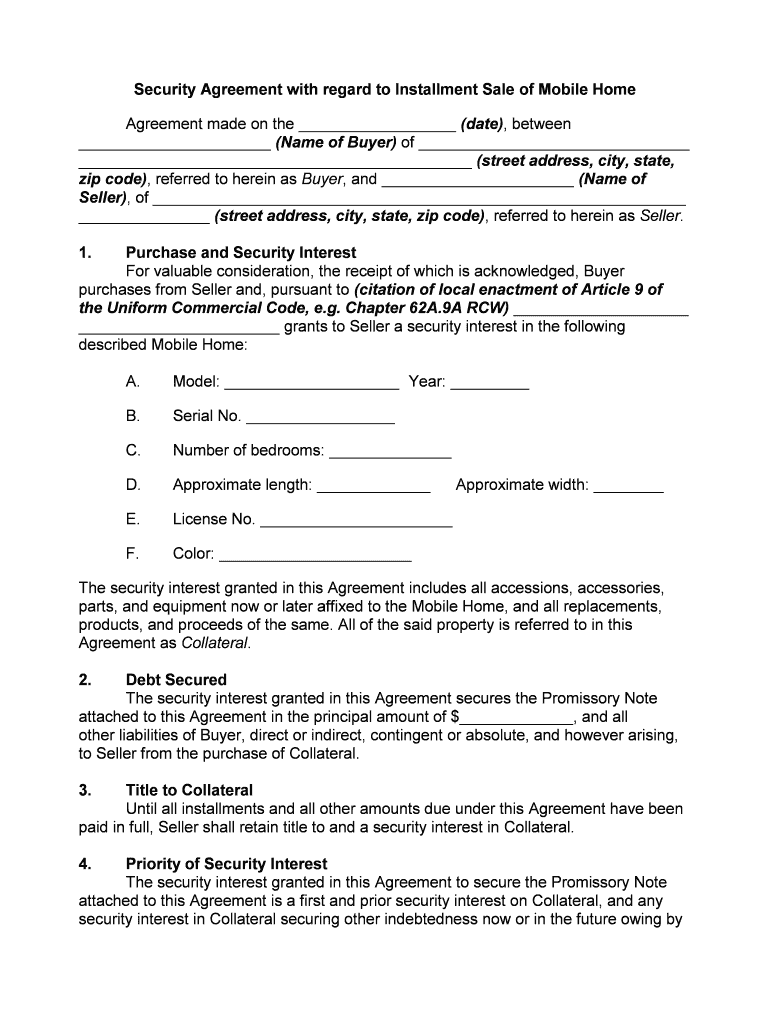

Security Agreement with regard to Installment Sale of Mobile Home

Agreement made on the __________________ (date), between

______________________ (Name of Buyer) of _______________________________

_____________________________________________ (street address, city, state,

zip code) , referred to herein as Buyer, and ______________________ (Name of

Seller) , of ________________________________________________ _____________

_______________ (street address, city, state, zip code) , referred to herein asSeller.

1. Purchase and Security Interest For valuable consideration, the receipt of which is acknowled ged, Buyer

purchases from Seller and, pursuant to (citation of local enactment of Article 9 of

the Uniform Commercial Code, e.g. Chapter 62A.9A RCW) ____________________

_______________________ grants to Seller a security interes t in the following

described Mobile Home:

A. Model: ____________________ Year: _________

B. Serial No. _________________

C. Number of bedrooms: ______________

D. Approximate length: _____________ Approximate width: _______ _

E. License No. ______________________

F. Color: ______________________

The security interest granted in this Agreement includes all acce ssions, accessories,

parts, and equipment now or later affixed to the Mobile Home, and all replacements,

products, and proceeds of the same. All of the said property is r eferred to in this

Agreement as Collateral.

2. Debt Secured The security interest granted in this Agreement secures the Promiss ory Note

attached to this Agreement in the principal amount of $_______ ______, and all

other liabilities of Buyer, direct or indirect, contingent or absolu te, and however arising,

to Seller from the purchase of Collateral.

3. Title to Collateral Until all installments and all other amounts due under this Agreem ent have been

paid in full, Seller shall retain title to and a security interes t in Collateral.

4. Priority of Security Interest The security interest granted in this Agreement to secure the Promisso ry Note

attached to this Agreement is a first and prior security interest o n Collateral, and any

security interest in Collateral securing other indebtedness now or in the future owing by

Buyer to Seller, or any assignee of Seller, is subordinate to the security interest granted

in this Agreement.

5. Additional Instruments Buyer shall join in executing, and shall pay all costs of filing , any financing or

termination statement required with respect to Collateral, and Buy er appoints Seller as

attorney-in-fact for Buyer to do whatever Seller may deem necessar y to perfect or

continue perfected the security interest of Seller in Collateral .

6. Location of Collateral After possession of Collateral is acquired by Buyer, Collatera l shall be located at

___________________________________________________ ___________________

(street address, city, state, zip code) .Buyer shall immediately advise Seller in writing

of any change in location of Collateral.

7. Use of Collateral Collateral shall be used by Buyer as a residence.

8. Protection of Collateral Buyer shall keep Collateral in good condition, free from lie ns and other security

interests, and shall pay promptly all taxes, assessments, or other charges on Collateral

or with respect to the use of Collateral. Buyer shall not use Collater al or any part of it

illegally or in violation of any applicable statute or ordinan ce or in any manner

inconsistent with this Agreement or any policy of insurance on Co llateral, or allow

Collateral to be so used. Buyer shall not lease, encumber, or disp ose of Collateral or

remove Collateral from _________________ (name of state) without the prior written

consent of Seller.

9. Insurance Buyer shall insure Collateral against all risks in form, amounts , and with an

insurer satisfactory to Seller. If Buyer fails to obtain such insur ance, Seller shall have

the right, without waiver of any other remedy, to obtain at the expense of Buyer such

insurance. Buyer assigns to Seller all the right to receive proce eds of insurance not

exceeding the unpaid balance, including any costs of collecti on, attorney's fees, or other

costs actually incurred in connection with the same, and Buyer di rects any insurer to

pay all such proceeds directly to Seller and authorizes Seller t o indorse any draft for

such proceeds. In the event of damage to Collateral and payment of insurance on the

same, Seller shall have the option of replacing Collateral or ap plying such proceeds on

any obligation secured by this Agreement. Seller may, on default u nder this Agreement

or default in the payment or performance of any obligation secured by this Agreement,

cancel any insurance on Collateral after repossession of the same, or on that portion of

Collateral repossessed if less than all.

10. Loss or Damage Loss of or damage to Collateral shall not release Buyer from the o bligations of

Buyer under this Agreement. Repairs to Collateral and to equipmen t or accessories

placed on Collateral shall be at the expense of Buyer and shall constitute component

parts of Collateral subject to the terms of this Agreement.

11. NoticeNotice to Buyer, required under this Agreement or by (citation of local

Enactment of Article 9 of the Uniform Commercial Code , e.g., Chapter 62A.9A

RCW) _____________________________ or other applicable statutes of ______________

(name of state) , shall be deemed given when sent to the above-stated address of

Buyer.

12. Late Charges If Buyer defaults in the payment of any installment, Buyer shall i mmediately pay

Seller, in addition to all amounts then due under this Agreement, a l ate charge of

______% of the installment in default.

13. Default The occurrence of any of the following shall constitute a defa ult under this

Agreement:

A. Failure of Buyer to perform any obligation or Agreement specifie d in this

Agreement;

B. Material falsity when made of any warranty or representatio n made under

this Agreement by Buyer;

C. Death of Buyer;

D. Institution of any proceeding in bankruptcy, receivership, or i nsolvency

against Buyer or against any obligor on any such secured obli gation,

institution by any party of any action for attachment or similar proc ess

against Collateral, issuance of execution process against any property of

Buyer or any such obligor, entry of any judgment against Buyer or any

such obligor, any assignment for benefit of creditors, or similar action

adversely involving Buyer or any such obligor.

E. Condemnation, levy, forfeiture, or similar action against Col lateral or any

part of the same.

F. Good-faith belief by Seller on reasonable grounds that the p rospect of

performance of any obligation of Buyer under this Agreement, or of

performance or payment of any obligation secured by this Agreemen t, by

Buyer or any other obligor on the obligation, is materially dimini shed.

14. Remedies In the event of a default under this Agreement, Seller shall have th e right to

declare all unpaid installments immediately due, enter any premises of Buyer and

without breach of the peace take possession of Collateral, and e xercise any or all of the

rights on default possessed by a secured party under (citation of local enactment

of Article 9 of the Uniform Commercial Code) ____________________________.

Seller may require Buyer to assemble Collateral and make Collat eral available to Seller

at a place to be designated by Seller that is reasonably convenie nt to Seller and Buyer.

Any notice of sale, disposition, or other intended action by Seller, s ent to Buyer at the

address specified above or such other address of Buyer as ma y from time to time be

shown on the records of Seller, at least _____ days prior to such action, shall constitute

reasonable notice to Buyer. Buyer shall pay all costs and expens es incurred in

enforcing the remedies of Seller under this Agreement, includ ing reasonable attorney's

fees and all advances made by Seller to protect its security inter est under this

Agreement, including advances made for or on account of levi es, insurance, repairs,

taxes, and for maintenance or recovery of Collateral.

15. Severability The invalidity of any portion of this Agreement will not and shal l not be deemed to

affect the validity of any other provision. If any provision of t his Agreement is held to be

invalid, the parties agree that the remaining provisions shall be deemed to be in full

force and effect as if they had been executed by both parties subseq uent to the

expungement of the invalid provision.

16. No Waiver The failure of either party to this Agreement to insist upon the perfo rmance of any

of the terms and conditions of this Agreement, or the waiver of any b reach of any of the

terms and conditions of this Agreement, shall not be construed as subsequently waiving

any such terms and conditions, but the same shall continue and r emain in full force and

effect as if no such forbearance or waiver had occurred.

17. Governing Law This Agreement shall be governed by, construed, and enforced in a ccordance

with the laws of the State of _____________.

18. Notices Any notice provided for or concerning this Agreement shall be in writing and shall

be deemed sufficiently given when sent by certified or registere d mail if sent to the

respective address of each party as set forth at the beginning of this Agreement.

19. Attorney �s Fees In the event that any lawsuit is filed in relation to this Agreement, the

unsuccessful party in the action shall pay to the successful pa rty, in addition to all the

sums that either party may be called on to pay, a reasonable sum for the successful

party's attorney fees.

20. Mandatory Arbitration

Any dispute under this Agreement shall be required to be resolved by binding

arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party

shall select one arbitrator and both arbitrators shall then sele ct a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitr ation shall be governed by

the rules of the American Arbitration Association then in force an d effect.

21. Entire Agreement This Agreement shall constitute the entire agreement between the parties and

any prior understanding or representation of any kind precedi ng the date of this

Agreement shall not be binding upon either party except to the extent in corporated in

this Agreement.

22. Modification of Agreement Any modification of this Agreement or additional obligation ass umed by either

party in connection with this Agreement shall be binding only if pla ced in writing and

signed by each party or an authorized representative of each par ty.

23. Assignment of Rights The rights of each party under this Agreement are personal to that p arty and may

not be assigned or transferred to any other person, firm, corp oration, or other entity

without the prior, express, and written consent of the other party.

24. In this Agreement, any reference to a party includes that party's heirs, executors,

administrators, successors and assigns, singular includes plural and masculine includes

feminine.

WITNESS our signatures as of the day and date first above state d.

________________________ _________________________

(Printed name) (Printed name)

________________________ __________________________

(Signature of Seller) (Signature of Buyer)