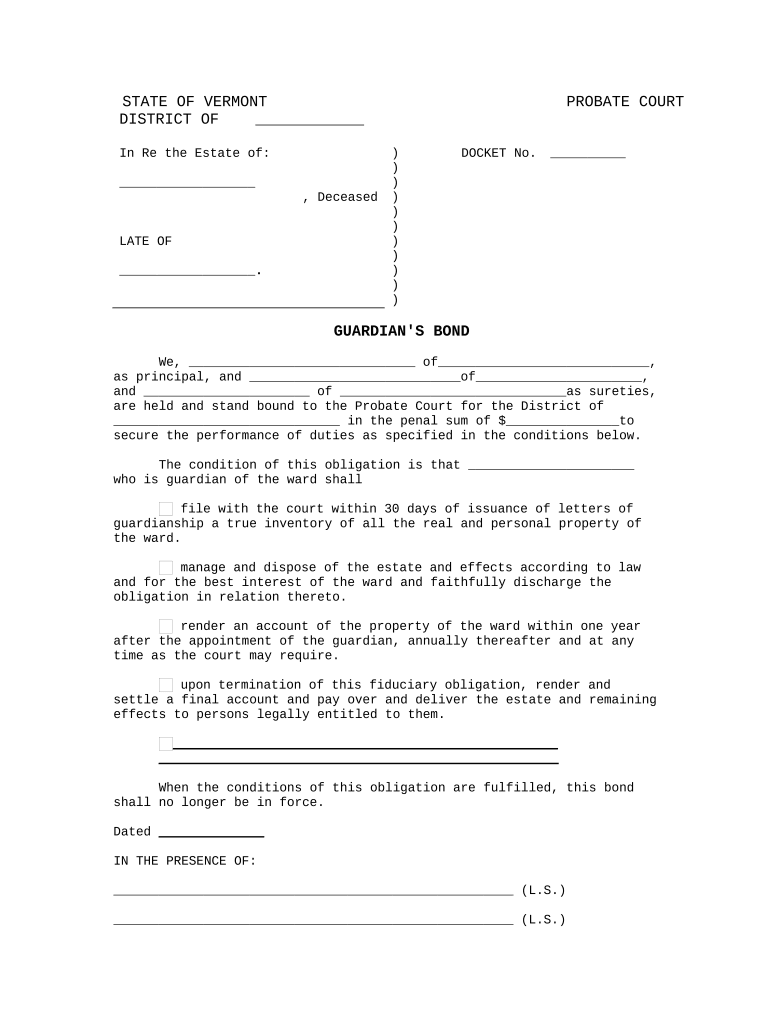

Fill and Sign the Guardians Bond Vermont Form

Valuable instructions on finalizing your ‘Guardians Bond Vermont’ digitally

Feeling overwhelmed by paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Take advantage of the robust features contained within this accessible and affordable platform, and transform your document management strategy. Whether you need to sign forms or gather eSignatures, airSlate SignNow manages everything seamlessly, with merely a few clicks.

Follow these comprehensive steps:

- Access your account or sign up for a complimentary trial of our service.

- Select +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Guardians Bond Vermont’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Guardians Bond Vermont or send it for notarization—our platform provides all the tools you need to accomplish those tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Guardian's Bond Vermont?

A Guardian's Bond Vermont is a type of surety bond required by the state for guardianship cases. It ensures that the guardian will manage the ward's finances responsibly and in their best interest. This bond is crucial for protecting vulnerable individuals and is a legal requirement in Vermont.

-

How much does a Guardian's Bond Vermont cost?

The cost of a Guardian's Bond Vermont varies based on the value of the assets being managed and the applicant's creditworthiness. Typically, premiums range from 1% to 3% of the bond amount. It’s advisable to obtain quotes from multiple surety bond providers to find the best rate.

-

What are the benefits of a Guardian's Bond Vermont?

A Guardian's Bond Vermont provides peace of mind to families and the courts by ensuring that guardians act in the best interests of their wards. It protects against potential mismanagement or fraud, thus safeguarding the ward's assets. Additionally, having this bond can help expedite the guardianship process.

-

How do I apply for a Guardian's Bond Vermont?

To apply for a Guardian's Bond Vermont, you must first contact a surety bond company that operates in Vermont. They will guide you through the application process, which typically involves providing financial information and undergoing a credit check. Once approved, you can purchase the bond to fulfill the guardianship requirements.

-

What documents do I need for a Guardian's Bond Vermont?

When applying for a Guardian's Bond Vermont, you will generally need to provide personal identification, financial statements, and court documents related to the guardianship case. Each surety company may have specific requirements, so it’s best to check with them for a complete list of necessary documents.

-

Can I get a Guardian's Bond Vermont if I have bad credit?

Yes, it is possible to obtain a Guardian's Bond Vermont even if you have bad credit. However, your premium may be higher due to the perceived risk. Some surety companies specialize in providing bonds to individuals with less-than-perfect credit, so it’s wise to shop around.

-

How long is a Guardian's Bond Vermont valid?

A Guardian's Bond Vermont typically remains valid as long as the guardianship is in effect. It’s important to note that you may need to renew the bond periodically, depending on the specific terms set by the court or the surety company. Always stay informed about renewal dates to maintain compliance.

The best way to complete and sign your guardians bond vermont form

Find out other guardians bond vermont form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles