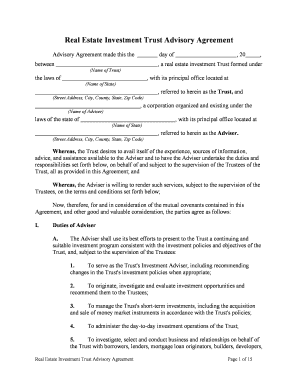

Real Estate Investment Trust Advisory Agreement Page 1 of 15 Real Estate Investment Trust Advisory Agreement Advisory Agreement made this the day of , 20 , between , a real estate investment Trust formed under (Name of Trust) the laws of , with its principal office located at (Name of State) , referred to herein as the Trust, and (Street Address, City, County, State, Zip Code) , a corporation organized and existing under the (Name of Adviser) laws of the state of , with its principal office located at (Name of State) , referred to herein as the Adviser. (Street Address, City, County, State, Zip Code) Whereas, the Trust desires to avail itself of the experience, sources of information,

advice, and assistance available to the Adviser and to have the Adviser undertake the duties and

responsibilities set forth below, on behalf of and subject to the supervision of the Trustees of the

Trust, all as provided in this Agreement; and Whereas, the Adviser is willing to render such services, subject to the supervision of the

Trustees, on the terms and conditions set forth below;Now, therefore, for and in consideration of the mutual covenants contained in this

Agreement, and other good and valuable consideration, the parties agree as follows: I.Duties of AdviserA. The Adviser shall use its best efforts to present to the Trust a continuing and

suitable investment program consistent with the investment policies and objectives of the

Trust, and, subject to the supervision of the Trustees:1.To serve as the Trust's Investment Adviser, including recommending

changes in the Trust's investment policies when appropriate;2.To originate, investigate and evaluate investment opportunities and

recommend them to the Trustees;3.To manage the Trust's short-term investments, including the acquisition

and sale of money market instruments in accordance with the Trust's policies; 4.To administer the day-to-day investment operations of the Trust;5.To investigate, select and conduct business and relationships on behalf of

the Trust with borrowers, lenders, mortgage loan originators, builders, developers,

Real Estate Investment Trust Advisory Agreement Page 2 of 15and other individuals, corporations and entities in furtherance of the investment

activities of the Trust;6.To invest and reinvest any money of the Trust;7.To obtain for the Trust such services as may be required for property

management and other activities relating to the investment portfolio of the Trust; 8. To advise the Trust in connection with negotiations with investment

banking firms, securities brokers or dealers or securities investors in connection

with the public or private sale of securities of the Trust;9.To provide personnel, office space and office equipment, or the use of the above, necessary or advisable to carry out its function as the Adviser to the Trust;

and 10.To make reports to the Trustees from time to time of its performance of

the above-mentioned services.B.Recommendations from the Adviser as to investments by the Trust will be

generated through the Adviser's mortgage loan department. In recommending

investments or participations in them to the Trust, the management of the Adviser will

select from the available investment opportunities those that it believes consistent with

the Trust's investment objectives. These investments will be generally representative of

comparable investments of similar quality being made by the Adviser for its own

account. Neither the Adviser nor any of its affiliates shall have any obligation to present

to the Trust any particular investment opportunity that comes to the Adviser or such

affiliate, even if the opportunity is such that, if presented to the Trust, it could be taken by

the Trust.C. Nothing contained in this Agreement shall prevent the Adviser from engaging in

other businesses or from acting as an adviser to or as an investment manager for any

other person even though the Adviser has or may have investment policies similar to the

Trust or interests in any particular investment that are or may be adverse to the interest of

the Trust in the same or any related investment. The Adviser shall be free from any

obligation to present to the Trust any particular investment opportunity that comes to the

Adviser, regardless of whether the opportunity is within the Trust's investment policies,

provided, however, that the Adviser shall act on a basis that is fair and reasonable to the

Trust and its shareholders in selecting from among the particular investment

opportunities that come to the Adviser that it presents to the Trust.D. Adviser shall from time to time furnish the Trust with information, on a

confidential basis, of any investment opportunity within the Trust's investment policies

that the Adviser subsequently decides to accept for its own account and, to the extent that

the Adviser deems it consistent with its obligations and legally permissible (if requested

by the Trust not later than the date of the second meeting of the Investment Committee of

Real Estate Investment Trust Advisory Agreement Page 3 of 15the Trust that next follows the date on which the Adviser informs the Trust of such

investment opportunity and of the Adviser's decision to accept such investment

opportunity for its own account), shall grant to the Trust a participation of equal terms in

such investment opportunity to the extent of % of the aggregate amount

invested in it by the Trust and the Adviser. By mutual agreement of the Trust and the

Adviser, the Trust's participation in such an investment may be greater than %.

On the request of the Trust, the Adviser shall permit the Trustees to review other

investment opportunities within the Trust's investment policy that are presented to the

Adviser's Finance Committee for investment by the Adviser for its own account, but not

approved by such Committee and, at the request of the Trust, shall use its best efforts to

make available any of such opportunities to the Trust for investment.

II.Servicing Functions. Adviser agrees by this Agreement to provide the requisite

servicing of the Trust's mortgage loans and real property investments. These servicing functions

may be performed directly by the Adviser or by others, but the Adviser shall, in any event, be

responsible for the supervision of such servicing performed by others. The servicing functions

shall include the review of appraisal reports and title opinions or reports from independent

counsel for the Trust, the collection of all payments when due, the supervision of the payment of

taxes, special assessments, fire and other insurance premiums, and any other required payments,

to the extent of funds collected, and the remission to the Trust of the balance. In the event of a

default on an investment, the Adviser shall advise the Trust and supervise foreclosure or other

remedies on the direction of the Trustees.III.Compliance with REIT Qualifications and Declaration of Trust. Anything else in this

Agreement to the contrary notwithstanding, the Adviser shall refrain from any action that, in its

sole judgment made in good faith, or in the judgment of the Trustees (of which the Adviser has

notice): (a) would adversely affect the status of the Trust as a real estate investment trust, as

defined and limited in the Internal Revenue Code of 1986, as amended (26 U.S.C.A. §§ 856 to

859), and the regulations promulgated under the Code; or (b) would violate any law, rule or

regulation of any governmental body or agency having jurisdiction over the Trust or would

otherwise not be permitted by the Declaration of Trust.IV.Records. The Adviser shall maintain appropriate books of account and records relating to

services performed under this Agreement, which books of account and records shall be

accessible for inspections by the Trust at any time during ordinary business hours.V.Bank Accounts. The Adviser may establish and maintain one or more bank accounts in

its own name, and may collect and deposit into any such account or accounts, and disburse from

any such account or accounts, any money on behalf of the Trust, under such terms and conditions

as the Trustees may approve, and the Adviser shall from time to time render appropriate

accounting of such collections and payments to the Trustees and to the auditors of the Trust.VI.Bond. The Adviser shall maintain such fidelity bond with a responsible surety company

and in such amount (not less than $ per person) as may be required by the Trust

from time to time, covering all officers and employees of the Adviser handling funds of the Trust

and any investment documents or papers. This bond shall inure to the benefit of the Trust in

Real Estate Investment Trust Advisory Agreement Page 4 of 15respect of losses of any such property from acts of such officers and employees through theft,

embezzlement, fraud, negligence in act, error or omission, or otherwise. The premium for this

bond shall be at the expense of the Trust.VII. Information Furnished Adviser. The Trustees shall at all times keep the Adviser fully

informed with regard to the investment policy of the Trust, the capitalization policy of the Trust,

and generally their then current intentions as to the future of the Trust. In particular, the Trustees

shall notify the Adviser promptly of their intention to sell or otherwise dispose of any of the

Trust's investments, or to make any new investment. The Trust shall furnish the Adviser with a

copy of all financial statements, a signed copy of each report or opinion prepared by independent

public accountants, and such other information with regard to its affairs as the Adviser may from

time to time reasonably request.VIII. Trustees, Officers and Employees of the Adviser. Trustees, officers and employees of

the Adviser or of affiliates of the Adviser may serve as Trustees, officers, agents, nominees or

signatories for the Trust. When executing documents or otherwise acting in such capacities for

the Trust, such persons shall use their respective titles in the Trust. Such persons who are officers

or employees of the Adviser shall not receive compensation from the Trust for their services to

the Trust in any such capacities.IX.Definitions. As used in this Agreement, the following terms have the meanings set forth

below:A.Advisory compensation shall mean for a calendar year an amount determined by

multiplying the shareholder benefit index for such calendar year by the advisory

compensation for the immediately preceding calendar year and shall mean for a part of a

calendar year an amount determined by multiplying the shareholder benefit index for

such part of a calendar year by that portion of the advisory compensation for the

immediately preceding entire calendar year which such part of a calendar year bears to a

whole calendar year. Solely for the purposes of this computation, advisory compensation

for the calendar year ended December 31, , shall be deemed to be (Year) $ .B.Book value of an asset or assets shall mean the value of such asset or assets on

the books of the Trust, reduced by provision for amortization, depreciation or depletion

but before deducting any indebtedness or other liability in respect of the asset or assets.

Depreciable assets shall be included at the lesser of fair market value (in the judgment of

the Trustees) or cost less depreciation. Depreciation shall be computed on a straight-line

basis.C. Declaration of Trust shall mean the Trust's Declaration of Trust dated , (Date) as amended and restated , and as subsequently amended from time to (Date) time.

Real Estate Investment Trust Advisory Agreement Page 5 of 15D.Development loans shall mean mortgage loans made to finance the development

of land into a site or sites suitable for the construction of improvements on them or

suitable for other residential, recreational, commercial, industrial or public uses, and may

include the financing of all or part of the cost of the acquisition of such land or leasehold

interests in them.E.Invested assets shall mean the Trust's total assets (without deduction of any

liabilities), but excluding good will and other intangible assets, cash, cash items, and

obligations of municipal, state and federal governments and governmental agencies. As

so defined, the term shall not include the undisbursed commitments of the Trust in

respect of closed loans or investments. Invested assets shall include obligations secured by a lien on real property owned, or to be acquired, by such governments or

governmental agencies and securities of the Federal Housing Administration, the Federal

National Mortgage Administration, and other governmental agencies issuing securities

backed by a pool of mortgages. F.Long-term and net lease investments shall mean mortgage loans (other than

development loans) with an initial term of more than years and real (Number) property that is under lease to one tenant who is required to pay directly all of the

property taxes, costs and expenses of maintaining the property and who pays rent to the

Trust net of all such taxes, costs and expenses. G.Month-end average invested assets of the Trust for a calendar year shall mean

the average of the amounts reflected in the computations at the end of each month during

such calendar year of invested assets.H. Month-end average net invested assets of the Trust for a calendar year shall

mean the month-end average invested assets of the Trust for such calendar year, minus

the arithmetic average of the liabilities of the Trust at the end of each month during such

calendar year.I.Mortgage loans shall mean notes, debentures, bonds and other evidences of

indebtedness or obligations, that are negotiable or nonnegotiable and that are secured or

collateralized by mortgages, deeds of Trust or other security interests in real property.J.Net income for a calendar year shall mean the net income of the Trust for such

calendar year computed on the basis of its results of operations for such year, plus the amount of any deductions for compensation paid to the Adviser under Sections X, XI

and XII of this Agreement that were deducted in determining such net income, and

excluding extraordinary items and gains and losses from the disposition of assets, all as

certified by the Trust's independent public accountants.K. Operating expenses shall mean for any calendar year the aggregate annual

operating expenses of every character, other than the expenses set forth in Paragraphs A

through N, inclusive, of Section XV of this Agreement, and any other expenses properly

Real Estate Investment Trust Advisory Agreement Page 6 of 15regarded as relating to the maintenance of the Trust.L.Other investments shall mean mortgage loans and real property investments

other than long-term and net lease investments.M.Person shall mean and include individuals, corporations, limited partnerships,

general partnerships, joint stock companies, joint ventures, associations, companies,

trusts, banks, federal savings banks, trust companies, land trusts, business trusts, or other

organizations, whether or not legal entities, and governments and agencies and political

subdivisions of governments.N.Real property shall mean land, ownership or other rights or interests in land

(including leasehold interests as lessee or lessor), and any buildings, structures,

improvements and fixtures located on or used in connection with land and rights in land,

or interests in land, but does not include mortgage loans or interests in mortgage loans.O.Shareholder benefit shall mean the Trust's fully diluted earnings per share

determined in the manner set forth in Opinion No. 15 issued by the Accounting Principles

Board of the American Institute of Certified Public Accountants based on an accrual

method of accounting in accordance with generally accepted accounting principles

consistently applied, adjusted: (i) by the addition of any depreciation and any increase in

the allowance for possible loan losses (however denominated) that were deducted in

determining such earnings per share; and (ii) by the subtraction of a fully diluted per

share basis of any losses (except any losses caused by an act or acts of God) experienced

by and recorded on the books of the Trust. Notwithstanding the above, shareholder

benefit shall not include any amount that would result in the Adviser's receiving any

compensation under this Agreement the receipt of which under any applicable law would

be prohibited or would render this Agreement unenforceable.P.Shareholder benefit index shall mean for a calendar year the quotient obtained

by dividing the amount of shareholder benefit for such calendar year by the amount of

shareholder benefit for the immediately preceding calendar year, and shall mean for a

part of a calendar year the quotient obtained by dividing the amount of shareholder

benefit for such part of a calendar year by that portion of the shareholder benefit for the

immediately preceding entire calendar year that such part of a calendar year bears to a

whole calendar year. X. Compensation for Advisory Functions. The Trust shall pay to the Adviser as

compensation for all services rendered to the Trust under this Agreement (except for

generating and servicing investments for which compensation is to be paid under

Sections XI and XII) for each calendar year advisory compensation as determined under

Section IX, Paragraph A. Within business days after the end of each (Number) month of a calendar year, the Trust shall pay to the Adviser an amount equal to the

difference between the advisory compensation for such calendar year to the end of such

month and the aggregate amount of payments under this section previously made by the

Real Estate Investment Trust Advisory Agreement Page 7 of 15Trust to and not refunded by the Adviser for such calendar year. If at the end of any

quarter of a calendar year the aggregate amount of payments under this section for such calendar year made by the Trust to and not refunded by the Adviser exceeds the advisory

compensation payable under this Agreement for such calendar year to the end of such

quarter, the excess shall be refunded by the Adviser to the Trust within (Number) business days of the date that the Adviser is notified by the Trust of the overpayment. All

of the above-mentioned payments may be based on unaudited financial statements. The

amount of advisory compensation payable under this Agreement for any calendar year

shall be finally determined after the close of the calendar year by independent

accountants satisfactory to the Trust and the Adviser based on audited financial

statements. Any payment by the Trust or repayment by the Adviser which shall be

indicated to be necessary in accordance with this Agreement shall be made promptly after

the completion of the audit.XI. Compensation for Investment Generation FunctionsA. The Trust shall pay to the Adviser as compensation for investment generation

functions, described in Section I of this Agreement, a fee as to any one investment

approved by the investment committee of the Trust or the Trustees during the term of this

Agreement based on the principal amount (which includes, in the case of real property,

the principal amount of any mortgage loan on such property) of such investment, which

fee shall be in the amount of % of the first $ of such investment

and % of the amount, if any, in excess of $ . For the purposes

of this Paragraph A, in the case of an investment that the Trust shares with the Adviser,

the aggregate amount of the investments made by all such persons shall be used to

determine the amount of the Adviser's fee, but the Adviser shall be entitled to a fee under

this Agreement only in regard to the Trust's portion of an investment. Notwithstanding

the preceding provisions of this Paragraph, for any loan as to which at the time the Trust

is first committed to make the loan the borrower has a firm commitment from any person

(including the Trust, or the Adviser) to make a loan to, or purchase the property from, the

borrower, on or before the maturity of the Trust's loan so that the proceeds of such loan

or purchase are to be used to repay the Trust's loan, the fee to which the Adviser is

entitled shall be one-half of the fee as determined above.

B. The above-described fee shall be paid to the Adviser when the principal amount

of the investment is disbursed by the Trust. However, if the principal amount of an

investment is disbursed by the Trust in more than one installment, the Trust shall pay to

the Adviser each time the Trust makes a disbursement of the principal amount of the

investment the appropriate percentage, as provided in Paragraph A of this Section XI,

of the amount of principal then disbursed.C. The Trust and the Adviser shall share equally in any fees received by the Trust

from and not refunded to an actual or prospective borrower or seller in regard to any

investment opportunity originated by the Adviser pursuant to this Agreement as to which

the Trust has a right to retain such fees because all or part of the funds committed by the

Real Estate Investment Trust Advisory Agreement Page 8 of 15Trust were not disbursed to such a borrower or seller. The Trust shall deliver to the

Adviser its share of such fees immediately on termination of the Trust's obligation to

refund the fees to such a borrower or seller.XII.Compensation for Servicing Functions A. On the last business day of each calendar month, the Trust shall pay to the

Adviser, as compensation for any servicing functions described in Section II of this

Agreement that the Adviser has performed or undertaken to perform, a fee based on the

book value of all mortgage loans and real property assets of the Trust, in each case as at

the beginning of the month, in respect of which the Adviser has performed or undertaken

to perform such services. The fee shall be equal to one-twelfth of the sum of the amounts

obtained by multiplying the total amount of each investment by the appropriate

percentage as set forth below:1. Long-term and net lease investments: %2. Other investments: % B. For the purpose of this Section XII, in the case of a long-term and net lease

investment that the Trust shares with the Adviser, the aggregate amount of the

investments made by all such persons shall be used to determine the amount of the

compensation payable to the Adviser, but the Adviser shall be entitled to compensation

under this Agreement only in regard to the Trust's portion of an investment. No servicing

compensation shall be payable to the Adviser under this section with respect to any

mortgage loan or real property investment as to which the Trust is paying servicing

compensation to any other person.XIII. Compensation for Additional Services. As and to the extent that the Adviser shall

render any services for the Trust other than those required to be rendered by the Adviser pursuant

to the provisions of this Agreement, such additional services and activities will be compensated

for separately on terms to be agreed on between such party and the Trust from time to time.XIV.Expenses of the Adviser. Without regard to the amount of compensation received under

this Agreement by the Adviser, the Adviser shall bear the following expenses:A. Employment expenses of the personnel employed by the Adviser (other than fees

paid to the Trustees, officers and employees of the Trust who are not officers or

employees of the Adviser, and reimbursement of expenses made to the Trustees, officers

and employees of the Trust, and fees and reimbursements of expenses made to

independent Advisers, independent contractors, mortgage servicers, consultants, managers and other agents employed by or on behalf of the Trust), including, but not

limited to, salaries, wages, payroll taxes, and the cost of employee benefit plans and

temporary help expenses;B. Expenses of servicing investments serviced by the Adviser;

Real Estate Investment Trust Advisory Agreement Page 9 of 15C. Advertising expenses incurred in seeking investments for the Trust;D. Rent, telephone, utilities, office furniture, equipment and machinery (including

computers, to the extent used, and fax equipment), and other office expenses of the

Adviser and the Trust, except as any of such expenses relate to an office maintained by

the Trust separate from the office of the Adviser; andE. Miscellaneous administrative expenses relating to performance by the Adviser of

its functions under this Agreement.XV.Expenses of the Trust. Except as expressly otherwise provided in this Agreement, the

Trust shall pay all its expenses not assumed by the Adviser, and without limiting the generality

of the above, it is specifically agreed that the following expenses of the Trust shall be paid by the

Trust and shall not be paid by the Adviser:A. The cost of borrowed money;B. Taxes on income, taxes and assessments on real property and other taxes

applicable to the Trust;C. Legal, auditing, accounting, underwriting, brokerage, listing, registration

(including all Blue Sky applications) and other fees, the printing, engraving and other

expenses and taxes incurred in connection with the issuance, distribution, transfer,

registration and stock exchange listing of the securities of the Trust;D. Expenses connected with the acquisition, disposition and ownership of real

property, mortgage loans or other property (including the cost of foreclosures, insurance

premiums, legal services, architectural and engineering fees, mortgage taxes, appraisal

and inspection fees, title and abstract expenses, brokerage, sale and leasing commissions,

maintenance, repairs and improvements of property);E. Fees and expenses paid to independent contractors, consultants, managers and

other independent agents employed directly by the Trust in connection with the

acquisition, operation, maintenance, protection and disposition of Trust properties (other

than mortgage and property servicing), including but not limited to salaries, wages,

payroll taxes and cost of employee benefit plans and temporary help expenses;F. Expenses of maintaining and managing real property interests or other investment

assets owned by the Trust;G. Insurance as required by the Trust, other than the cost of Trustees', shareholders'

and Advisers' liability insurance;H. Expenses of organizing or terminating the Trust;I. Expenses connected with payments of dividends or interest or distributions in

Real Estate Investment Trust Advisory Agreement Page 10 of 15cash or any other form made by the Trust to holders of securities of the Trust;J. All expenses connected with communications to holders of securities of the Trust

and the other bookkeeping and clerical work necessary in maintaining relations with

holders of securities, including the cost of printing and mailing certificates for securities

and proxy solicitation materials and reports to such holders and the cost of holding

meetings of holders of the Trust's securities;K. Transfer agents', registrars', authenticating agents', paying agents' and indenture

Trustees' fees and charges;L. Losses and provisions for losses on disposition of assets;M. All provisions for depletion, depreciation and amortization;N. The cost of the fidelity bond or bonds obtained by the Adviser as required by this

Agreement;O. The fees and expenses paid to Trustees, and appraisers, contractors, consultants,

managers, officers, employees and others employed by or on behalf of the Trust;P. To the extent not paid by borrowers from the Trust, loan administration and

mortgage and property servicing fees;Q. The cost of Trustees', shareholders' and Advisers' liability insurance;R. The expenses of revising, amending, converting or modifying the Trust;S. Legal, accounting and auditing fees;T. The cost of any accounting, statistical or bookkeeping equipment necessary for

the maintenance of the books and records of the Trust; andU. Rent, telephone, utilities, office furniture, equipment and machinery (including

computers, to the extent used, and fax equipment), and other office expenses of the Trust,

except as any of such expenses relate to an office maintained by the Trust together with

the office maintained by the Adviser.XVI.Refund by Adviser. Within days after the end of each calendar (Number) year the Adviser will refund to the Trust the amount, if any, by which the operating expenses of

the Trust during such calendar year exceeded the lesser of:A. % of the Trust's month-end average invested assets for such calendar

year (or a proportionately lesser percentage with respect to a calendar year of less than 12

months); or

Real Estate Investment Trust Advisory Agreement Page 11 of 15B.The greater of:1. % of the month-end average net invested assets of the Trust for

such calendar year (or a proportionately lesser percentage with respect to a

calendar year of less than 12 months); or

2. % of the net income of the Trust for such calendar year. The

Adviser shall not be obligated, however, to refund an amount that exceeds the

aggregate of the compensation payable to it under Sections X, XI and XII for

such calendar year.

XVII.Origination and Brokerage Fees. Any remuneration or brokerage fees received and

retained by the Adviser for services rendered in connection with the origination of a mortgage

loan or real property investment acquired by the Trust shall be credited against compensation

payable to the Adviser by the Trust pursuant to Section XI of this Agreement.XVIII.Designation of Trustees. During the term of this Agreement, the Trustees shall use their

best efforts to cause the nomination of persons designated by the Adviser (but not more than

49% of the number of Trustees) to act as Trustees.XIX. Adviser’s Participation in Investments.A. Adviser agrees that:1. During continuation of this Agreement and subject to legal investment

requirements applicable to it, the Adviser will, if requested by the Trust: a.Participate on equal terms with the Trust in any investment

recommended to the Trust by the Adviser to the extent of % of

the aggregate amount invested in it by the Trust and the Adviser, provided

that such request by the Trust is made within days after the

(Number) Trust acts on such recommendation; and b.Retain a participation of at least % in any mortgage loan

(other than a federally insured or guaranteed mortgage loan) sold to the Trust by the Adviser; and

2. If the Trust makes an investment, as a consequence of a recommendation

made by the Adviser, in connection with which the Adviser is engaged to perform

any service for a fee (other than services performed pursuant to this Agreement),

the Adviser shall, or shall cause any other person to, acquire, on the same terms as

the Trust, an interest in the investment at least as large as the Trust's interest.B. The simultaneous acquisition by the Trust and the Adviser of participations in a

loan or other investment shall not be deemed to constitute a purchase or a sale of property

Real Estate Investment Trust Advisory Agreement Page 12 of 15by one of them to the other, provided that the terms, other than the size of the

participation, are not less favorable to the Trust than to such other person.XX.Servicing of Investments on Termination of Agreement. If this Agreement shall

terminate for any reason, all investments of the Trust in which the Adviser had purchased or

committed to purchase a participation shall, for so long as the Adviser's investment in the same

remains unpaid, continue to be served by the Adviser or its designee on the same terms that

existed prior to the termination of this Agreement.XXI. Term; Termination of Agreement A. This Agreement shall continue in force for a period of one year from this date,

and it may be extended from year to year by the affirmative vote of a majority of

Trustees. Notice of renewal shall be given in writing by the Trust to the Adviser not less

than months before the expiration of this Agreement or of any extension (Number) of it.B. Notwithstanding any other provision to the contrary, this Agreement may be

terminated for any reason on days' written notice by the Adviser or on like (Number) notice by the Trust, on vote of a majority of the Trustees, or on vote of the holders of a

majority of the outstanding shares of the Trust. C. This Agreement shall not be assignable by the Adviser without the consent of the

Trust, or by the Trust without the consent of the Adviser, except in the case of assignment

by the Trust to a corporation, trust or other organization that is a successor to the Trust.

Such successor shall be bound under this Agreement and by the terms of the assignment

in the same manner as the Trust is bound under this Agreement.D. At the option solely of the Trustees, this Agreement shall be and become

terminated immediately on written notice of termination from the Trustees to the Adviser

if any of the following events shall occur: 1. If the Adviser shall violate any provision of this Agreement, and after

notice of the violation shall not cure the violation within days; (Number) 2. If the Adviser shall be adjudged bankrupt or insolvent by a court of

competent jurisdiction, or an order made by a court of competent jurisdiction for

the appointment of a receiver, liquidator or Trustee of the Adviser, or of all or

substantially all of its property by reason of the above, or approving any petition

filed against the Adviser for its reorganization, and such adjudication or order

shall remain in force or unstayed for a period of days; or (Number) 3. If the Adviser shall institute proceedings for voluntary bankruptcy or shall

file a petition seeking reorganization under the federal bankruptcy laws, or for

Real Estate Investment Trust Advisory Agreement Page 13 of 15relief under any law for the relief of debtors, or shall consent to the appointment

of a receiver of itself or of all or substantially all of its property, or shall make a

general assignment for the benefit of its creditors, or shall admit in writing its

inability to pay its debts generally, as they become due. 4. Adviser agrees that if any of the events specified in Subparagraphs 2 and

3 of this Paragraph D shall occur, it will give written notice of the fact to the

Trustees within days after the occurrence of such event. (Number) E. From and after the effective date of termination of this Agreement pursuant to

Paragraphs A, B, C and D of this Section XXI, the Adviser shall not (subject to Section

XIII of this Agreement) be entitled to compensation for further services under this

Agreement, but shall be paid all compensation accruing to the date of termination. The

Adviser shall be entitled to compensation under Section XI of this Agreement for any

investment approved by the Investment Committee of the Trust or the Trustees prior to

such termination without regard to whether any portion of the principal amount of such investment was disbursed prior to the termination. On such termination the Adviser shall:1. Pay over to the Trust all moneys collected and held for the account of the

Trust pursuant to this Agreement, after deducting any compensation then payable

and reimbursement for its expenses to which it is then entitled;2. As soon as possible deliver to the Trustees a full accounting, including a

statement showing all payments collected by it and a statement of all moneys held

by it, covering the period following the date of the last accounting furnished to the

Trustees; and3. Deliver to the Trustees all property and documents of the Trust then in the

custody of the Adviser.F. On termination of this Agreement by either party or by its terms, the Trustees

shall, on request of the Adviser, change the name of the Trust to a name not containing

the names or (First Name of Trust) (Second Name of Trust) (or any approximation or abbreviation of them) and sufficiently dissimilar to such names

as to be unlikely to cause confusion with such names or any of them, and shall not allude

in any public statement or advertisement to the former association, except as otherwise

required by law, in which case a statement shall be made that the former association no

longer continues.G. Nothing in this Agreement shall restrict or limit the right of the Adviser to employ

in any manner the names or (First Name of Trust) , or any approximation or abbreviation of (Second Name of Trust)

Real Estate Investment Trust Advisory Agreement Page 14 of 15them, whether or not in combination with any other names or designations. The Trust

agrees that this Agreement shall not constitute a license to use such names in its business,

provided, however, that until the termination of this Agreement the Trust may employ the

words as part of its name. (Acceptable Words) XXII.Effective Date. This Agreement shall be effective on . The Adviser (Date) shall be entitled to compensation as determined under Sections X and XI of this Agreement in

regard to any disbursements made on or after , of the principal amount of an (Date) investment approved by the Investment Committee of the Trust or the Trustees prior to that date.XXIII.MiscellaneousA. The Adviser assumes no responsibility under this Agreement other than to render

the services called for under it in good faith, and shall not be responsible for any action of

the Trustees in following or declining to follow any advice or recommendations of the

Adviser. Neither the Adviser, nor Trustees, officers or employees shall be liable to the

Trust, the Trustees or the holders of securities of the Trust except by reason of acts

constituting bad faith, willful misconduct or reckless disregard of their duties or their not

having acted in good faith in the reasonable belief that their actions were in the best

interests of the Trust.B. The Trust and the Adviser are not partners or joint venturers with each other, and

nothing in this Agreement shall be construed so as to make them partners or joint

venturers or impose any liability as such on either of them. The Adviser shall perform its

duties under this Agreement as an independent contractor, and not as an agent of the

Trust or the Trustees.C. Any notice, report or other communication required or permitted to be given

under this Agreement shall be in writing, unless some other method of giving such notice,

report, or other communication is accepted by the party to whom it is given, and shall be

given by being delivered at the following addresses of the parties to this Agreement:�The Trustees or the Trust: ; and (Address of Trust) �The Adviser: ; (Address of Adviser) Either party may at any time give notice in writing to the other party of a change of its

address for the purpose of this Paragraph C.D. This Agreement shall not be changed, modified, terminated or discharged in

whole or in part except by an instrument in writing signed by both parties to this

Agreement, or their respective successors or assigns, or otherwise as provided in this

Agreement.

Real Estate Investment Trust Advisory Agreement Page 15 of 15 E.The provisions of this Agreement shall be construed and interpreted in accordance

with the law of as at the time in effect. (Name of State) F.All calculations made pursuant to Sections IX, X, XI and XII of this Agreement

shall be based on statements (which may be unaudited, except as provided in them)

prepared on an accrual basis in accordance with generally accepted accounting principles

as approved by the independent public or certified accountants who shall regularly report

on the financial statements of the Trust, regardless of whether the Trust may also prepare

statements on a different basis.G. The name is the designation of the (Name of Trust) Trustees under a declaration of Trust dated , as amended from time to (Date) time. The obligations under this Agreement are not personally binding on, nor shall resort

be had to the private property of, any of the Trustees, shareholders, officers, employees or

agents of the Trust, but the Trust property only shall be bound.H.Mandatory Arbitration. Notwithstanding the foregoing, and anything herein to

the contrary, any dispute under this Agreement shall be required to be resolved by

binding arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each

party shall select one arbitrator and both arbitrators shall then select a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitration shall be governed by the

rules of the American Arbitration Association then in force and effect. WITNESS our signatures as of the day and date first above stated. (Name of Trust) (Name of Adviser) By: By: (Printed Name & Office of Trust) (Printed Name & Office in Adviser) (Signature of Officer) (Signature of Officer) (Acknowledgments before a notary public)