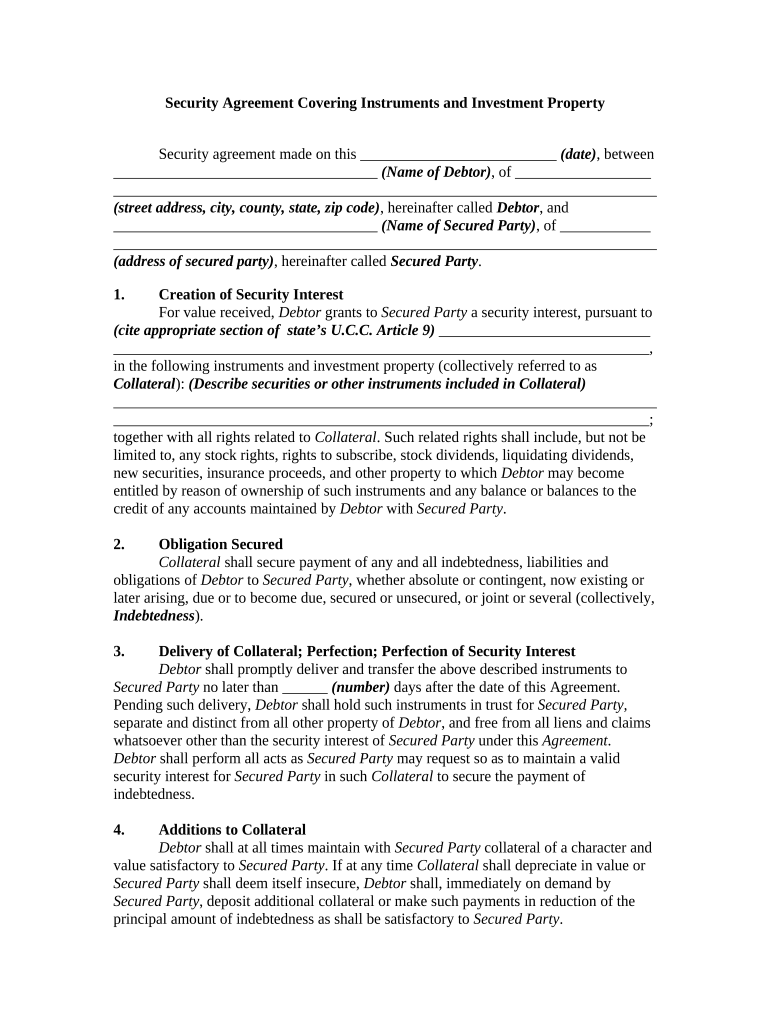

Security Agreement Covering Instruments and Investment Property

Security agreement made on this __________________________ (date) , between

___________________________________ (Name of Debtor) , of __________________

________________________________________________________________________

(street address, city, county, state, zip code) , hereinafter called Debtor , and

___________________________________ (Name of Secured Party) , of ____________

________________________________________________________________________

(address of secured party) , hereinafter called Secured Party .

1. Creation of Security Interest

For value received, Debtor grants to Secured Party a security interest, pursuant to

(cite appropriate section of state’s U.C.C. Article 9 ) ____________________________

_______________________________________________________________________ ,

in the following instruments and investment property (collectively referred to as

Collateral ): (Describe securities or other instruments included in Collateral)

________________________________________________________________________

_______________________________________________________________________;

together with all rights related to Collateral . Such related rights shall include, but not be

limited to, any stock rights, rights to subscribe, stock dividends, liquidating dividends,

new securities, insurance proceeds, and other property to which Debtor may become

entitled by reason of ownership of such instruments and any balance or balances to the

credit of any accounts maintained by Debtor with Secured Party .

2. Obligation Secured

Collateral shall secure payment of any and all indebtedness, liabilities and

obligations of Debtor to Secured Party , whether absolute or contingent, now existing or

later arising, due or to become due, secured or unsecured, or joint or several (collectively,

Indebtedness ).

3. Delivery of Collateral; Perfection; Perfection of Security Interest

Debtor shall promptly deliver and transfer the above described instruments to

Secured Party no later than ______ (number) days after the date of this Agreement.

Pending such delivery, Debtor shall hold such instruments in trust for Secured Party,

separate and distinct from all other property of Debtor , and free from all liens and claims

whatsoever other than the security interest of Secured Party under this Agreement .

Debtor shall perform all acts as Secured Party may request so as to maintain a valid

security interest for Secured Party in such Collateral to secure the payment of

indebtedness.

4. Additions to Collateral

Debtor shall at all times maintain with Secured Party collateral of a character and

value satisfactory to Secured Party . If at any time Collateral shall depreciate in value or

Secured Party shall deem itself insecure, Debtor shall, immediately on demand by

Secured Party , deposit additional collateral or make such payments in reduction of the

principal amount of indebtedness as shall be satisfactory to Secured Party .

5. Additions to Indebtedness

All costs and expenses, including reasonable attorney's fees, incurred or paid by

Secured Party in exercising or enforcing any right, power, or remedy conferred by this

Agreement shall become a part of Indebtedness and be secured by this Agreement.

6. Rights and Duties of Secured Party Respecting Collateral

Secured Party may collect the principal, interest or dividends on Collateral; keep

Collateral insured; and make any presentment, demand, notice of nonperformance, notice

of dishonor, or protest or notice of protest in connection with any of Collateral . Secured

Party shall be under no duty or obligation to do any of the above acts or to act in any

manner in the enforcement and collection of Collateral or the protection of Collateral ,

other than in the safekeeping of Collateral .

7. Assignment

Secured Party may assign or transfer the whole or any part of its security interest

under this Agreement and may transfer as collateral security the whole or any part of

Collateral. Any transferee of Collateral shall be vested with all the rights and powers of

Secured Party under this Agreement with respect to the Collateral so transferred;

subsequently, Secured Party shall be fully discharged from all liability and responsibility

with respect to the Collateral .

8. Protection of Collateral; Reimbursement of Secured Party

Debtor shall pay all taxes, charges and assessments against Collateral and do all

acts necessary to preserve and maintain the value and collectability of Collateral. On

failure of Debtor to do so, Secured Party may make such payments on account of the

same as in its discretion seem desirable; and Debtor shall reimburse Secured Party

immediately on demand for all such payments, as well as any sums expended by Secured

Party in enforcing, collecting and exercising its remedies respecting Collateral .

9. Default

The occurrence of any of the following events shall constitute a default under this

Agreement:

A. Failure by Debtor to honor or perform any of the terms and conditions of

this Agreement or of any agreement evidencing Indebtedness .

B. Default by Debtor in the payment when due of the principal of any of

Indebtedness , any installment of or any interest on such Indebtedness , whether at

maturity, by acceleration, or otherwise.

C. The death or dissolution of Debtor .

D. The insolvency of debtor, the making by Debtor of a general assignment

for the benefit of creditors, commencement by or against Debtor of any

proceeding of any nature under federal bankruptcy laws or under any state

insolvency statute, appointment of a receiver of or issuance of a writ or order of

attachment or garnishment against any of the property, assets, or income of

Debtor or any surety or guarantor of any of indebtedness.

E. Failure by Debtor to perform all acts necessary to preserve and maintain

the value and collectability of Collateral , including, but not limited to, the

payment of taxes and premiums on insurance on Collateral .

10. Remedies

On any default under this Agreement, at the option of Secured Party and without

demand or notice, all or any part of any of indebtedness shall immediately become due

and payable irrespective of any agreed maturity. On any such default, Secured Party shall

have all of the rights and remedies of a secured party under to (cite appropriate section

of state’s U.C.C. Article 9 )

___________________________________________________

_______________________________________________________________________ .

Without limiting any of the foregoing, Secured Party may sell, assign, transfer and

deliver the whole of Collateral, any part of Collateral, or any additions to or substitutes

for the same, in such order as Secured Party may elect any such sale, assignment, transfer

or delivery, may be by public or private sale, at such price or prices, and on such terms

and conditions as Secured Party in its sole and absolute discretion may determine. Any

sale of Collateral (being of a type customarily sold on a recognized market) may be

conducted without demand, advertisement or notice of any kind, all of which are waived

by Debtor. Secured Party may apply the remaining proceeds, after deducting all costs of

sale in payment or reduction of any of indebtedness in such order as Secured Party in its

discretion may determine. Debtor shall pay to Secured Party any deficiency remaining

after such application, and any excess proceeds of any such sale shall be paid over by

Secured Party to Debtor . At any public sale, Secured Party may, if it is the highest

bidder, purchase any or all of Collateral and may apply any unpaid indebtedness on

account of or in full satisfaction of the purchase price.

11. Waiver

Debtor waives any right that Debtor may have to require Secured Party to

proceed against any other person, to proceed against or exhaust Collateral or any part of

Collateral, or to pursue any other remedy that Secured Party may have. Debtor further

waives all defenses arising by reason of disability or cessation of liability of any other

person. Debtor consents to any and all extensions of time, renewals, waivers or

modifications of any of the terms and conditions of any of Indebtedness that may be

granted by Secured Party , to release Collateral or any part of Collateral with or without

substitution, and to the release, substitution or addition of any parties primarily or

secondarily liable on any of Indebtedness . Notice of any of the above is waived by

Debtor .

12. Joint and Several Liability

If this Agreement is executed by more than one party as Debtor , all references to

Debtor shall mean all or any one or more of them, and the obligations of Debtor under

this Agreement shall be joint and several.

13. Term of Agreement

This Agreement is a continuing agreement, and all rights, powers and remedies

under this Agreement shall apply to all past, present and future indebtedness of Debtor to

Secured Party, notwithstanding the death, dissolution, incapacity or insolvency of

Debtor, and shall continue in full force until all of Indebtedness shall have been paid in

full. The power of sale and other rights and remedies granted to Secured Party under this

Agreement may be exercised even though suit on indebtedness may be barred by any

applicable statute of limitations.

14. Effect of Execution by Secured Party

Execution of this Agreement by Secured Party shall not be construed as an

agreement or commitment on the part of Secured Party to make any advance or advances

to Debtor .

WITNESS our signatures as of the day and date first above stated.

_______________________________ _____________________________

DEBTOR SECURED PARTY

Valuable assistance on finalizing your ‘Security Property’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and small to medium-sized businesses. Wave farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign paperwork online. Take advantage of the comprehensive features packed into this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Security Property’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you require collaboration with your colleagues on your Security Property or need it for notarization—our platform provides you with everything necessary to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!