Revised June 2005

Sample Sponsorship Agreement

This Agreement is made this _________(date) between (sponsor - the NEH grant

recipient) and (subrecipient -e.g., the artist, producer, for-profit entity).

Purpose of Agreement

The sponsor has been awarded a grant from the National Endowment for the Humanities

("NEH") in the amount not to exceed _______ in support of ___________( "the Project"), a

____________________(description of project that defines project scope). In order for

(sponsor) to accept this award and ensure grant compliance, (sponsor) and the

(subrecipient) agree to the following:

I. General Provisions

1.1

The (subrecipient) agrees to expend NEH and cost-sharing funds exclusively for

the Project within the approved grant period, in accordance with the approved budget, and

subject to the administrative requirements and the terms and conditions specified in the

Official Notice of Action ("Grant Award Letter") dated _________ for the NEH grant

number __________________(NEH-assigned number). NEH funding for this award was

provided by the program described in the Catalog of Federal Domestic Assistance (CFDA)

section ______ (number to be found at the bottom of the "Remarks" section of the Official

Notice of Action -- this number is needed for the required audit of expenditures).

1.2

The (subrecipient's) relationship to (the sponsor) shall be that of an independent

contractor. Nothing in this Agreement shall constitute naming the Project as an agent or

legal representative of (sponsor) for any purpose whatsoever except as specifically and to

the extent set forth herein. This Agreement does not constitute a contract of employment

between (sponsor) and any individual. This Agreement shall not be deemed to create any

relationship of agency, partnership, or joint venture between the Project and (sponsor),

and the Project shall make no such representation to anyone.

1.3

The Project shall be operated in a manner consistent with (sponsor's) tax-exempt

status and as described in the (subrecipient's) application for NEH funding. No material

changes in the purposes or activities of the Project shall be made without prior written

permission of (sponsor), nor shall the (subrecipient) carry on activities or use funds in any

way that jeopardizes (sponsor's) tax-exempt status.

1.4

Should the (subrecipient) fail to comply with any part of this agreement, resulting in

the return of grant money to the NEH, the (subrecipient) agrees to make payment to

(sponsor) for any costs in question by the NEH.

�1.5

The (subrecipient) agrees to return to NEH the federal share of income earned by

the Project as accounted for in the annual program income reports and subject to the

NEH's program income policy.

1.6

The (subrecipient) agrees to license the NEH with the royalty-free nonexclusive

right to reproduce or use or authorize others to use for government purposes materials

produced under this grant.

II. Project Changes

2.1

The (subrecipient) will inform the (sponsor) in advance, in writing, of any proposed

changes to the project, including but not limited to changes in scope, key project

personnel, budget, timeline, foreign travel, or equipment purchases. The (subrecipient)

may not make any such proposed changes without the prior written consent of (sponsor).

(Sponsor) agrees not to withhold its consent unreasonably. Proposed changes requiring

written approval from the NEH will be forwarded by (sponsor) to the NEH.

2.2

Proposed administrative changes such as a one-time extension of a grant period,

incurring project costs prior to a grant award period, or the transfer of funds among budget

categories will be subject to (sponsor's) Organizational Prior Approval System (OPAS) as

required by NEH.

2.3

The (subrecipient) agrees not to accept loans or defer costs without NEH

consultation and, for deferred costs, without written approval from NEH prior to the

completion of the Project.

2.4

The (subrecipient) agrees not to sub-award or sub-contract substantive project

work to a third party without approval from (sponsor) and from NEH.

III. Record-keeping and Reporting

3.1

The (subrecipient) agrees to maintain supporting documentation and financial

records of incurred costs directly expended by the (subrecipient) for the project (including

travel receipts, vendor invoices, purchase orders and written agreements for consulting

services) in accordance with the standards set forth in the OMB Circular A-110 and with

Article 17 of the NEH publication General Terms and Conditions for Awards to

Organizations. Documents relating to the Project must be kept for three years following

the submission by the (sponsor) of a Final Financial Report to the NEH.

3.2

(Sponsor) will maintain financial records relating to grants and contributions

received and costs directly expended by (sponsor) on behalf of the Project, according to

generally accepted accounting principles and the requirements of OMB Circular A-110,

retain records as long as required by law, and make records available to auditors as

required by law.

�3.3

The (subrecipient) agrees to be audited by (sponsor). (Sponsor) will conduct an

organization-wide audit at least every two years to determine the fiscal integrity of financial

transactions and compliance with the terms and conditions of individual awards and

government-wide administrative requirements.

3.4

The (subrecipient) agrees to provide (sponsor) with a quarterly accounting of actual

project expenditures to ensure that the schedule of project goals outlined in the approved

application, the actual costs as compared with the original budget estimates, and NEH

grant restrictions are being met.

3.5

The (subrecipient) agrees to provide (sponsor) with all narrative and financial

materials necessary to ensure the timely reporting to the NEH according to the schedule

of due dates within the Grant Award Letter, including but not limited to Interim

Performance Reports, Final Financial and Performance Reports, and Program Income

Reports.

IV. Financial Transactions

4.1

On behalf of the (subrecipient), (sponsor) will establish and operate for the use of

the Project a designated account ("an Account") segregated on (sponsor's) books. All

amounts deposited into a Project's Account will be used in its support, subject to the

conditions set forth below.

4.2

(Sponsor) will disburse funds from an Account only as requested in writing on

properly filled-out (sponsor's) vouchers accompanied by required documentation and only

as authorized by this contract. Disbursements will be restricted to the support and

implementation of the Project only. Documentation must included specific reference to the

approved NEH budget by category. Upon receipt of completed vouchers with

documentation, (sponsor) will request funds from NEH, including a proportional amount of

indirect costs. The (subrecipient) agrees not to request funds exceeding anticipated

expenditures for a 30-day period.

4.3

The (subrecipient) shall act as principal coordinator of the Project's daily business

with (sponsor), and shall sign signature cards, and shall have authority to singly sign

disbursement requests to be submitted to (sponsor).

4.4

The Project shall not maintain a negative balance in its Account(s) at any time.

(sponsor) reserves the right to suspend financial activity or to stop payment of outstanding

checks if there are insufficient funds.

4.5

(Sponsor) will provide, upon request, sales tax exemption forms made out to

specific Project vendors limited to payments made with a check issued by (sponsor)

directly to the vendor. Any property purchased pursuant to using such sales tax

exemption shall become the Property of (sponsor) but may in (sponsor's) discretion be

transferred as a grant to the (subrecipient). The (subrecipient) shall indemnify (sponsor)

for any sales and use taxes (including interest, penalties and (sponsor's) reasonable

�contest expenses) ultimately determined to be payable by (sponsor) with respect to such

purchase and/or grant.

V. Distribution, Credit and Publicity

5.1

The (subrecipient) will submit to (sponsor) for review all distribution agreements

before they are finalized, subject to NEH review and approval.

5.2

(Sponsor) may use the names and descriptions of the Project for information and

promotion purposes provided however that all such published material shall be subject to

the (subrecipient's) reasonable approval in advance of publication.

5.3

The (subrecipient) will give proper credit to (sponsor) in all publicity in the following

form "[The Project] is a sponsored project of the (sponsor)" adding if necessary "with

funding provided by (funders)."

5.4

The (subrecipient) will acknowledge the NEH's support of the Project as required by

the terms of the NEH grant. The (subrecipient) agrees to consult the Acknowledgment

Requirements document of the NEH for guidance on promotion and credits before

implementation to properly acknowledge NEH support on the program itself and on all

non-broadcast print materials, including publicity and promotion.

5.5

The (subrecipient) agrees to provide (sponsor) and the NEH with copies of reviews

and other press materials, distribution brochures, notices of exhibition and awards, and

any other pertinent information. The (subrecipient) agrees to provide (sponsor) and the

NEH with copies of the completed program.

VI. Fees and Charges

6.1

(Sponsor) will retain from the NEH grant the amount of the indirect cost budget item

in the approved budget. This amount supersedes any previous written or oral

understanding pertaining to (sponsor's) fees as fiscal sponsor.

6.2

(Sponsor) will also charge the Project directly for any liabilities or direct expenses

the Project it may incur on behalf of the Project, including but not limited to bank charges

and postage fees.

6.3

(Sponsor) will have no right to make deductions from any funds not applied for by

(sponsor) nor from any income derived from exploitation of the Project.

VII. Liability and Insurance

7.1

The (subrecipient) is liable for (a) any and all debts and obligations authorized by

the (subrecipient) or incurred in good faith by (sponsor) on the Project's behalf during the

period of this Agreement, unless such debt or obligations are the result of (sponsor's)

�negligence, recklessness or willful misconduct and (b) adverse judgments against

(sponsor) resulting from the (subrecipient's) negligence which are not covered by

(sponsor's) liability policy.

7.2

The (subrecipient) hereby irrevocably and unconditionally agrees, to the fullest

extent permitted by law, to defend, indemnify and hold harmless (sponsor), its officers,

directors, trustees, employees and agents, from and against any and all claims, liabilities,

losses and expenses (including reasonable attorney's fees) directly, indirectly, wholly or

partially arising from or in connection with any act or omission of the (subrecipient) or the

(subrecipient's) employees or agents, in implementing and operating the Project, except to

the extent that such claims, liabilities, losses or expenses arise from or in connection with

any act or omission of (sponsor), its officers, directors, trustees, employees or agents.

7.3

The (subrecipient) shall cause the Project to obtain such liability insurance as

(sponsor) may require and shall upon (sponsor's) request cause any such policy of

insurance to specify (sponsor) as a named insured under the policy.

VIII. Termination

8.1

This agreement will terminate if any of the following events occur:

(a)

(Sponsor) requests the (subrecipient) to cease activities which it deems

might jeopardize its tax-exempt status and the Project fails to comply within a

period of ten (10) days;

(b)

The (subrecipient) fails to perform or observe any other covenant of this

agreement, which failure remains unremedied after fifteen (15) days of notice in

writing;

(c)

Upon expiration of four weeks after either the (subrecipient) or (sponsor) has

given written notice of its intent to terminate the agreement.

8.2

Except for amounts due (sponsor) pursuant to Article VI hereof, no amounts shall

be disbursed from an Account to or for the benefit of the (subrecipient) or the Project

during the 10-day or 15-day periods referred to in section 8.1 unless the (sponsor) request

is complied with or the failure in question is remedied, as the case may be, before such

period has expired.

8.3

In the event this Agreement is terminated, Project funds shall be returned to NEH

and may not be transferred to any person or entity.

IX. Certifications

9.1

The (subrecipient) agrees to abide by applicable certification required by NEH

concerning lobbying activities, as described in the General Terms and Conditions for

Awards to Organizations.

�9.2

The (subrecipient) shall not, and shall not permit the Project to, attempt to influence

legislation or participate or intervene in any political campaign on behalf of (or in

opposition to) any candidate for public office or otherwise engage in the carrying on of

propaganda (within the meaning of section 501 (c) (3) of the Internal Revenue Code of

1986) without prior written consent from (sponsor).

X. Department of Labor

10.1 The (subrecipient) acknowledges the requirements that all professional performers,

scriptwriters, and related or supporting professional personnel employed on the Project

must be paid not less than the prevailing minimum union or guild rates and that no part of

the Project may be performed or engaged in under working conditions which are

unsanitary or hazardous or dangerous to the health and safety of the employees, in

accordance with the regulations, Labor Standards on Projects or Productions Assisted by

Grants from the National Endowments for the Arts and Humanities; Final Rule. The

(subrecipient) further agrees to maintain the recordkeeping required by section 505.5 of

these regulations and to make these records available to (sponsor) or to the Department

of Labor.

XI. Miscellaneous

11.1 This Agreement will supersede any prior oral or written understanding between the

parties, and may not be amended or modified except in writing signed by both parties.

11.2 This Agreement shall be governed by and construed in accordance with the laws of

the State of _________ applicable to agreements made and to be performed entirely

within such State.

In witness whereof, the parties hereto have executed this Agreement on the day and year

first written above.

Accepted for (sponsor):

_______________________________________________

(Name and Title)

Date_________________

Accepted for (subrecipient):

_______________________________________________

(Name and Title)

Date_________________

�

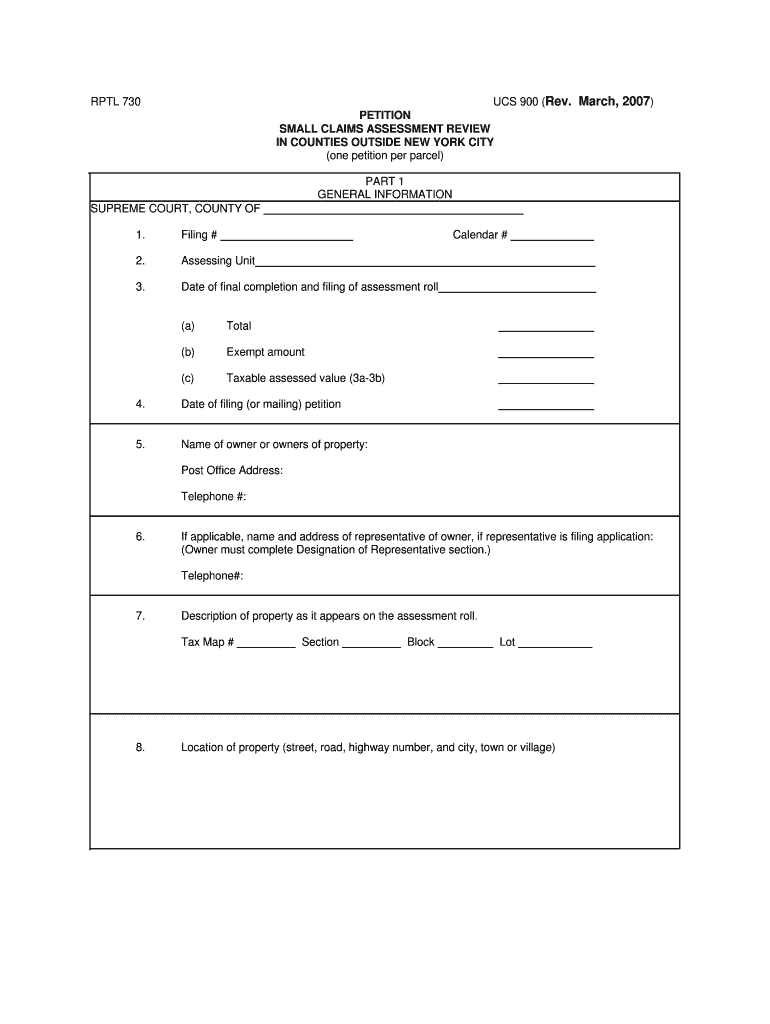

Practical advice on finalizing your ‘Petition Small Claims Form’ digitally

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Say farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your strategy for document administration. Whether you need to approve forms or collect signatures, airSlate SignNow manages it all efficiently, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our form library.

- Access your ‘Petition Small Claims Form’ in the editor.

- Hit Me (Fill Out Now) to set up the form on your end.

- Insert and assign fillable fields for others (if necessary).

- Proceed with the Send Invite options to obtain eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don't worry if you need to collaborate with others on your Petition Small Claims Form or send it for notarization—our platform provides everything you require to achieve these tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!