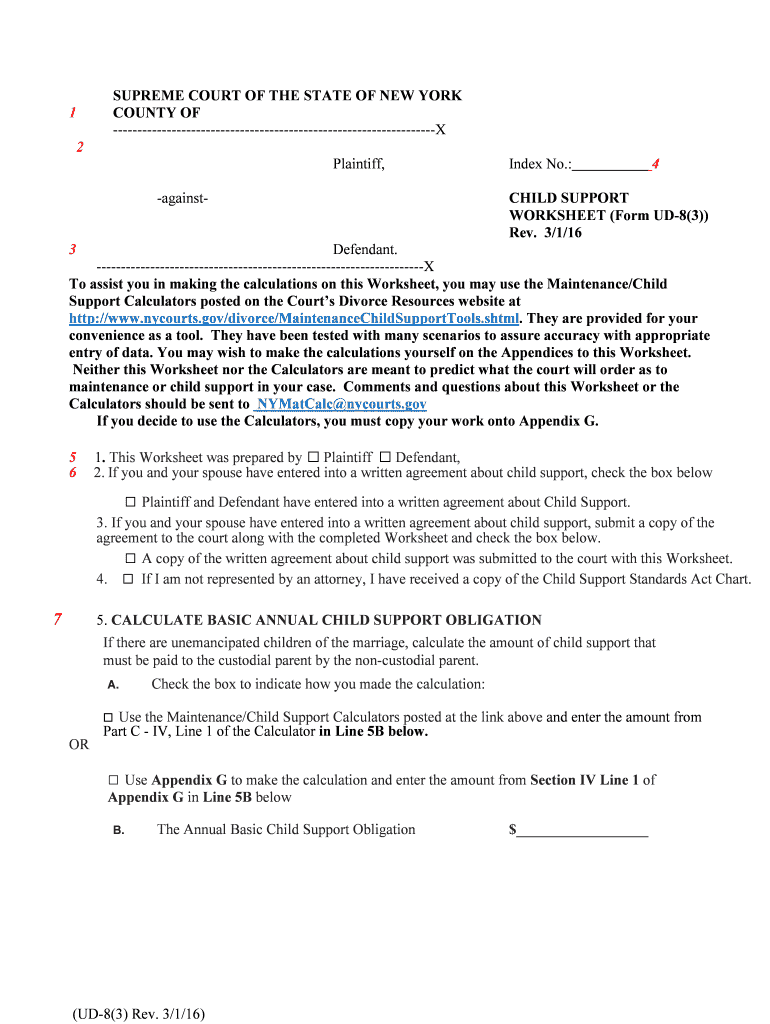

(UD-8(3) Rev. 3/1/16) SUPREME COURT OF THE STATE OF NEW YORK 1 COUNTY OF ------------------------------------------------------------------X 2 Plaintiff, Index No.: 4 -against- CHILD SUPPORT WORKSHEET (Form UD-8(3)) Rev. 3/1/16 3 Defendant. -------------------------------------------------------------------X To assist you in making the calculations on this Worksheet, you may use the Maintenance/Child Support Calculators posted on the Court’s Divorce Resources website at http://www.nycourts.gov/divorce/MaintenanceChildSupportTools.shtml. They are provided for your convenience as a tool. They have been tested with many scenarios to assure accuracy with appropriate entry of data. You may wish to make the calculations yourself on the Appendices to this Worksheet. Neither this Worksheet nor the Calculators are meant to predict what the court will order as to maintenance or child support in your case. Comments and questions about this Worksheet or the Calculators should be sent to NYMatCalc@nycourts.gov If you decide to use the Calculators, you must copy your work onto Appendix G. 5 1. This Worksheet was prepared by ☐ Plaintiff ☐ Defendant, 6 2. If you and your spouse have entered into a written agreement about child support, check the box below ☐ Plaintiff and Defendant have entered into a written agreement about Child Support. 3. If you and your spouse have entered into a written agreement about child support, submit a copy of the agreement to the court along with the completed Worksheet and check the box below. ☐ A copy of the written agreement about child support was submitted to the court with this Worksheet. 4. ☐ If I am not represented by an attorney, I have received a copy of the Child Support Standards Act Chart. 7 5. CALCULATE BASIC ANNUAL CHILD SUPPORT OBLIGATION If there are unemancipated children of the marriage, calculate the amount of child support that must be paid to the custodial parent by the non-custodial parent. A. Check the box to indicate how you made the calculation: ☐ Use the Maintenance/Child Support Calculators posted at the link above and enter the amount from Part C - IV, Line 1 of the Calculator in Line 5B below. OR □ Use Appendix G to make the calculation and enter the amount from Section IV Line 1 of Appendix G in Line 5B below B. The Annual Basic Child Support Obligation $__________________

(UD-8(3) Rev. 3/1/16) 8 6. If you believe the Annual Basic Child Support Obligation is unjust and should be changed,1 list the factors you would like the Court to consider in its decision, after reviewing the 10 child support adjustment factors in Appendix F. _________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ __________________________________________________________________________________ Attach an additional page if needed and check the box below: Additional Page Attached □ 9 7. If you would like the Court to award child support on Combined Parental Income in excess of $143,000, please list the factors you would like the Court to consider in its decision, after reviewing the 10 child support adjustment factors in Appendix F. 2 _________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ Attach an additional page if needed and check the box below: Additional Page Attached □ 10 8. I have carefully read this statement and attest that it is true and accurate to the best of my knowledge. ___________________________________ Signature ☐Plaintiff ☐Defendant _______________________________________ Subscribed and Sworn to print or type name before me on Notary Public 1 If a party believes that NCP’s Annual Child Support Obligation is unjust or inappropriate, the party can ask the Court to order the NCP to pay an adjusted amount after considering the 10 child support adjustment factors. The 10 child support adjustment factors pursuant to DRL §240(1 -b) (f) are listed on Appendix F. . 2 If the Combined Parental Income exceeds $143,000, the Court may award an additional amount of child support. In making such decision, the Court will consider the 10 child support adjustment factors and/or the child support percentages as shown for information only on Appendix G Section I lines 9- 9c and on Part C- I line 8 of the Calculators.

(UD-8(3) Rev. 3/1/16) SEE APPENDICES F AND G ATTACHED APPENDIX F. 10 Child Support Adjustment Factors Where Income Exceeds $143,000 or When Considering Adjustment of Award (see DRL 240(1-b)(f)) APPENDIX G. Calculation of Annual Basic Child Support Obligation

A P P E N D I X F Ch. 567 of the laws of 1989 APPENDIX F 10 CHILD SUPPORT ADJUSTMENT FACTORS PURSUANT TO DRL §240(B-1)(F) FOR ADJUSTMENT OF AWARD OR WHERE COMBINED PARENTAL INCOME EXCEEDS $143,000 1. The financial resources of the custodial and non-custodial parent, and those of the child; 2. The physical and emotional health of the child and his/her special needs and aptitudes; 3. The standard of living the child would have enjoyed had the marriage or household not been dissolved; 4. The tax consequences to the parties; 5. The non-monetary contributions that the parents will make toward the care and well-being of the child; 6. The educational needs of either parent; 7. A determination that the gross income of one parent is substantially less than the other parent's gross income; 8. The needs of the children of the non-custodial parent for whom the non-custodial parent is providing support who are not subject to the instant action and whose support has not been deducted from income pursuant to subclause (D) of clause (vii) of subparagraph five of paragraph (b) of this subdivision, and the financial resources of any person obligated to support such children, provided, however, that this factor may apply only if the resources available to support such Children are less than the resources available to support the children who are subject to the instant action; 9. Provided that the child is not on public assistance (i) extraordinary expenses incurred by the non- custodial parent in exercising visitation, or (ii) expenses incurred by the non-custodial parent in extended visitation provided that the custodial parent's expenses are substantially reduced as a result thereof; and 10. Any other factors the court determines are relevant in each case, the court shall order the non- custodial parent to pay his or her pro rata share of the basic child support obligation, and may order the non-custodial parent to pay an amount pursuant to paragraph (e) of this subdivision.

A P P E N D I X G 1 of 5 EFF.RRev. 3/1/16 (CH. 269, and CH. 387, L. 2015) APPENDIX G CALCULATION OF ANNUAL BASIC CHILD SUPPORT OBLIGATION I. ADJUST FOR MAINTENANCE AND COMPUTE BASIC CHILD SUPPORT BEFORE LOW INCOME ADJUSTMENT OR ADD-ONS 1. Enter the amount of the guideline award of maintenance on Income of Maintenance Payor up to $178,000 from Line 3B of Maintenance Guidelines Worksheet Form UD-8(2); OR, if you have a written agreement a s t o m a i n t e n a n c e w i t h y o u r s p o u s e , e n t e r t h e a g r e e d a m o u n t i n s t e a d ( a n d p r o v i d e t h e a g re e m e n t t o t h e c o u r t t o p r o v e t h e c o r r e c t a m o u n t ) . N o t e : i f n e i t h e r p a r t y s e e k s m a i n t e n a n c e , e n t e r z e r o i n s t e a d … … … … … … … $ 2. Net Annual Income of Party with lower income, adjusted for Maintenance (Line 1 above plus Line 1A or 1B of Annual Income Worksheet Form UD-8(1), whichever is lower)……………………………………………………………. $ 3. Net Annual Income of Party with higher income adjusted for Maintenance (Line 1A or 1B of Annual Income Worksheet Form UD-8(1), whichever is higher, m i n u s l i n e 1 a b o v e ). . . . … … … … … … … … … … … … … … … … … … . .$ 4.Combined Parental Income adjusted for Maintenance (Total 2 plus 3) . . … … … … … … … … … … … … … … … … … $ 5.Determine whether the Non-Custodial parent (NCP) is the party with the higher or lower income and enter the Income of the NCP from Line 2 or 3, whichever applies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ . . . . . . . . . ALSO ENTER THIS AMOUNT IN Section II, Line 1 5a. Enter the NCP’s Percentage Share of Combined Parental Income . . . . . . % Note: Divide Line 5 by Line 4 Note: The percentage share is sometimes referred to as the “pro rata share.” You will use this same percentage for the NCP’s share of Mandatory Add-on Expenses in Section III below. 5b. Enter the CP’s Percentage Share of Combined Parental Income. . . . . . . . _............. % Note: Divide Custodial Parent (“CP”)’s Income (from Line 2 or Line 3, whichever applies), by Line 4 Note: The percentage share is sometimes referred to as the “pro rata share.” You will use this same percentage for the CP’s share of Mandatory Health insurance Expenses in Section III below 6. Enter the percentage that applies based on the number of children . . . . . . % % 1 child =17%; 2 children =25%; 3 children =29%; 4 children =31%; 5 children= 35% (minimum) 7. Multiply the percentage in Line 6 by Combined Parental Income from Line 4, but only up to $143,000 of Combined Parental Income . . . . . . . . $ This is the Combined Child Support on Combined Income up to $143,000 Example: If Combined Parental Income in Line 4 is $150,000, and if there are 2 children, multiply $143,000 by 25%.

A P P E N D I X G 2 of 5 EFF.RRev. 3/1/16 (CH. 269, and CH. 387, L. 2015) 8. Multiply amount in Line 7 by percentage in Line 5a . . . . . . . . . . . . . . . $ This is the NCP’s Annual Percentage Share of Child Support on Combined Parental Income up to and including $143,000. ALSO ENTER THIS AMOUNT IN SECTION II, Line 2 NCP’S ANNUAL BASIC PAYMENT will be the total of Line 8 plus any possible increase at the court’s discretion after consideration of the 10 child support adjustment factors and /or the child support percentage for child support on combined parental income in excess of $143,000, if any. This is the amount the NCP must pay to the CP for all of the children’s costs and expenses, before possible low income adjustment (See Section II), Add On Ex- penses (see Section III), and possible adjustment at the Court’s discretion if the Court finds such amount to be unjust and inappropriate based on consideration of the 10 child support adjustment factors (See Appendix F). Lines 9-9c below are for information only and are not to be included in the totals in this worksheet. 9. Compute Child Support on Combined Parental Income Above $143,000, if any. If there is none, skip to Section II below. 9a. If there is Combined Parental Income above $143,000, enter the amount of such Income you asking the Court to use for child support. . . . . . . . . . . . . . . $ 9b. Multiply amount in Line 9a by percentage in Line 6 This is Combined Child Support on Income above $143,000 you are asking the court to consider for Child Support . . . . . . . . . . . . . . . . . . . . . . . . $ 9c. Multiply Line 9b by the percentage in Line 5a This is the NCP’s Annual Percentage Share of Income Above $143,000 that you are asking the court to consider for Child Support . . . . . . . . . . . . . . $

A P P E N D I X G 3 of 5 EFF.RRev. 3/1/16 (CH. 269, and CH. 387, L. 2015) II. DETERMINE WHETHER LOW INCOME EXEMPTION APPLIES 1. NCP’s Annual Income (Line 5 of Section I) . . . . . . . . . . . . . . . . . . . . . $ 2. Basic Child Support Obligation (Line 8 of Section I) . . . . . . . . . . . . . . . $ 3. Subtract Line 2 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ This is the NCP’s Annual Income after the Basic Child Support Obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ If Line 3 is less than the Self-Support Reserve (SSR) of $16,038, there will be a low income adjustment. If Line 3 is less than the SSR of $16,038 but greater than $11,880 (poverty level), child support shall be the greater of $600 or the difference between NCP Income and the SSR of $16,038. Proceed to Line 4a to compute the difference. Enter the greater of $600 or the difference in Line 4b. (Note: Add-on expenses may apply in the Court's discretion). If Line 3 is equal to or greater than the Self-Support Reserve (SSR) of $16,038, there will be no low income adjustment. Skip the rest of this section and proceed to Section III below. If Line 3 is less than $11,880 (the poverty level), the Basic Child Support shall be $300 1; Enter $300 in Line 4b below. Add on Expenses will not apply. 4a. NCP Income minus SSR: Subtract $16,038 from amount in Line 1. . . . . $ 4b. Enter the Basic Child Support Obligation with Low Income Exemption if applicable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ In Line 4b, enter $300 if Line 3 is less than $11,880. ALSO ENTER THIS AMOUNT ON LINE 5B at page 2 of the Worksheet. Skip Section III. OR In Line 4b, enter the greater of $600 and Line 4a, if Line 3 is greater than $11,880 but less than $16,038. Then proceed to Section III. OR In Line 4b, enter amount from Line 2 if Line 3 is equal to or greater than $16,038. Then Proceed to Section III. 1 However, if the Court finds such amount to be unjust and inappropriate, based on the factors in DRL§ 240 (1-b)(f), the Court can order the NCP to pay less than $300 per year.

A P P E N D I X G 4 of 5 EFF.RRev. 3/1/16 (CH. 269, and CH. 387, L. 2015) III. ADD-ON EXPENSES (SKIP THIS SECTION IF THE BASIC CHILD SUPPORT OBLIGATION WITH LOW INCOME EXEMPTION IS $300) IF LINE 3 of SECTION II IS LESS THAN THE SSR BUT GREATER THAN THE POVERTY LEVEL, THE COURT HAS DISCRETION WHETHER OR NOT TO AWARD THE MANDATORY ADD ON EXPENSES (see DRL 240(1-b)(d)). A. Mandatory Child Care Expenses 1. Enter annual cost of child care (child care costs from custodial parent's working, or receiving elementary, secondary or higher education or vocational training leading to employment. ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2. NCP’s Percentage Share of Child Care Expenses (from Line 5a of Section I) % 3. NCP’s Dollar Share of Child Care Expenses (multiply Line 1 x line 2) . . . . $ B. Mandatory Health Expenses (health insurance premiums and future unreimbursed health-related expenses) 4a. NCP's % share of health insurance premiums and future unreimbursed health-related expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . % 4b. CP's % share of health insurance premiums and future unreimbursed health-related expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . % 5. Annual cost of health insurance for the children . . . . . . . . . . . . . . . . . . $ 6. Does the NCP provide the Health Insurance? . . . . . . . . . . . . . . . . YES NO 6a. If No, NCP’s dollar share of Health Insurance (added to the Basic Child Support Obligation) (multiply Line 4a x line 5) . . $ 6b. If yes, CP’s dollar Share of Health Insurance (deducted from Basic Child Support Obligation)(multiply Line 4b x line 5). . $ 7. Health Care Adjustment (Add amount from Line 6a or subtract amount from Line 6b, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8. Total Mandatory Add-On Expenses (Total Lines 3 and 7) . . . . . . . . . . . $ 9. For Information Only, (not to add to the totals in this Worksheet), enter the total Discretionary Expenses for Child Care and Education if you are asking the Court to consider awarding .t h e m* * . . . . . ..$___________ ** Note: In addition to Mandatory Add-On Expenses in A and B above, the Court may determine and apportion additional Discretionary Expenses for child care expenses, and additional Discretionary Expenses for education.

A P P E N D I X G 5 of 5 EFF.RRev. 3/1/16 (CH. 269, and CH. 387, L. 2015) IV. BASIC ANNUAL CHILD SUPPORT OBLIGATION* Add Line 4b of Section II and Line 8 of Section III, BUT IF LINE 3 of SECTION II IS LESS THAN THE SSR BUT GREATER THAN THE POVERTY LEVEL (the “SSR Adjustment”) KEEP IN MIND THAT THE TOTAL MAY BE LOWER AFTER THE COURT DECIDES WHETHER TO AWARD THE ADD-ON EXPENSES. NCP’s Basic Child Support Obligation Adjusted for low income from Line 4b of Section II $_________________ NCP’s Total Share of Mandatory Child Care Expenses from Line 3 of Section III $____________________ NOTE: Leave this blank for the Court to fill in if there is an SSR Adjustment NCP’s Total Share of Mandatory Health Insurance Premiums for the Children from Line 7 of Section III $_________________ NOTE: Leave this blank for the Court to fill in if there is an SSR Adjustment Total Line 1 Section IV ……………………………… $____________________ This is the NCP’s Annual Basic Payment Adjusted for Low Income If any, Including Add On Expenses and Health Insurance Adjustment, if applicable ENTER THIS AMOUNT ON LINE 5B of the Worksheet * Note: The Basic Annual Child Support Obligation will also include whatever the Court may order the NCP to pay in child support on combined parental income above $143,000, if any, after considering the 10 child support adjustment factors and/or the child support percentage. .