Valuation Verdicts

Summer 2003

Current Valuation & Taxation Rulings Regarding Divorce

Failure to Have Business

Valued Results in

Malpractice Suit

In Donna Sue Fischer Faris v. Thomas K. Stone, No. 2001-SC-0864-DG

(KY April 24, 2003), the Kentucky Supreme Court considered an attorney malpractice claim in connection with the failure to obtain a business valuation pursuant to a divorce. Stone, an attorney, represented Faris in her divorce. Faris’s former

husband held a 50 percent interest in six

closely held companies. During property

settlement negotiations, Faris’ former

husband represented that the businesses

had an aggregate value of $3,000. Faris

received one-half this value in the settlement of the divorce. Stone did not obtain

an independent valuation of the business

or inform Faris of her right to have the

business valued. Two years after the divorce was finalized, she learned that

Stone had been negligent in failing to

obtain the valuation. She brought suit

against the husband in a CR 60.02 motion

to reopen the divorce, but that motion was

denied. Thereafter, Faris brought this

malpractice claim against Stone.

Before the trial court, Stone argued

that the statute of limitations on Faris’

malpractice claim had run. Generally a

malpractice claim must be filed within

one year of the discovery of the claim.

She argued that the statute did not toll

until the CR 60.02 motion had been denied. The trial court agreed. A jury then

determined that Stone had committed

malpractice and that Faris would have

ALIMONY?

Published By:

LARSON

APPRAISAL

SERVICES

11445 E. Via Linda Ste. 2

Scottsdale, AZ 85259

For Professional

Appraisals of PrivatelyOwned Business

Interests contact:

James A. Larson,

Ph.D., ASA, CFA

(480) 657-6219

Jim@larsonappraisal.com

For an electronic copy

of our brochure,

visit us on the web at:

larsonappraisal.com

(Continued on page 3: Malpractice Suit ...)

In Jane Gilbert v. CIR, T.C.

Memo. 2003-92, the Tax Court considered whether unallocated support payments made under a separation agreement qualify as alimony for federal tax

purposes under section 71 and 215.

The plaintiff and her former husband

filed for separation in 1990 in Pennsylvania. In 1992, the Pennsylvania family court entered a support order. The

order required the husband to pay

$2,177 per month in unallocated

spousal and child support. The support

order was cancelled in 1995. In 1993,

1994, and 1995, the husband reported

all the payments as deductible alimony

on his federal tax returns. The plaintiff

did not include any amount received

under the support order as income in

her federal tax returns. The IRS took

inconsistent positions with regard to

the taxable nature of the payments to

the plaintiff and her former spouse.

The actions were consolidated and

heard by the Tax Court.

The Tax Court first noted that in

order for support payments to be

treated as alimony for federal tax purposes, the payments must meet the four

requirements of section 71. That section requires the payments to be (1)

received under a divorce or separation

agreement, (2) the agreement does not

designate the payment as not includible

in gross income under sec. 71 and not

deductible from income under sec. 215,

(Continued on page 3: Alimony ...)

In This Issue:

Failure to Have Business Valued

Results in Malpractice Suit ...........................................................1

Alimony?..............................................................................................1

Opinion Testimony did Not Establish Value —

Business Valuation Ordered .........................................................2

Prenuptial Agreement Set Aside when

Actual Value Not Disclosed .......................................................... 2

Without Expert Testimony, Law Firm Valued at Zero ................. 3

1

�Valuation Verdicts

Summer 2003

Opinion Testimony Did Not Establish Value—Business Valuation Ordered

In Tracy Kelly v. Kimberly Kelly,

2003-Ohio-612 (February 7, 2003), the

Ohio Court of Appeals considered the

valuation of a photography business.

The husband started the business before

the parties married. During the marriage, the business expanded into a significantly larger studio and purchased

additional equipment. The lower court

determined that the appreciation of the

business during the marriage was marital property subject to distribution in

divorce. However, neither party presented expert valuation testimony regarding the value of the business. Both

parties presented opinion evidence as to

the value of the business. The husband

testified that he did not know the value

of the business at the time of the marriage nor its current value, and he could

only speculate as to the value of the

business’s assets. It was further

shown that the parties’ living expenses (of approximately $30,000

annually) were paid by the business.

It was also shown that the business

had one ‘casual’ employee and performed contracts for high school

events. The wife was unable to place

a value on the business or its assets.

Based on this testimony, the lower

court valued the business at the time

of the marriage at $1,000 and at the

time of the divorce at $3,400. It then

awarded the wife one-half the appreciation. She appealed.

On appeal, the wife argued that

the lower court abused its discretion

in undervaluing the business. The

appellate court agreed. It noted,

“Each [of the parties] was competent

to give opinions concerning the value

of the business, but neither did. Kimberly was unaware of its value. …

Tracy’s testimony concerning the

value of his business was so evasive

as to be less than credible.” Thus, the

appellate court concluded that the

lower court erred in assigning a value

to the business based on that testimony. It then reversed the lower

court’s valuation. In doing so, it

stated, “On this record, the [lower]

court could perform its statutory

charge to divide marital assets equally

only by appointing a qualified, independent appraiser to provide the court

a report on which it could rely. The

appraiser’s fee may be taxed as costs

to the parties.” Thus, it remanded the

valuation back to the lower court with

instructions to hire an independent

appraiser to value the business.

Prenuptial Agreement Set Aside when Actual Value Not Disclosed

In William P. Postiy v. Cynthia

L. Postiy, 2003-Ohio-2146 (April 28,

2003), the Ohio Court of Appeals,

Fifth District considered whether a

prenuptial agreement should be enforced. The parties married in 1982.

At that time, the husband held a 70

percent interest in a meat processing

business. The business was insured

for $700,000. For the purposes of

disclosing the value of his interest in

the prenuptial agreement, the husband

reported 70 percent of the insurance

value. The business was sold in 1999

and the husband received $670,000

for his interest. The parties filed for

divorce in 2001.

Before the trial court, the wife

argued that the prenuptial agreement

should be set aside. She claimed that

the value of the business interest re-

ported in the prenuptial agreement

was not its actual value. She did not

present any expert valuation testimony in connection with this claim.

However, the husband admitted that

the business could have been insured

for $1 million, but the $700,000

value was used because he did not

want pay for the extra insurance.

Based on the undervaluation of the

husband’s business interest and the

failure to report other assets, the prenuptial agreement was set aside. The

husband appealed.

On appeal, the husband argued

that the lower court erred in setting

aside the prenuptial agreement because “assets disclosed by the appellant in connection with the agreement were not listed at their actual

value, when there was no evidence

in the record that the actual value of

the assets was substantially different

from either the value stated by the

appellant in connection with the antenuptial agreement or from the

knowledge and understanding that the

appellee had of the appellant’s financial circumstances.” The appellate

court noted that a prenuptial agreement may be set aside when there

was not “full disclosure, or full

knowledge and understanding of the

nature, value and extent of the prospective spouse’s property.” Here, the

appellate court affirmed the lower

court’s decision to set aside the prenuptial agreement because the husband admitted to undervaluing the

business interest in addition to omitting certain other assets.

The brief summaries in this publication discuss only some valuation aspects of the subject cases and pronouncements.

The reader is referred to the actual documents for additional details. This publication does not constitute legal, tax,

accounting, or valuation advice, and it is offered as an informational service only. Those seeking specific advice should

contact a professional advisor. No liability whatsoever is assumed in connection with use of this newsletter.

2

�Valuation Verdicts

Summer 2003

Without Expert Testimony, Law Firm Valued at Zero

In Robert L. Schwartz v. Pamela

J. Schwartz, No. 231266 (Mich. App.

March 20, 2003), unpublished, the

Michigan Court of Appeals considered the value of a capital account in a

law practice. The husband was an attorney in a highly specialized area of

law. He held an ownership interest in

the firm. He estimated that his capital

contribution had a value of between

$35,000 and $36,000. However, he

further testified that the firm was not

marketable to other attorneys because

of its highly specialized niche, he had

problems finding help, and it was

highly dependent upon his skills.

Neither party presented expert testimony regarding the value of husband’s investment in the law firm.

Based on the evidence before it, the

lower court determined that “there

was no ascertainable marketable

value to plaintiff’s capital contribution account.” The wife appealed.

On appeal, the wife argued that

the lower court erred in failing to

compensate her for the value of the

husband’s investment in the law

firm. The appellate court disagreed.

It noted, “A party seeking to include

(Malpractice Suit ... Continued from page 1)

(Alimony … Continued from page 1)

received $162,100 as her share of the

businesses if the divorce had been handled properly. Stone appealed.

On appeal, the court of appeals

reversed the lower court’s decision. It

found that the statute of limitations

began to run on the date the malpractice was discovered. Faris appealed.

The Supreme Court affirmed the

court of appeals decision to reverse the

lower court. It found that a CR 60.02

motion is an extraordinary procedure

outside the appellate vehicle. The Supreme Court stated, “It is separate and

distinct from the main case, and a party

may not use it as a means to extend a

statutory period.” Thus, the Supreme

Court concluded, “the latter of the date

of occurrence or the date of discovery

of the negligence commences the oneyear statute of limitations.” It noted

that because Faris was unaware of the

malpractice on the date of occurrence,

the time when the underlying divorce

became final, the one-year period commenced when she learned of the malpractice.

(3) the payor and the payee must not

be members of the same household at

the time the payments are made, and

(4) there must be no liability for the

payor to continue to make the payment after the death of the payee. The

parties stipulated that the payments

met the first three requirements, but

disagreed over the fourth.

The Tax Court noted that

whether unallocated support payments continue after the death of the

payee spouse is a question of state

law. It noted that the separation

agreement was silent regarding the

status of the payments after the

payee’s death. It further noted that the

Pennsylvania Supreme Court had not

addressed this narrow issue. It then

found that Pennsylvania law in effect

at the time the tax returns were filed

was ambiguous on this issue. It noted

that while under the law alimony payments would terminate upon the

death of the payee, the family court

would retain jurisdiction over child

an asset in the marital estate has the

burden of proving the reasonable,

ascertainable value of that asset.”

The appellate court further noted,

“The evidence showed that plaintiff

could not sell the shares he held in his

firm. Moreover, plaintiff’s practice

depended principally on his own personal skills and expertise and was not

marketable to other attorneys.” Thus,

it affirmed the lower court’s determination that the husband’s investment

in the law firm had no readily ascertainable market value.

support payments. Therefore, it reasoned that the unallocated support

payments may continue beyond the

death of the payee spouse. It stated,

“Consequently, we have no reason to

conclude that … [the former husband’s] obligation to make unallocated

support payments under the … separation instrument terminates upon the

death of Ms. Gilbert.” Therefore, it

ruled that the fourth prong of the alimony test had not been satisfied, the

support payments were not taxable

alimony, and were properly excluded

from the plaintiff’s income.

“Valuation Verdicts” is a publication of Larson Appraisal Services (LAS). LAS provides a wide range of business and

financial services including the valuation of businesses, business ownership interests, intangible assets, and financial

litigation support. This work has been performed for a variety of businesses and for various purposes including divorce. The

principal, Jim Larson, has been involved in preparation and defense of those valuations since 1993. For further information

on Larson Appraisal Services please call 480-657-6219 or access the electronic brochure on the web at:

http://LarsonAppraisal.com.

3

�

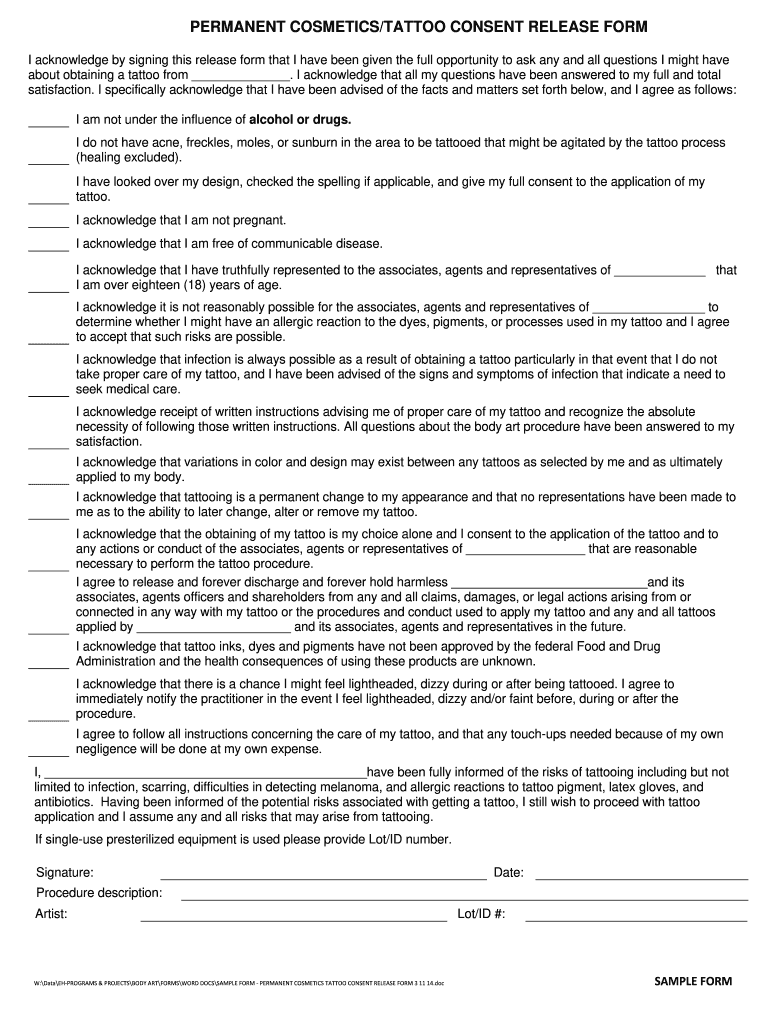

Practical advice on preparing your ‘Tattoo Consent Release Form’ online

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Bid farewell to the laborious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features bundled within this user-friendly and cost-effective platform and transform your approach to paperwork handling. Whether you need to approve forms or collect eSignatures, airSlate SignNow manages it all smoothly, needing only a few clicks.

Follow this step-by-step tutorial:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Edit your ‘Tattoo Consent Release Form’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for additional users (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Tattoo Consent Release Form or send it for notarization—our platform provides all you need to accomplish these tasks. Register with airSlate SignNow today and elevate your document management to a new level!