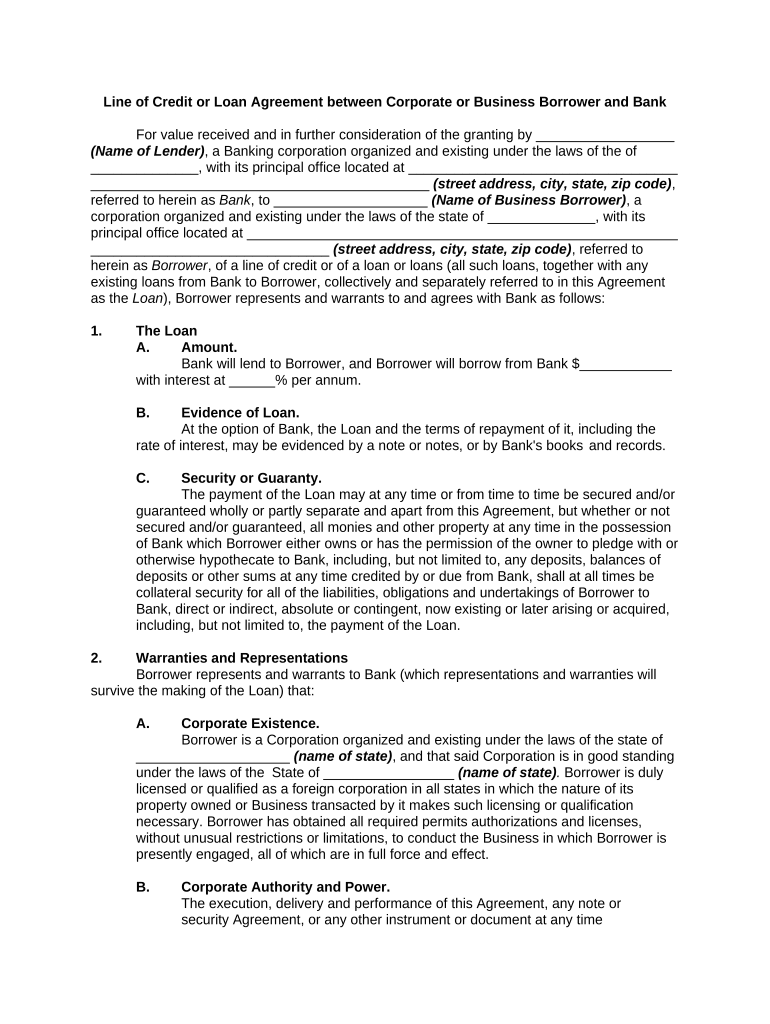

Line of Credit or Loan Agreement between Corporate or Business Borrower and Bank

For value received and in further consideration of the granting by __________________

(Name of Lender) , a Banking corporation organized and existing under the laws of the of

______________, with its principal office located at ___________________________________

____________________________________________ (street address, city, state, zip code) ,

referred to herein as Bank , to ____________________ (Name of Business Borrower) , a

corporation organized and existing under the laws of the state of ______________, with its

principal office located at ________________________________________________________

_______________________________ (street address, city, state, zip code) , referred to

herein as Borrower , of a line of credit or of a loan or loans (all such loans, together with any

existing loans from Bank to Borrower, collectively and separately referred to in this Agreement

as the Loan ), Borrower represents and warrants to and agrees with Bank as follows:

1. The Loan

A. Amount.

Bank will lend to Borrower, and Borrower will borrow from Bank $____________

with interest at ______% per annum.

B. Evidence of Loan.

At the option of Bank, the Loan and the terms of repayment of it, including the

rate of interest, may be evidenced by a note or notes, or by Bank's books and records.

C. Security or Guaranty.

The payment of the Loan may at any time or from time to time be secured and/or

guaranteed wholly or partly separate and apart from this Agreement, but whether or not

secured and/or guaranteed, all monies and other property at any time in the possession

of Bank which Borrower either owns or has the permission of the owner to pledge with or

otherwise hypothecate to Bank, including, but not limited to, any deposits, balances of

deposits or other sums at any time credited by or due from Bank, shall at all times be

collateral security for all of the liabilities, obligations and undertakings of Borrower to

Bank, direct or indirect, absolute or contingent, now existing or later arising or acquired,

including, but not limited to, the payment of the Loan.

2. Warranties and Representations

Borrower represents and warrants to Bank (which representations and warranties will

survive the making of the Loan) that:

A. Corporate Existence.

Borrower is a Cor poration organized and existing under the laws of the state of

____________________ (name of state) , and that said Corporation is in good standing

under the laws of the State of _________________ (name of state) . Borrower is duly

licensed or qualified as a foreign corporation in all states in which the nature of its

property owned or Business transacted by it makes such licensing or qualification

necessary. Borrower has obtained all required permits authorizations and licenses,

without unusual restrictions or limitations, to conduct the Business in which Borrower is

presently engaged, all of which are in full force and effect.

B. Corporate Authority and Power.

The execution, delivery and performance of this Agreement, any note or

security Agreement, or any other instrument or document at any time

required in connection with the Loan, are within the corporate powers of

Borrower, and not in contravention of law, the articles of

organization or bylaws of Borrower or any amendment of the same, or of

any indenture, Agreement or undertaking to which Borrower is a party or may

otherwise be bound, and each such instrument and document represent a

valid and binding obligation of Borrower and is fully enforceable according

to its terms. Borrower will, at the request of Bank at any time and from time

to time, furnish Bank with the opinion of counsel for Borrower with respect

to any or all of the foregoing or other matters, such opinion to be in

substance and form satisfactory to Bank.

C. Financial Status.

All financial statements and other statements previously or in the future

given by Borrower to Bank in respect of this Agreement are or will be true and

correct, subject to any limitation stated in them, consistent with any prior

statements furnished to Bank, and prepared in accordance with

generally accepted accounting principles to represent fairly the

condition of Borrower as of the date of the statement.

D. Litigation.

There is not now pending or threatened against Borrower any action or other

proceedings or any claim in which Borrower has any monetary or other proprietary

interest nor do any of the executive or managing personnel of Borrower know of any

facts which may give rise to any such litigation, proceeding or claim, except: (describe)

______________________________________________________________________

______________________________________________________________________

.

E. Events of Default.

No event of default specified in Section 5 of this Agreement, and no

event which, with the lapse of time or notice, would become such an event of

default, has occurred and is continuing.

F. Title to Property.

Borrower has good and marketable title to all property in which Borrower has

given or has agreed to give a security interest to Bank and such property is or will be

free of all encumbrances except: (describe) ___________________________________

______________________________________________________________________

.

G. Taxes.

Borrower has filed all tax returns required to be filed, has paid all taxes

due and has provided adequate reserves for payment of any tax which is being

contested.

3. Affirmative Covenants

Borrower agrees that until payment in full of the Loan and performance of all of its other

obligations under this Agreement, Borrower will, unless Bank otherwise consents in writing,

comply with the following:

A. Compensating Balances.

Bank shall be Borrower's main bank of deposit and Borrower shall maintain

average aggregate collected balances in its deposit account or accounts with Bank of

not less than ______% of the outstanding unpaid balance of the Loan or Loans, such

collected balances to be calculated net of any balances required to support demand

deposit account activity costs. Balances shall be averaged (e.g., monthly) __________ .

B. Commitment Fee.

Subject to the terms of this Agreement Bank commits itself, until (date), to lend to

Borrower at any time or from time to time a sum or sums in the aggregate amount of

$____________, and Borrower agrees to pay to Bank monthly in arrears for Bank's

commitment fee of ______% of the unused portion of the commitment so long as the

same is outstanding. Borrower shall also, in addition to the requirements of Paragraph

A of this Section 3 , maintain collected balances in its deposit account or accounts with

Bank of not less than ______% of the unused portion of the commitment. Repayments

on account of the Loan shall not operate to increase the unused portion of the

commitment, except in the case of revolving loans.

C. Financial Statements.

Borrower will furnish to Bank quarterly statements prepared by Borrower within

______ days of the close of each quarter, and, within ________ days after the close of

each fiscal year, an annual audit prepared by the equity method and certified by public

accountants selected by Borrower and approved by Bank, together with a certificate by

such accountants that at such audit date Borrower was acting in compliance with the

terms of this Agreement. Borrower shall indicate on the statements all guarantees made

by it. Borrower will upon request permit a representative of Bank to inspect and make

copies of Borrower's books and records at all reasonable times.

D. Insurance.

Borrower will maintain adequate fire insurance with extended coverage, public

liability and other insurance as Bank may reasonably require as consistent with

sound business practice and with companies satisfactory to Bank, which policies will show the

Bank as a loss payee.

E. Taxes and Other Liens.

Borrower will comply with all statutes and government regulations and pay all

taxes, assessments, governmental charges or levies, or claims for labor, supplies, rent

and other obligations made against it which, if unpaid, might become a lien or charge

against Borrower or on its property, except liabilities being contested in good faith and

against which, if requested by Bank, Borrower will set up reserves satisfactory to Bank.

F. Maintenance of Existence.

Borrower will maintain its existence and comply with all applicable statutes, rules

and regulations, and maintain its properties in good operating condition, and continue to

conduct its Business as presently conducted.

G. Notice of Default.

Within _____ Business days of becoming aware of (i) the existence of any

condition or event which constitutes a default under Section 5 of this Agreement; or

(ii) the existence of any condition or event which with notice or the passage of time, will

constitute a default under Section 5 of this Agreement, Borrower will provide Bank

with written notice specifying the nature and period of existence of the same and what

action Borrower is taking or proposes to take with respect to the same.

H. Use of Proceeds.

Borrower shall use the proceeds of the Loan under this Agreement for general

commercial purposes, provided that no part of such proceeds will be used for the

purpose of purchasing or carrying any margin security as such term is defined in

Regulation U of the Board of Governors of the Federal Reserve System.

I. Further Assurances.

Borrower will execute and deliver to Bank any writings and do all things

necessary, effectual or reasonably requested by Bank to carry into effect the provisions

and intent of this Agreement.

4. Negative Covenants

Without the prior written approval of Bank, Borrower will not:

A. Consolidation, Merger or Acquisition.

Participate in any merger or consolidation or alter or amend the capital structure

of Borrower, including, but not limited to, the issuance of additional stock, or make any

acquisition of the Business of another.

B. Dividends.

Pay any dividends, including a stock dividend, or make any distributions, in cash

or otherwise, including splits of any kind, to any officer, stockholder or beneficial owner

of Borrower, other than salaries.

C. Encumbrances.

Mortgage, pledge or otherwise encumber any property of Borrower or permit any

lien to exist on such property except liens (i) for taxes not delinquent or being

contested in good faith; (ii) of mechanics or materialmen in respect of obligations not

overdue or being contested in good faith; (iii) resulting from security deposits made

in the ordinary course of Business; or (iv) in favor of Bank.

D. Investments.

Invest any assets of Borrower in securities other than obligations of the United

States of America.

E. Disposition of Assets, Guarantees, Loans, Advances.

Sell, transfer or assign any assets of Borrower other than in the ordinary course

of Business or, except as specifically permitted in this Agreement (i) sell or transfer or

assign any of Borrower's accounts receivable with or without recourse; (ii) guarantee or

become surety for the obligations of any person, firm, or corporation; or (iii) make any

loans or advances except: (describe) _______________________________________

______________________________________________________________________

.

F. Working Capital.

Permit its inventory to exceed _______% of its current assets; permit its net

working capital (excess of current assets over current liabilities) to be less than

$____________ for the current fiscal year and for each subsequent fiscal year to be less

than the amount for the prior fiscal year plus ______% of Borrower's net income earned

for the prior year, after provision for taxes, provided that there shall be no reduction in

the required working capital for losses; or permit its current assets to be less than

_______% of its current liabilities, current assets and current liabilities to be computed in

accordance with customary accounting practice except that current liabilities shall in any

event include all rentals and other payments due within one year under any lease or

rental of personal property.

G. Liabilities.

Permit its total short and long term liabilities including borrowings to exceed

______% of Borrower's tangible net worth, the percentage to decrease ______% per

year for the term of the Loan.

H. Fixed Assets.

Make, or incur any obligation to make, any expenditures in any fiscal year for

fixed assets by purchase or lease Agreement the aggregate fair market value of which

assets is in excess of $____________.

I. Compensation.

Pay to its officers and directors aggregate compensation in any fiscal year which

exceeds $____________.

J. Employee Retirement Investment Security Act of 1974 ("ERISA").

Permit any pension plan to (i) engage in any prohibited transaction; (ii) fail to

report to Bank a reportable event; (iii) incur any accumulated funding deficiency; or (iv)

terminate its existence at any time in a manner which could result in the imposition of a

lien on the property of the Borrower. (The quoted terms are defined in Sections 2003(c),

302, and 4003, respectively, of ERISA, as amended.)

5. Default

If any one or more of the following events of default shall occur at any time, Bank shall

have the right to declare any or all liabilities or obligations of Borrower to Bank immediately due

and payable without notice or demand:

A. Any warranty, representation or statement made or furnished to Bank by or on

behalf of Borrower or any guarantor or surety for Borrower was in any material respect

false when made or furnished;

B. A failure to pay or perform when due any obligation, liability or covenant of

Borrower or of any guarantor or surety for Borrower, under this Loan Agreement or any

other indebtedness or obligation for borrowed money, or if such indebtedness or

obligation shall be accelerated, or if there exists any event of default under any such

instrument, document or Agreement evidencing or securing such indebtedness or

obligation, including, but not limited to, failure to perform the terms of this Agreement or

of the note or notes evidencing the Loan;

C. The commencement of any proceeding under any bankruptcy or insolvency laws

by or against Borrower, the appointment of a trustee, receiver, or custodian and,

if any such proceeding is involuntary, such proceeding has not been dismissed and all

trustees, receivers, or custodians discharged within _____ days of its commencement or

their appointment;

D. The service upon Bank of a writ in which Bank is named as trustee or Borrower

or any guarantor or surety for Borrower;

E. The liquidation, termination or dissolution of Borrower or its ceasing to carry on

actively its present Business; and, if any guarantor or surety for Borrower is a

corporation, trust or partnership, the liquidation, termination or dissolution of any such

organization or its ceasing to carry on actively its present business;

F. The death any guarantors or surety for Borrower, and if any guarantor or surety

for Borrower is a partnership, the death of any partner; or

G. A judgment or judgments of the payment of money aggregating in excess of

$____________ is outstanding against Borrower or any guarantor or surety for Borrower

and any one of such judgments has been outstanding for more than ________days from

the date of its entry and has not been discharged in full or stayed.

6. Miscellaneous

A. Other Agreements.

This Agreement is supplementary to every other Agreement between Borrower

and Bank and shall not be so construed as to limit or otherwise derogate from any of the

rights or remedies of Bank or any of the liabilities, obligations or undertakings of

Borrower under any such Agreement, nor shall any contemporaneous or subsequent

Agreement between Borrower and Bank be construed to limit or otherwise derogate from

any of the rights or remedies of Bank or any of the liabilities, obligations or undertakings

of Borrower under this Agreement unless such other Agreement specifically refers to this

Agreement and expressly so provides. This Agreement and the covenants and

Agreements contained in it shall continue in full force and effect and shall be applicable

not only with respect to the Loan, but also to all other obligations, liabilities and

undertakings of Borrower to Bank whether direct or indirect absolute or contingent, due

or to become due, now existing or later arising or acquired, until all such obligations,

liabilities and undertakings have been paid or otherwise satisfied in full.

B. Waivers.

No delay or omission on the part of Bank in exercising any right under this

Agreement shall operate as a waiver of such right or any other right, and waiver on any

one or more occasions shall not be construed as a bar to or waiver of any right or

remedy of Bank on any future occasion.

C. Expenses.

Borrower will pay or reimburse Bank for all reasonable expenses, including

attorney's fees, which Bank may in any way incur in connection with this Agreement or

any other Agreement between Borrower and Bank or with any Loan or which result from

any claim or action by any third person against Bank which would not have been

asserted were it not for Bank's relationship with Borrower under this Agreement or

otherwise.

D. Notices

Unless provided herein to the contrary, any notice provided for or concerning this

Agreement shall be in writing and shall be deemed sufficiently given when sent by

certified or registered mail if sent to the respective address of each party as set forth at

the beginning of this Agreement.

E. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance

with the laws of the State of ______________.

F. Successors and Assigns.

This Agreement shall be binding on Borrower's legal representatives, successors

and assigns and shall inure to the benefit of Bank's successors and assigns.

The parties have executed this Agreement at ___________________________

(Name of City and State) on _____________________ (date) .

____________________________ _______________________________

(Name of Bank) (Name of Borrower)

By:____________________________ By:____________________________

_______________________________ _______________________________

(P rinted Name & Office in Corporation) (P rinted Name & Office in Corporation)

______________________________ _______________________________

(Signature of Officer) (Signature of Officer)

Acknowledgments