Does the IRS Accept Scanned Signatures in India

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

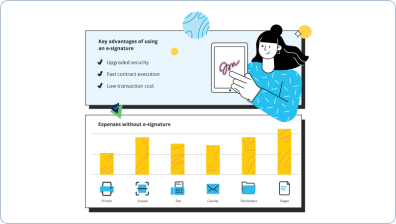

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your complete how-to guide - does the irs accept scanned signatures in india

Does the IRS accept scanned signatures in India? We have an answer!

Nowadays, printing hard copies of documents and manual signing is nothing but wasting time and paper. Millions of people around the globe are going paperless every single day and replacing wet ink signatures with eSignatures.

“does the IRS accept scanned signatures in India” is a big question right now. The answer is simple; utilize airSlate SignNow, an online solution for fast and legally-binding electronic signatures.

How can I electronically sign PDFs and does the IRS accept scanned signatures in India?

- Sign up for your account. Go to the airSlate SignNow website, select Free trial to start the registration procedure.

- Select a document. Select the Upload Documents button to find a file from the internal memory or drag and drop one into the specified area.

- Change the PDF file. Add new textual content, checkmarks, dates and so on, that you can find on the left sidebar.

- Make your sample interactive. Add smart fillable fields, dropdown lists, radio button groups, and more.

- Include a payment request. Click Settings > Request Payment.

- Double-check the your document. Make sure all the information is updated and accurate.

- Add signature fields. Include a Signature Field for each party you require.

- Sign the PDF. Select the My Signature element and choose to draw, type, or capture picture of your autograph.

- Send the sample for signing. Select Invite to Sign and indicate recipient email(s) to send a signature request.

- Download your copy. Select Save and Close > Download (on the right sidebar) to save the PDF on your device. /ol>

airSlate SignNow is helping active users all across India answer questions like “does the IRS accept scanned signatures in India?” Start your Free trial right now and boost your document workflows!

How it works

Rate your experience

Understanding IRS Acceptance of Scanned Signatures in India

The IRS has specific guidelines regarding signatures on documents. While scanned signatures may be acceptable in certain contexts, it is crucial to verify the requirements for each document type. Generally, the IRS prefers electronic signatures that comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This means that scanned signatures may not always meet the necessary legal standards for tax documents filed from India.

How to Use Scanned Signatures for IRS Documents

When using scanned signatures for IRS documents, it is essential to ensure that the signature is clear and legible. To use a scanned signature, follow these steps:

- Sign the document on paper.

- Scan the signed document to create a digital copy.

- Upload the scanned document to the appropriate IRS platform or attach it to your electronic submission.

Make sure to check if the specific form you are submitting allows for scanned signatures, as some may require original signatures.

Steps to Complete IRS Forms with Scanned Signatures

Completing IRS forms with scanned signatures involves several key steps:

- Access the required IRS form on the official website.

- Fill out the form electronically or print it and complete it by hand.

- Sign the form on paper and scan it to create a digital version.

- Submit the completed form with the scanned signature through the designated IRS submission method.

Always ensure that the form is submitted before the deadline to avoid any penalties.

Legal Considerations for Using Scanned Signatures

Using scanned signatures for IRS documents must comply with legal standards. The IRS recognizes electronic signatures, but scanned signatures may not always be considered valid. It is advisable to consult the specific IRS guidelines for the form you are submitting to ensure compliance. Additionally, keep in mind that some documents may require notarization, which cannot be fulfilled with a scanned signature.

Security and Compliance Guidelines for eSigning IRS Documents

When dealing with sensitive information, security is paramount. Ensure that any platform used for eSigning, such as airSlate SignNow, adheres to strict security protocols. This includes:

- Encryption of documents during transmission and storage.

- Access controls to limit who can view or sign the document.

- Audit trails to track who signed the document and when.

These measures help maintain compliance with IRS regulations and protect personal information.

Timeframes and Processing Delays for IRS Submissions

Understanding the timeframes for IRS submissions is essential. After submitting forms with scanned signatures, processing times may vary. Typically, electronic submissions are processed faster than paper submissions. However, if there are issues with the signature or documentation, this may lead to delays. It is advisable to follow up with the IRS if confirmation of receipt is not received within a reasonable timeframe.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

Does the IRS accept scanned signatures in India?

Yes, the IRS does accept scanned signatures in India under certain conditions. It's important to ensure that the scanned signature meets the IRS's requirements for authenticity and security. Using a reliable eSignature solution like airSlate SignNow can help you comply with these standards.

-

What features does airSlate SignNow offer for eSigning documents?

airSlate SignNow provides a range of features including customizable templates, secure cloud storage, and real-time tracking of document status. These features ensure that your documents are signed efficiently and securely, which is crucial when considering if the IRS accepts scanned signatures in India.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely! airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By using this cost-effective solution, small businesses can streamline their document signing processes while ensuring compliance with regulations, including those related to whether the IRS accepts scanned signatures in India.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration capability enhances your workflow and ensures that you can manage your documents efficiently, especially when dealing with IRS requirements for scanned signatures in India.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times for document signing. These advantages are particularly important for businesses that need to know if the IRS accepts scanned signatures in India.

-

How secure is airSlate SignNow for signing sensitive documents?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your sensitive documents. This level of security is essential for businesses concerned about compliance, especially regarding whether the IRS accepts scanned signatures in India.

-

What types of documents can I eSign with airSlate SignNow?

You can eSign a wide variety of documents with airSlate SignNow, including contracts, agreements, and tax forms. This versatility is beneficial for businesses that need to ensure their documents are compliant with IRS standards, including the acceptance of scanned signatures in India.

Does the irs accept scanned signatures in india

Trusted eSignature solution - does the irs accept scanned signatures in india

Related searches to does the irs accept scanned signatures in india

Join over 28 million airSlate SignNow users

Get more for does the irs accept scanned signatures in india

- Enhance Electronic Signature Legitimateness for ...

- Enhance Your Operations in European Union with ...

- Unlocking Electronic Signature Legitimateness for ...

- Unlock Electronic Signature Legitimateness for ...

- Electronic Signature Legitimateness for Operations in ...

- Unlock the Electronic Signature Legitimateness for ...

- Unlock the Power of Electronic Signature Legitimateness ...

- Boosting Electronic Signature Legitimateness for ...

The ins and outs of eSignature