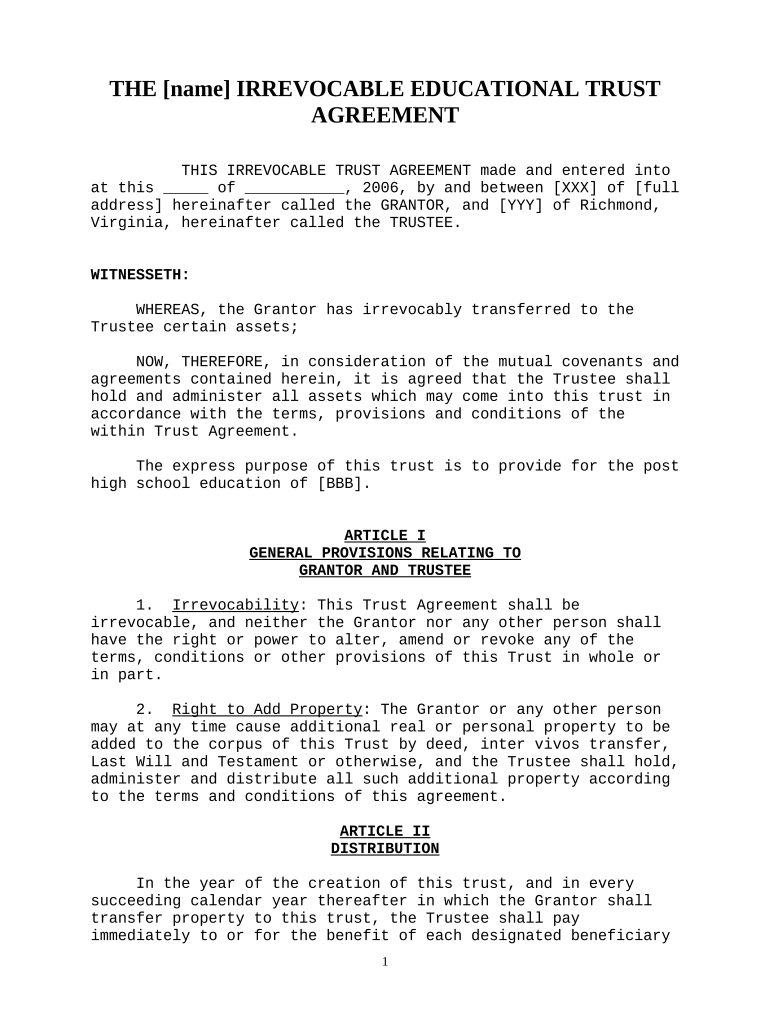

THE [name] IRREVOCABLE EDUCATIONAL TRUST

AGREEMENT

THIS IRREVOCABLE TRUST AGREEMENT made and entered into

at this _____ of ___________, 2006, by and between [XXX] of [full

address] here inafter called the GRANTOR, and [YYY] of Richmond,

Virginia, hereinafter called the TRUSTEE.

WITNESSETH:

WHEREAS, the Grantor has irrevocably transferred to the

Trustee certain assets;

NOW, THEREFORE, in consideration of the mutual covenants and

agreements contained herein, it is agreed that the Trustee shall

hold and administer all assets which may come into this trust in

accordance with the terms, provisions and conditions of the

within Trust Agreement.

The express purpose of this trust is to provide for the post

high school education of [BBB].

ARTICLE I

GENERAL PROVISIONS RELATING TO

GRANTOR AND TRUSTEE

1. Irrevocability : This Trust Agreement shall be

irrevocable, and neither the Grantor nor any other person shall

have the right or power to alter, amend or revoke any of the

terms, conditions or other provisions of this Trust in whole or

in part.

2. Right to Add Property : The Grantor or any other person

may at any time cause additional real or personal property to be

added to the corpus of this Trust by deed, inter vivos transfer,

Last Will and Testament or otherwise, and the Trustee shall hold,

administer and distribute all such additional property according

to the terms and conditions of this agreement.

ARTICLE II

DISTRIBUTION

In the year of the creation of this trust, and in every

succeeding calendar year thereafter in which the Grantor shall

transfer property to this trust, the Trustee shall pay

immediately to or for the benefit of each designated beneficiary

1

of the Grantor who personally or through his guardian shall

request (in an instrument in writing deposited with the Trustee

no later than thirty (30) days after notice is sent to such

designated beneficiary or his representative that property has

been transferred to this trust) property of a value equal to (a)

the value, as of the date of the transfer, of the property so

transferred in the respective year divided by (b) the number of

then designated beneficiaries of the Grantor; provided, however,

that the total amount that may be so requested by such

beneficiary in each calendar year shall not exceed the greater of

five thousand dollars ($5,000.00), or the maximum gift tax

exclusion. The Trustee shall send notice in writing by mail or

deliver notice personally to each designated beneficiary

representative within thirty (30) days after it receives such

transfer.

ARTICLE III

POWERS AND DUTIES OF TRUSTEE

Without the order, consent, approval or confirmation of any

court, person or persons, except as may be specifically required

elsewhere herein, the Trustee shall have full power and authority

to control and manage the trust estate, to collect, recover, and

receive the rents, issues, incomes, and proceeds therefrom and to

do all acts and things which the Trustee, in the exercise of

Trustee's discretion, may deem needful, desirable, or expedient

for the proper and advantageous control thereof to the same

extent and with like effect as might be done by an individual in

absolute ownership and control of said property including,

without prejudice to the generality of such powers, the following

powers:

1. To compromise, settle, compound, or adjust, submit to

arbitration, or abandon on such terms as Trustee may deem

advisable, any claim or demand by or against the trust estate and

to agree to any rescission or modification of any contract or

agreement;

2. To hold and retain indefinitely any portion or all of

any securities (including securities issued by any corporation

acting as Trustee hereunder) and other property of whatsoever

nature received in kind by the Trustee hereunder, including any

business owned by Grantor, without liability or responsibility

for any depreciation or loss caused thereby, so long as such

retention appears advisable, to exchange any such security or

property for other securities or properties and to retain such

items received in exchange;

3. To sell, exchange, assign, transfer and convey any

security or property, real or personal, held in the trust estate,

2

at public or private sale, at such time and price and upon such

terms and conditions (including credit) as the Trustee may

determine;

4. To invest and reinvest in such stocks, bonds and other

securities and properties, real, personal or mixed, and wherever

situated, as the Trustee deems advisable, including stocks and

unsecured obligations, undivided interests, interests in

investment trusts, common trust funds, mutual funds (including

any such trusts or funds managed by a subsidiary, parent or

affiliate of any corporate trustee), leases on property which is

outside of my domicile, all without diversification as to kind or

amount and without being restricted in any way by any statute or

court decision (now or hereafter existing) regulating or limiting

investments by fiduciary; and, in making investments or

reinvestments, to be obligated only to use good faith and to

exercise Trustee's honest judgment as to what investments are,

from time to time, for the best interests of the trust estate and

the beneficiaries thereof, and, unless inconsistent with other

provisions of this instrument, to hold any portion of the trust

estate in cash and uninvested whenever Trustee deems such holding

to be to the ultimate advantage of the trust estate or the

beneficiaries;

5. To exercise conversion, subscription, and other similar

rights pertinent to any securities at any time held hereunder, to

sell such rights, and to use such portion of the principal as may

be necessary to exercise such rights;

6. To register or record and carry any property in the name

of the Trustee or in the name of a nominee without disclosure of

the trust, or to keep and retain any such property, or any part

thereof, unregistered and in such condition that it may pass by

delivery, without thereby increasing or decreasing the Trustee's

liability as fiduciary, but no such registration, recording

and/or holding by the Trustee shall relieve the Trustee from

Trustee's responsibility for the safe custody and disposition of

the trust estate in accordance with the terms and provisions

hereof;

7. Unless inconsistent with other provisions of this

instrument, to consider and treat as principal the capital gains

portion of any dividend, all dividends payable in stock, all

dividends in liquidation and conversion, subscription and other

similar rights issued on securities, and to consider and treat as

income all other dividends received (except those declared as of

a "record date" preceding death but payable after, which shall be

considered and treated as principal);

3

8. Unless inconsistent with other provisions of this

instrument, to allocate, in Trustee's uncontrolled discretion,

all or any part of the receipts, including but not limited to

rents, capital gains, and dividends in cash, stock, or property,

to income or to principal or to both, and, in Trustee's

uncontrolled discretion, charge all or any part of the

disbursements, losses, premiums, and discounts to income or to

principal or to both, all without regard to any rule of practice

of law or equity with respect to trusts, and the decision of the

Trustee shall be binding and conclusive on all beneficiaries of

this trust and any other person or persons;

9. To vote in person or by proxy any stocks or securities

held, and to grant such proxies and powers of attorney to such

person or persons as the Trustee may deem proper and to consent

in writing and join in any voting trust, pooling or depository

agreement with respect to any shares of stock forming part of the

trust estate;

10. To consent to and participate in any plan for the

liquidation, reorganization, consolidation or merger of any

corporation, any security of which is held hereunder, including

the right to use any of the principal or income from the trust

estate for the payment of any charges or assessments imposed upon

the trust estate on account of its participation therein, and to

receive and continue to hold in trust any property or securities

allotted to the trust estate by reason of its participation

therein, regardless of any restrictions as to investments

contained herein;

11. To lease any real estate for such term, or terms and

upon such conditions and rentals and in such manner as the

Trustee may deem advisable with or without privilege of purchase

and/or renewal (including 99 - year leases renewable forever), and

any lease so made shall be valid and binding for the full term

thereof even though same shall extend beyond the duration of the

trust; to make repairs, replacements and improvements, structural

or otherwise, to any such real estate; to insure against fire or

any other risks and to charge the expense thereof to principal or

income (or apportion same between principal and income) as the

Trustee may deem proper; to subdivide real estate, to dedicate

same to public use and to grant easements as the Trustee may deem

proper;

12. Unless inconsistent with other provisions of this

instrument, whenever required or permitted to divide or

distribute any trust property hereunder; to make distributions or

divisions (including the satisfaction of any pecuniary bequest)

in cash or in specific property, real or personal, or an

undivided interest therein, or partly in cash and partly in such

4

property, and to do so without regard to the income tax basis of

specific property allocated to any beneficiary (including any

trust) and without giving any such beneficiary his proportionate

share each asset available for distribution or division. The

Trustee may exercise all powers herein conferred after the

termination of any trust and until the same is fully distributed;

13. To employ accountants, attorneys and such agents and

advisors as the Trustee may deem advisable; to pay reasonable

compensation for their services and to charge same to (or

apportion same between) income and principal as the Trustee may

deem proper, and the Trustee shall not be liable for any action

taken or omitted to be taken in reliance upon the opinion or

advice of counsel, nor for the default or misconduct of any

counsel or agents or other representative selected by Trustee in

good faith;

14. Unless inconsistent with other provisions of this

instrument, to hold two or more trusts or other funds in one or

more consolidated funds, in which the separate trusts or funds

all have undivided interests, or make physical division of a

single trust and hold and administer each share as a separate

trust, under the terms and conditions hereof;

15. To pay out of the income and/or principal of the trust

estate all taxes, assessments, or governmental charges of any

nature whatsoever, with the exception of estate or inheritance

taxes and which may be provided for elsewhere herein, which shall

become payable in respect to the trust estate or any part thereof

or any income or profit derived therefrom and which the Trustee,

in Trustee's sole discretion, shall deem it necessary or

advisable to pay. Such payments shall be considered as a part of

the expense of administration of this trust and shall be a charge

against the income and/or principal or against any share or

portion thereof as the Trustee, in Trustee's sole discretion,

shall deem just and equitable;

16. The Trustee, in Trustee's sole discretion, may contest

or prosecute any claim for refund of any tax, assessment, or

governmental charge and may pay the costs and expenses of such

contest or prosecution, including interest and penalties, if any

charged, out of the income and/or principal of the trust estate

and without any liability on Trustee's part, notwithstanding it

may be held that the Trustee contested any such tax, assessment

or governmental charge or prosecuted a claim, for refund thereof

without reasonable cause. The Trustee shall not be liable to any

beneficiary for Trustee's failure to return any property or

income for taxation, or for Trustee's failure or omission to pay

any taxes, assessments, or governmental charge of any nature or

to make any claim for refund thereof;

5

17. To execute and deliver any and all deeds, mortgages,

leases, contracts, agreements, bills of sale, notes, transfers,

assignments, powers of attorney, proxies, consents, waivers, and

all other documents and instruments relative to the trust estate

and assets in Trustee's hands hereunder, irrespective of the

period of duration of the trust;

18. To foreclose mortgages and land contracts and to bid

for and purchase at judicial sales, any property, mortgage or

other interest, using therefor such part of the principal of the

trust estate as the Trustee may deem necessary for said purposes

and at or after maturity thereof, the Trustee may continue,

extend, modify, or renew any mortgages or land contracts which

Trustee holds hereunder;

19. To join in partnerships or limited partnerships with

others for any legitimate purposes, including, but not limited

to: farming, mining, drilling, ranching, entertainment and sports

production or promotion, and real estate investment or

development;

20. To do any and all things not inconsistent with the

foregoing powers and authority which the Trustee may deem

necessary, advisable, or expedient in the administration of the

trust created herein.

ARTICLE IV

RULE AGAINST PERPETUITIES

Anything in this trust agreement to the contrary

notwithstanding, no trust created hereunder shall continue beyond

twenty-one (21) years after the death of [XXX]; and upon the

expiration of such period all trusts shall terminate and the

assets thereof shall be distributed outright to those parties

(and in the same proportions, or equally if no proportions are

stated) as are then receiving the income therefrom.

ARTICLE V

PROHIBITION AGAINST ALIENATION

The interest of any beneficiary of any trust shall not be

anticipated, sold, transferred, alienated, encumbered nor in any

other manner assigned by any such beneficiary. Such interest

shall not be subject to any legal process, bankruptcy proceedings

or the interferences or control of creditors, spouses, or

divorced spouses, governments or their agencies, or others, for

6

the debts, obligations or activities of any beneficiary or

beneficiary's legal representative.

ARTICLE VI

RESIGNATION, REMOVAL OR REPLACEMENT OF TRUSTEE

A. Any Trustee may resign by giving thirty (30) days

written notice to the income beneficiary not under legal

disability, or in the case of legal disability, to the legal

guardian or conservator, if any, of each income beneficiary under

legal disability, and to any Successor Trustee specifically

designated by such person or persons. For the purpose of this

article the term "income beneficiary" shall mean a person then

entitled to income from the Trust estate whether in the

discretion of the Trustee or otherwise.

B. The title to the trust estate shall vest forthwith in

any Successor Trustee acting pursuant to the foregoing provisions

hereof; but any resigning or removed Trustee shall execute all

instruments and do all acts necessary to vest such title in any

Successor Trustee of record without court accounting. A Successor

Trustee shall have no duty to examine the accounts, records and

acts of the previous Trustee or Trustees and shall in no way or

manner be responsible for any act or omission to act on the part

of any previous Trustee.

C. Each Successor Trustee hereunder shall have, exercise

and enjoy all of the rights, privileges and powers, both

discretionary and ministerial, as are herein and hereby given and

granted unto the original Trustee and shall incur all of the

duties and obligations imposed upon the original Trustee.

D. In the event that any corporate Trustee shall at any

time become a part of any other corporation having trust powers

or shall be merged with any other such corporation or

corporations into a new corporation having trust powers, then

such corporation of which the Trustee may become a part, or which

is created by such merger, shall, without further act on the part

of any of the parties hereto, be substituted in place and stead

of the original Trustee and shall have an the rights and powers

given to the original Trustee hereunder.

E. Any Successor Trustee appointed under the terms of this

Article shall be a bank or trust company having trust powers

under the laws of the State of Virginia.

ARTICLE VII

BENEFICIARIES

7

When the Trustee shall receive notice satisfactory to

[him/her] that [BBB] is regularly enrolled as a student in a

college, university, or other institution of collegiate grade,

the Trustee shall pay to or apply for her benefit the direct

costs of tuition, books, fees and expenses attributable to such

education including [sorority/fraternity] fees and dues, room and

board, and reasonable living expenses up to [amount] per month so

long as she is in enrolled in an institution of collegiate grade.

If [BBB] shall discontinue her studies, no further payment will

be made under this section until [month, day, year], at which

time the Trustee shall pay all the principal and accumulated

income to [BBB] and the trust shall terminate.

In the event [BBB] dies at any time prior to [month, day,

year], the Trustee or Successor Trustee shall terminate the trust

and pay all accumulated assets to [successor beneficiary] of

[city, state].

This trust shall terminate upon (a) trust corpus being fully

used up for education of the beneficiary, (b) the death, of the

beneficiary, or (c) [month, day, year].

ARTICLE VIII

WITHHOLDING OR POSTPONING DISTRIBUTION

1. Trustee's Discretion : Notwithstanding the foregoing

provisions of Article Seven, but subject to the limitations of

this Article, Trustee shall have the absolute discretion to

withhold or postpone any or all non - discretionary distributions

of principal to the Beneficiary or any Contingent Beneficiary if

Trustee determines, given circumstances at the time, that the

distribution should be withheld or postponed for any of the

following reasons:

a. The beneficiary is physically, mentally, or emotionally

impaired in a manner which affects the beneficiary's ability to

effectively manage the distribution;

b. The beneficiary has a substance abuse problem which

might adversely affect the beneficiary's ability to manage the

distribution;

c. The beneficiary is involved in pending, threatened or

potential litigation, bankruptcy, or insolvency proceedings, or

has other financial problems or marital difficulties which could

result in the diversion or dissipation of the distribution;

8

d. The beneficiary is involved with a quasi-religious

organization or living in a community or under a form of

government or other conditions which would result in the

confiscation or appropriation of the distribution;

e. The tax consequences to the beneficiary or the

beneficiary's estate of a distribution would be disadvantageous

to the beneficiary or the beneficiary's estate;

2. Limitations on Withholding or Postponing Distributions :

The provisions in this Article authorizing withholding or

postponing distributions shall not apply to property

distributable pursuant to a beneficiary's exercise or deemed

exercise of a power of withdrawal under Article Two or property

distributable pursuant to beneficiary's exercise of a

testamentary power of appointment under this Article.

3. Administration of Withheld or Postponed Distributions

for Beneficiaries Entitled to Benefits : Trustee shall administer

any withheld or postponed distributions for a beneficiary who is

entitled to benefits from any local, state or federal government

or from any private agency as follows:

a. Uses of Net Income or Principal . Trustee may refuse to

distribute any or all of the beneficiary's share or Trustee may

distribute so much of the net income or principal of his or her

share to, or for the use or benefit of, beneficiary as in the

sole discretion of Trustee shall be necessary and proper to

provide for her extra and supplemental care, comfort, support,

maintenance and education, including vocational, rehabilitation,

technical training, in addition to and over and above the

benefits beneficiary otherwise receives from any local, state or

federal government or from any private agency. So long as

beneficiary shall be under a legal disability to act on his or

her own behalf in respect to his or her own property and affairs,

or in the judgment of Trustee is otherwise unable to apply such

payments as may be made from this Trust from time to time to his

or her own best interests, Trustee shall consult with the

guardian or other person having physical custody of beneficiary

as to any payments to be made under this Trust Agreement. Any

income not so distributed shall be accumulated and added to

principal.

b. Statement of Grantor's Intent . In exercising the

discretionary powers conferred on Trustee in this Trust

Agreement, Trustee shall be guided by the following statement of

Grantor's purpose and intentions. It is Grantor's expectation

that the trust income and principal will not be made available to

provide primary support for beneficiary. Therefore, Trustee is

directed to investigate other sources of support available to him

9

or her and to take whatever steps necessary to enroll beneficiary

for such benefits or assistance. Trustee is authorized to make

trust distributions to or on beneficiary's behalf in such a way

that his or her life will be enriched and made More enjoyable,

including providing recreational and vacation opportunities for

him or her. Trustee is authorized to expend the Trust Property to

procure more sophisticated medical and/or dental treatment than

may otherwise be available to beneficiary and to seek private

rehabilitative and educational training.

c. Lifetime Care . The Trustee may, in Trustee's discretion,

obtain a lifetime care arrangement for beneficiary. At such time

as an arrangement for his or her lifetime care shall be made and

approved by a court of competent jurisdiction (whether such

arrangement be by way of commitment proceedings, private contract

or otherwise), and if the total cost of such lifetime care is

known or can reasonably be estimated, the Trustee shall set aside

an amount which, when added to any other sums available for such

purpose from whatever source, is reasonably sufficient in

Trustee's judgment to provide for such lifetime care.

4. Conclusive Discretion of Trustee . Grantor desires

Trustee to exercise the discretionary powers conferred on Trustee

in a manner which will provide flexibility in the administration

of the Trust under conditions from time to time existing, and in

exercising powers under this Article, the discretion of the

Trustee shall be conclusive as to the advisability of any

distribution of income or principal, and as to the person to or

for whom such distribution is to be made, and the same shall not

be subject to judicial review.

IN WITNESS WHEREOF, the Grantor has executed this instrument

and the Trustee has evidenced its acceptance of the Trust herein

expressed by setting their hands and seals this _______ of

___________________, 2004.

WITNESS our signatures and seals:

_____________________________

Witness XXX

Grantor

_______________________________

______________________________

Witness YYY

10

Trustee

STATE OF VIRGINIA )

)ss

CITY/COUNTY OF ___________________ )

The foregoing instrument was acknowledged before me this ____

day of __________________, 2006, by XXX and YYY.

___________________________

Notary Public

My Commission Expires:______________

11