedy. No

notice to or demand on the Guarantor shall be deemed to be a

waiver of the obligations of the Guarantor or of the right of

the Lender to take further action without notice or demand as

provided in this Guarantee. No course of dealing between the

Guarantor and the Lender shall change, modify or discharge, in

whole or in part, this Guarantee or any obligations of the Guarantor under this Guarantee.

Lender's Written Approval Required For Changes

. This

Guarantee may only be modified, amended, changed or terminated

by an agreement in writing signed by the Lender and the

Guarantor. No waiver of any term, covenant or provision of this

Guarantee shall be effective unless given in writing by the

Lender and if so given by the Lender shall only be effective in

the specific instance in which given. The execution and

delivery hereafter to the Lender by the Guarantor of a new

instrument of guaranty or any reaffirmation of guaranty, of

whatever nature, shall not terminate, supersede or cancel this

instrument, unless expressly so provided in such new instrument,

and all rights and remedies of the Lender, either under this

Guarantee or under any instrument of guaranty hereafter executed

and delivered to the Lender by the Guarantor, shall be cumulative and may be exercised singly or concurrently.Authority; Enforceability; Approvals; No Violations

.

The Guarantor represents and warrants to the Lender that:

18.1 neither the execution and delivery of this

Guarantee, nor the consummation of the transactions contemplated

by this Guarantee, nor compliance with the terms and provisions

of this Guarantee, will violate any applicable provision of law

or any applicable regulation or other manifestation of governmental action; and

18.2 all necessary approvals, consents, licenses,

registrations and validations of any governmental regulatory

body, including, without limitation, approvals required to

permit the Guarantor to execute and carry out the provisions of

this Guarantee, for the validity of the obligations of the

Guarantor under this Guarantee and for the making of any payment

or remittance of any funds required to be made by the Guarantor

under this Guarantee, have been obtained and are in full force and effect.

If the Guarantor is an entity, then the Guarantor also

represents and warrants that: 1) this Guarantee has been validly

authorized, executed and delivered by the Guarantor, and 2) the

Guarantor has the power to execute and deliver this Guarantee,

and to perform its obligations under this Guarantee, and 3) this

Guarantee constitutes the legally binding obligation of the

Guarantor and is fully enforceable against the Guarantor in accordance with the terms of this Guarantee.

Notices

. Each notice, request or demand given or made

under this Guarantee (each such notice, request, or demand being

called a "Notice

") shall be in writing and shall be hand

delivered or sent by Federal Express or other reputable courier

service or by postage prepaid registered or certified mail,

return receipt requested. Each Notice which is given by the

Guarantor or the Lender (the party giving the Notice is called

the "Sending Party

") to the other (such other party being called

the "Receiving Party ") shall be deemed given: (a) when received

by the Receiving Party at its address set forth below, if such

Notice is hand delivered or is sent by Federal Express (or other

reputable courier service) to such address, and (b) three (3)

business days after being postmarked and addressed to such

Receiving Party at its address set forth below if sent by registered or certified mail, return receipt requested:

If to the Guarantor: {{{61/GUARANTOR}}}

{{{62/ADDRESS OF GUARANTOR}}}Attention: {{{63/GUARANTOR'S REPRESENTATIVE}}}

With a copy to: {{{65/GUARANTOR'S ATTORNEY}}} {{{66/LAW FIRM OF GUARANTOR'S ATTORNEY}}}

{{{67/ADDRESS OF GUARANTOR'S ATTORNEY}}}

If to the Lender: {{{1/LENDER}}} {{{2/ADDRESS OF LENDER (FOR NOTICES)}}} Attention: {{{4/LENDER'S REPRESENTATIVE}}}

With a copy to: {{{12/LENDER'S ATTORNEY}}} {{{13/LAW FIRM OF LENDER'S ATTORNEY}}}

{{{14/ADDRESS OF LENDER'S ATTORNEY}}}

When the Sending Party gives a Notice to a Receiving Party, then

such Sending Party will use reasonable efforts also to send a

copy of such Notice to the address which immediately follows the

address of the Receiving Party and is preceded by the legend

"With a copy to." However, failure to deliver such copy or

copies to any address which is immediately preceded by such

legend shall have no consequence whatsoever to the effectiveness

of any such Notice if it is nonetheless actually given as

provided above to the Receiving Party. Each party to this

Guarantee may designate a change of address by Notice given, as

provided in this Guarantee, to the other party fifteen (15) days prior to the date such change of address is to become effective. Applicable Law

. This Guarantee is, and shall be

deemed to be, a contract entered into under and pursuant to the

substantive laws of the State of {{{87/STATE WHOSE LAW

GOVERNS}}} and shall be in all respects governed, construed,

applied and enforced in accordance with the laws of the State of

{{{87/STATE WHOSE LAW GOVERNS}}} without regard to principles of

conflicts of laws. Nevertheless, the Lender is hereby given the

right to elect, in its sole and absolute discretion, that this

Guarantee be governed by the laws of the state in which the collateral, if any, for the Indebtedness is situate.Jurisdiction and Venue

. The Guarantor agrees to

submit to personal jurisdiction in the State of {{{87/STATE

WHOSE LAW GOVERNS}}} in any action or proceeding arising out of

this Guarantee. In furtherance of such agreement, the Guarantor

hereby agrees and consents that without limiting other methods

of obtaining jurisdiction, personal jurisdiction over the

Guarantor in any such action or proceeding may be obtained

within or without the jurisdiction of any court located in

{{{87/STATE WHOSE LAW GOVERNS}}} and that any process or notice

of motion or other application to any such court in connection

with any such action or proceeding may be served upon the

Guarantor by registered or certified mail to, or by personal

service at, the last known address of the Guarantor, whether

such address be within or without the jurisdiction of any such

court. The Guarantor hereby further agrees that the venue of

any litigation arising in connection with the Indebtedness or in

respect of any of the obligations of the Guarantor under this

Guarantee, shall, to the extent permitted by law, be in {{{88/COUNTY FOR VENUE}}}.

No Exculpatory Provision Applies to Guarantor

. No

exculpatory provisions (if any) which may be contained in any

Loan Document shall in any event or under any circumstances be

deemed or construed to modify, qualify, or affect in any manner

whatsoever the obligations and liabilities of the Guarantor under this Guarantee.

Counterparts

. If there is more than one Guarantor,

then this Guarantee may be executed in one or more counterparts

by some or all of the parties to this Guarantee. Each

counterpart of this Guarantee need not be signed by each

signatory. Each such duplicate counterpart which has been

signed by at least one signatory, when combined with other

counterparts which have been signed by the other signatories,

shall be deemed an original. The failure of any party listed

below to execute this Guarantee, or any counterpart hereof, or

the ineffectiveness for any reason of any such execution, shall

not relieve the other signatories from their obligations under

this Guarantee, nor shall any implication arise, from the

failure of any of the original guarantors to sign this

Guarantee, that such non-signing guarantor, or any other

guarantor, is released from any of such non-signing guarantor's,

or other guarantor's, respective obligations under the original guaranty.

Waiver of Trial By Jury

. THE GUARANTOR HEREBY

IRREVOCABLY AND UNCONDITIONALLY WAIVES, AND THE LENDER BY ITS

ACCEPTANCE OF THIS GUARANTEE IRREVOCABLY AND UNCONDITIONALLY

WAIVES, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, SUIT

OR COUNTERCLAIM ARISING IN CONNECTION WITH, OUT OF OR OTHERWISE RELATING TO THIS GUARANTEE.IN WITNESS WHEREOF, the Guarantor has duly executed this

Guarantee the day and year first above set forth.

WITNESS/ATTEST: {{{61/GUARANTOR}}}

_________________________

Individual Acknowledgement4

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )

ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came

{{{61/GUARANTOR}}}, to me known and known to me to be the

individual described in and who executed the foregoing

instrument and acknowledged to me that {{{61/GUARANTOR}}} executed the same.

_______________________

Notary Public Corporate Acknowledgement

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came {{{63/GUARANTOR'S REPRESENTATIVE}}}, to me known, who, being by

me duly sworn, did depose and say that {{{63/GUARANTOR'S

REPRESENTATIVE}}} resides at {{{63.1/ADDRESS OF GUARANTOR'S

REPRESENTATIVE}}}; that {{{63/GUARANTOR'S REPRESENTATIVE}}} is

{{{63.2/TITLE OF GUARANTOR'S REPRESENTATIVE}}} of {{{61/GUARANTOR}}}, the corporation described in and which

executed the above instrument; and that {{{63/GUARANTOR'S

REPRESENTATIVE}}} signed the above instrument by authority of the Board of Directors of said corporation.

4 The following forms of acknowledgment are accepted for use in New

York. Most states have adopted the Uniform Acknowledgment Act, the Uniform Acknowledgments Act, the Uniform Recognition of Acknowledgments Act, or the Uniform Law on Notarial Acts, so the forms of acknowledgement have become standardized.

____________________________ Notary Public

General Partnership Acknowledgement

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came {{{63/GUARANTOR'S REPRESENTATIVE}}}, to me known and known to me

to be a partner of {{{61/GUARANTOR}}}, {{{64.3/TYPE OF

GUARANTOR}}}, and known to me to be the individual described in

and who executed the foregoing instrument as a partner of

{{{61/GUARANTOR}}}, and acknowledged before me that {{{61/GUARANTOR}}} executed such instrument as a partner in such

partnership for the uses and purposes in said instrument set forth.

______________________________Notary Public

LENDER'S ALTERNATIVE PROVISIONS FOR GUARANTEE

1 Continuing Guarantee . The above form of Guarantee

guarantees the payment of the Loan and certain related

indebtedness. Alternatively, the definition of the

"Indebtedness" in Section

of the Guarantee can be broadened to

include all indebtedness of the Borrower to the Lender, whenever

incurred, at least until the Guarantor gives notice of

termination of the Guarantee. The Guarantee should then clearly

cover all indebtedness of the Borrower to the Lender which is

incurred on or before the date that the Lender actually receives

notice of such termination. Such a Guarantee is called a "continuing" guarantee. 2 Completion Guarantee

. If the Guarantee is intended to be

not a guarantee of payment or collection, but instead a

guarantee that improvements will be constructed on the Mortgaged

Property, then add the following provisions to the Guarantee.

The following provisions assume that the Lender and the Borrower

enter into a separate Construction Loan Agreement (in the form

contained on this floppy disk), which defines each of the

capitalized terms used below in this Section but which are not defined below.

2.1 Delete Section

of the Guarantee, and substitute the

following for such Section:

1 Guarantee of Performance; Duty of Reimbursement

1.1 Guarantee Of Borrower's Performance . The

Guarantor absolutely, irrevocably and unconditionally guarantees to the Lender that:

[a] the Borrower shall construct and complete the

Work in accordance with the Plans and otherwise in

accordance with the provisions of the Construction Loan Agreement, and

[b] the Borrower shall pay all costs and expenses

incurred in connection with the construction and completion of the Work;

[c] the Borrower shall complete the construction of

all alterations, fixtures and other work in accordance with

each existing or future lease or occupancy agreement with

each tenant, licensee or other occupant of the Real Estate

(or any part thereof) (each such tenant, licensee, or other

occupant being called a "Tenant

"), to the extent such

construction is required to be performed by the Borrower

(all such construction described in this subparagraph being called the "Tenant Work

");

[d] the Borrower shall pay all costs and expenses

incurred in connection with the Tenant Work;

[e] the Borrower shall keep the Real Estate and the

Improvements free and clear of all liens connected with or

arising from the construction or completion of the Work and

all Tenant Work, whether equal or prior in lien or other priority or subordinate to the lien of the Mortgage.

1.2 Guarantor's Duty To Reimburse Lender

. If the

Borrower does not take and complete the actions specified

in the preceding subparagraphs [a] to [e] of the

immediately preceding paragraph of this Guarantee, in

accordance with the provisions of the Construction Loan

Agreement and the other documents evidencing or securing

the Note (the Construction Loan Agreement and all such

other documents being collectively called the "Loan

Documents "), or if an event of default shall occur and

shall be continuing beyond any applicable grace and cure

period under this Guarantee or any other Loan Document,

then the Guarantor shall reimburse the Lender, upon demand,

for all costs and expenses (including, but not limited to,

reasonable attorneys' fees and disbursements of the

Lender's counsel, whether in-house staff, retained firms or

otherwise), to the extent not otherwise reimbursed to the Lender by the Borrower, in connection with:

[a] the construction of the Work in accordance with

the provisions of the Construction Loan Agreement;

[b] the construction of the Tenant Work;

[c] the construction of any work to meet the

requirements of each Tenant, to the extent required to be

done at the sole cost and expense of the Lender, or any

designee or wholly owned subsidiary of the Lender which may

acquire all or any part of the Real Estate, or any

purchaser from the Lender or such designee or subsidiary

(the Lender, such designee, such subsidiary, and each such

purchaser, being collectively called the "Subsequent

Transferee ") pursuant to the provisions of any lease or

occupancy agreement entered into by the Subsequent

Transferee subsequent to the date upon which the Subsequent

Transferee obtains title to the Real Estate (or any part

thereof) by reason of either a foreclosure of any of the

Loan Documents, or acceptance of a deed or assignment in

lieu of a foreclosure or sale or otherwise, with respect to any portion of the Real Estate; and[d] the removal of any lien caused by the Borrower's

failure to comply with the provisions of the Construction

Loan Agreement or any other Loan Document, or arising from

the construction of the Work (whether such lien is equal or

prior in lien or other priority or subordinate to the lien

held by the Lender pursuant to the Loan Documents, and

irrespective of whether the validity, priority or

enforceability of any such lien has been adjudicated by a court of competent jurisdiction or otherwise).

Such reimbursement (as provided in this Section 1.2

) shall

be made to the Lender by the Guarantor as provided in this

Guarantee: 1) whether or not such costs and expenses are

incurred by the Lender prior or subsequent to the Lender

declaring the Loan immediately due and payable or the

occurrence of any Event of Default (as defined in this

Guarantee), 2) whether or not any Loan Document is modified

in any bankruptcy or insolvency proceeding or otherwise,

and 3) even though the Lender may not have an allowed claim

(for any amount guaranteed by the Guarantor pursuant to

this Guarantee) against the Borrower as a result of any

bankruptcy or insolvency proceeding. The Guarantor further

covenants and agrees, if requested by the Lender, to

complete or to cause the construction of the Work in

accordance with the Construction Loan Agreement and the Plans.

1.3 "Indebtedness"

. "Indebtedness ," as used in

this Guarantee, means all obligations of the Guarantor

under this Guarantee, together with the obligation, if any,

of the Borrower and any third party to pay any amount guaranteed by this Guarantee or any part thereof.

2.2 Add to Section

("Indemnity By Guarantor") the

following subparagraph immediately after subparagraph

(and then

renumber the subparagraphs thereafter):

7.3 the failure by the Borrower to construct the Work

or the Tenant Work or to take any other action which is

required to be taken by the Borrower as provided in this Guarantee or any other Loan Document.

2.3 Add the following as a new Section to the Guarantee

after Section 10

("Event of Default"), and then renumber the

subsequent Sections:

11 Specific Enforcement . The Guarantor agrees

that it will be impossible to accurately measure the

damages to the Lender resulting from a breach of the

covenants by the Guarantor to complete (or to cause the

completion of) the Work or the Tenant Work or any other

construction or work which the Guarantor is obligated to

perform pursuant to this Guarantee, that such a breach will

cause irreparable injury to the Lender and that the Lender

has no adequate remedy at law in respect of such breach.

As a consequence, the Guarantor agrees that each such

covenant specified in this paragraph shall be specifically

enforceable against the Guarantor. The Guarantor hereby

waives, and agrees not to assert, any defense to any

specific enforcement by the Lender of any such covenant by the Guarantor.

2.4 Add the following language to the beginning of Section

of the Guarantee:

any of the Plans, and

3 Guarantee of Carrying Costs

. Some Lenders may require the

Guarantor to deliver a Guarantee that all carrying costs

relating to the collateral will be paid as and when incurred.

If the Lender wants a "carrying cost" Guarantee, then

substitute, in exchange for the first two sentences of Section

of the Guarantee, the following:

The Guarantor guarantees, absolutely, irrevocably and

unconditionally, to the Lender the payment of the Carrying

Costs. "Carrying Costs

" means all operating expenses and

carrying costs of any nature whatsoever incurred in

connection with the property securing the Loan (such

property being called the "Collateral

"), including, without

limitation, real estate taxes and assessments, insurance

premiums, management and brokerage fees, tenant improvements and leasing commissions, renovations, utility

payments, maintenance and repair expenses, maintenance and

service contracts for the operation of the Mortgaged

Property, attorneys' fees and court costs, all other

expenditures which are properly expensed or amortized

consistent with generally accepted accounting principles

applied on a consistent basis, and debt service on: 1) any

loan or other indebtedness secured by the Collateral (or

any part thereof) other than the Loan, 2) any future loan

or other indebtedness secured by the Collateral, or any

part thereof (including, without limitation, in the case of

any such existing or future loan or indebtedness, all

principal, interest - including specifically all interest

accruing from and after the commencement of any case,

proceeding or action under any existing or future laws

relating to bankruptcy, insolvency or similar matters with

respect to the obligor under any such note or the then

owner of any Collateral - and all other sums of any nature

whatsoever which may or shall become due and payable in

connection with any such loan or indebtedness, all of the

above unaffected by modification thereof in any bankruptcy

or insolvency proceeding, and even though the holders of

the interests in such loan or indebtedness may not have an

allowed claim for the same against the obligor under any

such loan or indebtedness or the then owner of the

Mortgaged Property as a result of any bankruptcy or

insolvency proceeding). All Carrying Costs not paid by the

Borrower will be paid by the Guarantor ten (10) days after

demand from the Lender. "Indebtedness

" means all

obligations of the Guarantor under this Guarantee, together

with the obligation, if any, of the Borrower and any third party to pay the Carrying Costs or any part thereof.

1. Guarantee Of Borrower's Obligations Regarding Exceptions To

Nonrecourse Limitation . Even if the Lender is making a

nonrecourse loan, and is not requiring any personal guarantee of

the Loan, the Lender may still need the principals of the

Borrower to guarantee the Borrower's obligations with respect to

the "bad acts" which are exceptions to the nonrecourse

provisions. For example, if the Borrower is a shell

corporation, and its principals steal rents from the Mortgaged

Property, or defraud the Lender, then the Lender will want such

principals to acknowledge their personal liability directly to the Lender. 4 Financial Covenants By Guarantor

. The Guarantor may be

required to make various financial covenants to the Lender, such

as with respect to the Guarantor's debt service ratio and loan

to value ratio. For sample language, see Section 5

("Debt

Service Coverage Ratio") of the Lender's Optional Provisions for

Loan Commitment .

5 Multiple Guarantors

. Most lenders generally prefer to

have a separate Guarantee for each Guarantor. If there are

separate Guarantees for each Guarantor, and one Guarantor is

able to invalidate its Guarantee, then this will be less likely

to result in invalidation of the obligations of the other

Guarantors. If, nonetheless, there is more than one Guarantor,

then the Lender might consider inserting the following new Section into the Guarantee:

Multiple Guarantors

The term "Guarantor" as used

in this Guarantee shall, if this Guarantee is signed

by more than one party, unless otherwise stated in

this Guarantee, mean the "Guarantor and each of them"

and each undertaking contained in this Guarantee shall

be their joint and several undertaking. The Lender

may proceed against none, one or more of the Guarantor

at one time or from time to time as the Lender sees fit in its sole and absolute discretion.

The problem is that this clause is an awkward and

inefficient way of achieving the meaning intended by the drafter

of the Guarantee. In some contexts in the Guarantee, for

example, the drafter will mean "all Guarantors," while in other

contexts the drafter will prefer "each" or "any" Guarantor. The

best approach is to search for "Guarantor" wherever it appears

in the Guarantee and to customize each particular reference for the desired meaning. 6 New York Provisions

. In the case of a New York

guarantor, or a guaranty which may be enforced in New York State

or be subject to New York State law, then the following Section

should be added to the Guarantee (but not to a Completion

Guarantee or an Environmental Guarantee) as a new Section

(numbered "24" or the applicable Section number), and the subsequent Section should also be renumbered:

Instrument For The Payment of Money

. The

Guarantor acknowledges and agrees that this Guarantee

is, and is intended to be, an instrument for the

payment of money only, as such phrase is used in §

3213 of the Civil Practice Law and Rules of the State

of New York, and the Guarantor has been fully advised

by its counsel of the Lender's rights and remedies pursuant to said § 3213.

2. Additional Events Of Default

. Additional clauses (regarding

"acts of bankruptcy" by the Guarantor) will be required to be

added to Section

("Event of Default") of the Guarantee only if

they are not already part of the Loan Documents. Section 4.1

of

the Mortgage

currently contains language making the bankruptcy,

insolvency, etc. of the Guarantor a default under the Mortgage.

3. Limiting Risk Of Avoidance Of Guarantee

. If there is

any risk of avoidance of the Guarantee as a fraudulent transfer, 5

then the Lender can consider adopting a formula which limits the

guaranteed amount to the Guarantor's net worth. 6

Alternatively,

the Lender could insert the following provision in the Guarantee

5 See § 8.01[8] of the main text of this book.

6 See Cherkis, Collier Real Estate Transactions and the Bankruptcy Code ¶

2.04 at 2-121 (1995).

as a new Section (numbered "24" or the applicable Section number), and the subsequent Section should also be renumbered:Limit On Indebtedness

. Notwithstanding anything to

the contrary in this Guarantee, the amount of the

Indebtedness which is guaranteed by the Guarantor pursuant

to this Guarantee shall not exceed the maximum amount which

may be guaranteed by the Guarantor yet not be subject to

avoidance (or annulment) under any federal or state law

prohibiting fraudulent transfers or fraudulent conveyances

(including, without limitation, Section 548 of the

Bankruptcy Code). 7

4. Guarantor Liable For Last Portion

. If the Guarantor is

liable for only a portion of the Indebtedness, then the

following should also be added to the Guarantee as a new Section

(after Section

of the Guarantee). If the following language is

not added, then generally payments will be deemed to be applied

first to the guaranteed portion of the Indebtedness (until it is

reduced to zero), and then to the unguaranteed portion. 8

The

following Section should be numbered "2" or the applicable

Section number, and the Sections thereafter should be renumbered:

Guarantor Liable For Last Portion of

Indebtedness . The Guarantor agrees that no portion of

any sums applied, from time to time, in reduction of

the Indebtedness (other than sums paid by the

Guarantor pursuant to the provisions of this Guarantee) shall be deemed to have been applied in

reduction of the Guarantor's Share of Indebtedness.

The Guarantor's Share of Indebtedness shall be the

last portion of the Indebtedness to be paid. This

Guarantee shall remain in full force and effect, and

shall not be deemed discharged, until the earlier of:

1) the date upon which all of the obligations and

liabilities of the Guarantor under this Guarantee

shall have been performed and discharged by the

Guarantor in accordance with the provisions of this

Guarantee, or 2) the Indebtedness has been paid in

full, and the Lender has no further obligation to the

Borrower under the Loan Documents; provided, however,

that this sentence is subject to the other provisions of this Guarantee.

7 See Cherkis, Collier Real Estate Transactions and the Bankruptcy Code ¶

2.04 at 2-121 (1995).

8 Restatement Third, Property (Mortgages) § 1.1, Illus. 5 at 11 (1997).

GUARANTOR'S ALTERNATIVE PROVISIONS FOR GUARANTEE 9

5. Guarantee Of Payment Only . The Guarantor may agree to

guarantee only payment

of the Borrower's financial obligations

to the Lender, and not the performance

of the Borrower's

obligations. Such payment

obligations may be further limited to

only principal and interest (excluding unliquidated contingent

obligations under indemnities, for example). The exact language

limiting the scope of the Guarantee is subject to negotiation,

but several examples are set forth below (see Section

("Guarantee of Payment Of Portion Of Principal") below. 7 Guarantee of Payment Of Portion Of Principal

. If the

Guarantor is not guaranteeing the entire Indebtedness, but only

a percentage of the unpaid principal amount, then the Guarantor should consider the following language:

2.1 On page 1 of the Guarantee (in the last "Whereas"

clause), and in the first sentence of Section 1

, change "the

Indebtedness" to "the Guaranteed Portion of the Indebtedness."

Similar changes should be made at each other point that the

"Indebtedness" appears in the Guarantee. Then, in such first

sentence of Section 1

, add a period after "Indebtedness," and

delete the remainder of such sentence, if the Guarantor is

guaranteeing no other obligations. Similarly, delete "and

performance" from the heading to, and the first sentence of, Section

("Guarantee Of Payment And Performance") of the

Guarantee. Also, the Guarantor may want to limit the scope of Section

("Indemnity By Guarantor").

2.2 Add the following, as a new Section after Section 1

of

the Guarantee (and then renumber the subsequent Sections), if the Guarantor is guaranteeing 100% of the interest on the Loan:

2 Guarantor's Share of Indebtedness

.

"Guarantor's Share of Indebtedness

" as used in

this Guarantee means the total of:

1) a portion of the outstanding principal

balance of the Loan equal to the Guarantor's

Principal Share (defined below), provided that

whenever the outstanding principal balance of the

Loan is equal to, or less than, the Guarantor's

Principal Share, then the Guarantor's Share of

Indebtedness shall be the outstanding principal balance of the Loan,

(2) all interest and additional interest

(including specifically Post-Bankruptcy Interes