The U.S. Bank 2010 Cash Balance Plan

This document contains highlights of the U.S. Bank 2010 Cash Balance Plan (the "Plan"). The plan provides eligible

employees a financial base from which to build retirement income. If you are eligible to participate, U.S. Bank

provides you with a benefit from the Plan. U.S. Bank pays the full cost.

Plan Provisions At-A-Glance

Plan Feature

Plan Provision

If you are an employee of U.S. Bank, you are automatically eligible to participate in

Eligibility

the Plan on the first Jan. 1 or July 1 after you:

• reach age 21, and

• complete one year of service, during which you work at least 1,000 hours,

provided you are then working in an eligible position.

Note: Certain positions are not eligible to participate in the plan; for example, U.S.

citizens working abroad are not eligible, unless deemed to be in Recognized

Employment by the Benefits Administration Committee.

You must be vested to receive a benefit from the Plan. You receive one year of vesting

Vesting

service for each calendar year during which you work at least 1,000 hours. You

become 100% fully vested in your benefit once you complete three years of vesting

service. Once you are vested, your right to benefits under the Plan cannot be forfeited.

Retirement Dates

• Normal Retirement—age 65.

• Early Retirement—immediately at any age

• Late Retirement—if you work past age 65, you will continue to accumulate

benefits until you retire

If you are vested and die before your benefit payments begin, your spouse or

Pre-Retirement Death

beneficiary is eligible to receive a death benefit. If you are single, your beneficiary(ies)

Benefit

will receive a lump sum payment of your cash balance account. If you are married, or

if you are single with a domestic partner, your spouse or domestic partner will receive

50% of your earned benefit payable as a joint and survivor annuity. The remainder of

the present value of your benefit is paid to your spouse or domestic partner as a lump

sum. Regardless of your marital status, you may designate beneficiaries to receive a

death benefit if you die before your benefit payments begin.

If you become disabled under the terms of the U.S. Bank Long-Term Disability Plan,

Disability Benefit

you will continue to earn benefits until your normal retirement date if you have at least

eight years of vesting service at the time you begin receiving long-term disability

benefits.

If you are single, your benefit will be paid as a life annuity. If you are married, your

Normal Form of

benefit will be paid as a 50% joint and survivor annuity. The amount of your benefit

Payment

will be adjusted for the cost of the survivor annuity payable to your surviving spouse

(to whom you were married when you began receiving benefits).

Optional Forms of

• Single lump sum

Payment

• 50%, 75% or 100% joint and survivor annuity

• Single life annuity

• Estate protection annuity consisting of a life annuity or a 50% or 100% joint

and survivor annuity, with a lump sum benefit payable to your beneficiary if

the sum of the payments made is less than a guaranteed minimum

Calculating Your Retirement Benefit

Your pension benefit is based on your cash balance account. Your account grows over time based upon pay credits

and interest credits.

Pay Credits: On Dec. 31 of each year during which you work at least 1,000 hours, your account in the Plan will

receive a pay credit equal to a percentage of your eligible pay during the year. An additional pay credit will be made

to your account based on your eligible pay over the Social Security wage base. The Social Security wage base is the

maximum amount on which you and U.S. Bank pay Social Security taxes, and is typically adjusted for inflation each

�year. The Social Security wage base is $106,800 for 2009. The percentage of the pay credit is determined based on

your age and years of vesting service as of Dec. 31 of each year. You earn a point for each year of age and each year

of vesting service as follows:

Points (age + service)

Pay Credit on eligible pay up to

Social Security wage base shall

be equal to:

Less than 35 points

35 to 49 points

50 to 64 points

65 to 79 points

80 points and higher

2.0% of pay

2.5% of pay

3.0% of pay

4.0% of pay

5.0% of pay

Pay Credit on eligible pay at and above

the Social Security wage base to the limit

under section 401(a)(17) of the Internal

Revenue Code shall be equal to:

4.0% of pay

5.0% of pay

6.0% of pay

8.0% of pay

10.0% of pay

Eligible pay generally includes base salary (regular pay and shift differentials), commissions, bonuses or incentive

pay, and overtime, and excludes certain items, including, but not limited to, expense reimbursements, imputed

income, income from stock option exercises, restricted stock, retention bonuses, and amounts paid under the U.S.

Bank Incentive Cash Bonus and Retention Plan.

Pay credit examples:

• Mary is age 35, has ten years of service as of Dec. 31, and earned $30,000. Mary’s pay credit would be

calculated as follows:

Total points – 45

Pay credit – 2.5% of pay

Pay credit amount – $750 (2.5% of $30,000)

• Bob is age 55, has 20 years of service as of Dec. 31, and earned $125,000. Bob’s pay credit would be

calculated as follows:

Total points – 75

Pay credit – 4.0% on $106,800 of pay, 8.0% on $18,200 of pay (total pay

$125,000)

Pay credit amount – $4,272 + $1,456 = $5,728

Interest Credits: The annual interest credit is equal to your cash balance at the end of the preceding year, multiplied

by the interest crediting rate. The interest crediting rate is based on the 10-Year Treasury Rate for October of the

calendar year prior to the year in which the credit is applied. The interest credit will be pro-rated in the year of

retirement or termination.

Vesting in the Plan

You will become 100% vested in your benefit after you complete three years of vesting service. You earn a year of

vesting service for each year in which you work at least 1,000 hours. You are also vested in the Plan if you work

until normal retirement age (i.e. age 65). If you are vested in the Plan, you have a right to a retirement benefit from

the plan after you terminate your employment with U.S. Bank.

Receiving Benefits

You can begin to receive a benefit at any time following your termination of employment.

Options Available For Benefit Payment

The plan offers the following payment forms:

•

Single Lump Sum – This option provides a single payment of the value of your entire cash balance

account.

•

Single Life Annuity – If you receive a single life annuity, you will receive a monthly payment from the

plan for as long as you live. When you die, all monthly payments will stop. This is the normal form of

benefit for a single person.

�•

Joint and Survivor Annuity – With a joint and survivor annuity, you will receive reduced monthly

payments for life. If you die before your spouse or domestic partner, a percentage of your monthly amount

will be paid to your spouse or domestic partner for his or her life. The payment amount under a joint and

survivor annuity depends on your and your spouse’s or domestic partner’s age at the time your payments

commence.

The normal form of benefit for a married person is a 50% joint and survivor annuity. You can choose a

75% or 100% joint and survivor annuity or a life annuity. If you choose a higher percentage joint and

survivor annuity, the benefit your spouse or domestic partner can receive after you die will be higher.

Because of this, however, the monthly payments you receive will be lower.

•

Estate Protection Annuity – You also have the option to choose an estate protection annuity. An estate

protection annuity is a way to protect the benefit you earned. It offers a life annuity for single employees,

and a 50% or 100% joint and survivor annuity for married employees or those with domestic partners. By

choosing this option, you ensure that the sum of the payments made to you, your spouse or domestic

partner, and your estate or beneficiary will not be less than the present value of your benefit as of your

retirement date. If you (and your spouse or domestic partner if you have elected the joint and survivor

form) die before having received payments equal to that present value, your estate or beneficiary will

receive the remaining portion. Qualifying domestic partners are eligible to receive the same benefit forms

as spouses. If you have a domestic partner but do not elect another form, the normal form of benefit will be

the single life annuity.

If You Become Unable to Work

If you become disabled under the terms of the U.S. Bank Long-Term Disability Plan, you will continue to earn

benefits and accrue service until your normal retirement date if you have at least eight years of vesting service at the

time you begin receiving long-term disability benefits.

If You Die Before Payment Begins

Your spouse – or if you are single any beneficiary you name – can receive a death benefit from the plan if you die

before payments begin. Death benefits are based on the benefit you had earned through the date of your death. If you

are single when you die, your beneficiary (or the automatic beneficiaries per the plan rules if you have not named a

beneficiary) will receive a lump sum payment equal to the present value of your benefit. If you are married, or if you

are single with a domestic partner, your spouse or domestic partner will receive 50% of your earned benefit as a

survivor annuity. Your spouse or domestic partner may elect to begin receipt of the survivor annuity as early as the

first day of the month following your date of death. The remainder of the present value of your benefit is paid to

your spouse or domestic partner as a lump sum. If you are married, you can name someone other than your spouse

as beneficiary if the consent of your spouse is obtained.

If You Are Rehired by U.S. Bank

If you are rehired after you leave U.S. Bank and its affiliates, you will be credited with all the vesting service you

previously earned if you: (1) were vested when you left; or (2) return to U.S. Bank within five years. If you begin

receiving a retirement benefit from U.S. Bank and are rehired, your monthly pension payments will continue during

your re-employment. You are not allowed to repay the pension benefit payments you already received. You are,

however, allowed to continue your participation in the plan.

9/2009

�

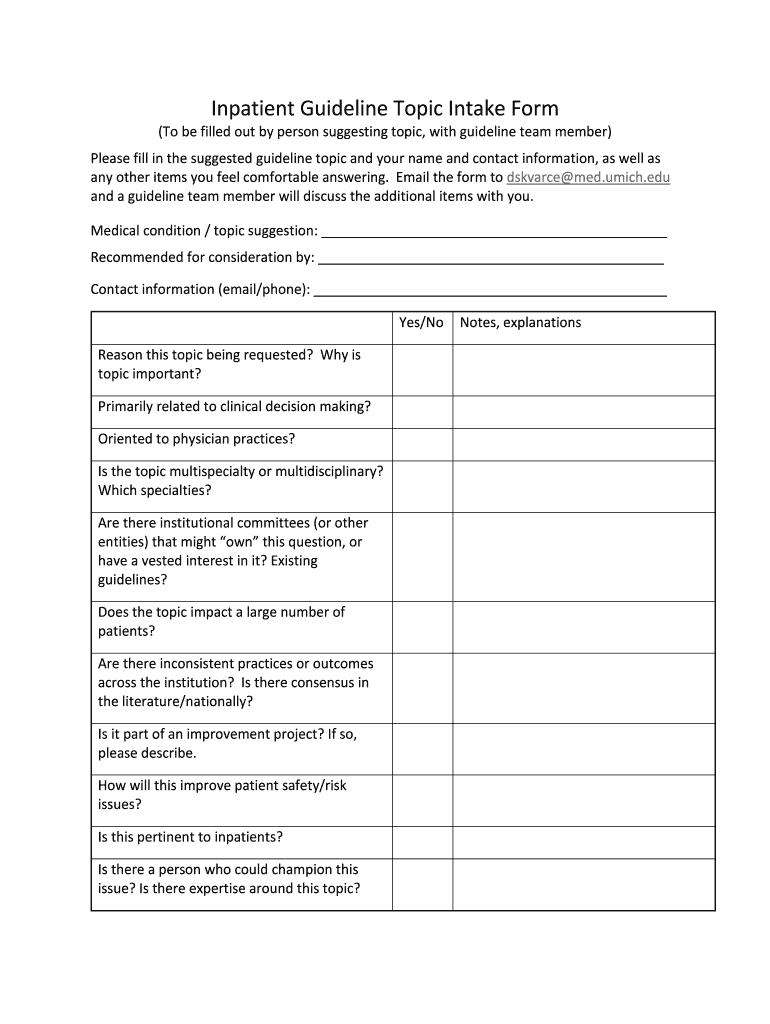

Useful tips for completing your ‘Inpatient Guideline Topic Intake Form’ online

Exhausted by the complications of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature service for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the robust features integrated into this intuitive and affordable platform and transform your method of document administration. Whether you require form approvals or to collect electronic signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Access your ‘Inpatient Guideline Topic Intake Form’ in the editor.

- Click Me (Fill Out Now) to set up the document on your side.

- Include and assign fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Inpatient Guideline Topic Intake Form or send it for notarization—our solution offers everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!