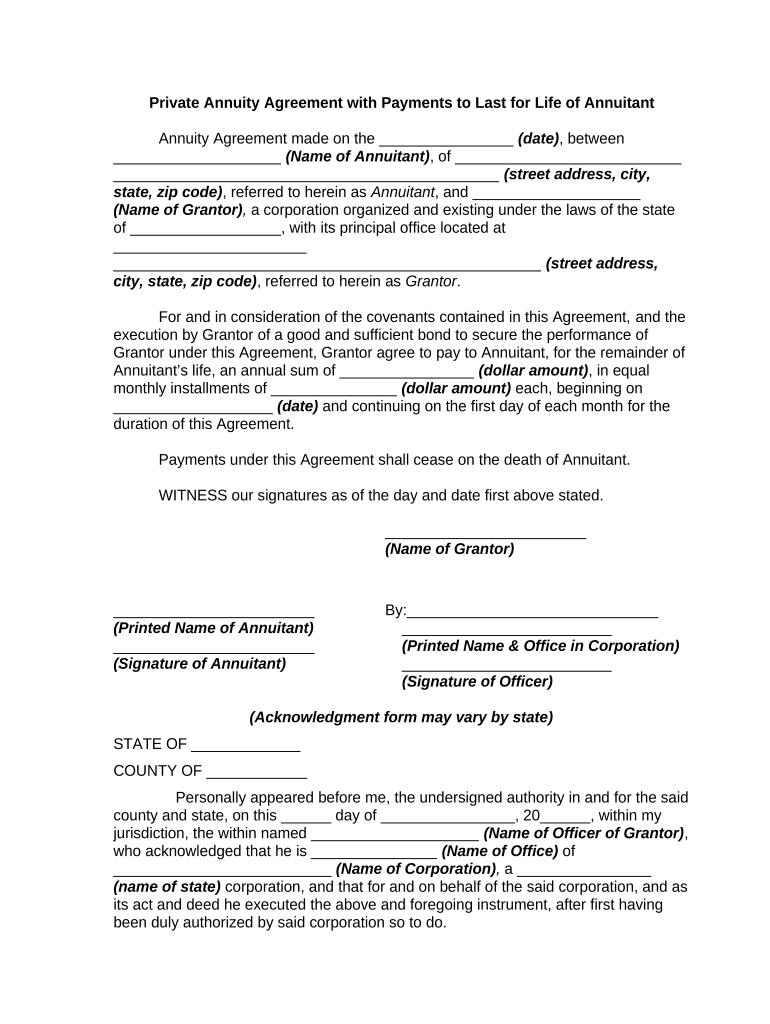

Fill and Sign the Private Annuity Agreement with Payments to Last for Life of Annuitant Form

Useful advice on getting your ‘Private Annuity Agreement With Payments To Last For Life Of Annuitant’ ready online

Are you weary of the trouble of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve documents or gather eSignatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our template library.

- Open your ‘Private Annuity Agreement With Payments To Last For Life Of Annuitant’ in the editor.

- Hit Me (Fill Out Now) to prepare the document on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Private Annuity Agreement With Payments To Last For Life Of Annuitant or submit it for notarization—our platform offers everything you require to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

A Private Annuity Agreement With Payments To Last For Life Of Annuitant is a financial arrangement where one party provides funds to another in exchange for a promise to make payments for the lifetime of the annuitant. This agreement can be beneficial for estate planning, allowing for income stability and tax advantages.

-

How can airSlate SignNow facilitate a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

airSlate SignNow offers an easy-to-use platform that simplifies the creation and signing of a Private Annuity Agreement With Payments To Last For Life Of Annuitant. Our eSignature solution ensures that all documents are signed securely and stored safely, enhancing your transaction's efficiency and compliance.

-

What are the benefits of using a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

The benefits of a Private Annuity Agreement With Payments To Last For Life Of Annuitant include secure lifetime income for the annuitant and potential tax benefits for the estate. Additionally, it can help avoid probate and streamline the transfer of assets, making it a strategic choice for financial planning.

-

Is there a cost associated with creating a Private Annuity Agreement With Payments To Last For Life Of Annuitant using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans are flexible, allowing you to choose the best option that fits your needs. This investment can lead to signNow savings and efficiencies in managing your Private Annuity Agreement.

-

Can I customize a Private Annuity Agreement With Payments To Last For Life Of Annuitant using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Private Annuity Agreement With Payments To Last For Life Of Annuitant to meet specific requirements. You can easily edit text fields, add clauses, and incorporate your branding, ensuring that your document aligns perfectly with your intentions.

-

What features does airSlate SignNow provide for a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

airSlate SignNow provides features such as secure eSignatures, document templates, and real-time tracking for your Private Annuity Agreement With Payments To Last For Life Of Annuitant. These features enhance the signing experience and provide peace of mind, knowing your documents are handled with the utmost security.

-

How does airSlate SignNow ensure the security of my Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure storage to protect your Private Annuity Agreement With Payments To Last For Life Of Annuitant. This ensures that your sensitive information remains confidential and secure throughout the signing process.

The best way to complete and sign your private annuity agreement with payments to last for life of annuitant form

Find out other private annuity agreement with payments to last for life of annuitant form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles