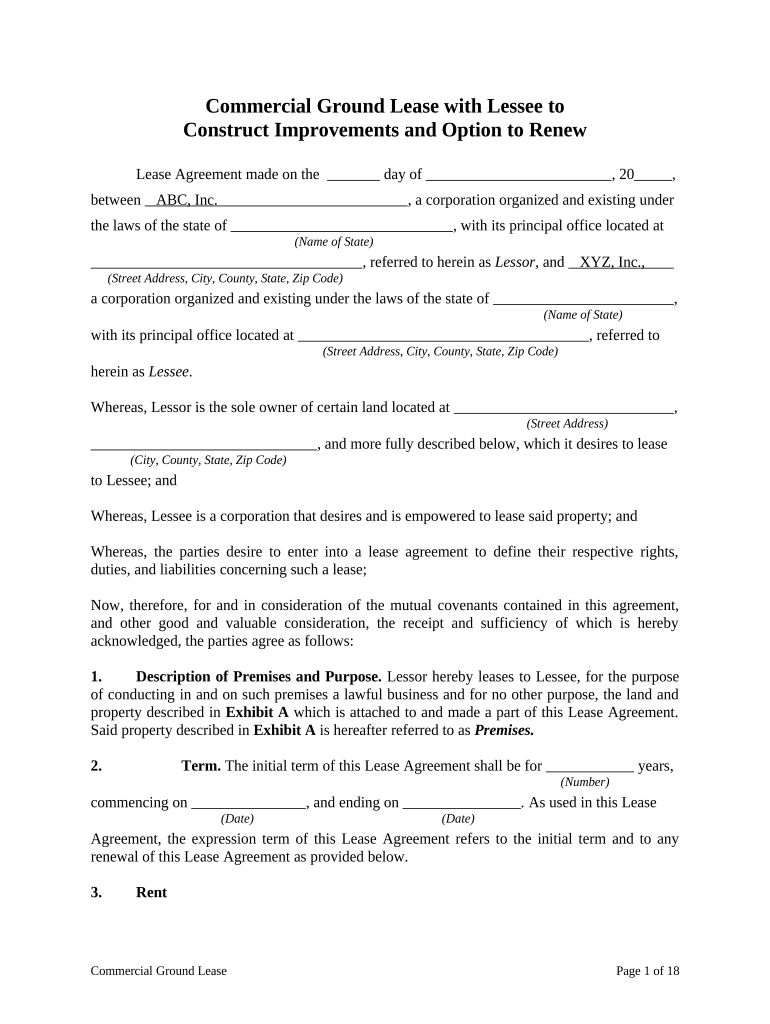

Commercial Ground Lease with Lessee to

Construct Improvements and Option to Renew

Lease Agreement made on the day of , 20 ,

between ABC, Inc. , a corporation organized and existing under

the laws of the state of , with its principal office located at

(Name of State)

, referred to herein as Lessor, and XYZ, Inc.,

(Street Address, City, County, State, Zip Code)

a corporation organized and existing under the laws of the state of ,

(Name of State)

with its principal office located at , referred to

(Street Address, City, County, State, Zip Code)

herein as Lessee .

Whereas, Lessor is the sole owner of certain land located at ,

(Street Address)

, and more fully described below, which it desires to lease

(City, County, State, Zip Code)

to Lessee; and

Whereas, Lessee is a corporation that desires and is empowered to lease said property; and

Whereas, t he parties desire to enter into a lease agreement to define their respective rights,

duties, and liabilities concerning such a lease;

Now, therefore, for and in consideration of the mutual covenants contained in this agreement,

and other good and valuable consideration, the receipt and sufficiency of which is hereby

acknowledged, the parties agree as follows:

1. Description of Premises and Purpose. Lessor hereby leases to Lessee, for the purpose

of conducting in and on such premises a lawful business and for no other purpose, the land and

property described in Exhibit A which is attached to and made a part of this Lease Agreement.

Said property described in Exhibit A is hereafter referred to as Premises.

2. Term. The initial term of this Lease Agreement shall be for years,

(Number)

commencing on , and ending on . As used in this Lease

(D ate) (D ate)

Agreement, the expression term of this Lease Agreement refers to the initial term and to any

renewal of this Lease Agreement as provided below.

3. Rent

Commercial Ground Lease Page 1 of 18

A. Lessee agrees to pay and Lessor agrees to accept $ for and as the

monthly rent for the Premises commencing upon execution of this Lease Agreement.

Such rent shall be paid in equal monthly installments in advance on the first day of every

month during the term of this Lease Agreement.

B. In addition to the rents as above stated, Lessee shall pay to Lessor a sum equal to

% of the amount received by Lessee from rental on subleases of Premises.

Said additional rent shall be due on the first day of the (e.g., sixth) month following

receipt of the first such sublease payment to Lessee and each (e.g., sixth) month thereafter

during the term of this Lease Agreement.

C. All rent payments shall be made in lawful money of the United States and

shall be paid to Lessor at , or to such

(Street Address, City, County, State, Zip Code)

other address as Lessor shall notify Lessee of in writing at ,

(Street Address)

.

(City, County, State, Zip Code)

D. Within days after the end of each calendar year of this Lease

(Number)

Agreement, during the term of this Lease Agreement beginning on the first calendar year

following the receipt by Lessee of a rent payment of one of its sublessees, Lessee shall

deliver to Lessor a complete statement signed by a duly authorized officer of Lessee

showing accurately and in reasonable detail the full amount of all rents collected by

Lessee from Lessee's sublessees. If the amount of rent due under the percentage as above

stated is greater than the amount of rent previously paid with respect to the same lease

year, the balance shall be paid by the Lessee with the submission of such statement.

E. Lessee agrees that Lessor or Lessor's agents may during normal business hours

inspect Lessee's books and records for the purpose of verifying Lessee's statement of rent

collections.

F. It is understood that all sums collected by Lessee from its sublessees for the

sublessees' share of taxes, insurance, common-area maintenance, and repairs shall not be

deemed to be rents collected by Lessee for the purpose of ascertaining Lessor's share

under the percentage arrangement above stated.

G. Such rents shall be absolutely net to Lessor so that this Lease Agreement shall,

except as provided to the contrary in this Lease Agreement, yield net to Lessor the rent as

provided above, to be paid in each year during the term of this Lease Agreement. All

costs, expenses, and obligations of every kind and nature whatever, relating to the

Premises, or any improvements on the Premises, which may arise or become due during

the term of this Lease Agreement, shall be paid by Lessee. Lessor shall be indemnified

and saved harmless by Lessee from and against same.

Commercial Ground Lease Page 2 of 18

4. Delivery of Possession. If Lessor, for any reason whatever, cannot deliver possession of

the Premises to Lessee at the commencement of the term of this Lease Agreement, as specified

above, this Lease Agreement shall not be void or voidable, nor shall Lessor be liable to Lessee

for any loss or damage resulting from such nondelivery; but in that event, there shall be a

proportionate reduction of rent covering the period between the commencement of the term of

this Lease Agreement and the time when Lessor can deliver possession.

5. Warranties of Title and Quiet Possession. Lessor covenants that Lessor is seized of the

Premises in fee simple and has full right to make and enter into this Lease Agreement and that

Lessee shall have quiet and peaceable possession of the Premises during the term of this Lease

Agreement.

6. Uses Prohibited . Lessee shall not use, or permit the Premises, or any part of the

Premises, to be used, for any purpose or purposes other than the purpose or purposes for which

the Premises are leased under this Lease Agreement. No use shall be made or permitted to be

made of the Premises, or acts done, which will cause a cancellation of any insurance policy

covering the building located on the Premises, or any part of such building, nor shall Lessee sell,

or permit to be kept, used, or sold, in or about the Premises, any article that may be prohibited by

the standard form of fire insurance policies. Lessee shall, at its sole cost, comply with all

requirements, pertaining to the Premises, of any insurance organization or company, necessary

for the maintenance of insurance, as provided in this Lease Agreement, covering any building

and appurtenances at any time located on the Premises.

7. Waste and Nuisance Prohibited . During the term of this Lease Agreement, Lessee shall

comply with all applicable laws affecting the Premises, the breach of which might result in any

penalty on Lessor or forfeiture of Lessor's title to the Premises. Lessee shall not commit, or

suffer to be committed, any waste on the Premises, or any nuisance.

8. Abandonment of Premises. Lessee shall not vacate or abandon the Premises at any time

during the term of this Lease Agreement. If Lessee abandons, vacates, or surrenders the

Premises, or is dispossessed by process of law, or otherwise, any personal property belonging to

Lessee and left on the Premises shall be deemed to be abandoned, at the option of Lessor, except

such property as may be encumbered to Lessor.

9. Lessor’s Right of Entry. Lessee shall permit Lessor and the agents and

employees of Lessor to enter into and on the Premises at all reasonable times for the purpose of

inspecting the Premises, or for the purpose of posting notices of nonresponsibility for alterations,

additions, or repairs, without any rebate of rent and without any liability to Lessee for any loss of

occupation or quiet enjoyment of the Premises occasioned by the entry. Lessee shall permit

Lessor and its agents and employees, at any time within the last years prior to

(Number)

the expiration of this Lease Agreement, to place on the Premises any usual or ordinary "To Let"

or "To Lease" signs and exhibit the Premises to prospective tenants at reasonable hours.

10. Encumbrance of Lessee’s Leasehold Interest

A. Lessee may encumber by mortgage or deed of trust, or other proper instrument, its

leasehold interest and estate in the Premises, together with all buildings and

Commercial Ground Lease Page 3 of 18

improvements placed by Lessee on the Premises, as security for any indebtedness of

Lessee. The execution of any mortgage, or deed of trust, or other instrument, or the

foreclosure of any mortgage, or deed of trust, or other instrument, or any sale, either by

judicial proceedings or by virtue of any power reserved in a mortgage or deed of trust, or

conveyance by Lessee to the holder of the indebtedness, or the exercising of any right,

power, or privilege reserved in any mortgage or deed of trust, shall not be held as a

violation of any of the terms or conditions of this Lease Agreement, or as an assumption

by the holder of the indebtedness personally of the obligations of this Lease Agreement.

No encumbrance, foreclosure, conveyance, or exercise of right shall relieve Lessee from

its liability under this Lease Agreement.

B. If Lessee shall encumber its leasehold interest and estate in the Premises and if

Lessee or the holder of the indebtedness secured by the encumbrance shall give notice to

Lessor of the existence of the encumbrance and the address of the holder, then Lessor

will mail or deliver to the holder, at such address, a duplicate copy of all notices in

writing which Lessor may, from time to time, give to or serve on Lessee under and

pursuant to the terms and provisions of this Lease Agreement. The copies shall be mailed

or delivered to the holder at, or as near as possible to, the same time the notices are given

to or served on Lessee. The holder may, at its option, at any time before the rights of

Lessee shall be terminated as provided in this Lease Agreement, pay any of the rents due

under this Lease Agreement, or pay any taxes and assessments, or do any other act or

thing required of Lessee by the terms of this Lease Agreement, or do any act or thing that

may be necessary and proper to be done in the observance of the covenants and

conditions of this Lease Agreement or to prevent the termination of this Lease

Agreement. All payments so made and all things so done and performed by the holder

shall be as effective to prevent a foreclosure of the rights of Lessee as if done and

performed by Lessee.

11. Subletting and Assignment. Lessee may sublet the Premises in whole or in part without

Lessor's consent, but the making of any sublease shall not release Lessee from, or otherwise

affect in any manner, any of Lessee's obligations under this Lease Agreement. Lessee shall not

assign or transfer this Lease Agreement, or any interest in this Lease Agreement, without the

prior, express, and written consent of Lessor, and a consent to an assignment shall not be deemed

to be a consent to any subsequent assignment. Any assignment without consent shall be void,

and shall, at the option of Lessor, terminate this Lease Agreement. Neither this Lease Agreement

nor the leasehold estate of Lessee nor any interest of Lessee under this Lease Agreement in the

Premises or any buildings or improvements on the Premises shall be subject to involuntary

assignment, transfer, or sale, or to assignment, transfer, or sale by operation of law in any

manner whatever. Any such attempted involuntary assignment, transfer, or sale shall be void and

of no effect and shall, at the option of Lessor, terminate this Lease Agreement.

12. Notice

A. All notices, demands, or other writings in this Lease Agreement provided to be

given or made or sent, or which may be given or made or sent, by either party to the

other, shall be deemed to have been fully given or made or sent when made in writing

Commercial Ground Lease Page 4 of 18

and deposited in the United States mail, registered and postage prepaid, and addressed as

follows:

1. To Lessor: ;

(Street Address, City, County, State, Zip Code)

2. To Lessee: .

(Street Address, City, County, State, Zip Code)

B. The address to which any notice, demand, or other writing may be given or made

or sent to any party as above provided may be changed by written notice given by the

party as above provided.

13. Taxes and Assessments

A. Taxes as additional rental. As additional rental under this Lease Agreement,

Lessee shall pay and discharge as they become due, promptly and before delinquency, all

taxes, assessments, rates, charges, license fees, municipal liens, levies, excises, or

imposts, whether general or special, or ordinary or extraordinary, of every name, nature,

and kind whatever, including all governmental charges of whatever name, nature, or kind,

which may be levied, assessed, charged, or imposed, or which may become a lien or

charge on or against the Premises, or any part of the Premises, the leasehold of Lessee in

and under this Lease Agreement, the Premises described in this Lease Agreement, any

building or buildings, or any other improvements now or later on the Premises, or on or

against Lessee's estate created by this Lease Agreement that may be a subject of taxation,

or on or against Lessor by reason of its ownership of the fee underlying this Lease

Agreement, during the entire term of this Lease Agreement, excepting only those taxes

specifically excepted below.

B. Assessments affecting improvements. Specifically and without in any way

limiting the generality of the provisions of Paragraph A of this Section, Lessee shall pay

all special assessments and levies or charges made by any municipal or political

subdivision for local improvements, and shall pay the same in cash as they shall fall due

and before they shall become delinquent and as required by the act and proceedings under

which any such assessments or levies or charges are made by any municipal or political

subdivision. If the right is given to pay either in one sum or in installments, Lessee may

elect either mode of payment and its election shall be binding on Lessor. If, by making

any such election to pay in installments, any of the installments shall be payable after the

termination of this Lease Agreement or any extended term of this Lease Agreement, the

unpaid installments shall be prorated as of the date of termination, and amounts payable

after that date shall be paid by Lessor. All of the taxes and charges under this Section 13

shall be prorated at the commencement and expiration of the term of this Lease

Agreement.

C. Taxes Excepted. In spite of anything in this section to the contrary, Lessee shall

not be required to pay any estate, gift, inheritance, succession, franchise, income, or

excess profits taxes that may be payable by Lessor or Lessor's legal representative,

successors, or assigns, nor shall Lessee be required to pay any tax that might become due

on account of ownership of property other than that leased in this Lease Agreement

Commercial Ground Lease Page 5 of 18

which may become a lien on or collectable out of the property leased under this Lease

Agreement.

D. Contesting Taxes. If Lessee shall, in good faith, desire to contest the validity or

amount of any tax, assessment, levy, or other governmental charge agreed in this section

to be paid by Lessee, Lessee shall be permitted to do so, and to defer payment of such tax

or charge, the validity or amount of which Lessee is so contesting, until final

determination of the contest, on giving to Lessor written notice prior to the

commencement of any such contest, which shall be at least days prior to

(Number)

delinquency, and on protecting Lessor on demand by a good and sufficient surety bond

against any such tax, levy, assessment, rate, or governmental charge, and from any costs,

liability, or damage arising out of any such contest.

E. Disposition of rebates. All rebates on account of any taxes, rates, levies, charges,

or assessments required to be paid and paid by Lessee under the provisions of this Lease

Agreement shall belong to Lessee, and Lessor will, on the request of Lessee, execute any

receipts, assignments, or other documents that may be necessary to secure the recovery of

any rebates, and will pay over to Lessee any rebates that may be received by Lessor.

F. Receipts. Lessee shall obtain and deliver receipts or duplicate receipts for all

taxes, assessments, and other items required under this Lease Agreement to be paid by

Lessee, promptly on payment of any such taxes, assessments, and other items.

14. Construction of New Building

A. Plans and specifications. On or before , Lessee shall, at

( Date)

Lessee's sole expense, prepare plans and specifications for buildings to be erected on the

Premises which shall provide for a .

(Description of buildings)

The plans and specifications shall be submitted to Lessor for Lessor's written approval or

any revisions required by Lessor. Lessor shall not unreasonably withhold approval, and in

the event of disapproval, Lessor shall give to Lessee an itemized statement of reasons for

disapproval within days after the plans and specifications are submitted

(Number)

to Lessor.

B. Arbitration. If plans and specifications are not approved by Lessor and Lessee in

writing within days after they are first submitted to Lessor, then Lessor

(Number)

and Lessee shall each select an arbitrator, and the two arbitrators so selected shall select a

third arbitrator. The three arbitrators so selected shall hear and determine the controversy

and their decision as to the final plans and specifications shall be final and binding on

both Lessor and Lessee, who shall bear the cost of the arbitration equally between them.

The arbitrators shall determine the controversy and notify Lessor and Lessee in writing of

their determination within days after the controversy has first been

(Number)

Commercial Ground Lease Page 6 of 18

submitted to the arbitrators.

C. Performance Bond. Prior to the commencement of any construction on new

buildings, Lessee shall furnish Lessor with a good and sufficient surety bond

guaranteeing the completion of the building and the payment of all bills in connection

with the work.

D. Alterations, Improvements, and Changes Permitted. Lessee shall have the

right to make such alterations, improvements, and changes to any building that may, from

time to time, be on the Premises as Lessee may deem necessary, or to replace any

building with a new one of at least equal value, provided that prior to making any

structural alterations, improvements, or changes, or to replacing any building, Lessee

shall obtain Lessor's written approval of the plans and specifications, which approval

Lessor shall not unreasonably withhold, provided that the value of the building shall not

be diminished and the structural integrity of the building shall not be adversely affected

by any such alterations, improvements, or changes, or that any proposed new building is

at least equal in value to the one that it is to replace, as the case may be. In the event of

disapproval, Lessor shall give to Lessee an itemized statement of reasons for the

disapproval. If Lessor does not disapprove the plans and specifications provided for in

this section within days after they have been submitted to Lessor, the

(Number)

plans and specifications shall be deemed to have been approved by Lessor. Lessee will in

no event make any alterations, improvements, or other changes of any kind to any

building on the Premises that will decrease the value of the building, or that will

adversely affect the structural integrity of the building. Prior to commencing any work

that will cost in excess of $ , Lessee shall furnish Lessor, on demand, with

a good and sufficient surety bond insuring the completion of the work and the payment of

all bills in connection with the work.

E . Disposition of new improvements. Any new building constructed by Lessee on

the Premises, and all alterations, improvements, changes, or additions made in or to the

Premises shall be the property of Lessor, and Lessee shall have only a leasehold interest

in them, subject to the terms of this Lease Agreement.

15. Repairs and Destruction of Improvements

A. Maintenance of Improvements. Lessee shall, throughout the term of this

Lease Agreement, at its own cost, and without any expense to Lessor, keep and maintain

the Premises, including all buildings and improvements of every kind that may be a part

of the Premises, and all appurtenances to the Premises, including sidewalks adjacent to

the Premises, in good, sanitary, and neat order, condition and repair, and, except as

specifically provided in this Lease Agreement, restore and rehabilitate any improvements

of any kind that may be destroyed or damaged by fire, casualty, or any other cause

whatever.

Commercial Ground Lease Page 7 of 18

B. No obligation by lessor to make improvements. Lessor shall not be obligated to

make any repairs, replacements, or renewals, of any kind, nature, or description, to the

Premises or any buildings or improvements on the Premises.

C. Lessee's Compliance with Laws. Lessee shall also comply with and

abide by all federal, state, county, municipal, and other governmental statutes,

ordinances, laws, and regulations affecting the Premises, the improvements on or any

activity or condition on or in the Premises.

D. Damage to and Destruction of Improvements. The damage, destruction, or

partial destruction of any building or other improvement that is a part of the Premises

shall not release Lessee from any obligation under this Lease Agreement, except as

expressly provided below. In case of damage to or destruction of any such building or

improvement, Lessee shall, at its own expense, promptly repair and restore it to a

condition as good or better than that which existed prior to the damage or destruction.

Without limiting the obligations of Lessee, it is agreed that the proceeds of any insurance

covering damage or destruction shall be made available to Lessee for repair or

replacement.

E. Damage or Destruction Occurring toward End of Term. In spite of anything

to the contrary in the immediately preceding paragraphs of this Section 15, in case of the

destruction of more than % of the improvements on the Premises or damage to

%, the buildings from any cause so as to make them untenantable occurring

during the last years of the term of this Lease Agreement, Lessee, if not

(Number)

then in default under this Lease Agreement, may elect to terminate this Lease Agreement

by written notice served on Lessor within days after the occurrence of

(Number)

the damage or destruction. In the event of such termination, there shall be no obligation

on the part of Lessee to repair or restore the buildings or improvements nor any right on

the part of Lessee to receive any proceeds collected under any insurance policies

covering the buildings or any part of the buildings. On such termination, rent, taxes,

assessments, and any other sums payable by Lessee to Lessor under this Lease

Agreement shall be prorated as of the termination date. If any rent, taxes, or assessments

shall have been paid in advance, Lessor shall rebate any such payment for the unexpired

period for which payment shall have been made.

F. Election not to Terminate. If, in the event of destruction or damage during the

last years of the term of this Lease Agreement, Lessee does not elect to

(Number)

terminate this Lease Agreement, the proceeds of all insurance covering the damage or

destruction shall be made available to Lessee for repair or replacement, and Lessee shall

be obligated to repair or rebuild the improvements as provided above.

16. Utilities. Lessee shall fully and promptly pay for all water, gas, heat, light, power,

telephone service, and other public utilities of every kind furnished to the Premises throughout

Commercial Ground Lease Page 8 of 18

the term of this Lease Agreement, and all other costs and expenses of every kind whatever of or

in connection with the use, operation, and maintenance of the Premises and all activities

conducted on the Premises, and Lessor shall have no responsibility of any kind for any such

utilities.

17. Liens

A. Lessee's Duty to keep Premises Free of Liens. Lessee shall keep all and every

part of the Premises and all buildings and other improvements at any time located on the

Premises free and clear of any and all mechanics', material suppliers', and other liens for

or arising out of or in connection with work or labor done, services performed, or

materials or appliances used or furnished for or in connection with any operations of

Lessee, any alteration, improvement, or repairs or additions that Lessee may make or

permit or cause to be made, or any work or construction, by, for, or permitted by Lessee

on or about the Premises, or any obligations of any kind incurred by Lessee, and at all

times promptly and fully to pay and discharge any and all claims on which any such lien

may or could be based, and to indemnify Lessor and all of the Premises and all buildings

and improvements on the Premises from and against any and all such liens and claims of

liens and suits or other proceedings pertaining to the Premises.

B. Written Notice. Lessee shall give Lessor written notice no less than

(Number)

days in advance of the commencement of any construction, alteration, addition,

improvement, or repair estimated to cost in excess of $ in order that Lessor

may post appropriate notices of Lessor's non-responsibility.

C. Contesting liens. If Lessee desires to contest any lien, it shall notify Lessor of its

intention to do so within days after the filing of the lien. In that case, and

(Number)

provided that Lessee shall, on demand, protect Lessor by a good and sufficient surety

bond against any lien and any cost, liability, or damage arising out of such contest,

Lessee shall not be in default under this Lease Agreement until days after

(Number)

the final determination of the validity of the lien, within which time Lessee shall satisfy

and discharge the lien to the extent held valid. However, the satisfaction and discharge of

any lien shall not, in any case, be delayed until execution is had on any judgment

rendered on the lien, and such delay shall be a default of Lessee under this Lease

Agreement.

D. Indemnification. In the event of any such contest, Lessee shall protect and

indemnify Lessor against any and all loss, expense, and damage resulting from the

contest.

18. Indemnification of Lessor. Lessor shall not be liable for any loss, injury, death, or

damage to persons or property that at any time may be suffered or sustained by Lessee or by any

person who may at any time be using or occupying or visiting the Premises or be in, on, or about

the Premises, whether the loss, injury, death, or damage shall be caused by or in any way result

Commercial Ground Lease Page 9 of 18

from or arise out of any act, omission, or negligence of Lessee or of any occupant, subtenant,

visitor, or user of any portion of the Premises, or shall result from or be caused by any other

matter or thing whether of the same kind as, or of a different kind than, the matters or things

above set forth. Lessee shall indemnify Lessor against any and all claims, liability, loss, or

damage whatever on account of any such loss, injury, death, or damage. Lessee waives all claims

against Lessor for damages to the building and improvements that are now on or later placed or

built on the Premises and to the property of Lessee in, on, or about the Premises, and for injuries

to persons or property in or about the Premises, from any cause arising at any time. The two

preceding sentences shall not apply to loss, injury, death, or damage arising by reason of the

negligence or misconduct of Lessor, its agents, or employees.

19. Attorney’s Fees. If any action at law or in equity shall be brought to recover any rent

under this Lease Agreement, or for or on account of any breach of, or to enforce or interpret any

of the covenants, terms, or conditions of this Lease Agreement, or for the recovery of the

possession of the Premises, the prevailing party shall be entitled to recover from the other party,

as part of the prevailing party's costs, reasonable attorney's fees, the amount of which shall be

fixed by the court and shall be made a part of any judgment or decree rendered.

20. Option to Renew. Lessor grants to Lessee, subject to the conditions set forth below, the

right and option to renew this Lease Agreement for a period of years, beginning on

(Number)

, and expiring on , at a rental determined as provided above, and

(Date) (Date)

otherwise subject to and on all of the terms and conditions contained in this Lease Agreement.

This option must be exercised by the giving to Lessor, on or before , a written

(Date)

notice of the exercise of the option by Lessee, but Lessee shall, in no event, be entitled to renew

the term of this Lease Agreement, even though the notice be timely given, unless Lessee shall

have timely performed all of its obligations under this Lease Agreement, and shall not be in

default in the performance of any such obligations, on the date of the expiration of the initial

term of this Lease Agreement.

21. Sidewalk Space. Lessor does not lease to Lessee any space under, in, or on any street or

sidewalk adjacent to the Premises but does license Lessee, subject to all the terms and provisions

of this Lease Agreement, and at Lessee's sole risk, the right to the use of any space under, in, or

on any adjacent street or sidewalk as Lessor itself may have. Lessee shall vacate the space if

Lessor is ordered to vacate it by any public authority; the vacation of the space by Lessee shall

not entitle Lessee to any reduction of rental due under this Lease Agreement. Lessee shall

indemnify Lessor against all claims of , or

(Name of City) (Name)

County, or any public authority, for compensation or damages for the use or occupation of or

intrusion on any adjacent sidewalk or street by Lessee or by any employee, agent, invitee, or

anyone acting under instruction or authority of Lessee. The rights of Lessee under this Lease

Agreement shall be subject to such present and future ordinances or regulations or laws as may

be made by , or County, or any

(Name of City) (Name)

Commercial Ground Lease Page 10 of 18

other public authority having jurisdiction.

22. Redelivery of Premises. Lessee shall pay the rent and all other sums required to be paid

by Lessee under this Lease Agreement in the amounts, at the times, and in the manner provided

in this Lease Agreement, and shall keep and perform all the terms and conditions on its part to be

kept and performed. At the expiration or earlier termination of this Lease Agreement, Lessee

shall peaceably and quietly quit and surrender to Lessor the Premises in good order and

condition subject to the other provisions of this Lease Agreement. In the event of the

nonperformance by Lessee of any of the covenants of Lessee undertaken in this Lease

Agreement, this Lease Agreement may be terminated as provided elsewhere in this instrument.

23. Remedies Cumulative. All remedies conferred on Lessor in this Lease Agreement shall

be deemed cumulative and no one exclusive of the other, or of any other remedy conferred by

law.

24. Insurance

A. Insurance Coverage of Premises. Lessee shall, at all times during the term of

this Lease Agreement and at Lessee's sole expense, keep all improvements that are now

or later a part of the Premises insured against loss or damage by fire and the extended

coverage hazards for $ of the full replacement value of the improvements,

with loss payable to Lessor and Lessee as their interests may appear. Any loss adjustment

shall require the written consent of both Lessor and Lessee.

B. Personal Injury Liability Insurance. Lessee shall maintain in effect throughout

the term of this Lease Agreement personal injury liability insurance covering the

Premises and its appurtenances and the sidewalks fronting on them in the amount of

$ for injury to or death of any one person, and $ for injury to

or death of any number of persons in one occurrence, and property damage liability

insurance in the amount of $ and insurance on all boilers and other

pressure vessels, fired or unfired, in the sum of $ . Such insurance shall

specifically insure lessee against all liability assumed by it under this Lease Agreement,

as well as liability imposed by law, and shall insure both Lessor and Lessee but shall be

so endorsed as to create the same liability on the part of the insurer as though separate

policies had been written for Lessor and Lessee.

C. Lessor's Right to Pay Premiums on Behalf of Lessee. All of the policies of

insurance referred to in this section shall be written in a form satisfactory to Lessor and

by insurance companies satisfactory to Lessor. Lessee shall pay all of the premiums for

insurance and deliver policies, or certificates of policies, to Lessor. In the event of the

failure of Lessee, either to effect insurance in the names called for in this Lease

Agreement or to pay the premiums for the insurance or to deliver the policies, or

certificates of the policies, to Lessor, Lessor shall be entitled, but shall have no

obligation, to effect such insurance and pay the premiums for the insurance, which

premiums shall be repayable to Lessor with the next installment of rental. Failure to

repay the same shall carry with it the same consequence as failure to pay any installment

of rental. Each insurer mentioned in this section shall agree, by endorsement on the

Commercial Ground Lease Page 11 of 18

policy or policies issued by it, or by independent instrument furnished to Lessor, that it

will give to Lessor ( number) days' written notice before the policy or policies in question

shall be altered or canceled. Lessor agrees that it will not unreasonably withhold its

approval as to the form or to the insurance companies selected by Lessee.

D. Definition of Full Replacement Value. The term full replacement value of

improvements, as used in this Lease Agreement, shall mean the actual replacement cost

of the improvements from time to time less exclusions provided in the normal fire

insurance policy. If either party believes that the full replacement value (that is to say, the

then replacement cost less exclusions) has increased or decreased, it shall have the right,

but, except as provided below, only at intervals of not less than years, to

(Number)

have such full replacement value redetermined by the fire insurance company which is

then carrying the largest amount of fire insurance carried on the Premises (referred to as

impartial appraiser). The party desiring to have the full replacement value so

redetermined by the impartial appraiser shall promptly, on submission of the

determination to the impartial appraiser, give written notice of the submission to the other

party to this Lease Agreement. The determination of the impartial appraiser shall be final

and binding on the parties to this Lease Agreement, and Lessee shall promptly increase

(or may decrease) the amount of the insurance carried pursuant to this section as the case

may be to the amount so determined by the impartial appraiser. The determination shall

be binding for a period of years, and subsequently until superseded by

(Number)

agreement between the parties to this Lease Agreement or by a subsequent

redetermination by an impartial appraiser. Each party shall pay one-half of the fee, if any,

of the impartial appraiser. If during any such -year period, Lessee shall

(Number)

have made improvements to the Premises, Lessor may have such full replacement value

redetermined at any time after the improvements are made, regardless of when the full

replacement value was last determined.

E. Adjustment of Coverage. If either party shall at any time deem the limits of the

personal injury or property damage public liability insurance then carried to be either

excessive or insufficient, the parties shall endeavor to agree on the proper and reasonable

limits for insurance then to be carried. Insurance shall then be carried with the limits thus

agreed on until further change pursuant to the provisions of this section; but, if the parties

shall be unable to agree on the limits, the proper and reasonable limits for insurance then

to be carried shall be determined by an arbitrator selected by the parties in accordance

with Section 41 below.

F. Blanket Insurance Policies. In spite of anything to the contrary contained in this

Section, Lessee's obligations to carry the insurance provided for in this section may be

brought within the coverage of a so-called blanket policy or policies of insurance carried

and maintained by Lessee. However, the coverage afforded Lessor shall not be reduced

or diminished or otherwise be different from that which would have existed under a

separate policy meeting all other requirements of this Lease Agreement by reason of the

Commercial Ground Lease Page 12 of 18

use of the blanket policy of insurance. The requirements of Paragraph E of this Section

must also be otherwise satisfied.

G. Cost of insurance deemed additional rental.

The cost of insurance required to be carried by Lessee in this section shall be

deemed to be additional rental under this Lease Agreement.

25. Prohibition and Effect of Involuntary Assignment; Effect of Bankruptcy or

Insolvency

A. Prohibition of Involuntary Assignment. Neither this Lease Agreement nor the

leasehold estate of Lessee nor any interest of Lessee under this Lease Agreement in the

Premises or in the building or improvements on the Premises shall be subject to

involuntary assignment, transfer, or sale, or to assignment, transfer, or sale by operation

of law in any manner whatever (except through statutory merger or consolidation, or

devise, or intestate succession); any attempt at involuntary assignment, transfer, or sale

shall be void and of no effect.

B. Effect of Bankruptcy. Without limiting the generality of the provisions of the

preceding Paragraph A of this Section, Lessee agrees that if any proceedings under the

Bankruptcy Act or any amendment to the act be commenced by or against Lessee, and, if

against Lessee, the proceedings shall not be dismissed before either an adjudication in

bankruptcy or the confirmation of a composition, arrangement, or plan or reorganization,

or if Lessee is adjudged insolvent or makes an assignment for the benefit of its creditors,

or if a receiver is appointed in any proceeding or action to which Lessee is a party, with

authority to take possession or control of the Premises or the business conducted on the

Premises by Lessee, and such receiver is not discharged within a period of

(Number)

days after his or her appointment, any such event or any involuntary assignment

prohibited by the provisions of the preceding Paragraph A of this Section shall be

deemed to constitute a breach of this Lease Agreement by Lessee and shall, at the

election of Lessor, but not otherwise, without notice or entry or other action of Lessor,

terminate this Lease Agreement and also all rights of Lessee under this Lease Agreement

and in and to the Premises and also all rights of any and all persons claiming under

Lessee.

26. Notice of Default

A. Except as to the provisions of Sections 11 and 25 of this Lease Agreement,

Lessee shall not be deemed to be in default under this Lease Agreement in the payment of

rent or the payment of any other moneys as required or in the furnishing of any bond or

insurance policy when required in this Lease Agreement unless Lessor shall first give to

Lessee days' written notice of the default and Lessee fails to cure the

(Number)

default within days.

(Number)

Commercial Ground Lease Page 13 of 18

B. Except as to the provisions or events referred to in the preceding Paragraph of this

Section, Lessee shall not be deemed to be in default under this Lease Agreement unless

Lessor shall first give to Lessee days' written notice of the default, and

(Number)

Lessee fails to cure the default within the - day period, or, if the default is of

(Number)

such a nature that it cannot be cured within days, Lessee fails to commence

(Number)

to cure the default within the period of days or fails to proceed to the curing

(Number)

of the default with all possible diligence.

27. Default. I n the event of any breach of this Lease Agreement by Lessee, Lessor, in

addition to the other rights or remedies it may have, shall have the immediate right of reentry and

may remove all persons and property from the Premises. The property may be removed and

stored in a public warehouse or elsewhere at the cost and for the account of Lessee. Should

Lessor elect to reenter, as provided in this Lease Agreement, or should it take possession

pursuant to legal proceedings or pursuant to any notice provided for by law, Lessor may either

terminate this Lease Agreement or it may from time to time, without terminating this Lease

Agreement, relet the Premises or any part of the Premises for such term or terms (which may be

for a term extending beyond the term of this Lease Agreement) and at such rental or rentals and

on such other terms and conditions as Lessor in the sole discretion of Lessor may deem advisable

with the right to make alterations and repairs to the Premises. On each reletting: (a) Lessee shall

be immediately liable to pay to lessor, in addition to any indebtedness other than rent due under

this Lease Agreement, the expenses of reletting and of making such alterations and repairs,

incurred by Lessor, and the amount, if any, by which the rent reserved in this Lease Agreement

for the period of reletting (up to but not beyond the term of this Lease Agreement) exceeds the

amount agreed to be paid as rent for the Premises for the period on reletting; or (b) at the option

of Lessor, rents received by the Lessor from reletting shall be applied, first, to the payment of

any indebtedness, other than rent due under this Lease Agreement from Lessee to Lessor;

second, to the payment of any expenses of reletting and of making alterations and repairs; third,

to the payment of rent due and unpaid under this Lease Agreement, and the residue, if any, shall

be held by Lessor and applied in payment of future rent as it may become due and payable under

this Lease Agreement. If Lessee has been credited with any rent to be received by reletting under

option (a), above, and the rent was not promptly paid to Lessor by the new tenant, or if the

rentals received from the reletting under option (b), above, during any month is less than that to

be paid during that month by Lessee under this Lease Agreement, Lessee shall pay any

deficiency to Lessor. The deficiency shall be calculated and paid monthly. No reentry or taking

possession of the Premises by Lessor shall be construed as an election on the part of Lessor to

terminate this Lease Agreement unless a written notice of such intention is given to Lessee or

unless the termination of this Lease Agreement is decreed by a court of competent jurisdiction.

In spite of any reletting without termination, Lessor may, at any subsequent time, elect to

terminate this Lease Agreement for such previous breach. Should Lessor at any time terminate

this Lease Agreement for any breach, in addition to any other remedy it may have, Lessor may

recover from Lessee all damages incurred by reason of the breach, including the cost of

recovering the Premises, and including the worth at the time of termination of the excess, if any,

Commercial Ground Lease Page 14 of 18

of the amount of rent and charges equivalent to rent reserved in this Lease Agreement for the

remainder of the stated term over the then reasonable rental value of the Premises for the

remainder of the stated term, all of which amounts shall be immediately due and payable from

Lessee to Lessor.

28. Lessor’s Right to Perform. If Lessee, by failing or neglecting to do or perform any act

or thing provided in this Lease Agreement by it to be done or performed, shall be in default

under this Lease Agreement and such failure shall continue for a period of

(Number)

days after written notice from Lessor specifying the nature of the act or thing to be done or

performed, then Lessor may, but shall not be required to, do or perform or cause to be done or

performed such act or thing (entering on the Premises for such purposes, if Lessor shall so elect),

and Lessor shall not be held liable or in any way responsible for any loss, inconvenience,

annoyance, or damage resulting to Lessee on account of that election. Lessee shall repay to

Lessor on demand the entire expense incurred on account of the election, including

compensation to the agents and employees of Lessor. Any act or thing done by Lessor pursuant

to the provisions of this Section shall not be construed as a waiver of any such default by Lessee,

or as a waiver of any covenant, term, or condition contained in this Lease Agreement, or of any

other right or remedy of Lessor, under this Lease Agreement or otherwise. All amounts payable

by Lessee to Lessor under any of the provisions of this Lease Agreement, if not paid when they

become due as in this Lease Agreement provided, shall bear interest from the date they become

due until paid at the rate of % per annum, compounded annually.

29. Lessee’s Right of First Refusal to Purchase Premises . If at any time during the term of

this Lease Agreement Lessor shall receive from any third party a bona fide offer to purchase the

Premises at a price and on terms acceptable to Lessor, Lessor shall give written notice of the

price and terms to Lessee, and Lessee shall have days after such notice in which to

(Number)

execute a written agreement with Lessor for the purchase of the Premises at that price and on

those terms. If Lessor shall so notify Lessee and Lessee shall fail to execute the agreement within

the - day period, Lessor shall then be free to sell the property to the third party

(Number)

making the offer on the same terms and conditions set forth in the offer. If the property is so sold

to that party, then all rights of Lessee under this Section shall promptly terminate. If the property

is not sold to the party making the offer, then Lessor shall give Lessee the same right to purchase

the property on receiving any subsequent offer from any third party that is acceptable to Lessor;

provided, however, that nothing contained in this Section shall in any way limit the right of

Lessor to transfer or convey the Premises on the dissolution of Lessor or otherwise, for nominal

or no consideration, and Lessee shall have no right to purchase the property in the event of a

transfer or conveyance.

30. Lessee’s Option to Terminate. Lessee shall have the right, by written notice to Lessor

given at least days prior to: (a) the expiration of the first - year

(Number) (Number)

period of the term of this Lease Agreement; or (b) the expiration of any subsequent

(Number)

Commercial Ground Lease Page 15 of 18

-year period of the term of this Lease Agreement, to terminate this Lease Agreement and

surrender its leasehold interest under this Lease Agreement to Lessor, effective on the expiration

of the - year or - year period. On the effective date, Lessee shall be

(Number) (Number)

relieved from all further liability under this Lease Agreement and shall deliver possession of the

Premises to Lessor.

31. Effect of Eminent Domain

A. Effect of total condemnation. If the entire Premises shall be appropriated or

taken under the power of eminent domain by any public or quasi-public authority, this

Lease Agreement shall terminate and expire as of the date of the taking, and Lessee shall

then be released from any liability subsequently accruing under this Lease Agreement.

B. Effect of Partial Condemnation. If a portion of the Premises shall be so

appropriated or taken and the remainder of the property shall not be suitable for the use

then being made of the property by Lessee, or if the remainder of the property is not one

undivided parcel of property, Lessee shall have the right to terminate this Lease

Agreement as of the date of the taking on giving to Lessor written notice of termination

within days after Lessor has notified Lessee in writing that the property has

(Number)

been so appropriated or taken.

C. If there is a partial taking and Lessee does not so terminate this Lease Agreement,

then this Lease Agreement shall continue in full force and effect as to the part not taken,

and the rental to be paid by Lessee during the remainder of the term, subject to

adjustment as provided in the rental adjustment provisions of Section 3 of this Lease

Agreement, shall be determined in the manner provided for in the rental adjustment

provisions. Any such determination shall not affect or change the times at which Lessor

may require an adjustment in rent under those provisions; provided, however, that the

words "which in no event shall be less than the rental then being paid by lessee"

appearing in the rental adjustment provisions shall not apply with respect to such

determination, but shall apply with respect to any subsequent adjustment under the rental

adjustment provisions.

D. Condemnation award. In the event of the termination of this Lease Agreement

by reason of the total or partial taking of the Premises by eminent domain, then in any

such condemnation proceedings, Lessor and Lessee shall be free to make claim against

the condemning or taking authority for the amount of any damage done to them,

respectively, as a result of the condemning or taking.

E. In the event of a partial taking of the Premises and this Lease Agreement is not

terminated, then Lessee shall have the right to make claim against the condemning or

taking authority for only the unamortized cost of the improvements placed on the

Premises by Lessee and located on the Premises at the time of the taking or appropriation,

which improvements shall be deemed to amortize in equal annual amounts over the

period commencing with the date of completion of the improvements and ending on

Commercial Ground Lease Page 16 of 18

.

(End date of amortization period)

32. Surrender of Lease . The voluntary or other surrender of this Lease Agreement by

Lessee, or a mutual cancellation of this Lease Agreement, shall not work a merger, and shall, at

the option of Lessor, terminate all or any existing subleases or subtenancies or may, at the option

of Lessor, operate as an assignment to it of any or all such subleases or subtenancies.

33. Disposition of Improvements on Termination of Lease . On termination of this Lease

Agreement for any cause, Lessor shall become the owner of any building or improvements on

the Premises. If the building extends onto other property owned by the then Lessee under this

Lease Agreement, the Lessee shall convey to Lessor, on termination, an undivided interest as

tenant in common in all of the property covered by the building which bears the same proportion

to the whole as the area of the Premises bears to the total area covered by the building. Lessor

shall convey to Lessee an undivided interest as tenant in common in the Premises that bears the

same relation to the whole of the Premises as the area covered by the building not included in the

Premises bears to the whole area covered by the building.

34. Transfer of Security. If any security is given by Lessee to secure the faithful

performance of all or any of the covenants of this Lease Agreement on the part of Lessee, Lessor

may transfer or deliver the security, as such, to the purchaser of the reversion, if the reversion be

sold, and then Lessor shall be discharged from any further liability in reference to the security.

35. Waiver. The waiver by Lessor of, or the failure of Lessor to take action with respect to,

any breach of any term, covenant, or condition contained in this Lease Agreement shall not be

deemed to be a waiver of such term, covenant, or condition, or subsequent breach of the same, or

any other term, covenant, or condition contained in this Lease Agreement. The subsequent

acceptance of rent under this Lease Agreement by Lessor shall not be deemed to be a waiver of

any preceding breach by Lessee of any term, covenant, or condition of this Lease Agreement,

other than the failure of lessee to pay the particular rental so accepted, regardless of Lessor's

knowledge of a preceding breach at the time of acceptance of rent.

36. Effect of Lessee’s Holding Over. Any holding over after the expiration of the term of

this Lease Agreement, with the consent of Lessor, shall be construed to be a tenancy from

month-to-month, at the same monthly rental as required to be paid by Lessee for the period

immediately prior to the expiration of the term of this Lease Agreement, and shall otherwise be

on the terms and conditions specified in this Lease Agreement, so far as applicable.

37. Governing Law. This Lease Agreement shall be governed by, construed, and enforced in

accordance with the laws of the State of .

(Name of State)

38. Entire Agreement . This Lease Agreement shall constitute the entire agreement between

the parties. Any prior understanding or representation of any kind preceding the date of this

Lease Agreement shall not be binding on either party except to the extent incorporated in this

Agreement.

Commercial Ground Lease Page 17 of 18

39. Modification of Agreement. Any modification of this Lease Agreement or additional

obligation assumed by either party in connection with this Lease Agreement shall be binding

only if evidenced in a writing signed by each party or an authorized representative of each party.

40. Additional Documents. The parties agree to execute whatever papers and documents

may be necessary to effectuate the terms of this Lease Agreement.

41. Mandatory Arbitration. Notwithstanding the foregoing, and anything herein to the

contrary notwithstanding, any dispute under this agreement shall be required to be resolved by

binding arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party

shall select one arbitrator and both arbitrators shall then select a third. The third arbitrator so

selected shall arbitrate said dispute. The arbitration shall be governed by the rules of the

American Arbitration Association then in force and effect.

WITNESS our signatures as of the day and date first above stated.

(Name of Corporation)

(Name of Corporation)

By: By:

(Signature of Officer) (Signature of Officer)

(Printed Name & Office in Corporation) (Printed Name & Office in Corporation)

Acknowledgment (form may vary state by state)

Attach Exhibits

Commercial Ground Lease Page 18 of 18