Fill and Sign the Irrevocable Trust Children Form

Practical advice on finalizing your ‘Irrevocable Trust Children’ online

Are you fed up with the inconvenience of managing paperwork? Your search ends here with airSlate SignNow, the leading electronic signature platform for individuals and businesses. Bid farewell to the lengthy ordeal of printing and scanning documents. With airSlate SignNow, you can seamlessly fill out and sign documents online. Utilize the powerful features embedded in this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages everything effortlessly, needing only a few clicks.

Follow this step-by-step guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘Irrevocable Trust Children’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and designate fillable fields for additional parties (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don't fret if you need to work with your associates on your Irrevocable Trust Children or send it for notarization—our solution provides everything you need to complete such tasks. Enroll with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

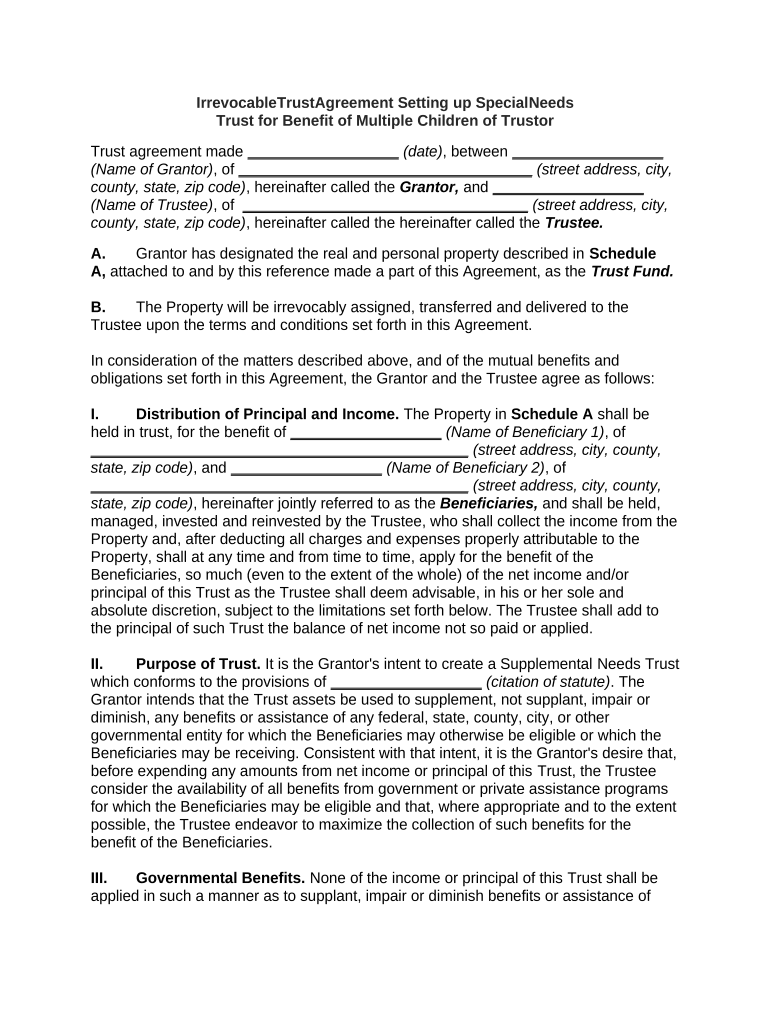

What is an Irrevocable Trust for Children?

An Irrevocable Trust for Children is a legal arrangement that allows parents or guardians to transfer assets to a trust that cannot be altered or revoked. This ensures that the assets are protected and managed for the benefit of the children, providing them with financial security. By establishing an Irrevocable Trust for Children, you can also help minimize estate taxes and avoid probate.

-

How can airSlate SignNow assist with creating an Irrevocable Trust for Children?

airSlate SignNow offers an efficient platform for drafting and signing legal documents, including an Irrevocable Trust for Children. With our user-friendly interface, you can easily create, edit, and eSign trust documents securely online. This streamlines the process, ensuring that you can focus on protecting your children's future.

-

What are the benefits of using airSlate SignNow for managing an Irrevocable Trust for Children?

Using airSlate SignNow to manage an Irrevocable Trust for Children provides several benefits, including secure document storage, easy access, and the ability to track changes. Our solution also helps ensure that all parties involved can sign documents remotely, making it convenient and efficient. This ultimately simplifies the management of your trust and its assets.

-

Is there a cost associated with using airSlate SignNow for Irrevocable Trusts?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are competitively priced, providing a cost-effective solution for managing your Irrevocable Trust for Children. You can choose a plan that fits your budget and the complexity of your trust documents.

-

Can I integrate airSlate SignNow with other tools for managing my Irrevocable Trust for Children?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, enhancing your workflow for managing an Irrevocable Trust for Children. Whether you need to connect with cloud storage services or accounting software, our platform supports integrations that simplify document management and collaboration.

-

How secure is airSlate SignNow for my Irrevocable Trust documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your Irrevocable Trust documents. You can trust that your sensitive information is safe and accessible only to authorized individuals, ensuring peace of mind as you manage your children's trust.

-

What types of documents can I create for an Irrevocable Trust for Children using airSlate SignNow?

With airSlate SignNow, you can create a variety of documents for managing an Irrevocable Trust for Children, including the trust agreement, amendments, and asset allocation statements. Our templates simplify the drafting process, ensuring that all necessary legal requirements are met while saving you time and effort.

The best way to complete and sign your irrevocable trust children form

Find out other irrevocable trust children form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles