Fill and Sign the Louisiana Collateral Mortgage Form

Useful Advice for Preparing Your ‘Louisiana Collateral Mortgage’ Online

Are you fatigued by the inconvenience of handling paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and organizations. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the robust features included in this user-friendly and affordable platform and transform your document management approach. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all effortlessly, requiring just a few clicks.

Adhere to these comprehensive instructions:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Louisiana Collateral Mortgage’ in the editor.

- Select Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you wish to collaborate with your colleagues on your Louisiana Collateral Mortgage or send it for notarization—our solution offers everything you need to accomplish these tasks. Register with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

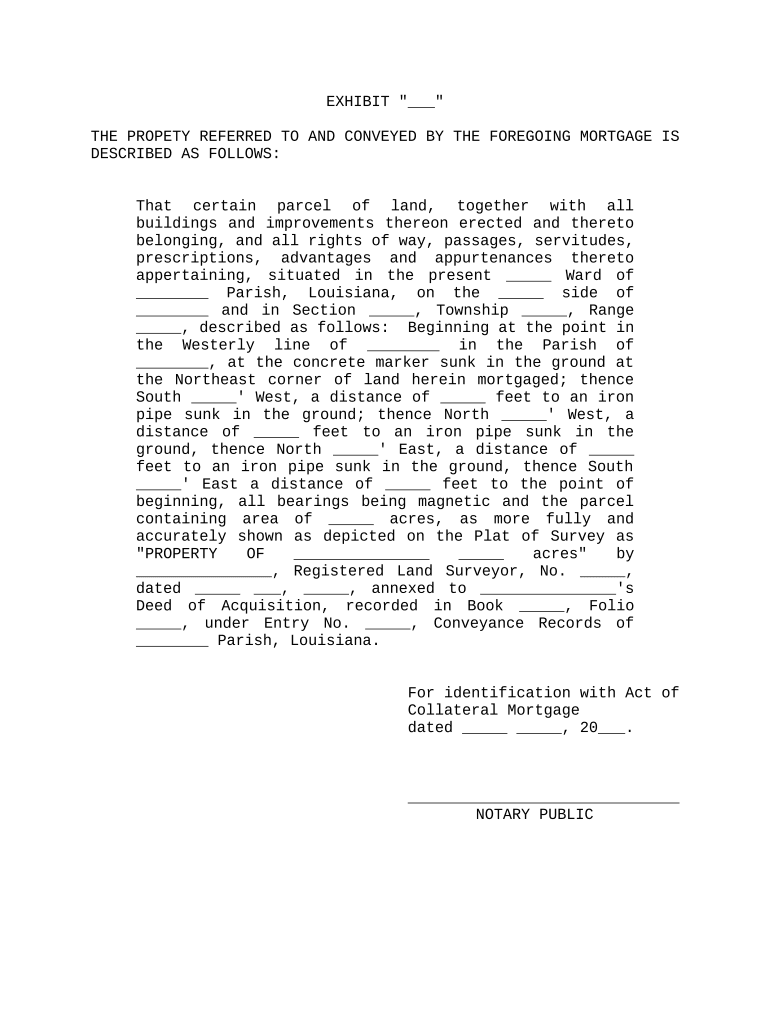

What is a Louisiana Collateral Mortgage?

A Louisiana Collateral Mortgage is a unique financing option that allows homeowners to secure a loan using their property as collateral. This type of mortgage can be beneficial for those looking to access the equity in their home without selling it. With a Louisiana Collateral Mortgage, borrowers can often enjoy lower interest rates and flexible terms.

-

How does a Louisiana Collateral Mortgage work?

In essence, a Louisiana Collateral Mortgage allows you to leverage the value of your property to obtain a loan. When you apply, the property is assessed, and the loan amount is based on its equity. This mortgage type typically simplifies the borrowing process and can be an attractive option for homeowners looking for quick access to funds.

-

What are the benefits of using a Louisiana Collateral Mortgage?

One of the primary benefits of a Louisiana Collateral Mortgage is the ability to borrow against your home's equity without needing to refinance or sell your property. Additionally, these loans often come with competitive interest rates and flexible repayment options, making them a financially savvy choice for many homeowners in Louisiana.

-

Are there any upfront costs associated with a Louisiana Collateral Mortgage?

Yes, obtaining a Louisiana Collateral Mortgage may involve some upfront costs such as appraisal fees, closing costs, and potential lender fees. It's essential to review these costs with your mortgage provider to ensure you understand the total expenses involved in securing your collateral mortgage.

-

How long does it take to get approved for a Louisiana Collateral Mortgage?

The approval process for a Louisiana Collateral Mortgage can vary depending on the lender and your financial profile. Generally, you can expect the approval process to take anywhere from a few days to several weeks. It's advisable to have all necessary documentation ready to expedite the process.

-

Can I use a Louisiana Collateral Mortgage for home improvements?

Absolutely! A Louisiana Collateral Mortgage can be an excellent way to fund home improvements. By leveraging your home's equity, you can access the necessary funds to enhance your property, potentially increasing its value while enjoying the benefits of improved living space.

-

What documents do I need to apply for a Louisiana Collateral Mortgage?

When applying for a Louisiana Collateral Mortgage, you'll typically need to provide financial documents such as recent pay stubs, tax returns, and information about your existing debts. Additionally, the lender may require details about the property being used as collateral to complete the application process.

The best way to complete and sign your louisiana collateral mortgage form

Find out other louisiana collateral mortgage form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles