Fill and Sign the Will and Trust Provisions Louisiana Form

Useful suggestions for preparing your ‘Will And Trust Provisions Louisiana’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign documents online. Utilize the robust tools integrated into this straightforward and affordable platform and transform your strategy for managing paperwork. Whether you need to approve documents or collect electronic signatures, airSlate SignNow manages everything seamlessly, needing just a few clicks.

Follow this step-by-step guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Will And Trust Provisions Louisiana’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t worry if you need to collaborate with your teammates on your Will And Trust Provisions Louisiana or send it for notarization—our platform offers everything required to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to a new level!

FAQs

-

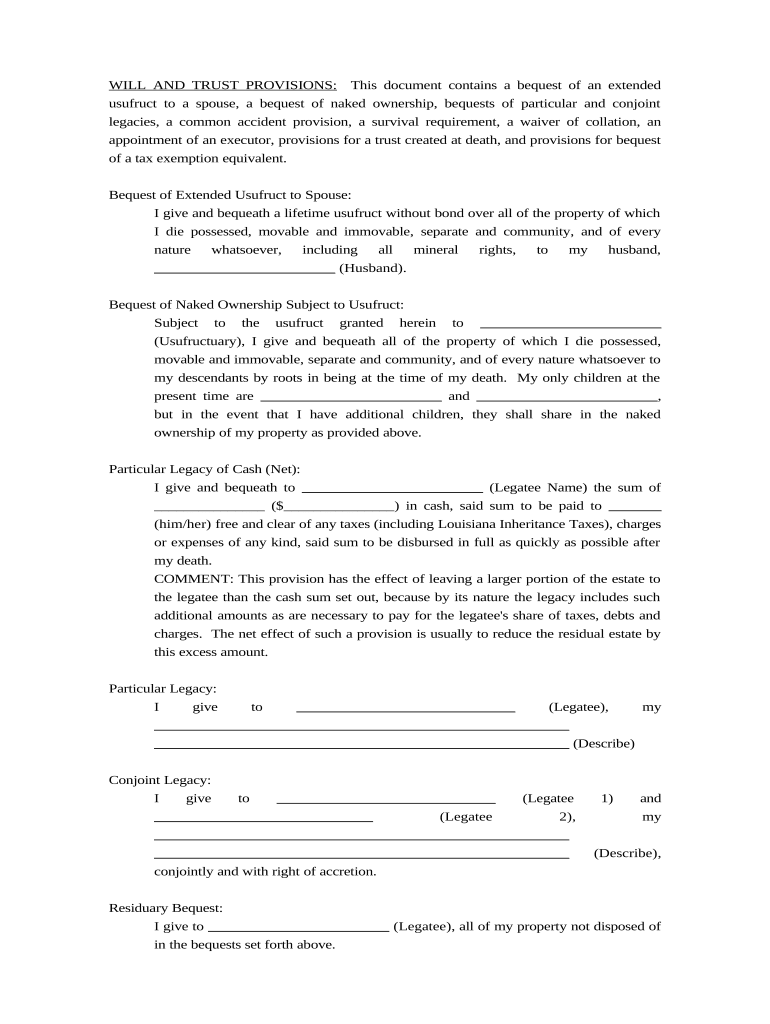

What are Will and Trust Provisions in Louisiana?

Will and Trust Provisions in Louisiana refer to the legal clauses that dictate how your assets will be distributed after your passing. Understanding these provisions is crucial for anyone looking to establish a clear estate plan. Properly drafted Will and Trust Provisions in Louisiana can help avoid disputes among heirs and ensure your wishes are honored.

-

How can airSlate SignNow help with Will and Trust Provisions in Louisiana?

airSlate SignNow provides a seamless platform for creating, signing, and managing documents related to Will and Trust Provisions in Louisiana. With our eSignature solution, you can easily send and receive vital documents securely, making the estate planning process efficient and effective. Our features streamline the execution of your Will and Trust Provisions in Louisiana, ensuring everything is legally compliant.

-

What is the pricing structure for airSlate SignNow when dealing with Will and Trust Provisions in Louisiana?

airSlate SignNow offers competitive pricing plans tailored for individuals and businesses needing to manage Will and Trust Provisions in Louisiana. Our flexible subscription options ensure you can choose a plan that fits your budget while accessing all the necessary tools for document management and e-signatures. Check our pricing page for the latest offers and package details.

-

Are there any specific features for managing Will and Trust Provisions in Louisiana?

Yes, airSlate SignNow includes features specifically designed for managing Will and Trust Provisions in Louisiana, such as customizable document templates, secure storage, and easy sharing options. These features allow users to draft legally sound documents, ensuring that all necessary provisions are included and properly executed. This simplifies the estate planning process signNowly.

-

Can I integrate airSlate SignNow with other tools for Will and Trust Provisions in Louisiana?

Absolutely! airSlate SignNow integrates seamlessly with various applications and services, enhancing the management of Will and Trust Provisions in Louisiana. Whether you use CRM tools, cloud storage solutions, or other software, our platform can connect with them, streamlining your workflow and document management process.

-

What are the benefits of using airSlate SignNow for Will and Trust Provisions in Louisiana?

Using airSlate SignNow for Will and Trust Provisions in Louisiana offers numerous benefits, including enhanced security, ease of use, and cost-effectiveness. Our platform ensures that your documents are signed securely and stored safely, while also providing a user-friendly interface that simplifies the entire process. This means you can focus on what matters most: your estate planning.

-

Is airSlate SignNow legally binding for Will and Trust Provisions in Louisiana?

Yes, documents signed through airSlate SignNow are legally binding in Louisiana, provided they meet state requirements. This includes proper execution and adherence to the guidelines for Will and Trust Provisions in Louisiana. With airSlate SignNow, you can confidently manage your estate documents knowing they have legal standing.

The best way to complete and sign your will and trust provisions louisiana form

Find out other will and trust provisions louisiana form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles