Texas Application for Direct Payment Permit

General Information

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about

you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to

request error correction, contact us at the address or phone numbers listed on this form.

Who may submit this application You may submit this application if you annually purchase at least $800,000 worth of taxable items

for your own use and not for resale.

• The Comptroller may issue a Direct Payment Permit after receiving this completed application

and finding that all the requirements for issuing a Direct Payment Permit stated in Item 1 of this

application, “Taxpayer’s Agreement,” have been met.

For assistance If you have any questions about this application, filing tax returns or any other tax-related matter,

contact your nearest Texas State Comptroller’s local office. You may also call (800) 252-5555 or

(512) 463-4600.

General Instructions

•

•

•

•

Please do not separate pages.

Write only in white areas.

Fill in all blanks and answer all questions completely and fully.

Do not use dashes when entering Social Security, Federal Employer Identification Number (FEIN),

Texas Taxpayer or Texas Vendor Identification numbers.

• Federal Privacy Act: Disclosure of your Social Security number is required and authorized under

law, for the purpose of tax administration and identification of any individual affected by applicable

law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on

this form in response to a public information request will be governed by the Public Information Act,

Chapter 552, Government Code, and applicable federal law.

NOTE: No purchases may be made tax free until this application has been approved and your Direct Payment

Permit has been issued.

Specific instructions are on the back of the next page.

Complete this application and mail to: Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

AP-101-1 (Rev.8-11/16)

�AP-101-2

(Rev.8-11/16)

PRINT FORM

Texas Application

for Direct Payment Permit

• Please read instructions.

CLEAR FIELDS

Page 1

• Type or print.

• Do not write in shaded areas.

1. Taxpayer's Agreement - The applicant, in consideration of the issuance of a Direct Payment Permit by the State of Texas according to the provisions of the law, agrees and affirms:

a. that applicant is a responsible person annually purchasing at least $800,000 worth of taxable items for use and not for

resale (complete Item 19);

TAXPAYER'S AGREEMENT

b. that the accounting method used will clearly distinguish between taxable and nontaxable purchases (complete Item 20);

c. that upon the issuance of a Direct Payment Permit to the applicant, the applicant will accrue and pay to the State of Texas

all taxes which are or may in the future be due by virtue of the State, Local, Metropolitan Transit Authority, City Transit

Department, County and Special Purpose District Sales and Use Tax Acts. The tax is due on all taxable purchases; and,

unless the tax is paid to the seller, it must be reported on the Texas Direct Payment Return. All taxes due will be paid

monthly on or before the 20th day of the month following each monthly reporting period;

d. that the Direct Payment Exemption Certificate will not be issued for taxable items purchased for resale;

e. to report all taxable purchases on the direct payment return and waive any claim for discounts for taxes paid. No taxable

purchases may be reported on a sales and use tax return;

f. upon request, to make available at any time to the Comptroller's office the books, papers, records and equipment of the

applicant's business;

g. to cooperate with the Comptroller's office in the examination of the books, papers, records and equipment of the applicant

and in the investigation of the applicant's activities, business and accounting methods; and

h. to fully disclose to the Comptroller's office in this agreement or upon acquisition, whichever occurs first, the nature and

extent of the ownership or control which the applicant has in the business from which the applicant makes purchases

pursuant to the Direct Payment Permit.

Legal cite: Tex. Tax Code Ann. Sec. 151.419

Type or print name of sole owner, partner or officer

Sole owner, partner or officer

TAXPAYER IDENTIFICATION

2. Legal name of owner (sole owner, partnership, corporation or other name)

3. Mailing address (street and number, P.O. Box or rural route and box number)

City

State

ZIP code

County

4. If you are a sole owner, enter your home address IF it is different from the address above. (street and number, city, state, ZIP code)

4a. Enter the phone number of the person primarily responsible for filing tax returns (area code and number).

(

)

5. Enter your Social Security number if you are a sole owner ............................................................................

6. Enter your Federal Employer Identification Number (FEIN), if any. ........................................................................

7. Enter your taxpayer number for reporting any Texas tax OR your Texas

Vendor Identification Number if you now have or have ever had one................................................................

8. Indicate how your business is owned.

1 - Sole owner

3 - Texas corporation

OWNERSHIP

2 - Partnership

6 - Foreign corporation

7 - Limited partnership

Other (explain)

File number

Month

Day

Year

Day

Year

9. If your business is a Texas corporation,

enter the file number and date. ......................................................................................

10. If your business is a foreign corporation, enter home state, home state registration number, Texas file number and date.

Home state

Home state registration number

Month

Texas file number

11. If the business is a limited partnership, enter the home state

and identification number. ............................................................................................................

State

Number

�AP-101-3

(Rev.8-11/16)

Texas Application

for Direct Payment Permit

• Please read instructions.

Page 2

• Type or print.

• Do not write in shaded areas.

12. Legal name of owner (same as Item 2)

13. List all general partners, officers or managing members of your business. (Attach additional sheets, if necessary.)

If you are sole owner, skip Item 13.

Name

Phone (area code and number)

(

PROPRIETORS

Home address

)

City

SSN

State

FEIN

County (or country, if outside the U.S.)

Percent of

ownership

Position held:

General partner

Officer/Director

Name

%

Managing member

Other

Phone (area code and number)

(

Home address

)

City

SSN

State

FEIN

General partner

Officer/Director

%

Managing member

Other

BUSINESS LOCATION/TYPE

14. Business name

DIRECT PAYMENT

INFORMATION

ZIP code

County (or country, if outside the U.S.)

Percent of

ownership

Position held:

ZIP code

Business phone (area code and number)

(

)

15. Location of your principal place of business (Use street and number or directions - NOT P.O. Box or rural route number.)

City

State

ZIP code

County

16. Is your business located inside the city limits of the city named in Item 15? ..................................................................

17. Indicate your principal type of business.

Exploration/Production

Construction

Manufacturer/Processor

Service

YES

NO

Other

18. Describe your Texas business and the goods or services you sell. (See instructions.)

19. Enter the amount of your annual purchases subject to Texas Use Tax .....................................

$

20. On a separate sheet, describe the accounting method that you will use to differentiate between taxable purchases, exempt purchases,

tax-paid purchases and items purchased tax free for resale. (See instructions.)

21. List and describe all sites of major fixed assets permanently located within Texas. (Attach additional sheets, if necessary.)

The sole owner, all general partners, members, officers or an authorized representative

must sign this application. Representative must submit a written power of attorney

with this application. (Attach additional sheets, if necessary.)

Month

Day

Year

Date of signature

SIGNATURES

22. I (We) declare, under penalties prescribed by law, that the information in this document and any attachments is true and correct to the best

of my (our) knowledge and belief.

Legal cite: Tex. Penal Code Ann. Sec. 37.10

Type or print name of sole owner, partner or officer

Sole owner, partner or officer

Type or print name of partner or officer

Partner or officer

Type or print name of partner or officer

Partner or officer

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to

conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online

at http://www.Texas.gov. You may also want to contact the municipality and county in which you will conduct business to determine

any local governmental requirements.

Field office or section number

Employee Name

USERID

Date

�Instructions for Completing

Texas Application for Direct Payment Permit

Item 2 - Sole owner - enter first name, middle initial

and last name.

Partnership - enter the legal name of the

partnership.

Corporation - enter the legal name exactly as it

is registered with the Secretary of State.

Other organization - enter the title of the

organization.

Item 3 - Enter the complete address where you want

to receive mail from the Comptroller of Public

Accounts.

NOTE: If you want to receive mail for other

taxes at a different address, attach a letter with

the other address(es).

Item 6 - Enter the Federal Employer Identification

Number (FEIN) assigned to your business by

the Internal Revenue Service.

Item 7 - If you have both a Texas Taxpayer and a

Texas Vendor Identification Number, enter only

the first eleven digits of the Vendor Identification

Number.

Item 8 - If you check “Other,” identify the type of

organization.

Examples: Social Club, Independent School

District, Family Trust.

Item 13 - Partnership - enter the information for ALL

partners. If a partner is a corporation, enter the

Federal Employer Identification Number (FEIN)

of the corporation.

Corporation or other organization - enter the

information for the principal officers (president,

secretary, treasurer).

Item 18 - The description of your business should

include the principal types of business.

Examples: highway construction, crude

petroleum, natural gas transmission, industrial

chemicals. Please be specific.

Item 19 - Enter the total amount of taxable items

purchased last year or to be purchased. This

does not include purchases for which a Resale

Certificate can be or could have been issued.

AP-101-4 (Rev.8-11/16)

Item 20 - To be eligible for a Direct Payment Permit,

you must maintain an accounting method that

clearly distinguishes between taxable and nontaxable purchases.

Describe your accounting method fully. Explain

the internal controls and the accounting flow of

the data that will be used to prepare your direct

payment return.

Answer the following questions in your explanation.

• How will you distinguish between

- purchases made under a direct payment

exemption certificate;

- purchases for resale;

- nontaxable purchases;

- purchases in Texas and out of state;

- any other tax-free purchases; and

- tax-paid purchases?

• If you purchase items for resale and for your

own use from the same supplier, will you

issue separate purchase orders? How will the

two types of purchases be accounted for?

• If you do not issue blanket exemption

certificates to your suppliers, how will you

indicate on which items the supplier will

collect tax?

• What accounting procedure will you follow

to report use tax in the same month that you

receive vendor’s billings?

• What procedure will you follow to report use

tax to the correct city, Metropolitan Transit

Authority (MTA) or City Transit Department

(CTD), County and/or Special Purpose

District (SPD)?

• When you prepare your direct payment

return, from what source(s) will you get the

necessary data? How will this data get to the

source(s)?

• Will more than one person review the

purchase records and compare them to

reported purchases?

• What procedures will you follow to ensure

that tax-free purchases are not reported on

the Texas Sales and Use Tax Return?

�

Practical advice on finishing your ‘Residential Gas Service Agreement 2018’ online

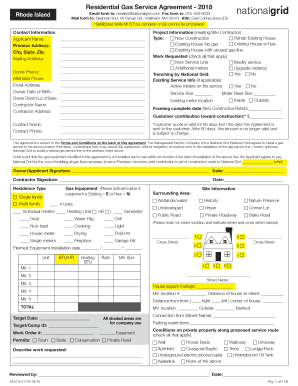

Are you fed up with the difficulty of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and companies. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow handles it all seamlessly, requiring just a few clicks.

Follow this detailed guide:

- Access your account or initiate a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our collection of templates.

- Open your ‘Residential Gas Service Agreement 2018’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print a copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Residential Gas Service Agreement 2018 or send it for notarization—our platform provides everything you require to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to a new level!