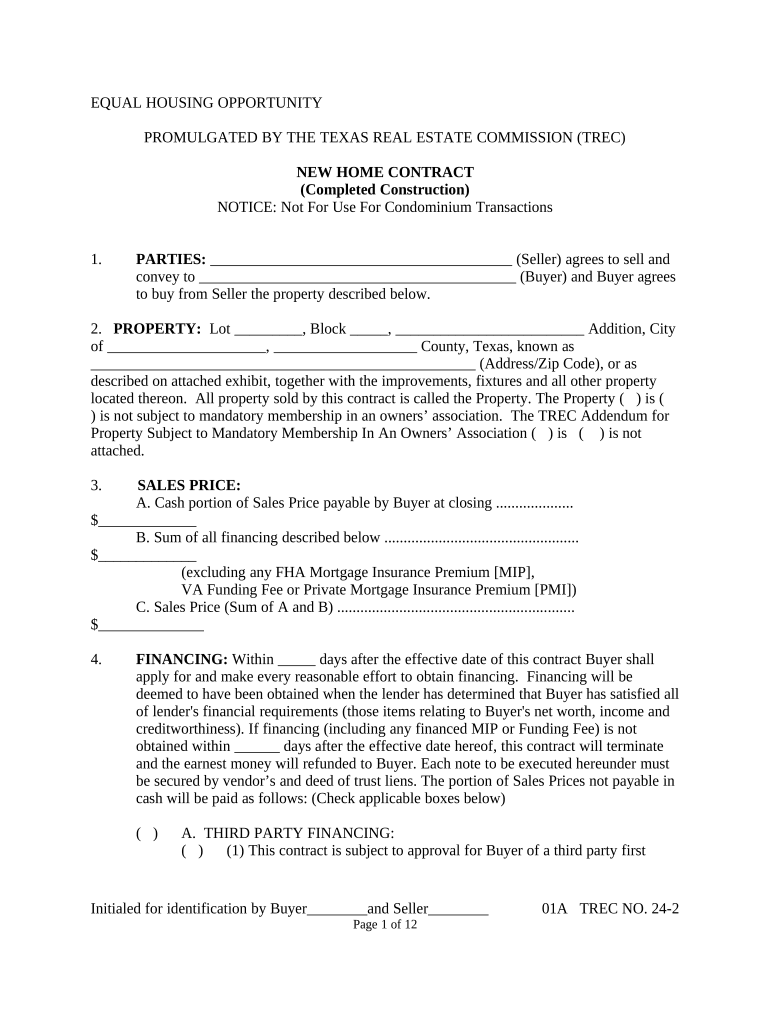

EQUAL HOUSING OPPORTUNITY

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREC)

NEW HOME CONTRACT

(Completed Construction)

NOTICE: Not For Use For Condominium Transactions

1. PARTIES: ________________________________________ (Seller) agrees to sell and

convey to __________________________________________ (Buyer) and Buyer agrees

to buy from Seller the property described below.

2. PROPERTY: Lot _________, Block _____, _________________________ Addition, City

of _____________________, ___________________ County, Texas, known as

___________________________________________________ (Address/Zip Code), or as

described on attached exhibit, together with the improvements, fixtures and all other property

located thereon. All property sold by this contract is called the Property. The Property ( ) is (

) is not subject to mandatory membership in an owners’ association. The TREC Addendum for

Property Subject to Mandatory Membership In An Owners’ Association ( ) is ( ) is not

attached.

3. SALES PRICE:

A. Cash portion of Sales Price payable by Buyer at closing ....................

$_____________

B. Sum of all financing described below ..................................................

$_____________

(excluding any FHA Mortgage Insurance Premium [MIP],

VA Funding Fee or Private Mortgage Insurance Premium [PMI])

C. Sales Price (Sum of A and B) .............................................................

$______________

4. FINANCING: Within _____ days after the effective date of this contract Buyer shall

apply for and make every reasonable effort to obtain financing. Financing will be

deemed to have been obtained when the lender has determined that Buyer has satisfied all

of lender's financial requirements (those items relating to Buyer's net worth, income and

creditworthiness). If financing (including any financed MIP or Funding Fee) is not

obtained within ______ days after the effective date hereof, this contract will terminate

and the earnest money will refunded to Buyer. Each note to be executed hereunder must

be secured by vendor’s and deed of trust liens. The portion of Sales Prices not payable in

cash will be paid as follows: (Check applicable boxes below)

( ) A. THIRD PARTY FINANCING:

( ) (1) This contract is subject to approval for Buyer of a third party first

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 1 of 12

mortgage loan having a loan-to-loan value ratio not to exceed _______%

as established by such third party (excluding any financed PMI premium),

due in full in _________ year(s), with interest not to exceed ______% per

annum for the first ________ year(s) of the loan. The loan will be ( )

with ( ) without PMI.

( ) (2) This contract is subject to approval for Buyer of a third party second

mortgage loan having a loan-to-value ratio not to exceed ________% as

established by such third party (excluding any financed PMI premium),

due in full in ________ year(s), with interest not to exceed _________%

per annum for the first ________ year(s) of the loan. The loan will be ( )

with ( ) without PMI.

( ) B. FHA INSURED FINANCING: This contract is subject to approval for Buyer

of a Section _______ FHA insured loan of not less than $___________

(excluding any financed MIP), amortizable monthly for not less than _____ years,

with interest not to exceed _______ % per annum for the first ________ year(s)

of the loan. As required by HUD-FHA, if FHA valuation is unknown, "It is

expressly agreed that, notwithstanding any other provisions of this contract, the

purchaser (Buyer) shall not be obligated to complete the purchase of the Property

described herein or to incur any penalty by forfeiture of earnest money deposits or

otherwise unless the purchaser (Buyer) has been given in accordance with

HUD/FHA or VA requirements a written statement issued by the Federal

Housing Commissioner, Department of Veterans Affairs, or a Direct

Endorsement Lender setting forth the appraised value of the Property of not less

than $ _____________________. The purchaser (Buyer) shall have the privilege

and option of proceeding with consummation of the contract without regard to

the amount of the appraised valuation. The appraised valuation is arrived at to

determine the maximum mortgage the Department of Housing and Urban

Development will insure. HUD does not warrant the value or the condition of the

Property. The purchaser (Buyer) should satisfy himself/herself that the price and

the condition of the Property are acceptable. If the FHA appraised value of the

Property (excluding closing costs and MIP) is less than the Sales Price (3C

above), Seller may reduce the Sales Price to an amount equal to the FHA

appraised value (excluding closing costs and MIP) and the parties to the sale shall

close the sale at such lower Sales Price with appropriate adjustments to 3A and

3B above.

( ) C. VA GUARANTEED FINANCING: This contract is subject to approval for

Buyer of a VA guaranteed loan of not less than $_____________ (excluding any

financed Funding Fee), amortizable monthly for not less than _____ years, with

interest not to exceed _________% per annum for the first ________ year(s) of

the loan.

VA NOTICE TO BUYER : It is expressly agreed that, notwithstanding any

other provisions of this contract, the Buyer shall not incur any penalty by

forfeiture of earnest money or otherwise or be obligated to complete the purchase

of the Property described herein, if the contract purchase price or cost exceeds

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 2 of 12

the reasonable value of the Property established by the Department of Veterans

Affairs. The Buyer shall, however, have the privilege and option of proceeding

with the consummation of this contract without regard to the amount of the

reasonable value established by the Department of Veterans Affairs.

If Buyer elects to complete the purchase at an amount in excess of the reasonable

value established by VA, Buyer shall pay such excess amount in cash from a

source which Buyer agrees to disclose to the VA and which Buyer represents will

not be from borrowed funds except as approved by VA. If VA reasonable value

of the Property is less than the Sales Price (3C above), Seller may reduce the

Sales Price to an amount equal to the VA reasonable value and the parties to the

sale shall close at such lower Sales Price with appropriate adjustments to 3A and

3B above.

( ) D. TEXAS VETERAN’S HOUSING ASSISTANCE PROGRAM

LOAN: This contract is subject to approval for Buyer of a Texas Veterans’

Housing Assistance program Loan of $____________ for a period of at least

__________ years at the interest rate established by the Texas Veteran’s Land

Board at the time of closing.

( ) E. SELLER FINANCING: A promissory note from Buyer to Seller of

$________, bearing _________% interest per annum, secured by vendor’s and

deed of trust liens, in accordance with the terms and conditions set forth in the

attached TREC Seller Financing Addendum. If an owner policy of title insurance

is furnished, Buyer shall furnish Seller with a mortgagee policy of title insurance.

( ) F. CREDIT APPROVAL ON SELLER FINANCING: Within _____

days after the effective date of this contract, Buyer shall deliver to Seller ( )

credit report ( ) verification of employment, including salary ( ) verification

of funds on deposit in financial institutions ( ) current financial statement to

establish Buyer’s creditworthiness for seller financing and

______________________

_____________________________________________________________. If

Buyer’s documentation is not delivered within the specified time, Seller may

terminate this contract by notice to Buyer within 7 days after expiration of the

time for delivery, and the earnest money will be paid to Seller. If this contract is

not so terminated, Seller will be deemed to have accepted Buyer’s credit. If the

documentation is timely delivered, and Seller determines in Seller’s sole

discretion that Buyer’s credit is unacceptable, Seller may terminate this contract

by notice to Buyer within 7 days after expiration of the time for delivery and the

earnest money will be refunded to Buyer. If Seller does not so terminate this

contract, Seller will be deemed to have accepted Buyer’s credit. Buyer hereby

authorizes any credit reporting agency to furnish to Seller at Buyer’s sole expense

copies of Buyer’s credit reports.

5. EARNEST MONEY: Buyer shall deposit $ ___________ as earnest money with

__________________________ at ___________________________________

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 3 of 12

(Address), as escrow agent, upon execution of this contract by both parties. Additional

earnest money of $________ must be deposited by Buyer with escrow agent on or before

____________________, 20______. If Buyer fails to deposit the earnest money as

required by this contract, Buyer will be in default.

6. TITLE POLICY AND SURVEY:

( ) A. TITLE POLICY: Seller shall furnish to Buyer at ( ) Seller’s ( )

Buyer’s expense an owner policy of title insurance (the Title Policy) issued by

__________________________ (the Title Company) in the amount of the Sales

Price, dated at or after closing, insuring Buyer against loss under the provisions of

the Title Policy, subject to the promulgated exclusions (including existing

building and zoning ordinances) and the following exceptions:

(1) Restrictive covenants common to the platted subdivision in which the

Property is located.

(2) The standard printed exception for standby fees, taxes and assessments.

(3) Liens created as part of the financing described in Paragraph 4.

(4) Utility easements created by the dedication deed or plat of the subdivision in

which the Property is located.

(5) Reservations or exceptions otherwise permitted by this contract or as may be

approved by Buyer in writing.

(6) The standard printed exception as to discrepancies, conflicts, shortages in area

or boundary lines, encroachments or protrusions, or overlapping improvements.

(7) The standard printed exception as to marital rights.

(8) The standard printed exception as to waters, tidelands, beaches, streams, and

related matters.

Within 20 days after the Title Company receives a copy of this contract, Seller

shall furnish to Buyer a commitment for title insurance (the Commitment) and, at

Buyer's expense, legible copies of restrictive covenants and documents

evidencing exceptions in the Commitment other than the standard printed

exceptions. Seller authorizes the Title Company to mail or hand deliver the

Commitment and related documents to Buyer at Buyer's address shown below. If

the Commitment is not delivered to Buyer within the specified time, the time for

delivery will be automatically extended up to 15 days. Buyer will have 7 days

after the receipt of the Commitment to object in writing to matters disclosed in

the Commitment.

( ) B. SURVEY: (Check one box only)

(1) Within _____ days after Buyer’s receipt of a survey furnished to a third-

party lender at ( ) Seller’s ( ) Buyer’s expense, Buyer may object in

writing to any matter shown on the survey which constitutes a defect or

encumbrance to title.

(2) Within ________ days after the effective date of this contract, Buyer may

object in writing to any matter which constitutes a defect or encumbrance

to title shown on a survey obtained by Buyer at Buyer’s expense.

The survey must be made by a Registered Professional Land Surveyor acceptable

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 4 of 12

to the Title Company and any lender. Utility easements created by the dedication

deed and plat of the subdivision in which the Property is located will not be a

basis for objection.

Buyer may object to existing building and zoning ordinances, items 6A(1)

through (8) above and matters shown on the survey if Buyer determines that any

such ordinance, items or matters prohibits the following use or activity:

________________________________________________________________

________________________________________________________________

Buyer’s failure to object under Paragraph 6A or 6B within the time allowed will

constitute a waiver of Buyer’s right to object; except that the requirements in

Schedule C of the Commitment will not be deemed to have been waived. Seller

shall cure the timely objections of Buyer or any third party lender within 15 days

from the date Seller receives the objections and the Closing Date will be extended

as necessary. If objections are not cured by the extended Closing Date, this

contract will terminate and the earnest money will be refunded to Buyer unless

Buyer elects to waive the objections.

NOTICE TO SELLER AND BUYER:

(1) Broker advises Buyer to have an abstract of title covering the Property examined

by an attorney of Buyer’s selection, or Buyer should be furnished with or obtain a Title

Policy. If a Title Policy is furnished, the Commitment should be promptly reviewed by

an attorney of Buyer’s choice due to the time limitations on Buyer’s right to object.

(2) If the Property is situated in a utility or other statutorily created district providing water,

sewer, drainage, or flood control facilities and services, Chapter 49 of the Texas Water

Code requires Seller to deliver and Buyer to sign the statutory notice relating to the tax

rate, bonded indebtedness, or standby fee of the district prior to final execution of this

contract.

(3) If the Property abuts the tidally influenced waters of the state, Section 33.135, Texas

Natural Resources Code, requires a notice regarding coastal area property to be included

in the contract. An addendum either promulgated by TREC or required by the parties

should be used.

(4) Buyer is advised that the presence of wetlands, toxic substances, including

asbestos and wastes or other environmental hazards or the presence of a threatened or

endangered species or its habitat may affect Buyer’s intended use of the Property. If

Buyer is concerned about these matters, an addendum either promulgated by TREC or

required by the parties should be used.

(5) Unless expressly prohibited in writing by the parties, Seller may continue to show the

Property for sale and to receive, negotiate and accept back-up offers.

(6) Any residential service contract that is purchased in connection with this transaction

should be reviewed for the scope of coverage, exclusions and limitations. The purchase

of a residential service contract is optional. Similar coverage may be purchased

from various companies authorized to do business in Texas.

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 5 of 12

7. PROPERTY CONDITION :

A. INSPECTIONS, ACCESS AND UTILITIES: Buyer may have the Property

inspected by an inspector selected by Buyer, licensed by TREC or otherwise

permitted by law to make such inspections. Seller shall permit access to the

Property at reasonable times for inspection, repairs and treatment and for

reinspection after repairs and treatment have been completed. Seller shall pay

for turning on utilities for inspection and reinspection.

B. ACCEPTANCE OF PROPERTY CONDITION: (check one box only):

( ) (1) In addition to any earnest money deposited with escrow agent, Buyer

has paid Seller $____________ (the Option Fee) for the unrestricted right

to terminate this contract by giving notice of termination to Seller within

_________ days after the effective date of this contract. If Buyer gives

notice of termination within the time specified, the Option Fee will not be

refunded, however, any earnest money will be refunded to Buyer. If

Buyer doe snot give notice of termination within the time specified, Buyer

will be deemed to have accepted the Property in its current condition and

the Option Fee ( ) will ( ) will not be credited to the Sales Price at

closing.

( ) (2) Buyer accepts the Property in its present condition; provided Seller, at

Seller’s expense, shall complete the following repairs and treatment:

____________________________________________________________

____________________________________________________________

____________________________________________________________

C. LENDER REQUIRED REPAIRS AND TREATMENTS (REPAIRS): Unless

otherwise agreed in writing, neither party is obligated to pay for lender required

repairs or treatments for wood destroying insects. If the cost of lender required

repairs exceeds 5% of the Sale Price, Buyer may terminate this contract.

D. COMPLETION OF REPAIRS AND TREATMENT. Unless otherwise agreed by

the parties in writing, Seller shall complete all agreed repairs and treatment prior to

the Closing Date. Repairs and treatments must be performed by persons who

regularly provide such repairs or treatments. At Buyer’s election, any transferable

warranties received by Seller with respect to the repairs will be transferred to Buyer at

Buyer’s expense. If Seller fails to complete any agreed repairs and treatment prior to the

Closing Date, Buyer may do so and the Closing Date will be extended up to 15 days, if

necessary, to complete repairs and treatment.

E. WARRANTIES: In connection with all improvements, fixtures and all other property

located on or made a part of the Property: (check one box only)

( ) (1) Seller makes not express warranties.

( ) (2) Seller makes the express warranties stated in Paragraph 11 or as

attached.

Seller agrees to assign to Buyer at closing all assignable manufacturer warranties.

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 6 of 12

F. INSULATION: Insulation information required under Federal Trade Commission

Regulations is included in the attached TREC addendum or a disclosure form

provided by Seller.

8. BROKERS' FEES : All obligations of the parties for payment of brokers’ fees are

contained in separate written agreements.

9. CLOSING: The closing of the sale will be on or before ___________________,

20_______, or within 7 days after objections to matters disclosed in the Commitment or

by the survey have been cured, whichever date is later (the Closing Date). If financing or

assumption approval has been obtained pursuant to Paragraph 4, the Closing Date will

be extended up to 15 days if necessary to comply with lender's closing requirements (for

example, appraisal, survey, insurance policies, lender-required repairs, closing

documents). If either party fails to close this sale by the Closing Date, the non-defaulting

party will be entitled to exercise the remedies contained in Paragraph 15. At closing

Seller shall furnish tax statements or certificates showing no delinquent taxes and a

general warranty deed conveying good and indefeasible title showing no additional

exceptions to those permitted in Paragraph 6.

10. POSSESSION : Seller shall deliver possession of the Property to Buyer on

_______________________ in its present or required repaired condition, ordinary wear

and tear excepted. Any possession by Buyer prior to closing or by Seller after closing

which is not authorized by a temporary lease from promulgated by TREC or required by

the parties will establish a tenancy at sufferance relationship between the parties.

Consult your insurance agent prior to change of ownership or possession as insurance

coverage may be limited or terminated. The absence of a written lease or appropriate

insurance coverage may expose the parties to economic loss.

11. SPECIAL PROVISIONS: (Insert only factual statements and business details

applicable to this sale. TREC rules prohibit licensees from adding factual statements or

business details for which a contract addendum, lease or other form has been

promulgated by TREC for mandatory use.)

12. SETTLEMENT AND OTHER EXPENSES:

A. The following expenses must be paid at or prior to closing:

(1) Loan appraisal fees will be paid by _______________________________________.

(2) The total of loan discount fees (including any Texas Veterans’ Housing Assistance

Program Participation Fee) may not exceed _____% of the loan of which Seller shall pay

___________________ and Buyer shall pay the remainder. The total of any buydown

fees may not exceed ________________ which will be paid by ___________________.

(3) Seller's Expenses:

(a) All Sales: Lender, FHA or VA completion requirements, releases of existing liens,

including prepayment penalties and recording fees; tax statements or certificates;

preparation of deed; one-half of escrow fee; those expenses Buyer is prohibited by FHA

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 7 of 12

or VA from paying; and other expenses stipulated to be paid by Seller under other

provisions of this contract.

(b) VA Loan Sales: Those expenses stated in 3(a) above and other expenses VA

regulation prohibits Buyer from paying.

(4) Buyer's Expenses:

(a) All Sales: Expenses incident to any loan, including application, origination, and

commitment fees; interest on he notes from date of disbursement to one month prior to

date of first monthly payments; recording fees; endorsements required by lender; copies

of easements and restrictions; mortgagee title policy; loan-related inspection fees; credit

reports; all prepaid items, including required premiums for flood and hazard insurance,

reserve deposits for insurance, ad valorem taxes and special governmental assessments;

tax deleting; EPA endorsement; final compliance inspection; other expenses stipulated to

be paid by Buyer under other provisions of this contract.

(b) Conventional Loan Sales: Expenses noted above and other loan-related expenses,

including PMI premiums, photos, amortization schedules, one-half of escrow fee,

preparation of loan documents, courier fee, repair inspections, underwriting fee, wire

transfer, tax statements or certificates.

(c) FHA Loan Sales: Expenses noted above and other loan-related expends, including

photos, amortization schedules, one-half of escrow fee, preparation of loan documents,

courier fee and repair inspections.

B. The VA Loan Funding Fee for FHA Mortgage Insurance Premium (MIP) not to

exceed _________________ will be paid by Buyer, and ( ) paid in cash at closing ( )

added to the amount of the loan or ( ) paid as follows:__________________________

______________________________________________________________________

C. If any expense exceeds an amount expressly stated in this contract for such expense to

be paid by a party, that party may terminate this contract unless the other party agrees to

pay such excess. In no event will Buyer pay charges and fees expressly prohibited by

FHA, VA or other governmental loan program regulations.

13. PRORATIONS: Taxes for the current year, maintenance fees, assessments,

dues and rents will be prorated through the Closing Date. If Seller’s change in use of the

Property prior to closing or denial of a special use valuation claimed by Seller results in

the assessment of additional taxes for periods prior to closing, the additional taxes will be

the obligation of Seller, and the obligation will survive closing. If taxes are not paid at or

prior to closing, Buyer will be obligated to pay taxes for the current year.

14. CASUALTY LOSS: If any part of the Property is damaged or destroyed by fire or other

casualty loss after the effective date of the contract, Seller shall restore the Property to its

previous condition as soon as reasonably possible, but in any event by the Closing Date.

If Seller fails to do so due to factors beyond Seller’s control, Buyer may either (a)

terminate this contract and the earnest money will be refunded to Buyer (b) extend the

time for performance up to 15 days and the Closing Date will be extended as necessary

or (c) accept the Property in its damaged condition and accept an assignment of insurance

proceeds. Seller’s obligations under this paragraph are independent of any obligations of

Seller under Paragraph 7.

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 8 of 12

15. DEFAULT: If Buyer fails to comply with this contract, Buyer will be in default, and

Seller may either (a) enforce specific performance, seek such other relief as may be

provided by law, or both, or (b) terminate this contract and receive the earnest money as

liquidated damages, thereby releasing both parties from this contract. If, due to factors

beyond Seller’s control, Seller fails within the time allowed to make any non-casualty

repairs or deliver the Commitment, Buyer may either (a) extend the time for performance

up to 15 days and the Closing Date will be extended as necessary or (b) terminate this

contract as the sole remedy and receive the earnest money. If Seller fails to comply with

this contract for any other reason, Seller will be in default and Buyer may either (a)

enforce specific performance, seek such other relief as may be provided by law, or both,

or (b) terminate this contract and receive the earnest money, thereby releasing both

parties from this contract.

16. DISPUTE RESOLUTION: It is the policy of the State of Texas to encourage the

peaceable resolution of disputes through alternative dispute resolution procedures. The

parties are encouraged to use an addendum approved by TREC to submit to mediation

disputes which cannot be resolved in good faith through informal discussion.

17. ATTORNEY'S FEES: The prevailing party in any legal proceeding brought under or

with respect to the transaction described in this contract is entitled to recover from the

non-prevailing party all costs of such proceeding and reasonable attorney’s fees.

18. ESCROW: The earnest money is deposited with escrow agent with the understanding

that escrow agent is not (a) a party to this contract and does not have any liability for the

performance or nonperformance of any party to this contract, (b) liable for interest on the

earnest money and (c) liable for any loss of earnest money caused by the failure of any

financial institution in which the earnest money has been deposited unless the financial

institution is acting as escrow agent. At closing, the earnest money must be applied first

to any cash down payment, then to Buyer's closing costs and any excess refunded to

Buyer. If both parties make written demand for the earnest money, escrow agent may

require payment of unpaid expenses incurred on behalf of the parties and a written

release of liability of escrow agent from all parties. If one party makes written demand

for the earnest money, escrow agent shall give notice of the demand by providing to the

other party a copy of the demand. If escrow agent does not receive written objection to

the demand from the other party within 30 days after notice to the other party, escrow

agent may disburse the earnest money to the party making demand reduced by the

amount of unpaid expenses incurred on behalf of the party receiving the earnest money

and escrow agent may pay the same to the creditors. If escrow agent complies with the

provisions of this paragraph, each party hereby releases escrow agent from all adverse

claims related to the disbursal of the earnest money. Escrow agent's notice to the other

party will be effective when deposited in the U. S. Mail, postage prepaid, certified mail,

return receipt requested, addressed to the other party at such party's address shown

below. Notice of objection to the demand will be deemed effective upon receipt by

escrow agent.

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 9 of 12

19. REPRESENTATIONS: Seller represents that as of the Closing Date (a) there will be no

liens, assessments, or security interests against the Property which will not be satisfied

out of the sales proceeds unless securing payment of any loans assumed by Buyer and (b)

assumed loans will not be in default. If any representation in this contract is untrue on the

Closing Date, this contract may be terminated by Buyer and the earnest money will be

refunded to Buyer. All representations contained in this contract will survive closing.

20. FEDERAL TAX REQUIREMENT: If Seller is a "foreign person", as defined by

applicable law, or if Seller fails to deliver an affidavit that Seller is not a "foreign

person", then Buyer shall withhold from the sales proceeds an amount sufficient to

comply with applicable tax law and deliver the same to the Internal Revenue Service

together with appropriate tax forms. IRS regulations require filing written reports if cash

in excess of specified amounts is received in the transaction.

21. AGREEMENT OF PARTIES: This contract contains the entire agreement of the

parties and cannot be changed except by their written agreement. Addenda which are a

part of this contract are (list):

_____________________________________________________

_______________________________________________________________________.

22. CONSULT YOUR ATTORNEY: Real estate licensees cannot give legal advice. This

contract is intended to be legally binding. READ IT CAREFULLY. If you do not

understand the effect of this contract, consult your attorney BEFORE signing.

Buyer’s Seller’s

Attorney is:______________________________ Attorney is:__________________________

23. NOTICES: All notices from one party to the other must be in writing and are effective

when mailed to, hand-delivered at, or transmitted by facsimile machine as follows:

To Buyer at: To Seller at:

_______________________________________ ___________________________________

_______________________________________ ___________________________________

_______________________________________ ___________________________________

Telephone ( )__________________________ Telephone ( )_______________________

Facsimile ( )____________________________ Facsimile ( )________________________

EXECUTED the ____ day of _________________, 20____ (THE EFFECTIVE DATE).

(BROKER: FILL IN THE DATE OF FINAL ACCEPTANCE.)

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 10 of 12

_______________________________________ ____________________________________

Buyer Seller

_______________________________________ ____________________________________

Buyer Seller

The form of this contract has been approved by the Texas Real Estate Commission. Such

approval relates to this contract form only. No representation is made as to the legal validity or

adequacy of any provision in any specific transaction. It is not suitable for complex transactions.

Extensive riders or additions are not to be used. Texas Real Estate Commission, P.O. Box

12188, Austin, TX 78711-2188, 1-800-250-8732 or (512) 459-6544 (http://www.trec.state.tx.us)

TREC NO. 24-2. This form replaces TREC NO. 24-1.

BROKER INFORMATION AND RATIFICATION OF FEE

Listing Broker has agreed to pay Other Broker _________________________ of the total sales

price when Listing Broker’s fee is received. Escrow Agent is authorized and directed to pay

Other Broker from Listing Broker’s fee at closing.

_______________________________________ ____________________________________

Other Broker License No. Listing Broker License No.

represents ( ) Seller as Listing Broker’s subagent represents ( ) Seller and Buyer as an

intermediary

( ) Buyer only as Buyer’s agent ( ) Seller only as Seller’s agent

____________________________________

Listing Associate Telephone

__________________________________ ____________________________________

Associate Telephone Selling Associate Telephone

__________________________________ ____________________________________

Broker Address Broker Address

__________________________________ ____________________________________

Telephone Facsimile Telephone Facsimile

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 11 of 12

RECEIPT

Receipt of ( ) Contract and ( ) $_______________ Earnest Money in the form of

________________________ is acknowledged.

Escrow Agent:__________________________ Date: _______________________, 20____

By:___________________________________

______________________________________ Telephone ( )________________________

Address

______________________________________ Facsimile ( )_________________________

City State Zip Code

Initialed for identification by Buyer________and Seller________ 01A TREC NO. 24-2

Page 12 of 12