ELECTRONIC COMMERCE:

TAXATION FRAMEWORK CONDITIONS

A Report by the Committee on Fiscal Affairs,

as presented to Ministers at the OECD Ministerial Conference,

“A Borderless World: Realising the Potential of Electronic Commerce”

on 8 October 1998.

Ministers welcomed the report and endorsed the proposals on how to

take forward the work as outlined within it.

�THE DRAFT MINISTERIAL REPORT

PREFACE

This Report has been prepared by the Committee on Fiscal Affairs of the OECD. The Report has benefited from inputs by the

European Commission and the World Customs Organisation in the area of indirect taxes and from an exchange of views with the

business community.

TABLE OF CONTENTS

ELECTRONIC COMMERCE: TAXATION FRAMEWORK CONDITIONS ........................................................................ 3

I. Introduction ........................................................................................................................................................... 3

II. Main conclusions ................................................................................................................................................. 3

III. Taxpayer service opportunities ........................................................................................................................... 3

IV. The broad taxation principles which should apply to electronic commerce ....................................................... 4

V. The challenge of implementing these broad principles ....................................................................................... 5

VI. The post-Ottawa agenda and process ............................................................................................................... 6

Boxes

Box 1. Taxpayer service opportunities offered by new technologies ........................................................................... 4

Box 2. Broad taxation principles which should apply to electronic commerce ............................................................. 4

Box 3. Electronic commerce: elements of a taxation framework ................................................................................. 5

Box 4. The post-Ottawa agenda .................................................................................................................................. 6

Box 5. The post-Ottawa process.................................................................................................................................. 7

2

�ELECTRONIC COMMERCE: TAXATION FRAMEWORK CONDITIONS

A Report by the Committee on Fiscal Affairs

I.

Introduction

1.

Electronic commerce has the potential to be one of the great economic developments of the 21st Century.

The information and communication technologies which underlie this new way of doing business open up

opportunities to improve global quality of life and economic well being. Electronic commerce has the potential to spur

growth and employment in industrialised, emerging and developing countries.

2.

Revenue authorities have a role to play in realising this potential. Governments must provide a fiscal

climate within which electronic commerce can flourish, weighed against the obligation to operate a fair and predictable

taxation system that provides the revenue required to meet the legitimate expectations of citizens for publicly provided

services. Striking the right balance between these objectives is the aim of this Report.

II.

Main conclusions

3.

The Committee on Fiscal Affairs (CFA) recognises that the technologies which underlie electronic

commerce offer Revenue authorities significant new opportunities to improve taxpayer service and Member countries

are committed to exploiting fully these opportunities (see Section III).

4.

The taxation principles which guide governments in relation to conventional commerce should also guide

them in relation to electronic commerce. The CFA believes that at this stage of development in the technological and

commercial environment, existing taxation rules can implement these principles.

5.

This approach does not preclude new administrative or legislative measures, or changes to existing

measures, relating to electronic commerce, provided that those measures are intended to assist in the application of

the existing taxation principles, and are not intended to impose a discriminatory tax treatment of electronic commerce

transactions.

6.

Any arrangements for the application of these principles to electronic commerce adopted domestically and

any adaptation of existing international taxation principles should be structured to maintain the fiscal sovereignty of

countries, to achieve a fair sharing of the tax base from electronic commerce between countries and to avoid double

taxation and unintentional non taxation (see Section IV). Revenue authorities acting within the OECD or other fora,

must take an active role in encouraging protocols and standards for electronic commerce which are compatible with

these principles.

7.

The CFA has been able to reach conclusions on conditions for a taxation framework needed to implement

these principles (see Section V). Intensified co-operation and consultation with business will be an important part of

the process of implementing these principles (see Section VI).

III.

Taxpayer service opportunities

8.

Revenue authorities recognise that electronic commerce technologies will open up new ways by which they

can undertake their business of administering tax law and collecting tax revenues and new ways by which they interact

with the wider community.

3

�Box 1. Taxpayer service opportunities offered by new technologies

Improving service standards

(i)

Communications facilities and access to information can be enhanced to assist taxpayers and to improve

response times.

Minimising business compliance costs

(ii)

Tax registration and filing requirements could be simplified and norms promoted for the acceptance of

electronic material.

Enhance voluntary compliance

(iii)

Electronic assessment and collection of tax could be encouraged. Easier, quicker and more secure ways of

paying taxes and obtaining tax refunds could be facilitated.

IV.

The broad taxation principles which should apply to electronic commerce

9.

Box 2 sets out the widely accepted general tax principles that should apply to electronic commerce.

Box 2. Broad taxation principles which should apply to electronic commerce

Neutrality

(i)

Taxation should seek to be neutral and equitable between forms of electronic commerce and between

conventional and electronic forms of commerce. Business decisions should be motivated by economic

rather than tax considerations. Taxpayers in similar situations carrying out similar transactions should be

subject to similar levels of taxation.

Efficiency

(ii)

Compliance costs for taxpayers and administrative costs for the tax authorities should be minimised as far

as possible.

Certainty and simplicity

(iii)

The tax rules should be clear and simple to understand so that taxpayers can anticipate the tax

consequences in advance of a transaction, including knowing when, where and how the tax is to be

accounted.

Effectiveness and Fairness

(iv)

Taxation should produce the right amount of tax at the right time. The potential for tax evasion and

avoidance should be minimised while keeping counter-acting measures proportionate to the risks involved.

Flexibility

(v)

The systems for the taxation should be flexible and dynamic to ensure that they keep pace with

technological and commercial developments.

10.

The full application of the principles set out in Box 2 will require further work after the Ottawa Ministerial

meeting.

4

�V.

The challenge of implementing these broad principles

11.

The challenge facing Revenue authorities is how to implement the broad taxation principles identified in

Box 2 in a rapidly changing environment. In a number of areas the CFA has been able to reach conclusions on the

elements of a taxation framework that will incorporate these principles. These are summarised in Box 3.

Box 3. Electronic commerce: elements of a taxation framework

Taxpayer service

(i)

Revenue authorities should make use of the available technology and harness commercial developments in

administering their tax system to continuously improve taxpayer service.

Tax administration, identification and information needs

(ii)

Revenue authorities should maintain their ability to secure access to reliable and verifiable information in

order to identify taxpayers and obtain the information necessary to administer their tax system.

Tax collection and control

(iii)

Countries should ensure that appropriate systems are in place to control and collect taxes.

(iv)

International mechanisms for assistance in the collection of tax should be developed, including proposals

for an insert of language in the OECD Model Tax Convention.

Consumption taxes

(v)

Rules for the consumption taxation of cross-border trade should result in taxation in the jurisdiction where

consumption takes place and an international consensus should be sought on the circumstances under

which supplies are held to be consumed in a jurisdiction.

(vi)

For the purpose of consumption taxes, the supply of digitised products should not be treated as a supply of

goods.

(vii)

Where business and other organisations within a country acquire services and intangible property from

suppliers outside the country, countries should examine the use of reverse charge, self-assessment or

other equivalent mechanisms where this would give immediate protection of their revenue base and of the

competitiveness of domestic suppliers.

(viii)

Countries should ensure that appropriate systems are developed in co-operation with the WCO and in

consultation with carriers and other interested parties to collect tax on the importation of physical goods,

and that such systems do not unduly impede revenue collection and the efficient delivery of products to

consumers.

International tax arrangements and co-operation

(ix)

While the OECD believes that the principles which underlie the international norms that it has developed in

the area of tax treaties and transfer pricing (through the Model Tax Convention and the Transfer Pricing

Guidelines) are capable of being applied to electronic commerce, there should be a clarification of how the

Model Tax Convention applies with respect to some aspects of electronic commerce.

5

�12.

The CFA also recognises that there are ongoing developments in areas such as establishing electronic

trading, payment, certification and technical standards and protocols and in the reform of Internet governance where

Revenue authorities both individually and in such international fora as the OECD may need to play a role if they are to

succeed in implementing the tax principles set out in Box 2. In addition, Revenue authorities in co-operation with other

appropriate authorities, will closely monitor developments in electronic means of payment, particularly unaccounted

systems.

13.

Recognising the global nature of electronic commerce, Revenue Authorities will intensify their use of

existing co-operative arrangements, explore options for multilateral administrative assistance and examine the

application of the recommendations relating to geographically mobile activities contained in the OECD Report Harmful

1

Tax Competition to the electronic commerce environment.

14.

The CFA believes that an implementation of the framework conditions set out in Box 3 will enable

Governments to harness the opportunities and to respond to the challenges of electronic commerce and thereby lead

to an internationally consistent taxation approach to electronic commerce.

VI.

The post-Ottawa agenda and process

15.

The Turku conference of November 1997 initiated work on developing taxation framework conditions for

electronic commerce. The Ottawa Ministerial meeting of October 1998 will take this process further. However, much

remains to be done. This Report has identified the broad taxation principles which should apply to electronic

commerce and identified implementation issues, including how these new technologies offer Revenue authorities the

opportunity to improve the service they provide to taxpayers.

Box 4. The post-Ottawa agenda

Revenue authorities will work through the OECD and in consultation with business to identify concrete substantive

steps that can help implement and extend the taxation framework conditions described in Box 3, and to consider the

feasibility and practicality of those steps, including the following:

Taxpayer service

(i)

Developing an international consensus on ways to simplify taxation systems to minimise the cost of tax

compliance, particularly for small- to medium-sized enterprises.

Tax administration, identification and information needs

(ii)

Adopting conventional identification practices for businesses engaged in electronic commerce.

(iii)

Developing internationally acceptable guidelines on the levels of identification sufficient to allow digital

signatures to be considered acceptable evidence of identity in tax matters.

(iv)

Developing internationally compatible information requirements, such as acceptance of electronic records,

format of records, access to third party information and other access arrangements and periods of retention

and tax collection arrangements.

Tax collection and control

(v)

Designing appropriate strategies and measures to improve tax compliance with regard to electronic

commerce transactions, including measures to improve voluntary compliance.

Consumption taxes

(vi)

Reaching agreement on, inter alia, defining place of consumption, on place of taxation rules and on

internationally compatible definitions of services and intangible property.

(vii)

Developing options for ensuring the continued effective administration and collection of consumption taxes

as electronic commerce develops.

1.

Luxembourg and Switzerland abstained from the Council recommendation which accompanied this report.

6

�Box 4. The post-Ottawa agenda (continued)

International tax arrangements and co-operation

(viii)

With regard to the OECD Model Tax Convention, clarifying how the concepts used in the Convention apply

to electronic commerce, in particular:

(a) To determine taxing rights, such as the concepts of “permanent establishment” and the

attribution of income; and

(b) To classify income for purposes of taxation, such as the concepts of intangible property,

royalties, and services, and in particular as regards digitised information.

(ix)

Monitoring of developments in, and tax administration challenges presented by, electronic commerce, in the

application of the OECD Transfer Pricing Guidelines.

(x)

Improving the use of existing bilateral and multilateral agreements for administrative assistance.

(xi)

Considering how harmful tax competition for electronic commerce is to be avoided, in the context of the

Recommendations on geographically mobile activities accompanying the OECD Report Harmful Tax

Competition.

16.

The Committee on Fiscal Affairs further recognises that the full application of the principles which underlie

these arrangements will require further work after the Ottawa Ministerial meeting. It also accepts that any taxation

arrangements put in place must be capable of developing as the technological and commercial environment changes.

The Committee welcomes the willingness of business to work with Government in developing further approaches for

the implementation of these principles and looks forward to working with business at both the technological and policy

level. This further dialogue entails a recognition of the place of Revenue authorities as stake holders in electronic

commerce and the validity of their involvement in the development of the standards and protocols which are now

emerging.

Box 5. The post-Ottawa process

To pursue the post Ottawa agenda, Revenue Authorities will continue to:

(i)

Carry forward the work programme in the Committee on Fiscal Affairs including monitoring developments

in, and tax administration challenges presented by, electronic commerce and continuing its close

relationship with the European Commission and the World Customs Organisation.

(ii)

Intensify co-operation and regular consultation with the business community.

(iii)

Develop its contacts with interested non-member economies.

(iv)

Report back periodically to the OECD Council and, if appropriate, to Ministers.

7

�

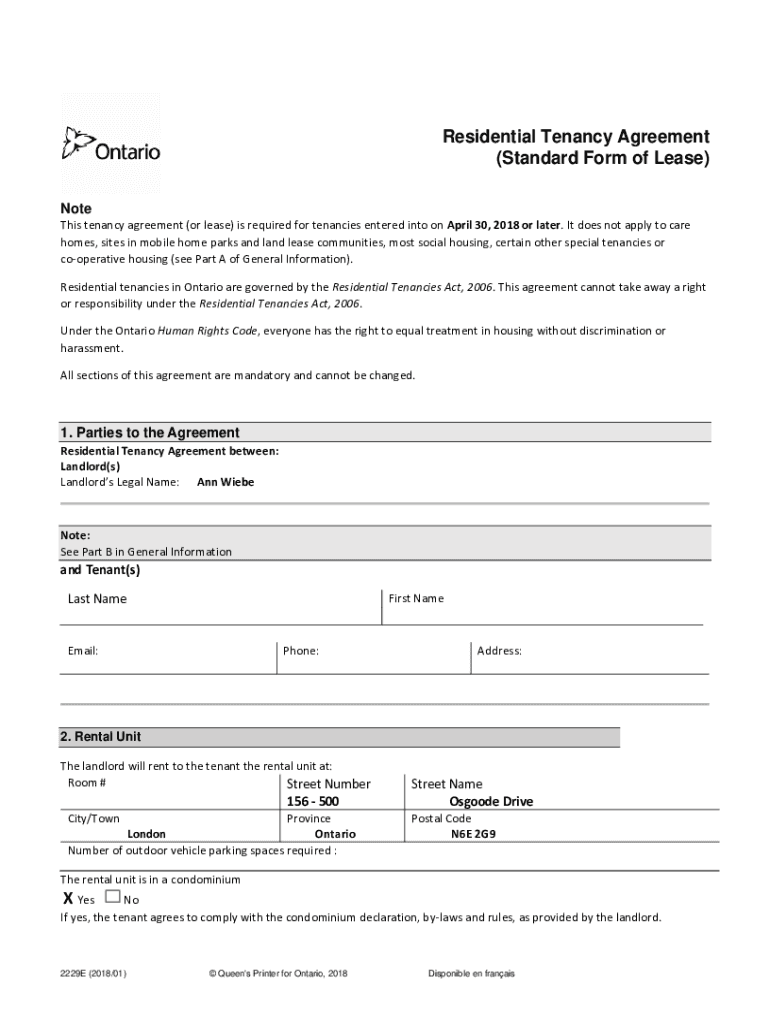

Valuable suggestions for finishing your ‘Residential Tenancy Agreement Standard Form Of Lease’ online

Fed up with the difficulties of managing documentation? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can conveniently complete and authorize documents online. Utilize the powerful features embedded in this intuitive and affordable platform and transform your method of handling documents. Whether you need to sign forms or gather eSignatures, airSlate SignNow takes care of everything effortlessly, with just a few clicks.

Adhere to this detailed guide:

- Access your account or sign up for a free trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Edit your ‘Residential Tenancy Agreement Standard Form Of Lease’ in the editor.

- Click Me (Fill Out Now) to customize the form on your end.

- Include and allocate fillable fields for other participants (if necessary).

- Move forward with the Send Invite options to seek eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t worry if you need to collaborate with your teammates on your Residential Tenancy Agreement Standard Form Of Lease or send it for notarization—our platform provides all the tools required to accomplish these tasks. Sign up with airSlate SignNow today and enhance your document management to a new dimension!