§21.105 PROXY STATEMENTS : STRATEGY & FORMS

21-135B© 1992 Jefren Publishing Company, Inc.

E

xhibit B

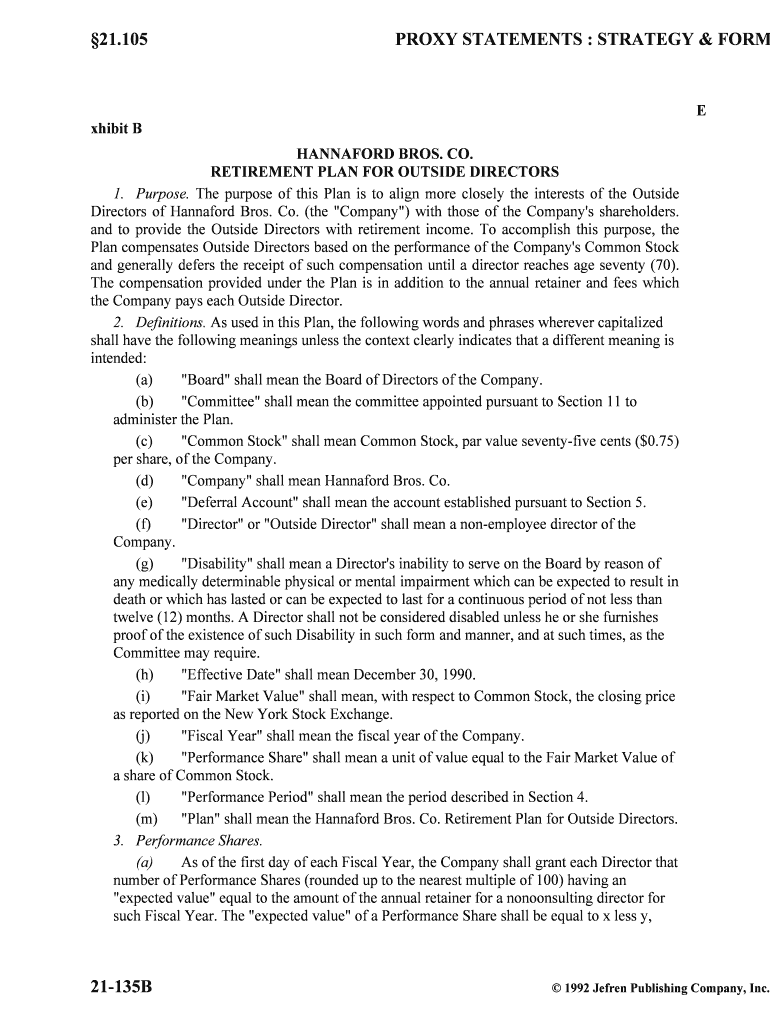

HANNAFORD BROS. CO.

RETIREMENT PLAN FOR OUTSIDE DIRECTORS

1. Purpose. The purpose of this Plan is to align more closely the interests of the Outside

Directors of Hannaford Bros. Co. (the "Company") with those of the Company's shareholders.

and to provide the Outside Directors with retirement income. To accomplish this purpose, the

Plan compensates Outside Directors based on the performance of the Company's Common Stock

and generally defers the receipt of such compensation until a director reaches age se venty (70).

The compensation provided under the Plan is in addition to the annual retainer and fe es which

the Company pays each Outside Director.

2. Definitions. As used in this Plan, the following words and phrases wherever capitalized

shall have the following meanings unless the context clearly indicates that a different meaning is

intended:

(a) "Board" shall mean the Board of Directors of the Company.

(b) "Committee" shall mean the committee appointed pursuant to Section 11 to

administer the Plan.

(c) "Common Stock" shall mean Common Stock, par value seventy-five cents ($0.75)

per share, of the Company.

(d) "Company" shall mean Hannaford Bros. Co.

(e) "Deferral Account" shall mean the account established pursuant to Section 5.

(f) "Director" or "Outside Director" shall mean a non-employee director of the

Company.

(g) "Disability" shall mean a Director's inability to serve on the Board by reason of

any medically determinable physical or mental impairment which can be expected to result in

death or which has lasted or can be expected to last for a continuous period of not less than

twelve (12) months. A Director shall not be considered disabled unless he or she furnishes

proof of the existence of such Disability in such form and manner, and at such times, as the

Committee may require.

(h) "Effective Date" shall mean December 30, 1990.

(i) "Fair Market Value" shall mean, with respect to Common Stock, the closing price

as reported on the New York Stock Exchange.

(j) "Fiscal Year" shall mean the fiscal year of the Company.

(k) "Performance Share" shall mean a unit of value equal to the Fair Market Value of

a share of Common Stock.

(l) "Performance Period" shall mean the period described in Section 4.

(m) "Plan" shall mean the Hannaford Bros. Co. Retirement Plan for Outside Directors.

3. Performance Shares. (a) As of the first day of each Fiscal Year, the Company shall grant each Director that

number of Performance Shares (rounded up to the nearest multiple of 100) having an

"expected value" equal to the amount of the annual retainer for a nonoonsulting director for

such Fiscal Year. The "expected value" of a Performance Share shall be equal to x less y,

RETIREMENT PLANS§21.105

August 1992 21-135C

discounted to present value for the number of years in the Performance Period by z, where--

xis the Fair Market Value of a share of Common Stock as of the date a

Performance Share is granted, compounded annually for the number of years

in the Performance Period at the rate of twelve percent (12%) per annum;

y is the Fair Market Value of a share of Common Stock as of the date a

Performance Share is granted; and

z is eight and one-half percent (85%).

(b) For the Fiscal Year beginning on the Effective Date ("1991 Fiscal Year"), in

addition to the Performance Shares granted under subsection (a) of this section, the Company

shall grant each Director the number of additional Performance Shares determined by

multiplying the number of Performance Shares granted under subsection (a) of this section

by the appropriate multiple from the following table: Multiple of Normal Annual Grant of PerformanceShares for Short Performance Periods

Beginning in the 1991 Fiscal Year

Years of Service on the Board One Year Two Year Three Year Four Year

as of May 31, 1991 Period Period Period

Less than 5 0.2 0.4 0.6

5 but less than 10 0.4 0.55 0.7

10 but less than 15 0.6 0.7 0.8

15 but less than 20 0.8 0.85 0.9

20 or more 1.0 1.0 1.0

(c) The Company shall appropriately record each grant of Performance Shares on its

books and furnish each Director with a written notice reflecting the number of Performance

Shares granted and such other terms and conditions consistent with the Plan as the

Committee shall determine.

(d) If during any Performance Period the number of shares of outstanding Common

Stock changes as a result of a stock sprit or stock dividend, the Committee shall appropriately

adjust the number of Performance Shares granted.

4. Performance Period. Except as hereinafter provided, a Performance Period shall be the

five (5) consecutive Fiscal Years commencing on the date Performance Shares are granted, and a

new Performance Period shall begin on the first day of each Fiscal Year. For the 1991 Fiscal

Year, five (5) Performance Periods shall begin concurrently, one ending with such Fiscal Year,

one ending after two (2) consecutive Fiscal Years, one ending after three (3) consecutive Fiscal

Years, one ending after four (4) consecutive Fiscal Years, and one ending after five (5)

consecutive Fiscal Years.

A Performance Period shall not be curtailed by the retirement after attaining age seventy

(70), Disability or death of a Director. In the event a Director resigns from the Board prior to

attaining age seventy (70), all Performance Periods in effect on the date of such resignation shall

end with the Fiscal Year in which such resignation occurs.

5. Deferral Account. The Company shall establish and maintain an account on behalf of

each Director. Subject to the provisions of subsection (d) of Section 3, at the end of each

§21.105 PROXY STATEMENTS : STRATEGY & FORMS

21-135D© 1992 Jefren Publishing Company, Inc.

Performance Period, the Company shall credit to such account an amount equal to x less y,

multiplied by z, where-

x is the Fair Market Value of a share of Common Stock as of the date a

Performance Period ends;

y is the Fair Market Value of a share of Common Stock as of the date such

Performance Period begins; and

z is the number of Performance Shares granted at the commencement of such

Performance Period.

The Committee shall provide each Director with an account statement at least annually.

6. Investment of Account. Solely for purposes of valuing a Director's Deferral Account, such

account shall be treated as invested in Common Stock and shall be credited with any dividends

declared thereon until distribution of such account is made or commences, If distribution of a

Director's Deferral Account is not made in a lump sum, solely for purposes of valuing such

account after distribution commences, such account shall be credited with interest at the rate paid

on five-year U.S. Treasury notes on the first day of the calendar year in which the interest is to

be credited or at such other rate as is prescribed by the Committee.

7. Distribution to Director. The amount credited to a Director's Deferral Account shall be

paid to him or her in a lump sum, substantially equal consecutive monthly payments over a

period not to exceed ten (10) years, or in such other form as the Committee may permit. Each

Director shall, prior to resigning from the Board, specify on such written form as the Committee

may prescribe, the manner in which and the time distribution is to be made or commence to him

or her. Except as provided in Section 8, distribution with respect to a Director shall not be made

or commence before the later of the Director's resignation from the Board or attainment of age

seventy (70).

8. Distribution to Beneficiary. Except as provided in Section 9, the amount credited to a

Director's Deferral Account at the time of his or her death shall be paid to his or her designated

beneficiary in a lump sum, substantially equal consecutive monthly installments over a period

not to exceed ten (10) years, or in such other form as is permitted by the Committee. If payment

commenced in accordance with Section 7 prior to the Director's death, payment shall continue in

accordance with the form of payment then in effect. If payment has not commenced in

accordance with Section 7, payment shall be made or commence as soon as practicable following

the date of death.

A Director shall specify on such form as the Committee may prescribe the manner in which

distribution shall be made to his or her designated beneficiary. In the absence of such

specification, distribution shall be made to his or her designated beneficiary in such manner as

the Committee shall determine.

9. Acceleration by Committee. In the event a Director suffers a financial hardship caused

by accident, illness or other event beyond his or her control, the Committee may, in its

discretion, accelerate payment of the amount credited to the Director's Deferral Account to the

extent reasonably necessary to eliminate such hardship. In addition, if following the death of a

Director, his or her beneficiary or beneficiaries suffers a financial hardship caused by accident,

illness or other event beyond the control of such beneficiary or beneficiaries, the Committee

may, in its discretion, accelerate payment of the amount credited to the Director's Deferral

Account to which such beneficiary or beneficiaries are entitled to the extent reasonably

RETIREMENT PLANS§21.105

August 1992 21-135E

necessary to eliminate such hardship.

10. Designation of Beneficiary. Each Director may from time to time, by completing and

signing a form furnished by the Committee, designate any person or persons (who may be

designated concurrently, contingently or successively), the Director's estate or any trust or trusts

created by the Director to receive amounts which are payable under this Plan to the Director's

designated beneficiary or beneficiaries. Each beneficiary designation shall revoke all prior

designations and shall be effective only when filed in writing with the Committee. If a Director

fails to designate a beneficiary or if a beneficiary dies before the date of such Director's death

and no contingent beneficiary has been designated, then the amounts payable hereunder shall be

paid to his or her estate. If payment of benefits to a beneficiary commences and such beneficiary

dies before all amounts to which such beneficiary is entitled have been paid, the remaining

benefits shall be paid to the successive beneficiary or beneficiaries, if any, designated by the

Director, otherwise to the beneficiary's estate.

11. Administration. The Plan shall be administered by a Committee, appointed by the

Board, of at least three (3) persons who are not current or former members of the Board. A

majority of the Committee shall constitute a quorum, and an action of the majority present at any

meeting shall be deemed the action of the Committee. Further, any action of the Committee ma y

be taken without a meeting if all members of the Committee sign written consents setting forth

the action taken or to be taken, at any time before or after the intended effective date of such

action. Any member of the Committee may participate in a meeting of the Committee by means

of a conference telephone or similar communications equipment enabling all persons

participating in the meeting to hear each other. The Committee may authorize any member

thereof to execute ??truments required in the administration of the Plan, and such instruments

may be executed by facsimile signature.

The Committee may, by a writing signed by a majority of its members, delegate to any

member or members of the Committee or to any employee or employees of the Company the

authority to perform any ministerial act in connection with the administration of the Plan.

The Committee shall have the authority to control and manage the operation and

administration of the Plan and the discretion to construe Plan provisions. Subject to the

provisions of the Plan, the Committee may from time to time establish rules for the

administration and interpretation of the Plan. The final determination of the Committee as to any

disputed questions shall be conclusive. All decisions and interpretations of the Committee in

administering the Plan shall be made in a uniform and nondiscriminatory manner.

The Company shall indemnify and hold harmless each member of the Committee against all

expenses and liabilities arising out of his or her acts or omissions with respect to the Plan,

provided such member would be entitled to indemnification pursuant to the bylaws of the

Company.

12. Miscellaneous. (a) Unsecured Creditor Status. The Plan shall not be construed to create or require

the Company to create a trust of any kind to fund the amounts payable hereunder. To the

extent a Director or other person acquires a right to receive payments from the Company in

accordance with the Plan, such right shall be no greater than the right of any unsecured

general creditor of the Company.

§21.105 PROXY STATEMENTS : STRATEGY & FORMS

21-135F© 1992 Jefren Publishing Company, Inc.

(b) Nontransferability. Performance Shares may not be sold, transferred or otherwise

disposed of and may not be pledged, hypothecated or otherwise encumbered, except by will

or the laws of descent and distribution. The right of any Director or any beneficiary to

payments under the Plan shall not be subject to alienation, assignment, garnishment,

attachment, execution or levy of any kind, and any attempt to cause such amounts to be so

subjected shall not be recognized by the Company.

(c) Amendment and Termination. The Board reserves the right to amend the Plan

from time to time or terminate the Plan; provided, however, that no such amendment or

termination shall adversely affect the rights of any Director or beneficiary, without such

person's prior written consent, with respect to Performance Shares granted prior to such

amendment or termination. Performance Shares granted prior to an amendment or

termination of the Plan shall remain in full force and effect as if the Plan had not been

amended or terminated.

(d) Governing Law. This Plan shall be governed by and construed in accordance with

the laws of the State of Maine.

Hannaford Bros. Co. 3/29/91

Useful advice on finishing your ‘Xhibit B’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to authorize forms or collect signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Refer to this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Access your ‘Xhibit B’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your part.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to seek eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don't fret if you need to collaborate with others on your Xhibit B or send it for notarization—our solution equips you with everything required to carry out such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!