Fill and Sign the Inter Company Loan Agreement Template Form

Practical tips for finishing your ‘Inter Company Loan Agreement Template’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature service for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning files. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to authorize forms or gather signatures, airSlate SignNow manages everything seamlessly, requiring just a few clicks.

Adhere to this comprehensive guideline:

- Log into your account or sign up for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘Inter Company Loan Agreement Template’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and designate fillable fields for other users (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work with others on your Inter Company Loan Agreement Template or submit it for notarization—our solution has everything necessary to facilitate these tasks. Register with airSlate SignNow today and take your document management to a new height!

FAQs

-

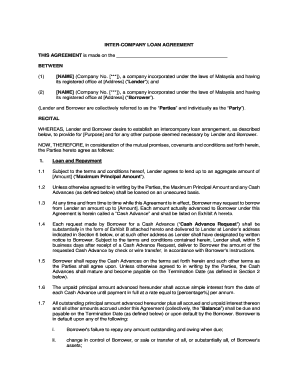

What is an Inter Company Loan Agreement Template?

An Inter Company Loan Agreement Template is a pre-designed document that outlines the terms and conditions for loans between affiliated companies. This template simplifies the process of creating legally binding agreements and ensures compliance with financial regulations. Using an Inter Company Loan Agreement Template can save time and reduce the risk of errors.

-

How can I customize the Inter Company Loan Agreement Template?

You can easily customize the Inter Company Loan Agreement Template using airSlate SignNow's intuitive editing tools. Simply upload the template, fill in the necessary details such as loan amount, interest rate, and repayment terms, and adjust any clauses to fit your specific needs. Customization ensures that your agreement aligns perfectly with your business requirements.

-

Is the Inter Company Loan Agreement Template legally binding?

Yes, the Inter Company Loan Agreement Template becomes legally binding once it is signed by the authorized representatives of the involved companies. airSlate SignNow ensures that all eSignatures are compliant with legal standards, providing you with a secure and reliable way to execute your agreements. Always consult with a legal professional for specific compliance questions.

-

What are the benefits of using an Inter Company Loan Agreement Template?

Using an Inter Company Loan Agreement Template streamlines the process of drafting loan agreements, saving time and reducing legal costs. It provides a comprehensive framework that covers essential aspects of intercompany lending, promoting transparency and accountability. This approach minimizes the risk of disputes and ensures all parties understand their obligations.

-

Can I integrate the Inter Company Loan Agreement Template with other software?

Yes, airSlate SignNow allows seamless integration of the Inter Company Loan Agreement Template with various business applications such as CRM and accounting software. This integration enhances workflow efficiency by enabling automatic data transfer and document management. You can easily sync your templates with tools you already use.

-

What is the pricing for using the Inter Company Loan Agreement Template?

airSlate SignNow offers competitive pricing plans that include access to the Inter Company Loan Agreement Template along with other features. Plans vary based on the number of users and additional functionalities required. You can choose a plan that best fits your business needs and budget, ensuring a cost-effective solution for document management.

-

How does airSlate SignNow ensure the security of my Inter Company Loan Agreement Template?

airSlate SignNow prioritizes security by employing advanced encryption technologies to protect your Inter Company Loan Agreement Template and associated data. Our platform complies with industry standards to ensure that all documents are stored securely and access is limited to authorized users only. This provides peace of mind when managing sensitive agreements.

Find out other inter company loan agreement template form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles