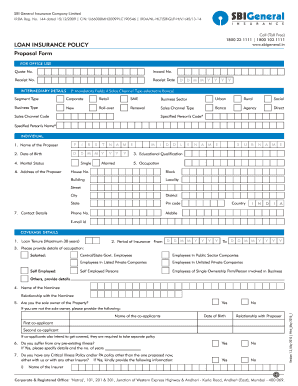

Fill and Sign the Loan Insurance Policy Form

Valuable assistance for finalizing your ‘Loan Insurance Policy’ online

Are you weary of the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature service for individuals and organizations. Wave goodbye to the tedious task of printing and scanning documents. With airSlate SignNow, you can conveniently finalize and endorse paperwork online. Take advantage of the extensive features bundled into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to sign forms or collect signatures, airSlate SignNow takes care of everything effortlessly, requiring just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Loan Insurance Policy’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and allocate fillable fields for other individuals (if required).

- Follow the Send Invite settings to solicit eSignatures from others.

- Store, print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Loan Insurance Policy or send it for notarization—our solution equips you with everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to unprecedented levels!

FAQs

-

What is a Loan Insurance Policy?

A loan insurance policy is designed to protect lenders and borrowers in the event of unforeseen circumstances that may impact loan repayment. This type of policy typically covers scenarios like job loss, disability, or death, ensuring that the loan is paid off even if the borrower cannot make the payments. By securing a loan insurance policy, borrowers can ensure peace of mind as they navigate their financial commitments.

-

How does a Loan Insurance Policy work?

A loan insurance policy works by providing coverage that pays off the outstanding balance of a loan if the borrower faces a qualifying event, such as death or serious illness. When you purchase this policy, you pay regular premiums, and in return, the insurance company guarantees loan repayment under the agreed conditions. This ensures that your loved ones are not burdened with debt in difficult times.

-

What are the benefits of a Loan Insurance Policy?

The primary benefit of a loan insurance policy is financial protection for both the borrower and their family. It helps alleviate the stress of loan repayments in case of emergencies, safeguarding both personal finances and the lender's interests. Additionally, having a loan insurance policy can enhance creditworthiness, making it easier to secure future loans.

-

How much does a Loan Insurance Policy cost?

The cost of a loan insurance policy varies based on several factors, including the loan amount, the borrower’s age, health status, and the coverage terms. Generally, premiums are affordable and can be included as part of your loan payments, making it a cost-effective solution for protecting your financial future. It's advisable to compare different policies to find one that meets your budget and coverage needs.

-

Can I customize my Loan Insurance Policy coverage?

Yes, many lenders offer customizable loan insurance policies that allow borrowers to choose the level of coverage that suits their needs. You can adjust factors such as the coverage amount, term length, and specific conditions that trigger payouts. Personalizing your loan insurance policy ensures you get the best protection tailored to your situation.

-

Is a Loan Insurance Policy required for all loans?

A loan insurance policy is not always a requirement for all loans, but some lenders may mandate it, especially for high-risk loans. It's important to check with your lender to understand their specific requirements regarding loan insurance policies. Even if not required, having a policy can provide signNow peace of mind and financial security.

-

What types of loans can a Loan Insurance Policy cover?

A loan insurance policy can cover various types of loans, including personal loans, mortgages, auto loans, and business loans. Each type of loan may have different policy options and coverage specifics, so it’s essential to consult with your lender to ensure your loan insurance policy effectively meets your needs. This versatility makes it a valuable financial tool.

Find out other loan insurance policy form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles