Mail to:

Florida Department of Revenue

5050 W Tennessee St

Tallahassee Florida 32399-0150

DR-145

R. 07/12

Page 1

Oil Production Monthly Tax Return

Rule 12B-7.008

Florida Administrative Code

Effective 05/13

Use black ink. Example A - Handwritten Example B - Typed

0 1

Name

Address

City/St/ZIP

2 3 4 5 6 7 8 9

Certificate #

:

FEIN

:

Applied Period

:

0123456789

Return Due Date :

DOR USE ONLY

POSTMARK OR HAND-DELIVERY DATE

Tax Due with Return Calculation

Complete Return Schedules First

US DOLLARS

27. Gross Tax Due (Enter the sum of Line 8, Line 16, Line 23, and Line 26)........................................... $

28. Credit for Contributions to Nonprofit Scholarship Funding Organizations....... $

29. DOR Credit Memo Issued (attach original credit memo)..................................................... $

30. Total Tax Due........................................................................................................... $

31. Penalty..................................................................................................................... $

32. Interest..................................................................................................................... $

33. Total Due with Return ............................................................................................ $

,

,

,

,

,

,

,

CENTS

,

,

,

,

,

,

,

Under penalties of perjury, I declare that I have read the foregoing and the facts stated in it are true.

___________________________________________________________________________________________________________________________________________

Signature of officer

Title

Phone number

Date

___________________________________________________________________________________________________________________________________________

Signature of preparer

Address of preparer

Phone number

Date

Do Not Detach Coupon

DR-145

R. 07/12

Oil Production Monthly Tax Return

Enclose your payment coupon and check with your tax return to ensure your account is properly credited.

Return is due on the 25th day of the following month.

M M D D Y Y

Check here if you transmitted funds electronically.

Total amount due

from Line 33

▼

Period

Ending

Enter name and address, if not preprinted:

,

US DOLLARS

,

CENTS

FEIN

Enter FEIN if not preprinted

Name

Address

City/St/ZIP

Do Not Write in the Space Below.

DR-145

0600 0 20120131 0052037031 7 4000012345 6789 3

�Th

is

pa

ge

in

te

nt

io

na

lly

le

f

tb

la

nk

.

DR-145

R. 07/12

Page 2

Internet Address: www.myflorida.com/dor

�DR-145

R. 07/12

Page 3

SCHEDULE I - Ordinary Oil Production (8%)

COUNTY NAME

COUNTY

TOTALS

1. Total Barrels Produced

2. EXEMPTION Barrels used in lease operations on the lease or

unit where produced

3. Taxable Barrels (Line 1 minus Line 2)

4. Value Per Barrel (Round to the nearest

hundreths)

5. Taxable Value (Line 3 times Line 4)

6.

Total Taxable Value (Line 5) for all counties.

7.

Tax Rate

8.

Gross Tax Due (Multiply Line 6 times Line 7)

$

8% of value

$

SCHEDULE II - Small Well (5%)

COUNTY NAME

COUNTY

TOTALS

9. Total Barrels Produced

10. EXEMPTION Barrels used in lease operations on the lease

or unit where produced

11. Taxable Barrels (Line 9 minus Line 10)

12. Value Per Barrel (Round to the nearest

hundreths)

13. Taxable Value (Line 11 times Line 12)

14. Total Taxable Value (Line 13) for all counties.

$

5% of value

15. Tax Rate

16. Gross Tax Due (Multiply Line 14 times Line 15)

$

�DR-145

R. 07/12

Page 4

SCHEDULE III - Tertiary and Mature Field Recovery Oil Production (rate varies)

A

B

C

D

County Name

Total Barrels Produced

17.

EXEMPTION -

Barrels used in lease operations on the lease or unit

where produced

18.

19.

Taxable Barrels (Line 17 minus Line 18)

20.

Value Per Barrel (Round to the nearest hundreths)

21.

Taxable Value (Multiply Line 19 by Line 20)

$

$

$

Tax Due - Value of oil is $60 and below (Line 19

times the applicable value, not to exceed $60 times

1 percent)

$

$

$

$

$

$

$

$

22b.

Tax Due - Value of oil is greater than $60 and less

than $80 (Line 19 times the applicable value, not to

exceed $19.99, times 7 percent.)

Tax Due - Value of oil is $80 and above (Line 19

times the applicable value times 9 percent)

$

$

$

$

22c.

23.

Gross Tax Due for All Counties (Line 22a plus 22b plus 22c)

22a.

Tax Calculation

$

Tax Due (See Schedule III Instructions - Multiply

Line 19 times the tiered value per barrel times the

tiered tax rate. Enter the result on Line 22a, 22b, or

22c under the appropriate row and column.)

$

SCHEDULE IV - Escaped Oil (12.5%)

24. Gross Value of any Escaped Oil

$

12.5% of value

25. Tax Rate

26. Gross Tax Due (Multiply Line 24 times Line 25)

$

Internet Address: www.myflorida.com/dor

�DR-145

R. 07/12

Page 5

Instructions for Filing Oil Production Monthly Tax Return

Who Must File? Every producer of oil in Florida must file a

monthly tax return. Producers must file a return even if no tax

is due. Producer means any person who:

•

•

•

•

Owns, controls, manages, or leases oil property.

Owns, controls, manages, or leases oil wells.

Produces any taxable oil products.

Owns any royalty or other interest in any taxable product

(consistent with oil production) or its value, whether the

taxable product is produced by, or on behalf of someone

under a lease contract or otherwise.

Return Due Date? The monthly return is due on or before

the 25th day of the month following the month production

occurred. If the due date falls on a Saturday, Sunday, or state

or federal holiday, returns and payments will be considered

timely if postmarked on the next business day. Late-filed

returns are subject to penalty and interest.

Late Returns:

If your return and payment are late, a delinquency penalty

of 10 percent of any tax due will be added for each month,

or portion of a month, the return is late. The maximum

delinquency penalty cannot exceed 50 percent of the tax due.

A minimum penalty of $50 per month, or portion of a month,

applies even if no tax is due. This penalty cannot exceed

$300. A floating rate of interest applies to underpayments

and late payments of tax. We update the interest rate January

1 and July 1 of each year using the formula established in

Florida Statutes. To obtain updated interest rates, visit our

Internet site at www.myflorida.com/dor or contact Taxpayer

Services at 800-352-3671.

Electronic Funds Transfer (EFT): Any taxpayer who paid

more than $20,000 in severance taxes between July 1 and

June 30 (the state’s fiscal year), must pay their taxes by

Electronic Funds Transfer (EFT) in the next calendar year.

More information on EFT requirements and procedures can

be found on our Internet site or you can contact Taxpayer

Services (see “Contact Us”).

Amended returns: If you are filing an amended return,

use the Oil Production Monthly Amended Tax Return

(Form DR-145X). Do not resubmit Form DR-145.

Credit for Contributions to Nonprofit Scholarship Funding

Organizations:

A credit is available against severance tax on oil production for

contributions to nonprofit scholarship funding organizations

(SFOs). More information about this credit and how to submit

your Application for Tax Credit Allocation for Contributions

to Nonprofit Scholarship funding Organizations (SFOs)

(Form DR-116000) is on our Internet site.

The Department of Revenue must approve an allocation of

this credit before it can be taken. One hundred percent of an

eligible contribution is allowed as a credit, but the amount of

the credit taken may not exceed 50 percent of the gross tax

due reported on Line 27 of the return. If the credit granted

is not fully used in any one fiscal year (July through June),

you must apply for approval to carry forward the credit in a

subsequent year. An unused credit cannot be carried forward

more than five (5) years.

Instructions for Completing the Return

Schedule I:

Complete this schedule to report production of ordinary oil

subject to the eight percent tax rate. Ordinary oil includes all

oil that does not qualify as tertiary oil or small well oil.

For each county, in separate columns, enter the

gross production, exemption, and value per barrel.

Calculate the taxable barrels for each county and enter

the results on Line 3. Multiply the taxable barrels by the

value per barrel and enter the results on Line 5. Add

each taxable value listed on Line 5, and enter the result

on Line 6. Multiply the total taxable value by the tax

rate (8 percent) and enter the result on Line 8 (Gross

Tax Due).

Schedule II:

Use this schedule to report small well oil produced in

Florida for sale, transport, storage, profit, or commercial

use.

For each county, in separate columns, enter the gross

production, exemptions, and value per barrel. Calculate

the taxable barrels for each county and enter the results on

Line 11. Multiply the taxable barrels by the value per barrel

and enter the results on Line 13. Add each taxable value

listed on Line 13, and enter the result on Line 14. Multiply the

total taxable value by the tax rate (5 percent) and enter the

result on Line 16 (Gross Tax Due).

Schedule III:

Use this schedule to report tertiary or mature field oil produced

in Florida for sale, transport, storage, profit, or commercial

use. Report production, exemptions, and value per barrel

under the county in which the oil was severed (Columns A, B,

C, and D).

Tax due from tertiary or mature field oil production is

calculated using a tiered formula. Tax rates are based on

the value per barrel of oil at the time of production. Value

is defined as the sale or market price of the oil at the point

it reaches the mouth of the well in its natural, unrefined

condition.

�DR-145

R. 07/12

Page 6

A tax rate of:

•

•

•

One percent is levied on the first $60 of value.

Seven percent is levied on a value greater than $60 and

less than $80.

Nine percent is levied on a value greater than or equal to

$80.

Tax due is determined by multiplying the total number of

barrels produced, times the tiered value per barrel, times the

tiered tax rate.

Example 1

If 200 barrels of oil were produced and each barrel had a value

of $90 at the time of production, tax is calculated as follows:

•

•

•

200 barrels times $60 times 1 percent equals $120.

200 barrels times $19.99 times 7 percent equals $279.86.

200 barrels times $10.01 times 9 percent equals $180.18.

Total tax due in this example equals $580.04.

Example 2

If 200 barrels of oil were produced and each barrel had a value

of $50 at the time of production, tax is calculated as follows:

•

200 barrels times $50 times 1 percent equals $100.

Subtract exempt barrels reported on Line 18 from the total

barrels reported as produced on Line 17, and enter the result

on Line 19 (Taxable Barrels). Multiply Line 19 by the Value Per

Barrel (Line 20), and enter the result on Line 21.

Multiply Line 19 times the tiered value per barrel times the

tiered tax rate and enter the results on Lines 22a, 22b, or

22c. Add Lines 22a plus 22b plus 22c, and enter the result on

Line 23.

Schedule IV:

Complete this schedule to report any escaped oil subject

to the 12.5 percent tax rate. Enter the gross value of any

escaped oil by multiplying the total barrels by the value per

barrel. Multiply the gross value listed on Line 24 by the tax

rate (12.5 percent) reported on Line 25, and enter the result on

Line 26 (Gross Tax Due).

Front page of return:

Add Line 8 plus Line16 plus Line 23 plus Line 26 and carry the

result (Gross Tax Due) to Line 27, of the return. If the return

and payment are late, calculate and add penalty and interest.

To calculate interest, multiply the daily interest factor times

Line 30 (Total Tax Due) times the number of days late.

Total tax due in this example equals $100.

Sign and date the return and mail it with your payment to:

In separate columns for each county, enter:

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0150

•

•

•

Total Barrels Produced (Line 17).

Exemption

Value Per Barrel (Line 20).

If your payment is made by EFT, be sure to check the EFT box.

Contact Us

Information, forms, and tutorials are available on our Internet site:

www.myflorida.com/dor

To speak with a Department representative, call Taxpayer Services, Monday through Friday, 8 a.m. to

7 p.m., ET, at 800-352-3671.

To find a taxpayer service center near you, go to: www.myflorida.com/dor/contact.html

For written replies to tax questions, write to:

Taxpayer Services - Mail Stop 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

Subscribe to our tax publications to receive due date reminders or an e-mail when we post:

• Tax Information Publications (TIPs).

• Facts on Tax, a quarterly publication.

• Proposed rules, notices of rule development workshops, and more.

Go to: www.myflorida.com/dor/list/

Reference: Section 211.02 Florida Statutes

�

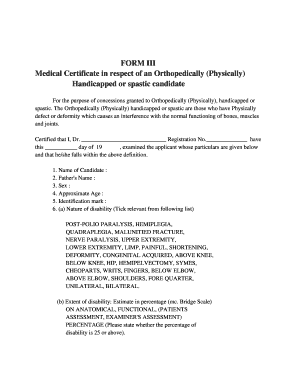

Practical advice on preparing your ‘Medical Certificate For Physically Handicapped For Driving License’ online

Are you fed up with the annoyance of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features included in this user-friendly and cost-effective platform and transform your approach to document administration. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this step-by-step guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Medical Certificate For Physically Handicapped For Driving License’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for additional participants (if required).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with your teammates on your Medical Certificate For Physically Handicapped For Driving License or submit it for notarization—our platform provides everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document administration to a new level!