Fill and Sign the Referral Appointment Letter Cmcssnet Form

Useful Advice for Preparing Your ‘Referral Appointment Letter Cmcssnet’ Online

Are you exhausted by the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly fill out and sign documents online. Take advantage of the powerful features included in this user-friendly and cost-effective platform and transform your method of managing paperwork. Whether you need to sign forms or collect eSignatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Referral Appointment Letter Cmcssnet’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other parties (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Referral Appointment Letter Cmcssnet or send it for notarization—our platform offers everything you need to complete such tasks. Create an account with airSlate SignNow today and take your document management to the next level!

FAQs

-

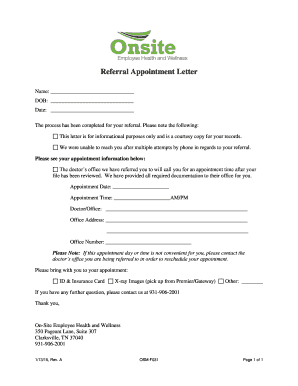

What is a Referral Appointment Letter Cmcssnet?

A Referral Appointment Letter Cmcssnet is a formal document used to schedule appointments within the CMCSS network. This letter typically contains essential details such as the appointment date, time, and purpose, ensuring clear communication between parties. Utilizing airSlate SignNow, you can easily create and manage these letters to enhance your scheduling process.

-

How can airSlate SignNow streamline my Referral Appointment Letter Cmcssnet process?

airSlate SignNow offers an intuitive platform that allows users to create, send, and eSign Referral Appointment Letters Cmcssnet efficiently. With its user-friendly interface, you can customize templates and automate workflows, reducing time spent on administrative tasks. This means you can focus more on your core activities while ensuring your appointment letters are handled professionally.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to meet different needs, including options for individuals and businesses. Each plan includes features that enhance the management of documents like the Referral Appointment Letter Cmcssnet. You can start with a free trial to explore its capabilities before committing to a subscription.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing you to streamline your workflow. You can connect it with popular tools like Google Drive, Salesforce, and Microsoft Office to enhance the functionality of your Referral Appointment Letter Cmcssnet processes. These integrations help in maintaining a cohesive and efficient digital workspace.

-

What are the benefits of using airSlate SignNow for sending Referral Appointment Letters Cmcssnet?

Using airSlate SignNow for your Referral Appointment Letters Cmcssnet provides numerous benefits, including fast document turnaround and improved accuracy. The platform allows for easy tracking of sent documents, ensuring that you can follow up efficiently. Additionally, the eSigning feature enhances security and compliance, making your appointment scheduling more reliable.

-

Is airSlate SignNow secure for handling Referral Appointment Letters Cmcssnet?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents, including Referral Appointment Letters Cmcssnet. The platform adheres to industry standards for data protection, ensuring that all sensitive information is safe from unauthorized access. This commitment to security allows you to send and sign documents with peace of mind.

-

Can I customize my Referral Appointment Letter Cmcssnet template in airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of your Referral Appointment Letter Cmcssnet templates. You can easily add your branding elements, modify text, and include specific details pertinent to your appointments. This flexibility ensures that your letters not only serve their purpose but also reflect your organization's identity.

Find out other referral appointment letter cmcssnet form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles