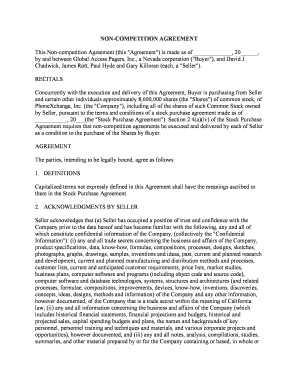

NON-COMPETITION AGREEMENT

This Non-competition Agreement (this "Agreement") is made as of _____________, 20______,

by and between Global Access Pagers, Inc., a Nevada corporation ("Buyer"), and David J.

Chadwick, James Rott, Paul Hyde and Gary Killoran (each, a "Seller").

RECITALS

Concurrently with the execution and delivery of this Agreement, Buyer is purchasing from Seller

and certain other individuals approximately 8,600,000 shares (the "Shares") of common stock, of

PhoneXchange, Inc. (the "Company"), including all of the shares of such Common Stock owned

by Seller, pursuant to the terms and conditions of a stock purchase agreement made as of

___________, 20___(the "Stock Purchase Agreement"). Section 2.4(a)(iv) of the Stock Purchase

Agreement requires that non-competition agreements be executed and delivered by each of Seller

as a condition to the purchase of the Shares by Buyer.

AGREEMENT

The parties, intending to be legally bound, agree as follows:

1. DEFINITIONS

Capitalized terms not expressly defined in this Agreement shall have the meanings ascribed to

them in the Stock Purchase Agreement.

2. ACKNOWLEDGMENTS BY SELLER

Seller acknowledges that (a) Seller has occupied a position of trust and confidence with the

Company prior to the date hereof and has become familiar with the following, any and all of

which constitute confidential information of the Company, (collectively the "Confidential

Information"): (i) any and all trade secrets concerning the business and affairs of the Company,

product specifications, data, know-how, formulae, compositions, processes, designs, sketches,

photographs, graphs, drawings, samples, inventions and ideas, past, current and planned research

and development, current and planned manufacturing and distribution methods and processes,

customer lists, current and anticipated customer requirements, price lists, market studies,

business plans, computer software and programs (including object code and source code),

computer software and database technologies, systems, structures and architectures (and related

processes, formulae, compositions, improvements, devices, know-how, inventions, discoveries,

concepts, ideas, designs, methods and information) of the Company and any other information,

however documented, of the Company that is a trade secret within the meaning of California

law; (ii) any and all information concerning the business and affairs of the Company (which

includes historical financial statements, financial projections and budgets, historical and

projected sales, capital spending budgets and plans, the names and backgrounds of key

personnel, personnel training and techniques and materials, and various corporate projects and

opportunities), however documented; and (iii) any and all notes, analysis, compilations, studies,

summaries, and other material prepared by or for the Company containing or based, in whole or

in part, on any information included in the foregoing, (b) the business of the Company is

international in scope, (c) its products and services are marketed throughout the World; (d) the

Company competes with other businesses that are or could be located in any part of the World;

(e) Buyer has required that Seller make the covenants set forth in Sections 3 and 4 of this

Agreement as a condition to the Buyer's purchase of the Shares owned by Seller; (f) the

provisions of § 3 and 4 of this Agreement are reasonable and necessary to protect and preserve

the Company's business, and (g) the Company would be irreparably damaged if Seller were to

breach the covenants set forth in § 3 and 4 of this Agreement.

3. CONFIDENTIAL INFORMATION

Seller acknowledges and agrees that all Confidential Information known or obtained by Seller,

whether before or after the date hereof, is the property of the Company. Therefore, Seller agrees

that Seller will not, at any time, disclose to any unauthorized Persons or use for his own account

or for the benefit of any third party any Confidential Information, whether Seller has such

information in Seller's memory or embodied in writing or other physical form, without Buyer's

written consent, unless and to the extent that the Confidential Information is or becomes

generally known to and available for use by the public other than as a result of Seller's fault or

the fault of any other Person bound by a duty of confidentiality to Buyer or the Company. Seller

agrees to deliver to Buyer at any time Buyer may request, all documents, memoranda, notes,

plans, records, reports, and other documentation, models, components, devices, or computer

software, whether embodied in a disk or in other form (and all copies of all of the foregoing),

relating to the businesses, operations, or affairs of the Company and any other Confidential

Information that Seller may then possess or have under Seller's control.

4. NON-COMPETITION

As an inducement for Buyer to enter into the Stock Purchase Agreement and as additional

consideration for the consideration to be paid to Seller under the Stock Purchase Agreement,

Seller agrees that:

a. For a period of five years after the Closing:i. Seller will not, directly or indirectly, engage or invest in, own, manage, operate, finance,

control, or participate in the ownership, management, operation, financing, or control of,

be employed by, associated with, or in any manner connected with, or render services or

advice to, any business whose products or activities compete in whole or in part with the

products or activities of the Company or any affiliate of the Company (including Buyer),

anywhere within the United States; provided,

however, that Seller may purchase or otherwise acquire up to (but not more than) 4.99

percent of any class of securities of any enterprise (but without otherwise participating in

the activities of such enterprise) if such securities are listed on any national or regional

securities exchange or have been registered under Section 12(g) of the Securities Exchange

Act of 1934; provided, further, that this provision shall not apply to any interest or

investment in any business owned by Seller as of January 1, 1999 as long as (i) any

activity associated with, or business time of Executive devoted to, such investment does

not materially interfere with Seller' duties under any employment agreement or

relationship with the Company or any affiliate of the Company (including Buyer), (ii) no

Confidential Information is used by Seller or such business, or disclosed to any employee,

officer or director of such business, to the benefit of such business or the material

detriment of the Company or any affiliate of the Company (including Buyer), and (iii) the

business or activities conducted by such business does not materially change from the

business or activities conducted by such business as of January 1, 1999, which change

would cause such business to compete more directly and materially with the Company or

any affiliate of the Company (including Buyer). Seller agrees that this covenant is

reasonable with respect to its duration, geographical area, and scope.

ii. Seller will not, directly or indirectly, either for himself or any other Person, (A) induce or

attempt to induce any employee of the Company or any affiliate of the Company (including

Buyer) to leave the employ of the Company or any affiliate of the Company (including

Buyer), (B) in any way interfere with the relationship between the Company or any affiliate

of the Company (including Buyer) and any employee of the Company or any affiliate of the

Company (including Buyer), (C) employ, or otherwise engage as an employee, independent

contractor, or otherwise, any employee of the Company or any affiliate of the Company

(including Buyer), or (D) induce or attempt to induce any customer, supplier, licensee, or

business relation of the Company or any affiliate of the Company (including Buyer) to cease

doing business with the Company or any affiliate of the Company (including Buyer), or in

any way interfere with the relationship between any customer, supplier, licensee, or business

relation of the Company or any affiliate of the Company (including Buyer).

iii. Seller will not, directly or indirectly, either for himself or any other Person, solicit the

business of any Person known to Seller to be a customer of the Company or any affiliate of the

Company (including Buyer), whether or not Seller had personal contact with such Person, with

respect to products or activities which compete in whole or in part with the products or activities

of the Company;

b. In the event of a breach by Seller of any covenant set forth in Subsection 4(a) of this

Agreement, the term of such covenant will be extended by the period of the duration of such

breach;

c. Seller will not, at any time during or after the five year period, disparage Buyer or the

Company, or any of their affiliates, shareholders, directors, officers, employees, or agents; and

d. Seller will, for a period of five years after the Closing, within ten days after accepting any

employment, advise Buyer of the identity of any employer of Seller. Buyer or the Company may

serve notice upon each such employer that Seller is bound by this Agreement and furnish each

such employer with a copy of this Agreement or relevant portions thereof.

5. REMEDIES

If Seller breaches the covenants set forth in Sections 3 or 4 of this Agreement,

Buyer and the Company will be entitled to the following remedies:

a. Damages from Seller:

b. To offset against any and all amounts owing to Seller under the Stock

Purchase Agreement any and all amounts which Buyer or the Company

claim under Subsection 6(a) of this Agreement; and

c. In addition to its right to damages and any other rights it may have,

to obtain injunctive or other equitable relief to restrain any breach

or threatened breach or otherwise to specifically enforce the

provisions of Sections 3 and 4 of this Agreement, it being agreed

that money damages alone would be inadequate to compensate the Buyer

and the Company and would be an inadequate remedy for such breach.

d. The rights and remedies of the parties to this Agreement are

cumulative and not alternative.

6. SUCCESSORS AND ASSIGNS

This Agreement will be binding upon Buyer, the Company and Seller and will

inure to the benefit of Buyer and the Company and their affiliates, successors

and assigns and Seller and Seller's assigns, heirs and legal representatives.

7. WAIVER

The rights and remedies of the parties to this Agreement are cumulative and not

alternative. Neither the failure nor any delay by any party in exercising any

right, power, or privilege under this Agreement will operate as a waiver of such right, power, or

privilege, and no single or partial exercise of any such right, power, or privilege will preclude

any other or further exercise of such right, power, or privilege or the exercise of any other right,

power, or privilege. To the maximum extent permitted by applicable law, (a) no claim or right

arising out of this Agreement can be discharged by one party, in whole or in part, by a waiver or

renunciation of the claim or right unless in writing signed by the other party; (b) no waiver that

may be given by a party will be applicable except in the specific instance for which it is given;

and (c) no notice to or demand on one party will be deemed to be a waiver of any obligation of

such party or of the right of the party giving such notice or demand to take further action without

notice or demand as provided in this Agreement.

8. GOVERNING LAW

This Agreement will be governed by the laws of the State of California without regard to

conflicts of laws principles.

9. JURISDICTION; SERVICE OF PROCESS

Any action or proceeding seeking to enforce any provision of, or based on any right arising out

of, this Agreement may be brought against any of the parties in the courts of the State of

California, County of Los Angeles, or, if it has or can acquire jurisdiction, in the United States

District Court for the Central District of California, and each of the parties consents to the

jurisdiction of such courts (and of the appropriate appellate courts) in any such action or

proceeding and waives any objection to venue laid therein. Process in any action or proceeding

referred to in the preceding sentence may be served on any party anywhere in the world.

10. SEVERABILITY

Whenever possible each provision and term of this Agreement will be interpreted in a manner to

be effective and valid but if any provision or term of this Agreement is held to be prohibited by

or invalid, then such provision or term will be ineffective only to the extent of such prohibition

or invalidity, without invalidating or affecting in any manner whatsoever the remainder of such

provision or term or the remaining provisions or terms of this Agreement. If any of the covenants

set forth in Section 4 of this Agreement are held to be unreasonable, arbitrary, or against public

policy, such covenants will be considered divisible with respect to scope, time and geographic

area, and in such lesser scope, time and geographic area, will be effective, binding and

enforceable against Seller.

11. COUNTERPARTS

This Agreement may be executed in one or more counterparts, each of which will

be deemed to be an original copy of this Agreement and all of which, when taken

together, will be deemed to constitute one and the same Agreement.

12. SECTION HEADINGS, CONSTRUCTION

The headings of Sections in this Agreement are provided for convenience only and will not

affect its construction or interpretation. All references to "Section" or "Sections" refer to the

corresponding Section or Sections of this Agreement unless otherwise specified. All words used

in this Agreement will be construed to be of such gender or number as the circumstances require.

Unless otherwise expressly provided, the word "including" does not limit the preceding words or

terms.

13. NOTICES

All notices, consents, waivers, and other communications under this Agreement

must be in writing and will be deemed to have been duly given when (a) delivered by hand (with

written confirmation of receipt, (b) sent by facsimile (with written confirmation of receipt),

provided that a copy is mailed by registered mail, return receipt requested, or (c) when received

by the addressee, if sent by a nationally recognized overnight delivery service (receipt

requested), in each case to the appropriate addresses and facsimile numbers set forth in the Stock

Purchase Agreement (or to such other addresses and facsimile numbers as a party may designate

by notice to the other parties):

14. ENTIRE AGREEMENT

This Agreement, the Employment Agreement between the parties, and the Stock

Purchase Agreement constitute the entire agreement between the parties with respect to the

subject matter of this Agreement and supersede all prior written and oral agreements and

understandings between Buyer and Seller with respect to the subject matter of this Agreement.

This Agreement may not be amended except by a written agreement executed by the party to be

charged with the amendment.

15. SPECIAL TERMINATION

In the event that the value of the Shares received by Sellers at the Closing and

any shares issuable pursuant to the _____________ Payments, in each case pursuant to

Section 2.2 of the Stock Purchase Agreement, is less than _________________ upon

termination of the Employment Agreement of any Seller, for any reason, then at such Seller's

option, the Buyer will release the Seller from all obligations under this Agreement upon the

tender by such Seller of all shares received by such Seller pursuant to Section 2.2 in the Stock

Purchase Agreement.

IN WITNESS WHEREOF, the parties have executed and delivered this Agreement as

of the date first written above.

BUYER:

GLOBAL ACCESS PAGERS,INC.

a Nevada corporation

By: /s/ CHARLES MCGUIRK ------------------------------------------

SELLERS:

/s/ DAVID J. CHADWICK ------------------------------------------

David J. Chadwick

/s/ JAMES ROTT ------------------------------------------

James Rott

/s/ PAUL HYDE

------------------------------------------

Paul Hyde

/s/ GARY KILLORAN ------------------------------------------

Gary Killoran