Closing big deals for banking

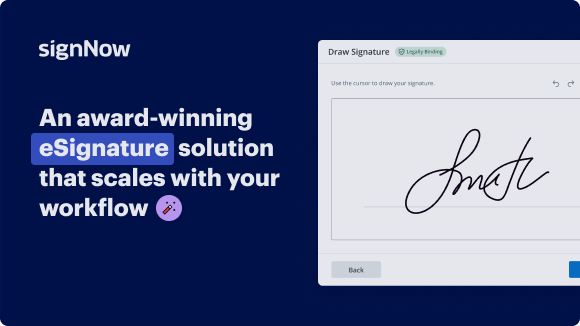

See airSlate SignNow eSignatures in action

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Closing big deals for Banking

Closing big deals for Banking

With airSlate SignNow, you can streamline the process of sending and signing documents, saving time and ensuring that deals are closed quickly. Take advantage of airSlate SignNow's benefits today to revolutionize how you close big deals for Banking.

Try airSlate SignNow now and experience the convenience of eSignature technology.

airSlate SignNow features that users love

Get legally-binding signatures now!

FAQs online signature

-

What does it mean to close a business deal?

Closing a deal is a term sales professionals use to describe a situation where they bring negotiations to an end by reaching an agreement with their prospect. It's the very moment when a prospect decides to make the purchase.

-

What does close that deal mean?

: to make an agreement official.

-

How to close a big business deal?

Closing the deal: The following seven negotiation strategies can help you overcome these roadblocks to closing a business deal. Negotiate the process. ... Set benchmarks and deadlines. ... Try a shut-down move. ... Take a break. ... Bring in a trusted third party. ... Change the line-up. ... Set up a contingent contract.

-

What is the meaning of closing a contract?

Contract closure is concerned with completing and settling the terms of the contracts for the project. It supports the project completion process because the contract closure process determines if the work described in the contracts was completed accurately and satisfactorily.

-

What does closing a deal mean?

Closing a deal is a term sales professionals use to describe a situation where they bring negotiations to an end by reaching an agreement with their prospect. It's the very moment when a prospect decides to make the purchase.

-

How to celebrate closing a big deal?

Plan a trip to honor the deal. This is not only a great way to celebrate the hard work you've done on this deal, but a great way to reset your mind from work. Therefore, upon returning you will be refreshed and ready to work just as hard as you did on the last deal.

-

How do you close a big sales deal?

More videos on YouTube Pitch Your Solution (Not Just the Product) ... Follow Up, Follow Up, Follow Up. ... Create a Sense of Urgency (the Now or Never Close) ... Offer Them a Test Drive. ... Go Through the Summary Close. ... Overcome Their Objections. ... Ask for the Sale (and Nail Your Closing Questions) ... Expect Yes, Embrace No.

-

What does time to close a deal mean?

Average Time to Close Deal measures the average duration it takes to close a deal, from initial contact to the signing of the contract. Sales. Deal time.

Trusted e-signature solution — what our customers are saying

How to create outlook signature

Bank branches are closing faster than they're opening new ones last year they closed over 3,000 branches and only opened 1,000 my name is Darius and I'm Carmen in this video we are going to discuss why major banks are closing and why you should be your own bank but before we jump into all of that information make sure you subscribe to our Channel it is completely free and hit that thumbs up because it significantly helps us grow on YouTube now let's jump into these juicy details with the collapse of the Silicon Valley Bank in the beginning of 2020 three banks have followed market trends and budget constraints to make adjustments so that they can stay profitable they should always be doing this anyway but we are seeing this take place because we are noticing more and more branches are closing every single day and it's just this year alone so just like the banks when they are looking at their costs and looking at their budget constraints we should follow suit because we need to make sure that we are making the necessary adjustments so we can stay liquid or profitable like the banks do just so that we can buy food water and shelter now the reason why banks are closing branches faster than they're opening new ones is because of how many people are using online banking ing to bank rate 27% of Americans are Banking online and another 75% is interested in going digital to next year so the in-person services are being replaced by online services what this means is that adjustment is reducing the cost for the banks but not you D so let me give you a real life example of kind of what we're experiencing here since March 2022 the feds have been increasing interest rates to cool down inflation which is a cost to you right it's a cost of you Banks haven't been as quick to lend money because of this increase but so you have a lack of access to Capital uh and the cost of your living is going up which is another inconvenience to you so with all this being being said how do you maintain your income how do you reduce your cost and how do you increase profits just like the banks are doing by closing their branches and going online MH yeah and really what we're talking about by reducing costs and being more profitable it's just about keeping more of your money so how can you do this if the cost of just living is continuing to increase right because one thing that didn't happen with the banks moving online it hasn't adjusted the income that we're able to earn from the bank right yeah I haven't seen those um Check accounts coming our way yeah they hadn't reduced the interest on the credit cards no they've gone up ridiculous now they had increase the the interest that we get from our checkins and savings account yeah I even called uh the the bank on one of our credit cards just to see if we could get it reduced and I guess they don't do it on the phone anymore I didn't this was new news to me and so they're like sorry we don't do this anymore and I'm like at the end of the day the only thing you can do is ask the question let them tell you yes or no exactly now let's get back to the script we aren't knocking online banking because it's a huge convenience we use it every single day but in this video what we really want to stress is how you can utilize this mobile banking to enhance your banking systems which is what we talk about all the time on the wealth Nation channel so to explain online banking to make sure we are all on the same page it really offers a digital platform where consumers can go and manage their accounts transfer funds pay bills and have access to all of their financial information in the palm of their hands which makes it super simple now the best part about online banking is because when you add an infinite banking into the mix you can manage all of your transactions and watch your systems grow all in the palm of your hands so we want to make sure that you understand how digital banking or online banking can really enhance this whole system and it's just all about convenience at the end of the day right now let's let's move on to the banking environment in which we're able to maintain our income because every time we get paid we put our money into the bank and the banks pay us from our savings or checking account interest every depit that we into our savs account we earn interest monthly on the money that's there if the money isn't there you can't earn any interest on money that's not there so there's a good luck right so there's there's an opportunity there savings and in in checking accounts we earn interest whole life insurance we actually earn interest too uh guaranteed interest rates now let's talk about maintaining our income in in this environment so when we talk about whole life insurance we're not talking about whole life insurance as an investment which a lot of people think whole life insurance is more more similar to something like a a a savings account the reason why I say it's similar to a savings account I'm not saying it's a savings account but it's similar to it because you earn interest on the funds that are in your account so just like your savings account and your checking account as long as those funds are there you're going to earn interest on what is in your in your your checking or savings account you're going to earn a guaranteed interest rate the difference between between the two is the death benefit that you have in the event that you pass away you don't have a death benefit when it comes to your segments a check-ins account you just hope that whoever you leave your your estate to or you're leaving your money to they have access to your account with the whole life insurance policy you guaranteed that there's going to be money that transitions over to somebody taxfree um whoever the beneficiary is M now the convenience of having both of these together is the fact that with your checking account you're able to pay whatever transactions that you want to pay but you can get a loan from your insurance policy so that you can not only make transactions but you can receive payments through your banking system by uh integrating them together exactly now we aren't telling everyone to just jump for the hills and start opening up whole life insurance policies because it doesn't work the same way as your savings or your your checkings account we're just using those analogies so that you could see the similarities in how these accounts work so the at the end of the day we just want you to see that if you put money in a savings account or if you put money in a whole life insurance policy you are both going to earn interest and you have access to the cash that's the point that we were trying to make so now the next point that we want to move to is how can you reduce cost by not getting loans from the bank this is a super juicy topic that we have a solution for you now this is the reason why we think you should be your own bank in the first place is to reduce your cost meaning keep more of your money on hand now the banks give you loans based on how much debt you can manage want to make sure you hear me on cred score that's your credit score whereas life insurance companies give you access to cash based on what you have in your hand what you have access to right now let me break that down a little bit further so what I mean is Banks offer consumers various types of loans right personal loans mortgages auto loans business loans whatever the case may be and they provide these loans to individuals and businesses so that they can have funding since they don't have it because they're asking for the funds anyway now what happens when you get a loan from the bank is you have to pay principal and interest if your credit score says that you qualify for said loan because that credit score is going to determine how much cash you have access to and it's also going to determine your interest rate so you are dependent on maintaining a credit score in order to get cash from the bank now on the other hand you have a whole life insurance policy for example and as long as you are paying your premiums into the whole life insurance policy you are going to have access to Capital where there is no credit check needed and there is no interest rate variation because there's no credit score system right so the if you get your loan from an insurance company every policy holder at that insurance company is probably going to have the same interest rate based off of when they requested that loan because again it's not going back and forth on this credit system whatever cash you have access to is the cash that is going to be available to you and you just have to fill out a simple one-page document signing that you are requesting this funding and you don't have to ask permission for it now how does this reduce our cost is because we are paying significantly less interest to the insurance company versus the bank because on any of our policy loans that we have requested we have not paid over 42% for any of our financing needs at the end of the day in order for you to reduce your cost just like the banks it's important for you to know the options that you have regarding your financial needs absolutely banks are closing branches because are moving to digital they're following a a trend on the other hand the cost of inflation and interest rates increase and what do we do a lot of times we complain but do something with the information that you have access to if you can't beat them join them so if you are ready to get a policy and start banking for yourself then definitely click on the link below so that we can help you create the right plan for yourself and your family and also check out the next video where we talk about becoming your own bank while the others are collapsing don't forget to own your own lifestyle or someone else will

Show more