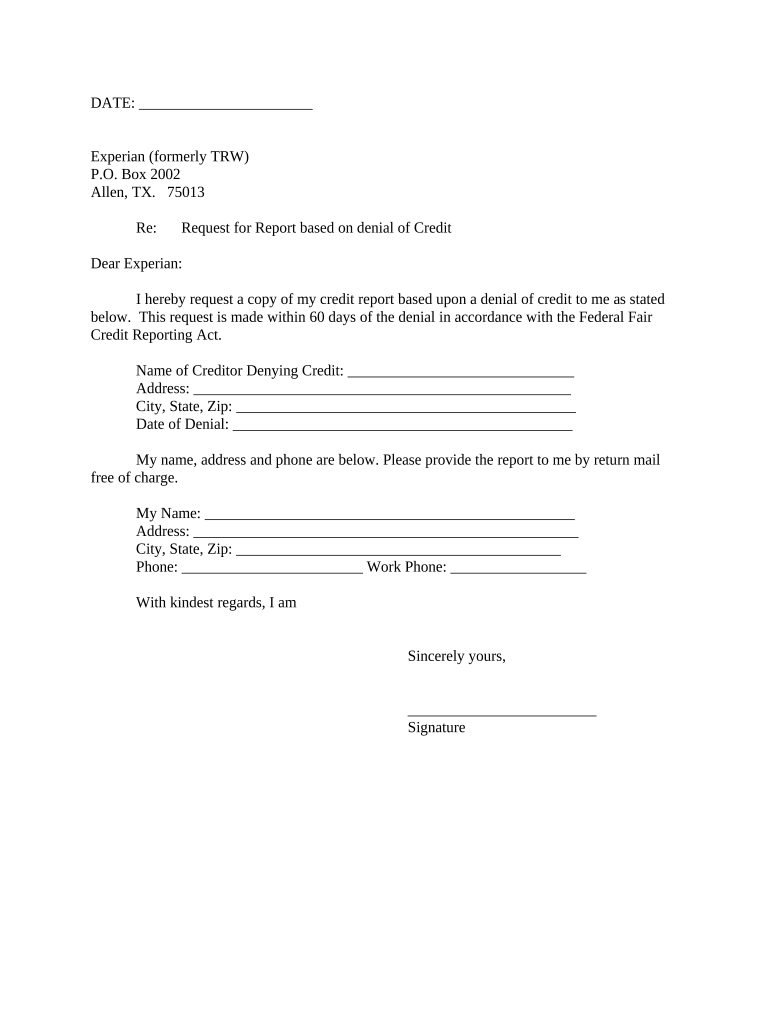

Fill and Sign the Letter Requesting Credit Form

Useful suggestions for finishing your ‘Letter Requesting Credit’ online

Are you fatigued by the inconvenience of managing paperwork? Search no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Wave goodbye to the tedious process of printing and scanning documents. With airSlate SignNow, you can seamlessly fill out and sign documents online. Take advantage of the powerful features integrated into this user-friendly and economical platform and transform your method of document handling. Whether you need to approve forms or collect signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a free trial with our service.

- Select +Create to upload a document from your device, cloud, or our form library.

- Open your ‘Letter Requesting Credit’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Letter Requesting Credit or send it for notarization—our platform provides everything you require to achieve such tasks. Register with airSlate SignNow today and enhance your document management to a new level!

FAQs

-

What is a sample credit request letter to supplier?

A sample credit request letter to supplier is a template used by businesses to formally request credit from their suppliers. It typically includes essential details such as the reason for the credit request, the amount needed, and any relevant account information. Utilizing a sample credit request letter to supplier can simplify the process and ensure that all necessary information is included.

-

How can airSlate SignNow help with a sample credit request letter to supplier?

airSlate SignNow allows users to easily create, send, and eSign a sample credit request letter to supplier. The platform's user-friendly interface and templates make it simple to customize your request letter to fit your specific needs. Additionally, airSlate SignNow ensures that your letter is securely stored and easily accessible.

-

Are there any costs associated with using airSlate SignNow for a sample credit request letter to supplier?

airSlate SignNow offers various pricing plans to accommodate different business needs. Users can choose from free trials or subscription models that provide access to advanced features, including those needed to create a sample credit request letter to supplier. Pricing is competitive, making it a cost-effective solution for managing document workflows.

-

What features does airSlate SignNow provide for creating documents like a sample credit request letter to supplier?

airSlate SignNow includes features such as customizable templates, drag-and-drop document editing, and real-time collaboration. These tools make it easy to craft a professional sample credit request letter to supplier that meets your business requirements. Additionally, the platform supports electronic signatures, streamlining the approval process.

-

Can I integrate airSlate SignNow with other software to manage my sample credit request letter to supplier?

Yes, airSlate SignNow offers integrations with a variety of applications, including CRM systems, cloud storage services, and project management tools. This allows you to seamlessly manage your documents, including a sample credit request letter to supplier, within your existing workflows. Integrating these tools can enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for a sample credit request letter to supplier?

Using airSlate SignNow to create a sample credit request letter to supplier provides numerous benefits. The platform ensures that your documents are professional, legally binding, and easily shareable. Moreover, it saves time by automating the signing process, allowing for quicker responses from suppliers.

-

Is it easy to get started with airSlate SignNow for creating a sample credit request letter to supplier?

Absolutely! Getting started with airSlate SignNow is straightforward. You can sign up for a free trial and access a range of templates, including a sample credit request letter to supplier. The intuitive design of the platform means that even those with minimal technical skills can create and send documents quickly.

The best way to complete and sign your letter requesting credit form

Find out other letter requesting credit form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles